1) Portfolio summary - Sep-end

$ADYEY $AYX $BABA $CRWD $DAO $DDOG $DKNG $DOCU $ETSY $FEAC $FROG $FSLY $MELI $OKTA $ROKU $SE $SHOP $SNOW $SQ $TWLO $U $VRM $ZM

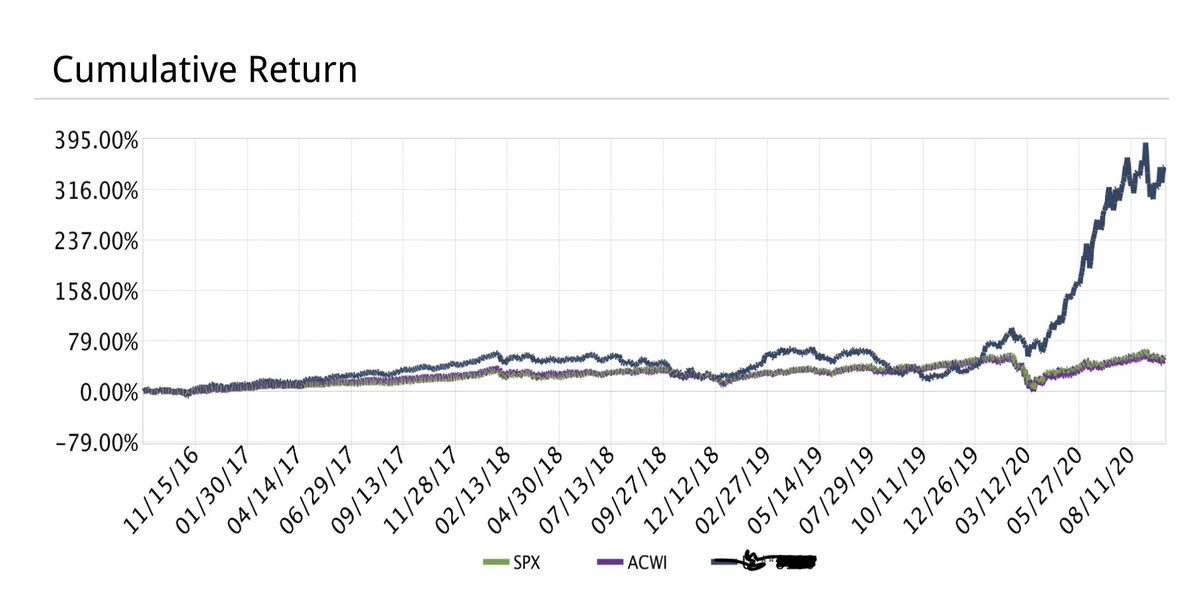

Return since 1 Sept & #39;16 -

Portfolio +354.65%

$ACWI +34.83%

$SPX +54.92%

Contd...

$ADYEY $AYX $BABA $CRWD $DAO $DDOG $DKNG $DOCU $ETSY $FEAC $FROG $FSLY $MELI $OKTA $ROKU $SE $SHOP $SNOW $SQ $TWLO $U $VRM $ZM

Return since 1 Sept & #39;16 -

Portfolio +354.65%

$ACWI +34.83%

$SPX +54.92%

Contd...

2) CAGR since inception (1 Sept 2016) -

Portfolio +44.94%

$ACWI +7.60%

$SPX +11.33%

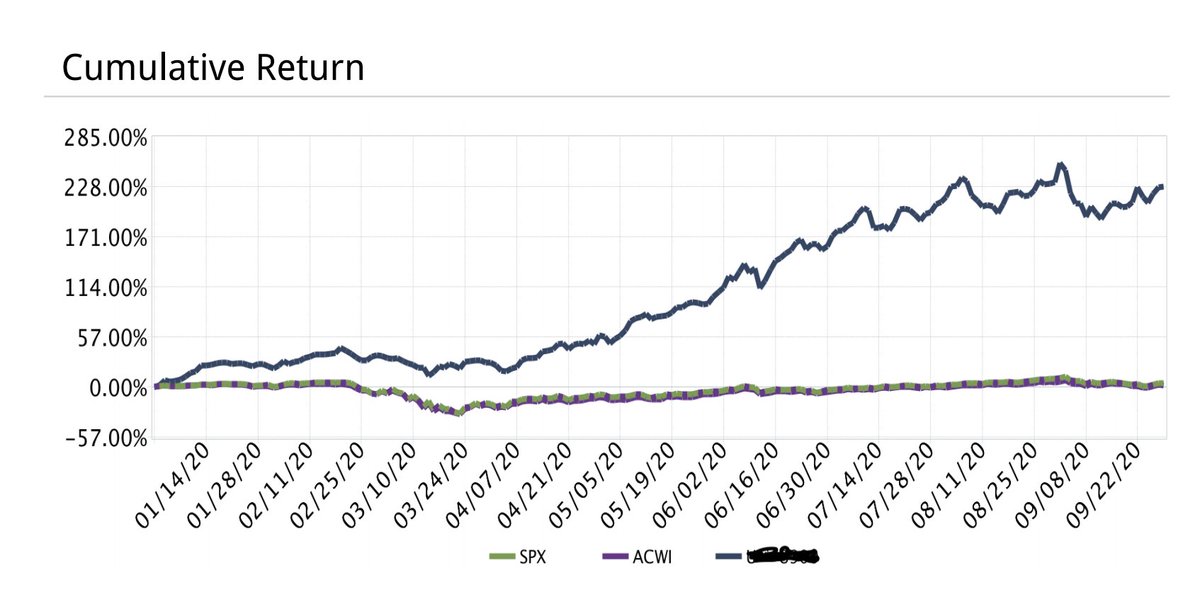

YTD return -

Portfolio +227.27%

$ACWI (-)0.45%

$SPX +4.09%

Contd...

Portfolio +44.94%

$ACWI +7.60%

$SPX +11.33%

YTD return -

Portfolio +227.27%

$ACWI (-)0.45%

$SPX +4.09%

Contd...

3) Biggest positions -

1) $SE 2) $ROKU 3) $MELI 4) $BABA 5) $ZM

New buys - $DKNG $FEAC $FROG $U (rentals) + $SNOW

Sells - $STNE http://1797.HK"> http://1797.HK

Contd....

1) $SE 2) $ROKU 3) $MELI 4) $BABA 5) $ZM

New buys - $DKNG $FEAC $FROG $U (rentals) + $SNOW

Sells - $STNE http://1797.HK"> http://1797.HK

Contd....

4) Commentary -

September was a volatile month for the stock market and my portfolio was no different.

At the worst point, my portfolio experienced a 20% drawdown but recovered some of those losses towards the end of the month. The drawdown wasn& #39;t fun but this is the price...

September was a volatile month for the stock market and my portfolio was no different.

At the worst point, my portfolio experienced a 20% drawdown but recovered some of those losses towards the end of the month. The drawdown wasn& #39;t fun but this is the price...

5)...of admission ---> no pain/no gain.

As I& #39;ve been saying for months, drawdowns are *normal* and can& #39;t be avoided. In fact this drawdown was the 4th major pullback in my portfolio in less than 2 years; so this just goes to show that these air pockets are quite frequent...

As I& #39;ve been saying for months, drawdowns are *normal* and can& #39;t be avoided. In fact this drawdown was the 4th major pullback in my portfolio in less than 2 years; so this just goes to show that these air pockets are quite frequent...

6) Turning over to the portfolio, towards the middle of the month when sentiment turned pretty bearish yet price action indicated a double bottom, I decided to use a bit of leverage and picked up shares of $DKNG $FEAC $FROG $U as potential multi-month rentals.

Currently...

Currently...

7)... my gross exposure is 120% of my account equity and my plan is to get rid of this leverage and sell these rentals after a big multi-month rally.

Elsewhere, despite its nose-bleed valuation, I bought shares of $SNOW over several days and it is now a full position for me...

Elsewhere, despite its nose-bleed valuation, I bought shares of $SNOW over several days and it is now a full position for me...

8)...Yes, $SNOW is *extremely* richly valued but this is a disruptive business, growing at a breakneck pace and run by top-notch management with an excellent track record!

Add into the mix, ZIRP, QE and the Fed& #39;s forward guidance and its no surprise that the top-tier growth...

Add into the mix, ZIRP, QE and the Fed& #39;s forward guidance and its no surprise that the top-tier growth...

9)...companies are trading at super high valuations. Of course, they are expensive - why wouldn& #39;t they be!?

In terms of selling, in order to raise cash for $SNOW and Ant Group, last month I got rid of http://1797.HK"> http://1797.HK and $STNE (both were low conviction positions)...

In terms of selling, in order to raise cash for $SNOW and Ant Group, last month I got rid of http://1797.HK"> http://1797.HK and $STNE (both were low conviction positions)...

10)...In terms of my existing holdings, last month was a great one for $ADYEY $DDOG $ROKU $SQ $ZM etc.

As far as the broad market is concerned, October might turn out to be another choppy month (election uncertainty), but I am pretty convinced that we are in the early stage...

As far as the broad market is concerned, October might turn out to be another choppy month (election uncertainty), but I am pretty convinced that we are in the early stage...

11)...of a multi-year bull market and the next recession-induced bear-market is probably at least 4-5 years away.

Yes, COVID-19 is an awful reality but by now we know that the central banks and governments will throw everything at this nightmare; to keep things ticking over...

Yes, COVID-19 is an awful reality but by now we know that the central banks and governments will throw everything at this nightmare; to keep things ticking over...

12)...and I& #39;ve been doing this long enough to know that you don& #39;t fight the Fed!

Last but not least, I will no longer post my trades in real-time as many others simply copy my buys/sells, they can& #39;t tolerate the near-term & #39;heat& #39;, they panic sell and then curse me...

Last but not least, I will no longer post my trades in real-time as many others simply copy my buys/sells, they can& #39;t tolerate the near-term & #39;heat& #39;, they panic sell and then curse me...

13)....Frankly, investing without learning about any company is an awful idea (it never ends well in the long run) and I don& #39;t want the added responsibility of knowing that my personal investment decisions are affecting thousands of people.

This is why, henceforth I will...

This is why, henceforth I will...

14)...only post a month-end portfolio summary and a mid-month "updated portfolio" list.

What can I say?

For 18 months now, many on FinTwit have criticised me and warned me that my & #39;bubble& #39; stocks are ridiculous, that they are unprofitable, that they will crash...

What can I say?

For 18 months now, many on FinTwit have criticised me and warned me that my & #39;bubble& #39; stocks are ridiculous, that they are unprofitable, that they will crash...

15)....and burn, and my portfolio will turn into dust!

Yet, here we are in the middle of one of the worst recessions ever and my entire portfolio has more than tripled in 9 months and even during this stock market pullback, many of my & #39;bubble& #39; stocks have broken out to ATHs...

Yet, here we are in the middle of one of the worst recessions ever and my entire portfolio has more than tripled in 9 months and even during this stock market pullback, many of my & #39;bubble& #39; stocks have broken out to ATHs...

16)...I haven& #39;t mentioned this to gloat but to point out that perhaps there is a & #39;method to my madness& #39; and perhaps there is a good reason why the collective wisdom of the market agrees with my assessment.

I am fairly convinced (as sure as you can be in this business) that...

I am fairly convinced (as sure as you can be in this business) that...

17)...the secular trends in ecommerce, online payments/fintech, software, streaming etc are still pretty young and they are likely to persist for several years.

Furthermore, the dominant businesses in these industries are akin to modern-day utilities (on steroids)...

Furthermore, the dominant businesses in these industries are akin to modern-day utilities (on steroids)...

18)...After all, where else can you find -

Unheard of growth rates, network effects, stickiness, frequent repeat purchases, asset-light operations, benefits of scale, high margins, recurring revenues/cash flows and massive TAMs?

For my part, I intend to profit from these...

Unheard of growth rates, network effects, stickiness, frequent repeat purchases, asset-light operations, benefits of scale, high margins, recurring revenues/cash flows and massive TAMs?

For my part, I intend to profit from these...

Read on Twitter

Read on Twitter