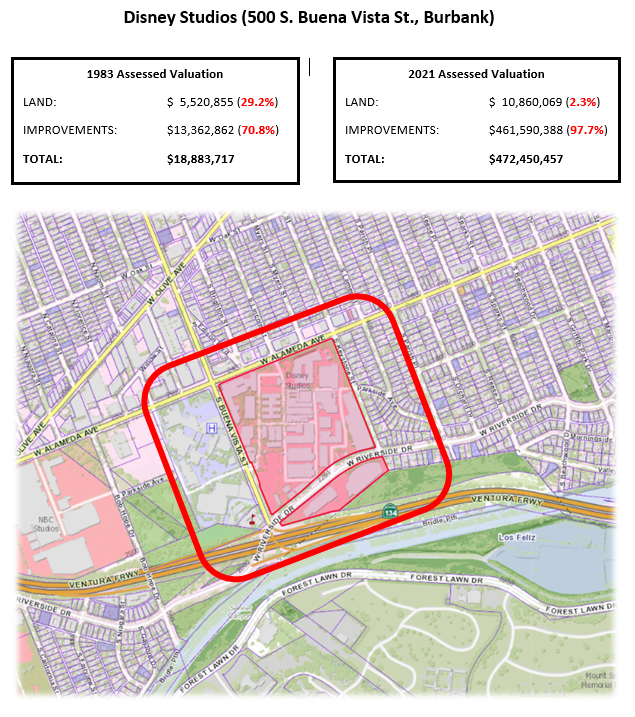

The real property tax is, in theory, a combination of 2 taxes: a tax on land + a tax on buildings. Perversely, under California& #39;s Prop 13, the tax on buildings is growing in (relative) significance, while the land tax is gradually disappearing, as shown here for Disney Studios.

The principle expressed by William Vickrey here would seem to suggest that Prop 13 has it exactly backwards.

And Milton Friedman agreed with Vickrey on this point: the land tax is the GOOD part of the property tax. Again, Prop 13 has it exactly backwards.

If I had my druthers (I don& #39;t), I& #39;d reform Prop 13 to tax land MORE and buildings LESS, perhaps even doing so on a revenue neutral basis, as suggested here in my essay very cleverly titled, "Reforming Proposition 13 to Tax Land More and Buildings Less" https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2727503">https://papers.ssrn.com/sol3/pape...

Proposition 15, which is on the California ballot NOW, offers a version of this solution, albeit not on a revenue neutral basis, by putting all commercial/industrial property to market value taxation. Details here: https://voterguide.sos.ca.gov/propositions/15/">https://voterguide.sos.ca.gov/propositi...

Prop 15 changes the taxation of buildings very little, since gradually over time those get rebuilt and redesigned and come into the assessment rolls at market value (as shown in the Disney Studios assessment figures above). The REAL change from Prop 15 is in the taxation of LAND.

Read on Twitter

Read on Twitter