I& #39;m delayed on this, but I& #39;ve never listened in/read an Invesco Earnings call. So am doing that now, and will share interesting parts here.

This is from their 2nd qtr results (call was end of July)

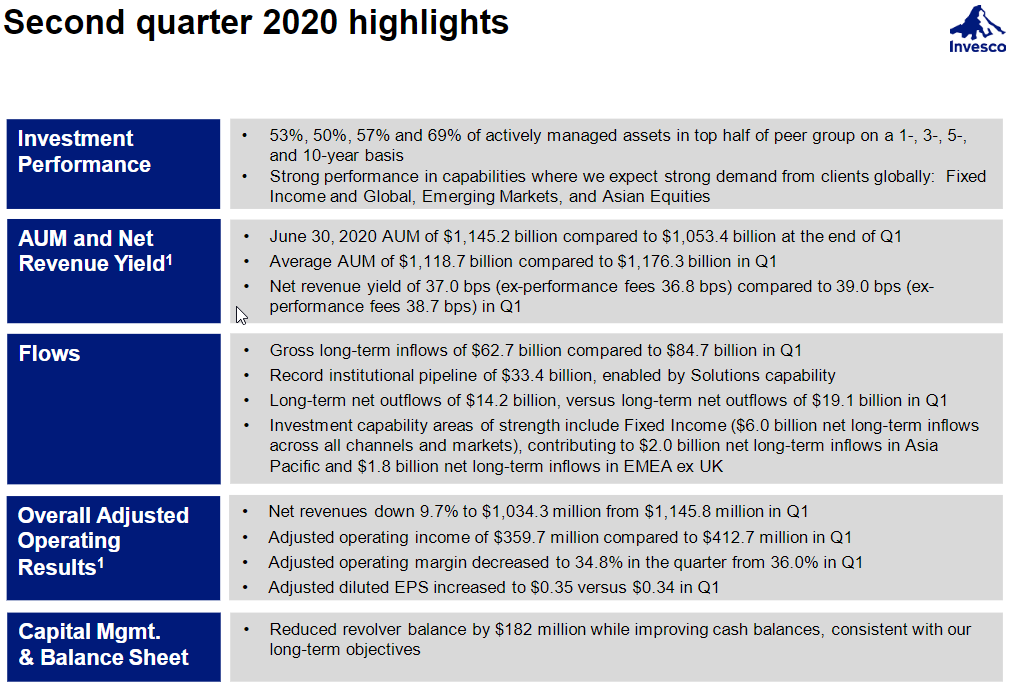

What jumps out at me on this page? Avg fee dropped from 39 bps to 37 bps

This is from their 2nd qtr results (call was end of July)

What jumps out at me on this page? Avg fee dropped from 39 bps to 37 bps

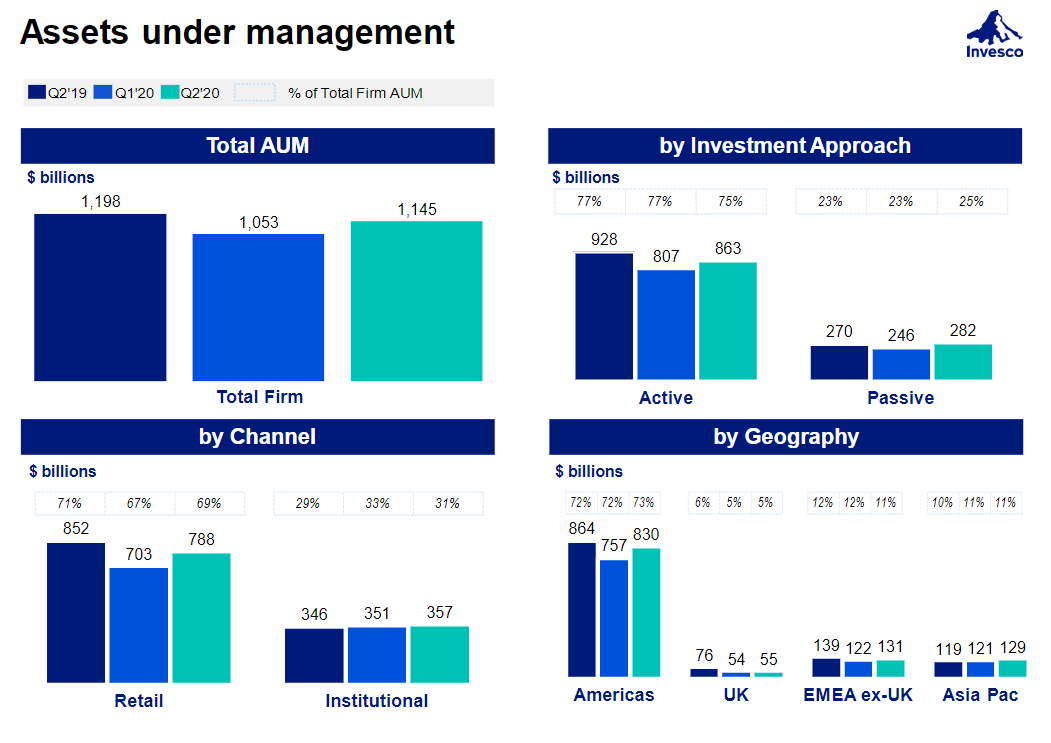

Retail AUM seemingly shrinking. Institutional channel growing. Helps explain the lower average fees.

(also, disclaimer to all of this is that we& #39;re comparing some extremely wild times between 1st qtr and 2nd qtr in these numbers. So take everything with a pound of salt)

(also, disclaimer to all of this is that we& #39;re comparing some extremely wild times between 1st qtr and 2nd qtr in these numbers. So take everything with a pound of salt)

This was mentioned by Martin Flanagan (CEO) at the top of the earnings call:

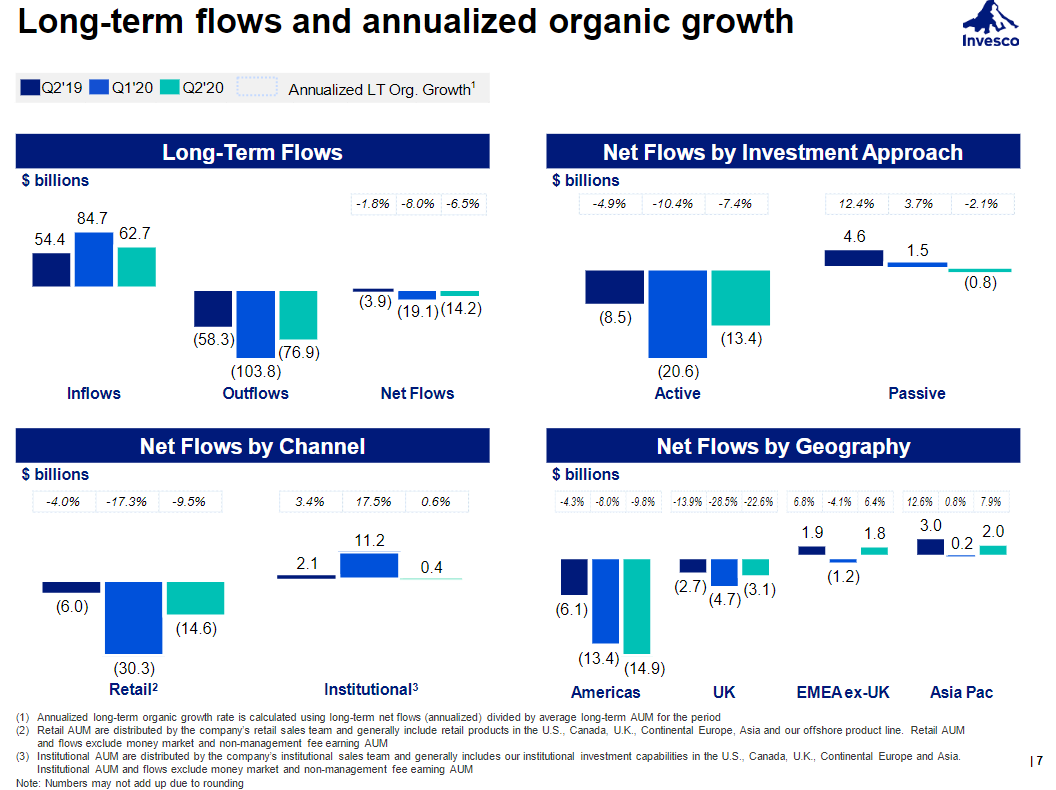

"Retail flows improved during the quarter but were net outflows."

My hunch (though I haven& #39;t checked yet) is the outflows were largely due to Oppenheimer outflows (who they acquired).

"Retail flows improved during the quarter but were net outflows."

My hunch (though I haven& #39;t checked yet) is the outflows were largely due to Oppenheimer outflows (who they acquired).

And yes, confirmed by this slide of "long term flows". Top right you can see active in big outflows. More or less flat on the passive side (which ain& #39;t bad given circumstances of Q1/Q2).

Outflows being driven by their US funds (bottom right)

Outflows being driven by their US funds (bottom right)

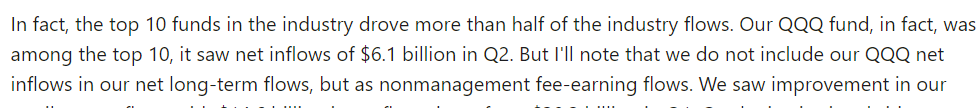

Interesting point from the call. QQQ was top 10 ETF in inflows for 2nd quarter (as would be expected), but they don& #39;t count that fund in their net long term flows numbers.

Like SPY at State Street, that fund just does what it does in terms of flows.

Like SPY at State Street, that fund just does what it does in terms of flows.

Question on how the combined Oppenheimer/Invesco sales force is doing:

TLDR: Had positive flows of $2 billion in our ETFs. So going well. Is a greenshoot for the company.

TLDR: Had positive flows of $2 billion in our ETFs. So going well. Is a greenshoot for the company.

Read on Twitter

Read on Twitter