A few thoughts on @CFTC & @SEC_News joint order requiring @jpmorgan to pay $920 million for 8-year scheme manipulating precious metals and US Treasuries markets. 1/

https://www.cftc.gov/PressRoom/PressReleases/8260-20">https://www.cftc.gov/PressRoom...

https://www.sec.gov/news/press-release/2020-233">https://www.sec.gov/news/pres...

https://www.cftc.gov/PressRoom/PressReleases/8260-20">https://www.cftc.gov/PressRoom...

https://www.sec.gov/news/press-release/2020-233">https://www.sec.gov/news/pres...

This is not the first time in recent years JPMC has been caught manipulating markets.

It was fined for manipulating energy markets in 2014.

It was also part of a multi-bank settlement for manipulating Foreign Exchange markets. 2/ https://www.reuters.com/article/us-jpmorgan-ferc/jpmorgan-to-pay-410-million-to-settle-power-market-case-idUSBRE96T0NA20130730">https://www.reuters.com/article/u...

It was fined for manipulating energy markets in 2014.

It was also part of a multi-bank settlement for manipulating Foreign Exchange markets. 2/ https://www.reuters.com/article/us-jpmorgan-ferc/jpmorgan-to-pay-410-million-to-settle-power-market-case-idUSBRE96T0NA20130730">https://www.reuters.com/article/u...

DOJ is also entering a deferred prosecution agreement with JPMC.

DOJ & JPMC had a DPA for F/X manipulation, w/a condition that JPMC wouldn& #39;t commit any federal crimes from & #39;15-& #39;18.

Appears they were manipulating markets in violation of the F/X DPA. 3/

https://www.justice.gov/opa/pr/five-major-banks-agree-parent-level-guilty-pleas">https://www.justice.gov/opa/pr/fi...

DOJ & JPMC had a DPA for F/X manipulation, w/a condition that JPMC wouldn& #39;t commit any federal crimes from & #39;15-& #39;18.

Appears they were manipulating markets in violation of the F/X DPA. 3/

https://www.justice.gov/opa/pr/five-major-banks-agree-parent-level-guilty-pleas">https://www.justice.gov/opa/pr/fi...

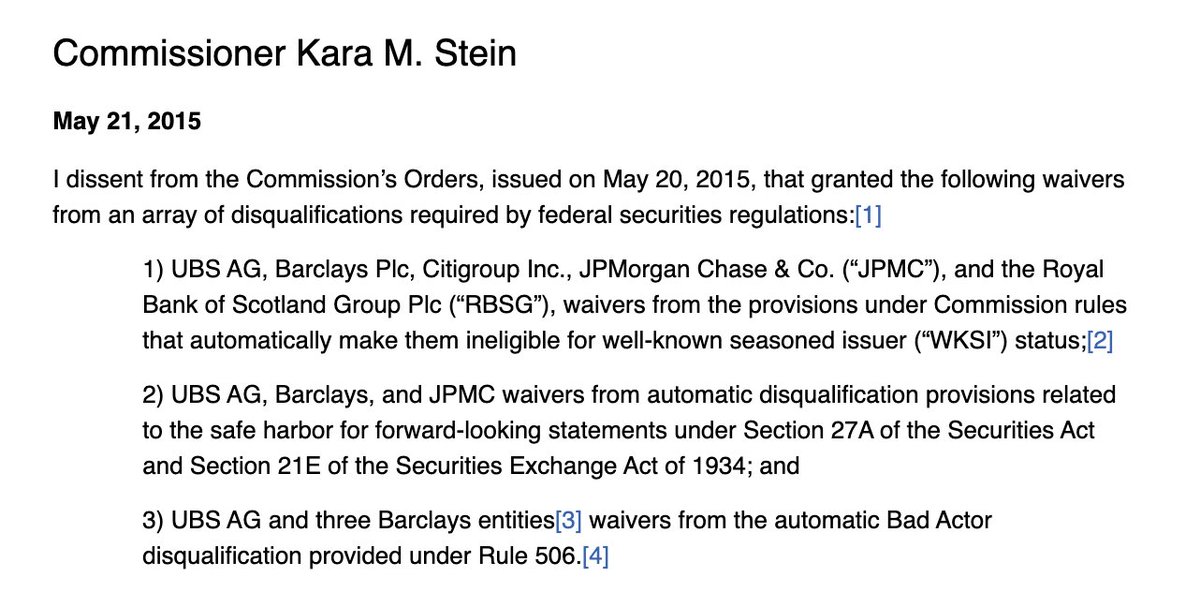

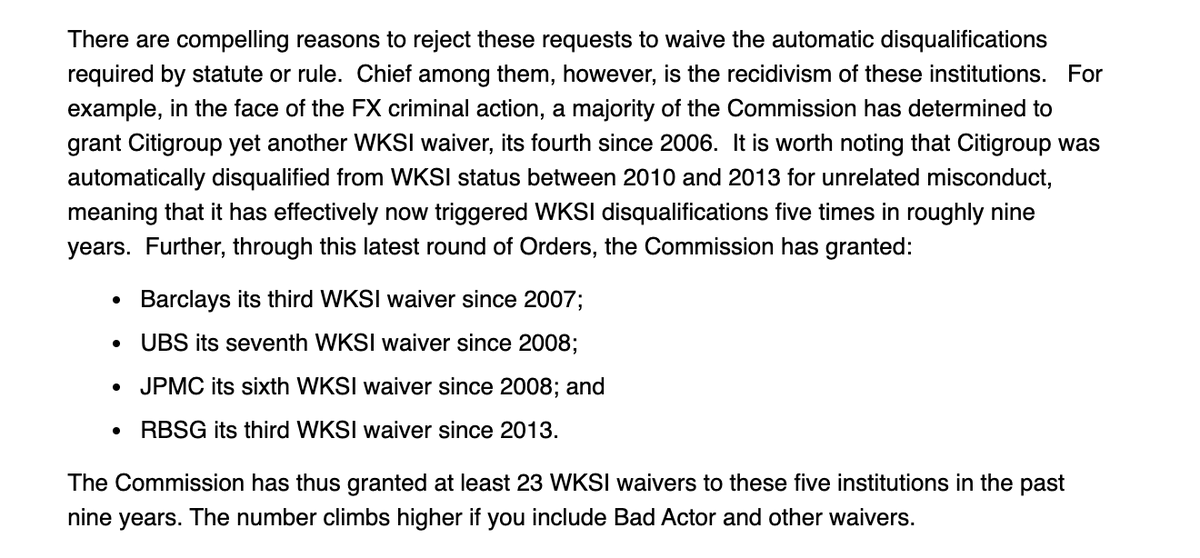

. @CFTCberkovitz notes that SEC can disqualify JPMC from certain privileges as a & #39;bad actor.& #39;

Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/

https://www.cftc.gov/PressRoom/SpeechesTestimony/berkovitzstatement092920

https://www.cftc.gov/PressRoom... href=" https://www.sec.gov/news/statement/stein-waivers-granted-dissenting-statement.html">https://www.sec.gov/news/stat...

Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/

https://www.cftc.gov/PressRoom/SpeechesTestimony/berkovitzstatement092920

Last observation: no apparent enforcement action by @federalreserve here.

The Fed also has the ability to modify or rescind its order allowing JPMC to trade physical commodities. "Unfair competition" is one of the considerations.

/end

https://www.federalreserve.gov/boarddocs/press/orders/2005/20051118/attachment.pdf">https://www.federalreserve.gov/boarddocs...

The Fed also has the ability to modify or rescind its order allowing JPMC to trade physical commodities. "Unfair competition" is one of the considerations.

/end

https://www.federalreserve.gov/boarddocs/press/orders/2005/20051118/attachment.pdf">https://www.federalreserve.gov/boarddocs...

Read on Twitter

Read on Twitter

https://www.sec.gov/news/stat..." title=". @CFTCberkovitz notes that SEC can disqualify JPMC from certain privileges as a & #39;bad actor.& #39; Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/ https://www.cftc.gov/PressRoom... href=" https://www.sec.gov/news/statement/stein-waivers-granted-dissenting-statement.html">https://www.sec.gov/news/stat...">

https://www.sec.gov/news/stat..." title=". @CFTCberkovitz notes that SEC can disqualify JPMC from certain privileges as a & #39;bad actor.& #39; Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/ https://www.cftc.gov/PressRoom... href=" https://www.sec.gov/news/statement/stein-waivers-granted-dissenting-statement.html">https://www.sec.gov/news/stat...">

https://www.sec.gov/news/stat..." title=". @CFTCberkovitz notes that SEC can disqualify JPMC from certain privileges as a & #39;bad actor.& #39; Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/ https://www.cftc.gov/PressRoom... href=" https://www.sec.gov/news/statement/stein-waivers-granted-dissenting-statement.html">https://www.sec.gov/news/stat...">

https://www.sec.gov/news/stat..." title=". @CFTCberkovitz notes that SEC can disqualify JPMC from certain privileges as a & #39;bad actor.& #39; Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/ https://www.cftc.gov/PressRoom... href=" https://www.sec.gov/news/statement/stein-waivers-granted-dissenting-statement.html">https://www.sec.gov/news/stat...">

https://www.sec.gov/news/stat..." title=". @CFTCberkovitz notes that SEC can disqualify JPMC from certain privileges as a & #39;bad actor.& #39; Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/ https://www.cftc.gov/PressRoom... href=" https://www.sec.gov/news/statement/stein-waivers-granted-dissenting-statement.html">https://www.sec.gov/news/stat...">

https://www.sec.gov/news/stat..." title=". @CFTCberkovitz notes that SEC can disqualify JPMC from certain privileges as a & #39;bad actor.& #39; Past Dem SEC commissioners objected to permissive waivers, including for JPMC manipulating foreign currency markets. 4/ https://www.cftc.gov/PressRoom... href=" https://www.sec.gov/news/statement/stein-waivers-granted-dissenting-statement.html">https://www.sec.gov/news/stat...">