This is why I think Trump is doing more than tax avoidance.

This is from financials for the Aberdeen property. It& #39;s one page from one year, but tells a story repeated year after year.

I hope at least some stick with me (esp. @susannecraig @russbuettner @mmcintire )

1/

This is from financials for the Aberdeen property. It& #39;s one page from one year, but tells a story repeated year after year.

I hope at least some stick with me (esp. @susannecraig @russbuettner @mmcintire )

1/

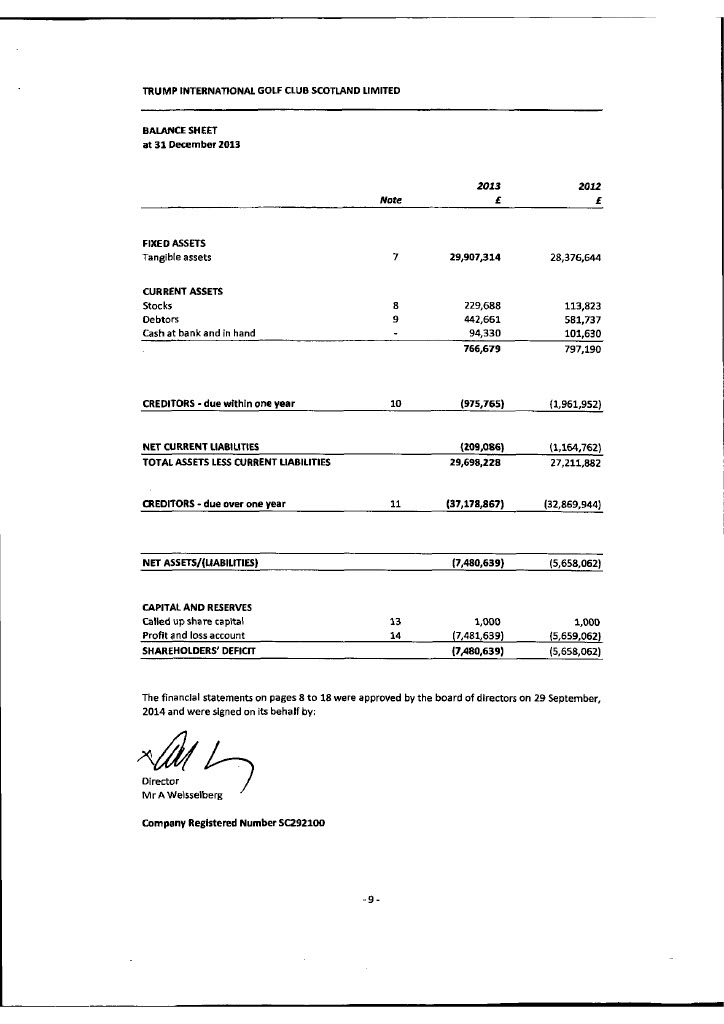

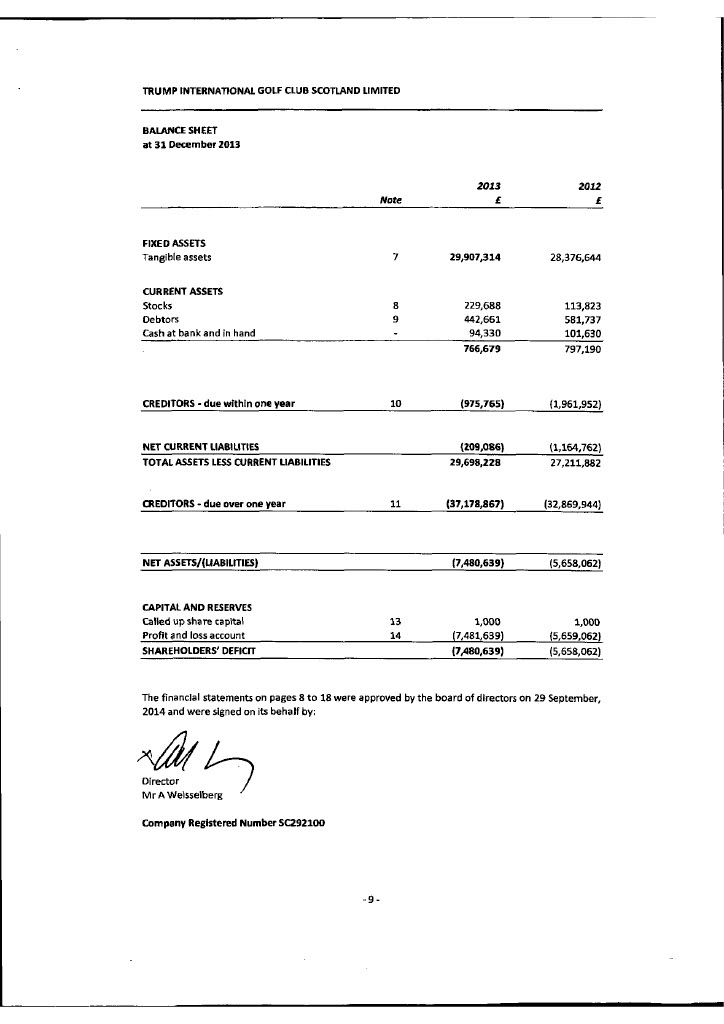

The thing everyone reports is the losses--the shareholder (Trump) has lost more than £7M.

But the interesting stuff is the fixed asset value and the creditors--over one year.

Trump is all of them: he owns the asset, lends the money, owes the money, is owed the money.

2/

But the interesting stuff is the fixed asset value and the creditors--over one year.

Trump is all of them: he owns the asset, lends the money, owes the money, is owed the money.

2/

We see the same process year after year. He lends himself millions, the asset value is increased by that same number of millions.

This happens in many years when he does no work on the property--no investment, no building.

It happened through the 2008 crash.

3/

This happens in many years when he does no work on the property--no investment, no building.

It happened through the 2008 crash.

3/

Aberdeen was collapsing from the overall financial crisis and the--locally--far worse collapse of North Sea Oil. Property values were shrinking.

Trump Aberdeen saw the same process--no development, but huge loans from Trump and huge increase in claimed asset value.

4/

Trump Aberdeen saw the same process--no development, but huge loans from Trump and huge increase in claimed asset value.

4/

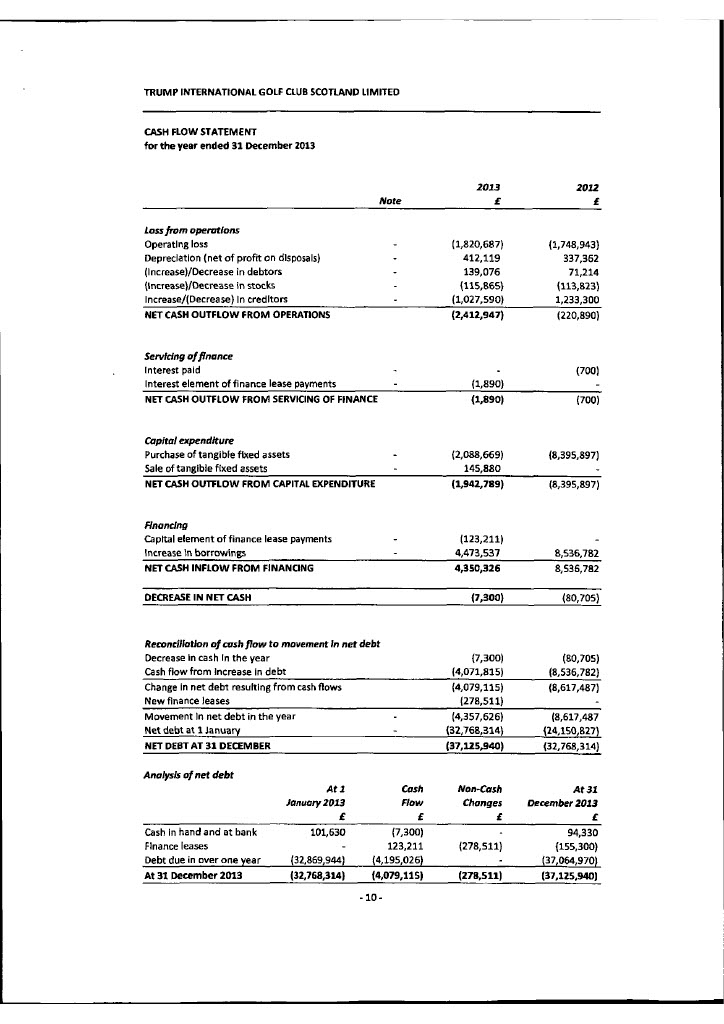

Those loans are actually spent. Here is Page 10.

You see: major outflows of cash for operations and capital. The cash on hand at end of year is only £94K.

Again--this happens in years when he spends no money on developing the course or resort.

5/

-

You see: major outflows of cash for operations and capital. The cash on hand at end of year is only £94K.

Again--this happens in years when he spends no money on developing the course or resort.

5/

-

There& #39;s much more to say--each line here is fascinating.

But the overall picture is crystal clear: Every year, Trump lends millions to himself, spends all that money on something, and claims the asset is worth all the money he spent.

6/

But the overall picture is crystal clear: Every year, Trump lends millions to himself, spends all that money on something, and claims the asset is worth all the money he spent.

6/

He cannot have spent all that money on the properties. We have the planning docs. We know how much he spent--it& #39;s far less than what he claims.

The money truly disappears. It goes from one pocket to another pocket and then the pocket is opened to reveal nothing is there.

7/

The money truly disappears. It goes from one pocket to another pocket and then the pocket is opened to reveal nothing is there.

7/

A bit of this could be explained as tax avoidance or fraud. But he is going to enormous effort to falsify upwards the overall valuation of the property--the opposite of what he& #39;d do if this was solely tax fraud.

8/

8/

Instead, this is a huge effort to mask a money pit as an appreciating asset--in other words, one he can& #39;t write off.

That is why I am skeptical of the idea that this is all his own money.

I have shown these docs to many accountants, lawyers, prosecutors, FBI agent, etc.

9/

That is why I am skeptical of the idea that this is all his own money.

I have shown these docs to many accountants, lawyers, prosecutors, FBI agent, etc.

9/

Nobody has come up with a plausible legitimate reason for these accounting shenanigans. And all agree it& #39;s a bit ornate and not quite right for simple tax avoidance.

The most likely explanation is, of course, money laundering.

10/

The most likely explanation is, of course, money laundering.

10/

Remember: these are the cleanest financials we have from the Trump Org. They are audited and made public because of UK rules.

So, whatever is going on here should be the least sketchy thing he& #39;s doing.

Please please please check my math and my analysis.

11/

So, whatever is going on here should be the least sketchy thing he& #39;s doing.

Please please please check my math and my analysis.

11/

You can do this at home.

Go to:

https://beta.companieshouse.gov.uk/

search">https://beta.companieshouse.gov.uk/">... "Trump International Golf" and open the FULL ACCOUNTS for each year.

You see a clear trend:

From 2005 to 2010, the disappearing cash is relatively low--a million or two a year.

12/

Go to:

https://beta.companieshouse.gov.uk/

search">https://beta.companieshouse.gov.uk/">... "Trump International Golf" and open the FULL ACCOUNTS for each year.

You see a clear trend:

From 2005 to 2010, the disappearing cash is relatively low--a million or two a year.

12/

Then it grows and grows from 2010 to 2016, far outpacing his actual spending.

Then, when he becomes president, it all stops. It just remains at its inflated value without the annual loan. Which is weird, ...

13/

Then, when he becomes president, it all stops. It just remains at its inflated value without the annual loan. Which is weird, ...

13/

The family was claiming to be preparing a massive investment and surely needed money for architects, designers, planning docs, lawyers, etc.

Why would he turn off this mechanism in 2017?

14/

Why would he turn off this mechanism in 2017?

14/

I am blown away by the NYT reporters work. A great 40,000 foot view of the whole forest.

But you also have to look at each tree and see what is going on.

These financials are clear: this is not a golf business, it& #39;s a money disappearing business.

15/

But you also have to look at each tree and see what is going on.

These financials are clear: this is not a golf business, it& #39;s a money disappearing business.

15/

I posted the wrong assets page on tweet 5. Here it is.

But, again, you can do all this at home. Free and sort of easy.

16/end

But, again, you can do all this at home. Free and sort of easy.

16/end

Oh, forgot to make the most obvious point:

If this is a money disappearing business and it is not only tax fraud, then he is making money disappear for somebody else and charging some sort of fee. Which might explain why a money-losing golf course pays huge fees to its owner.

If this is a money disappearing business and it is not only tax fraud, then he is making money disappear for somebody else and charging some sort of fee. Which might explain why a money-losing golf course pays huge fees to its owner.

Read on Twitter

Read on Twitter