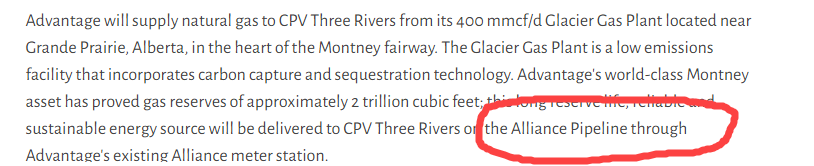

1. So the Advantage $AAV #SparkSpread power deal announced has me thinking about the next phase of natty market diversification for producers in the #WCSB. https://www.advantageog.com/investors/newsreleases/article?id=122681

[Come">https://www.advantageog.com/investors... for a ride with bill]

[Come">https://www.advantageog.com/investors... for a ride with bill]

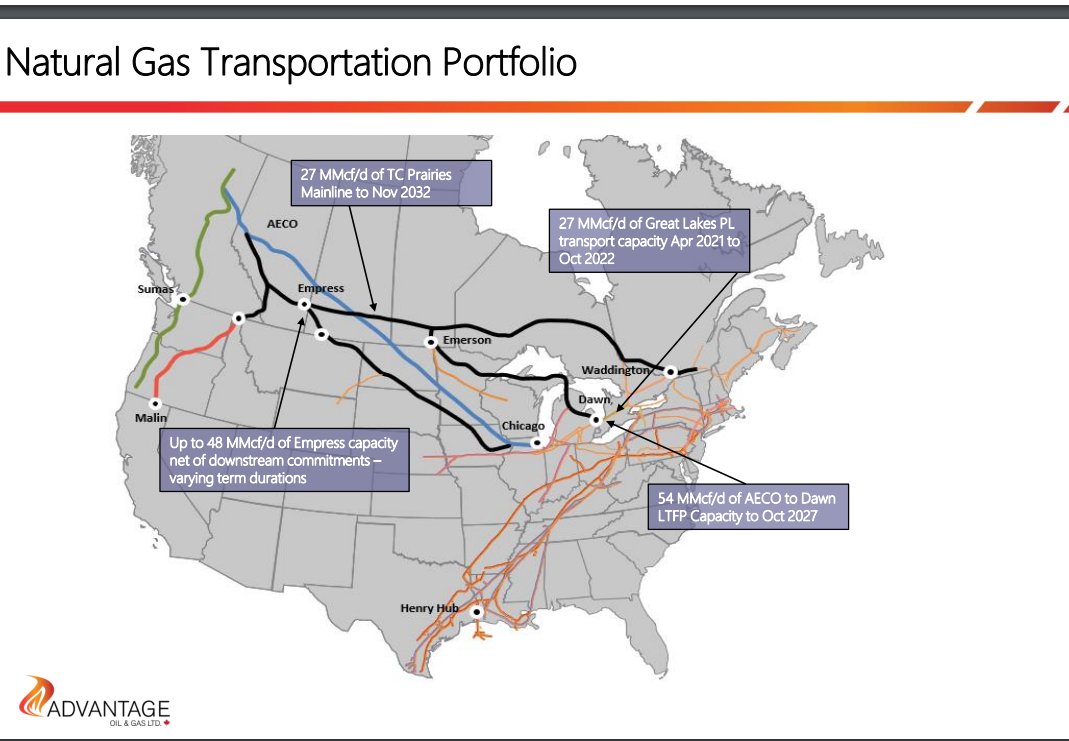

2. AECO has always been a great but sometimes challenging market – market dynamics in the mid-90’s lead to the construction of the Alliance pipeline ( $ENB $PPL ) by companies seeking improved pricing in the US Chicago market.

3. Demand growth from primarily SAGD projects in the 2000’s soak up additional supply, and more recently Coal-to-Gas power gen switching has boosted demand. https://transalta.com/alberta-wire/coal-to-gas-asset-conversions-starting-in-2020/">https://transalta.com/alberta-w...

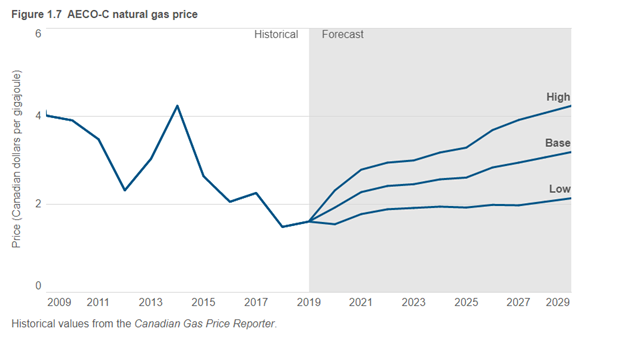

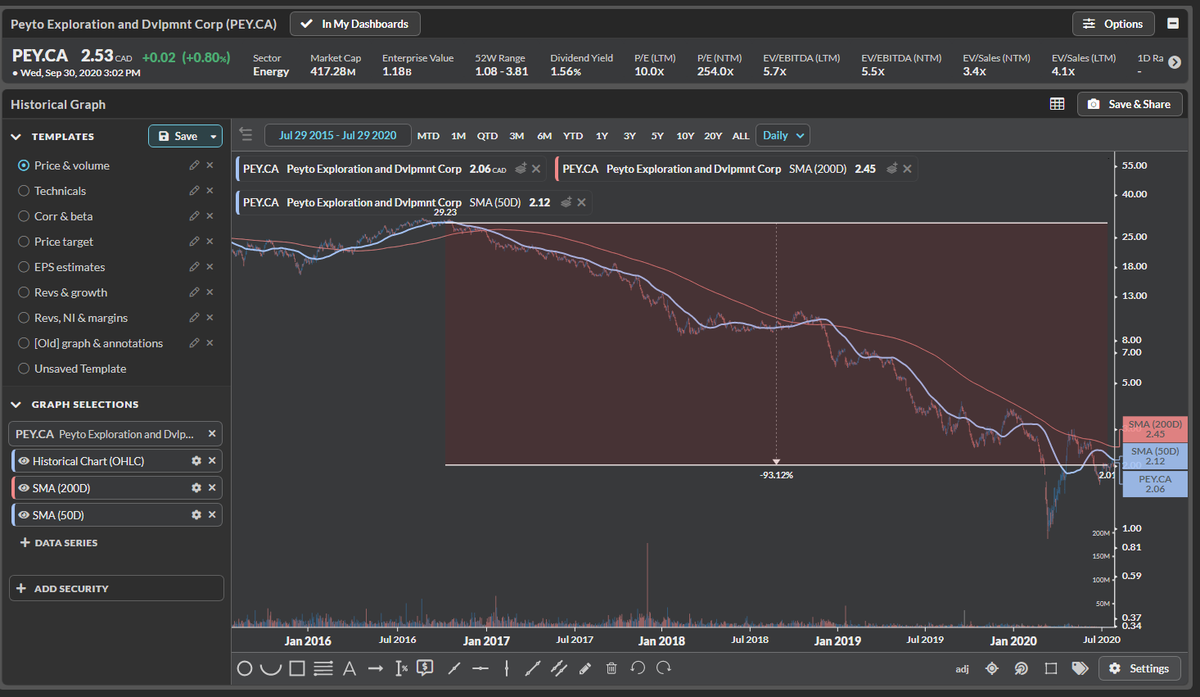

4. So there is fundamental demand at AECO, but as the late 20-aughts showed AECO exposed producers it can be a vicious market who will rip your fucking face off.

5. This absolutely hammered companies like $PEY who has historically stuck to their deep basin knitting and just sold onto NGTL and left the more complex marketing to someone else – a reason they and companies like them could have such small staffs.

6. In fact the ability to have such an plug and play model for gas sales helped many small companies start out – NGTL is a massive advantage for small producers to plug into, though they pay $TRP dearly for the privilege.

7. So WTF happned, well condy drilling and associated gas + slower oil sands growth lead to serious oversupply. Then $TRP changed the way gas flowed into storage which made AECO more volatile and at many points – negative. https://financialpost.com/commodities/canadian-natural-gas-prices-enter-negative-territory-amid-pipeline-outages">https://financialpost.com/commoditi...

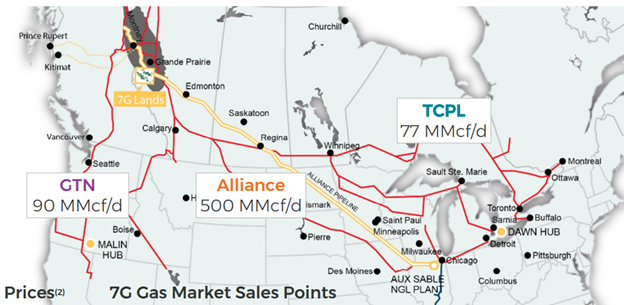

8. Producers who has been selling into AECO were fuuuucked, so they went looking for alternatives – though there were not many to be found – see companies like $VII, who has contacted 1/4th of Alliance pipes volume has essentially locked up all available firm export capacity.

9. Producers without FT out of the market scrambled and signed NYMEX basis deals…. Which in hindsight seems to have been a mistake – see $TRP agreed to the TSP allowing better flows into shortage on NGTL. Diffs closed and many of the basis swaps are now out of the money.

10. Now this is not good for anyone who signed FT that is now out of the money – as @matt_levine says, it is always better to have more money than less. But this is better for companies with real FT not synthetic FT (like basis swaps).

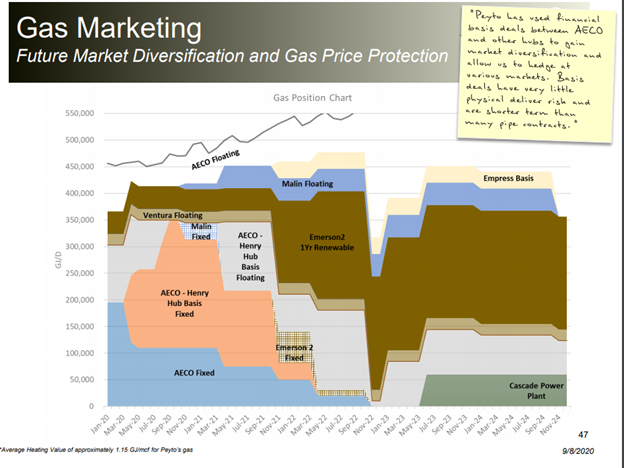

11. This is because producers with real FT have options- $TOU uses their FT to Cali to inject for the…what passes as “winter” season? This is not really an option with the cheaper/easier basis swaps. At a large enough scale the option value of diversification covers the costs

12. Which brings us around to $AAV – it seems the next phase of market diversification is not location but product.

We are seeing $AAV and $PEY doing this with electricity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

We are seeing $AAV and $PEY doing this with electricity

13. Although we don’t know which companies have signed up to pay $IPL’s fee-for-service/take-or-pay contracts at the Heartland PDH/PP project; ~ 40-50% of the 22,000bbl/d of propane consumed has been committed by producers who will own the plastic produced on the other end.

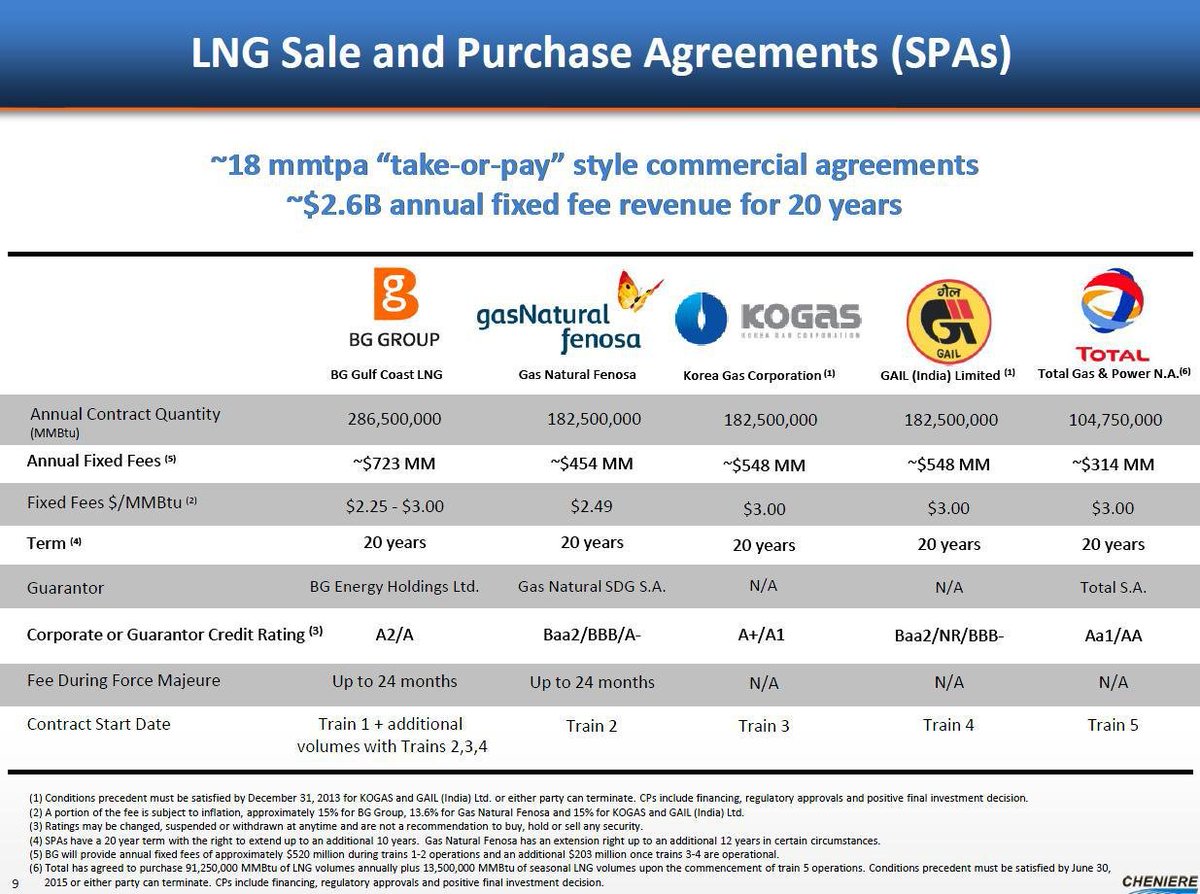

14. So both these are similar to $LNG ’s take or pay tolling model – there is a product transformation – gas companies moving up the value chain, but having to pay to do it (or someone else is paying but getting the upside)

15. $AAV has to pay alliance $PPL/ $ENB to get their gas to Chicago, E&P’s have to pay $IPL tolls regardless of the economics of plastic production. (Weird $AAV doesn& #39;t make Alliance capacity clear)

16. $TOU ’s Rose was asked about this model for West Coast LNG and he said they would much rather a supply deal than a deal where they retained all waterborne upside but had liquefaction liability on the balance sheet.

17. This is where $AAV ’s deal is appealing – they are getting a price based off of #PJM without the cost of an expensive tolling agreemen https://twitter.com/homet ela a LNG Liquefaction or PDH/PP.

(Don& #39;t throw money away on tolls)

(Don& #39;t throw money away on tolls)

18.This is where the real FT mentioned earlier comes back around – $AAV still has the pipe to move gas to Chicago on Alliance $PPL/ $ENB, they retain that optionality. $PEY will have similar advantages at Cascade because NGTL $TRP is cheap(ish).

19.Side Note – I reached out to $PEY for more details on their pricing structure for the Cascade sales but have not heard back.

20. So it seems the next phase of natural gas market diversification is not new market’s for gas (which is good considering we are heading to a global gas price) but new markets for products and states of matter made from #CH4.

Some late breaking followup - #NGTL is fucked again folks. https://twitter.com/geoffreymorgan/status/1311369879300136960">https://twitter.com/geoffreym...

Read on Twitter

Read on Twitter![1. So the Advantage $AAV #SparkSpread power deal announced has me thinking about the next phase of natty market diversification for producers in the #WCSB. https://www.advantageog.com/investors... for a ride with bill] 1. So the Advantage $AAV #SparkSpread power deal announced has me thinking about the next phase of natty market diversification for producers in the #WCSB. https://www.advantageog.com/investors... for a ride with bill]](https://pbs.twimg.com/media/EjL33znXsAUHXh6.png)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" title="12. Which brings us around to $AAV – it seems the next phase of market diversification is not location but product. We are seeing $AAV and $PEY doing this with electricity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" title="12. Which brings us around to $AAV – it seems the next phase of market diversification is not location but product. We are seeing $AAV and $PEY doing this with electricity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" class="img-responsive" style="max-width:100%;"/>