$DADA An IPO that also exhibits relative strength

Notes

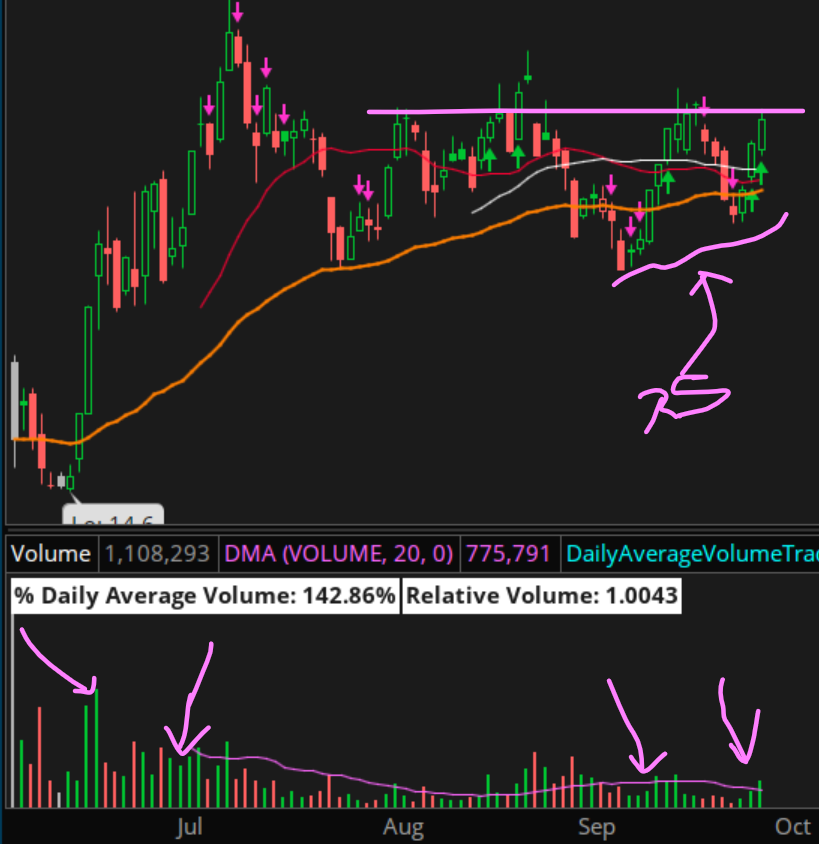

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Watching for tightness in the coming days with dry up in volume

Notes

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Watching for tightness in the coming days with dry up in volume

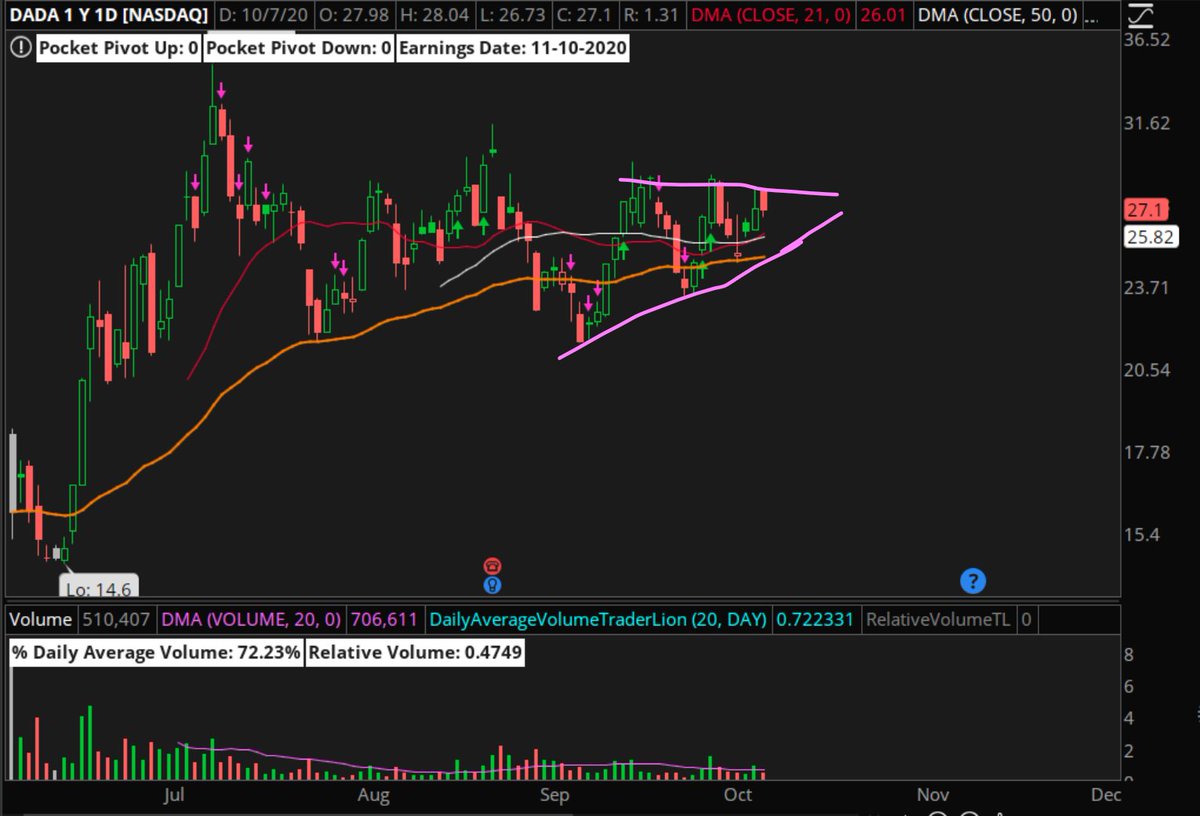

$DADA continues to act well tightening its ranges with higher lows and lower highs on the daily chart.

This sort of formation has a ton of "pent up" energy that has been built.

Some may say "VCP" ala Mark.

Concern: Liquidity/Bid-Ask Ranges.

This sort of formation has a ton of "pent up" energy that has been built.

Some may say "VCP" ala Mark.

Concern: Liquidity/Bid-Ask Ranges.

$DADA the higher low, lower high formation has my eye.

Been circling this one in my daily plan the past few nights as I build a plan.

Continuing to watch.

Been circling this one in my daily plan the past few nights as I build a plan.

Continuing to watch.

$DADA attempting to break out from its tight higher lows and lower highs pattern. Volume runs well ahead.

Note the #winning characteristics. IPOs that have "no business" holding up in a corrective market phase are starting to outperform.

Note the #winning characteristics. IPOs that have "no business" holding up in a corrective market phase are starting to outperform.

$DADA An IPO that also exhibited relative strength

Notes

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Breakout today on highest volume since July

Notes

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Breakout today on highest volume since July

$DADA An IPO that exhibited relative strength.

Notes

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Follow through today.

*Releasing that "pent up" energy.

Notes

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Follow through today.

*Releasing that "pent up" energy.

$DADA An IPO that exhibited RS has spent the past week releasing pent up energy.

Notes

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Releasing that "pent up" energy.

Notes

*Higher Lows, big volume up days small volume down days

*Relative Strength since September

*Back in July highest volume since IPO within the first 2 weeks.

*Releasing that "pent up" energy.

Read on Twitter

Read on Twitter