One of Carta& #39;s under-appreciated advantages is how well their cap table business sets them up to succeed in creating liquidity in private markets—where SecondMarket, SharesPost, and many others have failed.

That& #39;s because Carta, like Visa, is an infrastructure business.

That& #39;s because Carta, like Visa, is an infrastructure business.

2012 may have marked the high watermark of enthusiasm for the concept of a private share exchange.

Facebook& #39;s IPO had just cut SecondMarket& #39;s revenue by 1/3.

Many $FB employees were left feeling like they got bad deals.

Other startups were horrified by the chaos.

Facebook& #39;s IPO had just cut SecondMarket& #39;s revenue by 1/3.

Many $FB employees were left feeling like they got bad deals.

Other startups were horrified by the chaos.

This last point was maybe the most important, because if a company doesn& #39;t want secondary sales to happen, they& #39;re not going to happen.

People can find workarounds, but they& #39;re risky, and it definitely can& #39;t work at scale unless companies actively invite it to happen.

People can find workarounds, but they& #39;re risky, and it definitely can& #39;t work at scale unless companies actively invite it to happen.

After the shock of what happened at $FB wore off, SecondMarket became @NPM and transitioned into basically software for running small, private, controlled markets.

Instead of trying to force liquidity into the system, they started working with issuers—trying to coax it out.

Instead of trying to force liquidity into the system, they started working with issuers—trying to coax it out.

The same year that Facebook went public, @henrysward founded Carta.

He never tried to hide the grand plan for Carta: digitizing paper stock certificates was always phase 1 of a much bigger, master plan. https://www.financialpoise.com/a-few-minutes-with-henry-ward-ceo-of-eshares/">https://www.financialpoise.com/a-few-min...

He never tried to hide the grand plan for Carta: digitizing paper stock certificates was always phase 1 of a much bigger, master plan. https://www.financialpoise.com/a-few-minutes-with-henry-ward-ceo-of-eshares/">https://www.financialpoise.com/a-few-min...

Carta, like Nasdaq PM, wants to coax issuers to offer liquidity—rather than using complex financial instruments to engineer workarounds.

Their advantage in doing so is simply that they& #39;ve built the infrastructure to make it easy. http://cartax.com/ ">https://cartax.com/">...

Their advantage in doing so is simply that they& #39;ve built the infrastructure to make it easy. http://cartax.com/ ">https://cartax.com/">...

Nasdaq PM only does around $5B in volume a year, but that& #39;s impressive when you realize the months of work and cost that go into integrating a company& #39;s cap table so their shares can trade for just one block of time.

It is an arduous process that Carta can make non-arduous.

It is an arduous process that Carta can make non-arduous.

They have the line of sight not just into a company& #39;s current cap table, but all the relevant history and tax context needed to enable secondary sales. Plus they handle the actual transfer of shares.

The strength of (narrative violation?) centralization.

The strength of (narrative violation?) centralization.

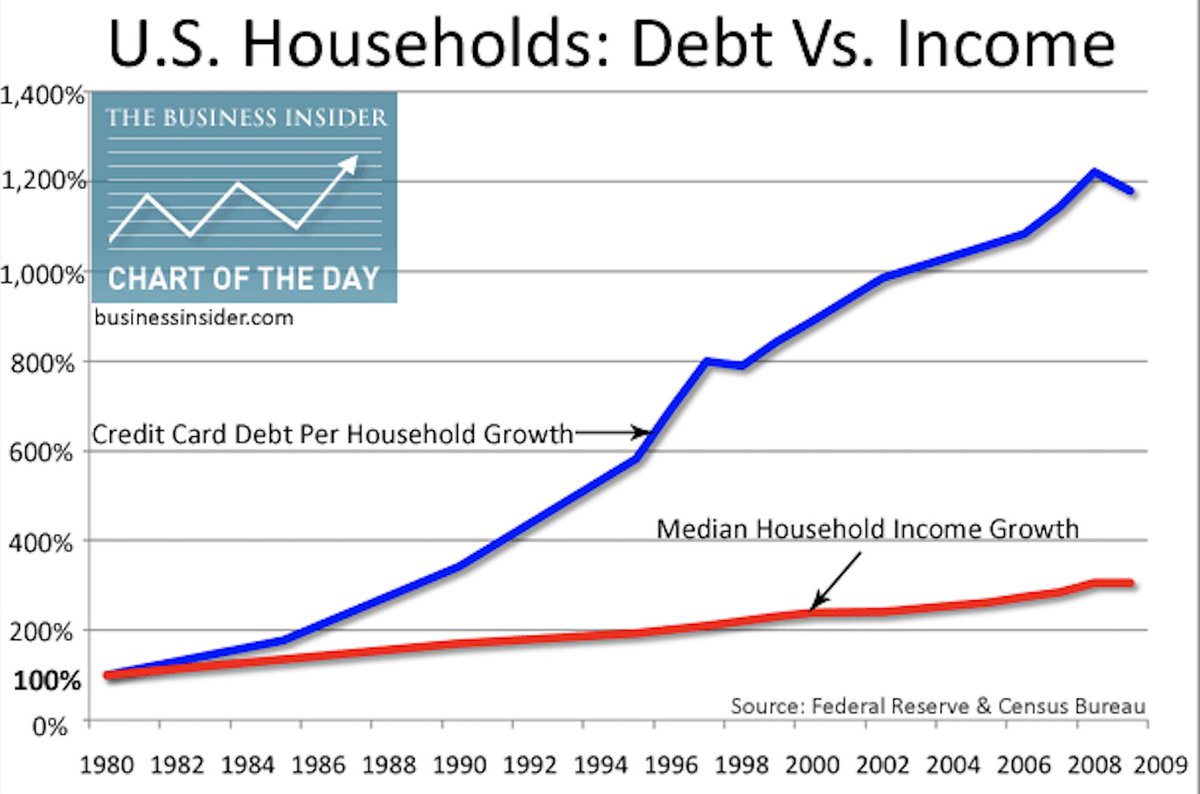

For a historical parallel, look at how credit cards came about.

Credit cards were, like secondary markets, mostly associated with scams and bad behavior in the early days.

Fraud was rampant and missed payments were high.

Credit cards were, like secondary markets, mostly associated with scams and bad behavior in the early days.

Fraud was rampant and missed payments were high.

In 1968, Visa& #39;s Dee Hock brought the banks together and suggested they work together.

Hock would handle the payment network, and make it reliable enough for them all to use.

Consumer spending skyrocketed.

Hock would handle the payment network, and make it reliable enough for them all to use.

Consumer spending skyrocketed.

By digitizing credit, Visa made it frictionless, trustworthy, and useful.

Carta has been doing the same thing to private assets for the last eight years, long before anyone else realized why it was an interesting opportunity.

Carta has been doing the same thing to private assets for the last eight years, long before anyone else realized why it was an interesting opportunity.

Looking at it like this, CartaX and the idea of building a "NYSE for the private markets" is interesting, but still just one step towards something potentially much bigger.

Read on Twitter

Read on Twitter