What I wish I knew about money & investing 5 years ago (+ resources & tips I used to get started.)

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)">

A thread

I was vaguely suspicious of trading on the stock market for most of my life. Why? I didn’t understand it.

Recently that changed. @funkomi ran a #MoneyUp brunch in Jan & @JoyMateSpeaks was keen but out of the country. So she gave me her ticket and I went to take notes for her...

Recently that changed. @funkomi ran a #MoneyUp brunch in Jan & @JoyMateSpeaks was keen but out of the country. So she gave me her ticket and I went to take notes for her...

Before the brunch I’d cleared £20k+ of debt, saved a decent amount and was always the friend people borrowed from. I thought I knew a lot about money. Hah.

Even shared my tips a couple years back in this interview: https://inews.co.uk/inews-lifestyle/money/full-time-job-startup-business-147629

(Still">https://inews.co.uk/inews-lif... useful. But blinkered.)

Even shared my tips a couple years back in this interview: https://inews.co.uk/inews-lifestyle/money/full-time-job-startup-business-147629

(Still">https://inews.co.uk/inews-lif... useful. But blinkered.)

Today @afrocenchix is doing great & I’m on an average salary... but until the brunch I was doing the same things with my money that I did two years ago when bootstrapping on a low income and sacrificing to save.

Back to the brunch. Funke demystified ETFs, bonds & utilities...

Back to the brunch. Funke demystified ETFs, bonds & utilities...

She explained how she started her portfolio with just £50 and I was curious. So I decided to give it a shot.

I had £100 sitting in a ISA. Over the 5 years it had sat there I gained around 10p in interest. So I finally closed it down and opened a @freetrade account.

I had £100 sitting in a ISA. Over the 5 years it had sat there I gained around 10p in interest. So I finally closed it down and opened a @freetrade account.

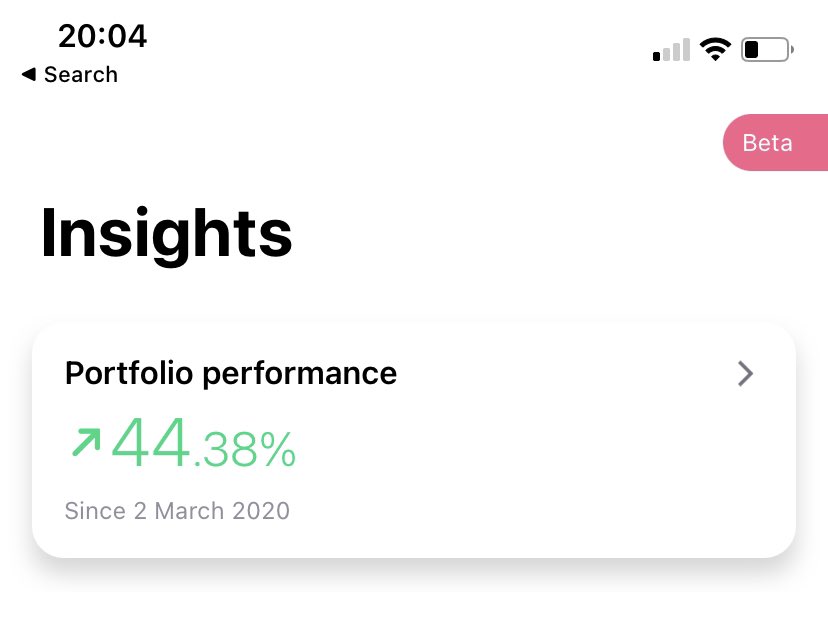

Since March my portfolio has increased in value by 44.38% meanwhile my savings accounts have dropped their rates to an abysmal range of 0.2% to 1.7%

Here are the things I wish I’d known back when I’d cleared debt and was ready for smarter saving & investment.

Here are the things I wish I’d known back when I’d cleared debt and was ready for smarter saving & investment.

1. Inflation erodes the purchasing power of savings.

I had a small 0.2% ISA and money sitting in Quidco doing nothing. Average inflation over the last 5 years has been 2% therefore every year the purchasing power of that same money DECREASED. If invested, I could have gained ~6%

I had a small 0.2% ISA and money sitting in Quidco doing nothing. Average inflation over the last 5 years has been 2% therefore every year the purchasing power of that same money DECREASED. If invested, I could have gained ~6%

2. Typical annual returns for investments over 5 years are 6% but they can be much better.

Started off with a few shares from companies I already knew enough about to feel confident investing. Then I tried a risky strategy of buying low stocks that have done well in the past...

Started off with a few shares from companies I already knew enough about to feel confident investing. Then I tried a risky strategy of buying low stocks that have done well in the past...

High risks (can) bring high returns.

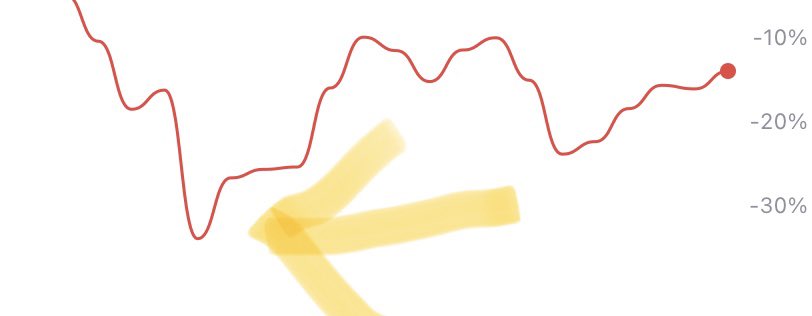

The duds I bought low (eg where the yellow arrow is) bounced back as I’d anticipated and my portfolio popped.

(Note: Historically stocks & shares have outperformed money in savings accounts BUT there’s no guarantee they& #39;ll do so in future.)

The duds I bought low (eg where the yellow arrow is) bounced back as I’d anticipated and my portfolio popped.

(Note: Historically stocks & shares have outperformed money in savings accounts BUT there’s no guarantee they& #39;ll do so in future.)

3. Don’t panic

As you can see from the graph above, the gains I’d made slipped away.

Remember, it’s not a loss until you sell. Investments go down as well as up. If you can hold for ~5 years you’ll often see corrections on losses. My shares thankfully recovered more quickly.

As you can see from the graph above, the gains I’d made slipped away.

Remember, it’s not a loss until you sell. Investments go down as well as up. If you can hold for ~5 years you’ll often see corrections on losses. My shares thankfully recovered more quickly.

4. Some stocks & shares may decrease in value BUT pay high dividends.

I have shares that have gone down since I bought them but have already given me 5-10% of the value back in dividends in just a few months. The dips have been less so despite the share price being down, I’m up.

I have shares that have gone down since I bought them but have already given me 5-10% of the value back in dividends in just a few months. The dips have been less so despite the share price being down, I’m up.

5. Don& #39;t put all your plantain in one pot

Diversity in investment, as in life, has wonderful benefits. A diverse portfolio lowers risk exposure. I invest in different types of companies (after research) and have a mixture of shares, bonds & ETFs. Some for dividends, some growth

Diversity in investment, as in life, has wonderful benefits. A diverse portfolio lowers risk exposure. I invest in different types of companies (after research) and have a mixture of shares, bonds & ETFs. Some for dividends, some growth

Was gonna share more but my law degree is screaming liability. Hope the above is helpful!

Follow @funkomi @Bola_Sol @BrickzwithTipz @MoneySavingExp for money content.

Great blog post for newbies like me: https://www.moneysavingexpert.com/savings/investment-beginners/

Cute">https://www.moneysavingexpert.com/savings/i... IG I learnt from: https://instagram.com/richjourney?igshid=4tptvrtazjra">https://instagram.com/richjourn...

Follow @funkomi @Bola_Sol @BrickzwithTipz @MoneySavingExp for money content.

Great blog post for newbies like me: https://www.moneysavingexpert.com/savings/investment-beginners/

Cute">https://www.moneysavingexpert.com/savings/i... IG I learnt from: https://instagram.com/richjourney?igshid=4tptvrtazjra">https://instagram.com/richjourn...

Oh and before you ask, I mainly use @freetrade — easy interface, free shares for referrals AND you can buy fractional shares.

Link for a free share worth up to £200 to get started:

https://freetrade.io/freeshare/?code=VUN49SPJIA&sender=4iXPzdG8

(one">https://freetrade.io/freeshare... time use so DM me for a fresh link if it’s gone)

Link for a free share worth up to £200 to get started:

https://freetrade.io/freeshare/?code=VUN49SPJIA&sender=4iXPzdG8

(one">https://freetrade.io/freeshare... time use so DM me for a fresh link if it’s gone)

Oh! And if you want a completely risk free way of starting an investment portfolio...

1. Open Quidco account

2. Get cash back on things you were planning to buy anyway

3. Invest the cash back cash

Made £1k+ doing my regular shopping

Link to get started: https://www.quidco.com/raf/593611/ ">https://www.quidco.com/raf/59361...

1. Open Quidco account

2. Get cash back on things you were planning to buy anyway

3. Invest the cash back cash

Made £1k+ doing my regular shopping

Link to get started: https://www.quidco.com/raf/593611/ ">https://www.quidco.com/raf/59361...

Read on Twitter

Read on Twitter " title="What I wish I knew about money & investing 5 years ago (+ resources & tips I used to get started.)A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="What I wish I knew about money & investing 5 years ago (+ resources & tips I used to get started.)A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)">" class="img-responsive" style="max-width:100%;"/>