1/ Today, @hrw published an investigation into how the automation of #UniversalCredit, the UK& #39;s benefits system, is driving people into hunger, debt and poverty.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">: https://www.hrw.org/news/2020/09/29/uk-automated-benefits-system-failing-people-need">https://www.hrw.org/news/2020...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">: https://www.hrw.org/news/2020/09/29/uk-automated-benefits-system-failing-people-need">https://www.hrw.org/news/2020...

2/ #UniversalCredit is supposed to simplify the benefits system - combine six social security benefits into a monthly lump sum paid and calculated monthly.

But what the government has created is devilishly complex. https://www.hrw.org/report/2020/09/29/automated-hardship/how-tech-driven-overhaul-uks-social-security-system-worsens">https://www.hrw.org/report/20...

But what the government has created is devilishly complex. https://www.hrw.org/report/2020/09/29/automated-hardship/how-tech-driven-overhaul-uks-social-security-system-worsens">https://www.hrw.org/report/20...

3/ The means-testing algorithm at the heart of #UniversalCredit is flawed. It& #39;s supposed to adjust people& #39;s benefit as their earnings change. But it frequently misinterprets people& #39;s earnings.

4/ That& #39;s because the data fed to the algorithm only shows the wages people receive in any given month, not how frequently they are paid. That& #39;s fine if you receive one paycheck and that& #39;s your salary for the month.

5/ But what if you receive several paychecks for multiple periods of work? The algorithm just assumes all of it is your monthly earnings.

6/ This can wreak havoc in people& #39;s lives. A single mother of two in London had her benefit plummet to £388 in March, then rise to £2020 in April, and fall to £1406 in May.

Her income remained the same throughout.

Her income remained the same throughout.

7/ When calculating her benefit in March, the algorithm counted her January and February paychecks towards her monthly earnings, because both paydays happened to fall within the monthly means-testing window she was assigned.

Inflated earnings = benefit slashed.

Inflated earnings = benefit slashed.

8/ The extreme fluctuations made life incredibly hard. She struggled to make rent and feed her family in March. In May, she told me, "I& #39;m always on eggshells. I don& #39;t know what& #39;s around the corner." #1088">https://www.hrw.org/report/2020/09/29/automated-hardship/how-tech-driven-overhaul-uks-social-security-system-worsens #1088">https://www.hrw.org/report/20...

9/ The problem is more than just bad math. The algorithm reacts poorly to complex financial realities, because it uses too rigid a framework to assess people& #39;s needs.

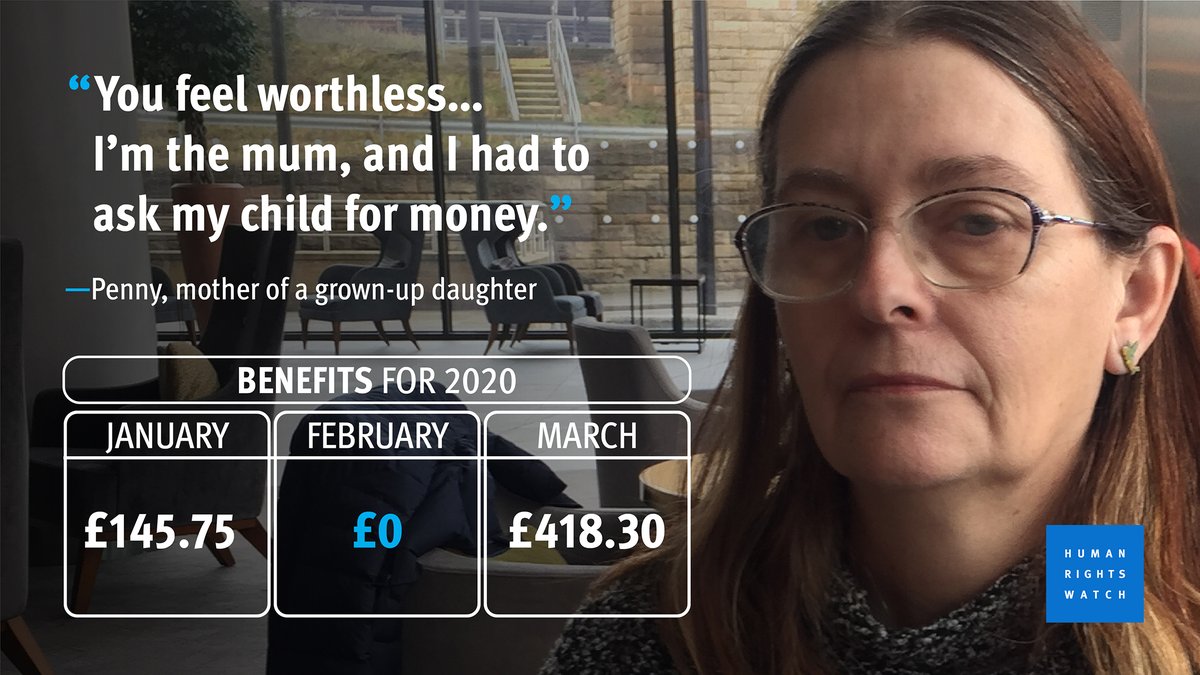

Wages Penny received in January for temp work she did before Xmas reduced her benefit to zero - in *February*

Wages Penny received in January for temp work she did before Xmas reduced her benefit to zero - in *February*

10/ In a case brought by @CPAGUK @LeighDay_Law on behalf of four mothers, the Court of Appeal ordered the government to fix the effect of the algorithm on people with regular monthly salaries. https://www.hrw.org/news/2020/06/24/court-corrects-flaw-uks-automated-benefits-system">https://www.hrw.org/news/2020...

11/ This is encouraging - it shows that courts are willing to hold governments accountable when their algorithms hurt people.

But it doesn& #39;t solve everything.

But it doesn& #39;t solve everything.

12/ The fear is that the government (which has accepted the ruling) will slap on a band-aid, when what& #39;s needed is a fundamental rethinking of how the benefit is calculated.

13/ The real problem is the government& #39;s wishful thinking that the benefits system should mirror a world where people hold steady, monthly-paid jobs.

Is it any wonder that the system works poorly for people who don& #39;t conform to this narrow ideal?

Is it any wonder that the system works poorly for people who don& #39;t conform to this narrow ideal?

14/ The same wishful thinking about the digital age - that people should just get on with it and learn to be internet savvy - is also causing hardship.

It ignores the socio-economic inequalities that are making it difficult for people to come online. #7508">https://www.hrw.org/report/2020/09/29/automated-hardship/how-tech-driven-overhaul-uks-social-security-system-worsens #7508">https://www.hrw.org/report/20...

It ignores the socio-economic inequalities that are making it difficult for people to come online. #7508">https://www.hrw.org/report/2020/09/29/automated-hardship/how-tech-driven-overhaul-uks-social-security-system-worsens #7508">https://www.hrw.org/report/20...

15/ I met a father of three who was repeatedly sanctioned for not submitting online evidence of his job search to the government& #39;s satisfaction.

He ended up going to the food bank to feed his family.

He ended up going to the food bank to feed his family.

16/ The government has increased funding to some charities to help people apply online for the "predominantly digital" benefit, but demand for support outstrips supply.

@ThriveTeesside told me that the burden fell on groups like them to pick up the pieces.

@ThriveTeesside told me that the burden fell on groups like them to pick up the pieces.

17/ This hardship is not inevitable. Social security experts and anti-poverty groups that have studied the benefits system for years, if not decades, have provided the government multiple technical and policy options to make #UniversalCredit fit for purpose.

18/ The government needs to listen to groups and experts like @jrf_uk @CPAGUK @CitAdvNewcastle @ThriveTeesside @NAWRA_UK @ApleCollective @EinsteinsAttic @gmorgan_ferret @richardjpope.

Above all, they need to listen to the people who are directly affected by #UniversalCredit.

Above all, they need to listen to the people who are directly affected by #UniversalCredit.

19/ Whether the government changes #UniversalCredit for the better will have important global implications.

@PhilipGAlston @cpjvanveen have found that many governments are automating their welfare systems, often in ways that harm people& #39;s rights. https://twitter.com/PhilipGAlston/status/1184846110843719682">https://twitter.com/PhilipGAl...

@PhilipGAlston @cpjvanveen have found that many governments are automating their welfare systems, often in ways that harm people& #39;s rights. https://twitter.com/PhilipGAlston/status/1184846110843719682">https://twitter.com/PhilipGAl...

20/ With meaningful #universalcredit reform, the government can reverse the tide of hardship and set an important precedent for protecting people& #39;s rights in the digital age. /END

Read on Twitter

Read on Twitter