Fredun Pharmaceuticals Limited - Another Caplin Point in making?

Fredun Pharma is a WHO approved Pharmaceuticals Company; exporting to nearly 30 countries (mostly to African countries & Asian countries) and totally committed to supplying affordable quality medicines for decades.

Fredun Pharma is a WHO approved Pharmaceuticals Company; exporting to nearly 30 countries (mostly to African countries & Asian countries) and totally committed to supplying affordable quality medicines for decades.

About the Company

The company started operations way back in the 1990s as contract manufacturer for big pharma companies. Currently, contract manufacturing is only 2% of its total turnover. Anti-diabetic contribute 25% of its total sales, anti-cardiac 18%, NSAID 24% & others 33%

The company started operations way back in the 1990s as contract manufacturer for big pharma companies. Currently, contract manufacturing is only 2% of its total turnover. Anti-diabetic contribute 25% of its total sales, anti-cardiac 18%, NSAID 24% & others 33%

Financials (Last four years)

SALES

2017 : 57 crs

2018 : 60 crs

2019 : 97 crs

2020 : 113 crs

PAT

2017 : 1.4 crs

2018 : 1.7 crs

2019 : 4.4 crs

2020 : 1.9 crs

EBIDTA Margin

2017 : 5.9%

2018 : 9.6%

2019 : 10.5%

2020 : 7.4%

SALES

2017 : 57 crs

2018 : 60 crs

2019 : 97 crs

2020 : 113 crs

PAT

2017 : 1.4 crs

2018 : 1.7 crs

2019 : 4.4 crs

2020 : 1.9 crs

EBIDTA Margin

2017 : 5.9%

2018 : 9.6%

2019 : 10.5%

2020 : 7.4%

COVID-19 Impact

Last two quarters were not so good as company had to hold procurement for many products due to high API prices and export ban. This lowered the sales by around 40%. Hence, Profitability and Margin got impacted.

Last two quarters were not so good as company had to hold procurement for many products due to high API prices and export ban. This lowered the sales by around 40%. Hence, Profitability and Margin got impacted.

Promotor& #39;s Background

Fredun Medhora is just a chap of 33 years and one of the rare fanatic guy who dares to dream big. He completed his Masters in Business Administration from Cardiff Business School Wales.

Fredun Medhora is just a chap of 33 years and one of the rare fanatic guy who dares to dream big. He completed his Masters in Business Administration from Cardiff Business School Wales.

Promotor& #39;s Background ( Contd.)

Fredun joined the company as a whole time director in 2013 and since his joining the company has grown its sales from 15 crs to 113 crs in just 7 years. He is a passionate guy who works 15-18 hours a day and currently is the MD of the company.

Fredun joined the company as a whole time director in 2013 and since his joining the company has grown its sales from 15 crs to 113 crs in just 7 years. He is a passionate guy who works 15-18 hours a day and currently is the MD of the company.

Product Portfolio Update

The company product portfolio has expanded from 63 products in 2017 to 427 in 2019. They are further planning to register over 433 products in next 2 years & will add 6 new counties for first time registrations. They are sure of first supply by Nov 2021.

The company product portfolio has expanded from 63 products in 2017 to 427 in 2019. They are further planning to register over 433 products in next 2 years & will add 6 new counties for first time registrations. They are sure of first supply by Nov 2021.

Fredun going the Caplin way?

Here& #39;s an old Paragraph from Forbes article on Caplin Point

"To counter investor concerns that it sells in unregulated markets where there’s no reliable data on key players or market shares, Caplin put out a detailed AR outlining the Latin American-

Here& #39;s an old Paragraph from Forbes article on Caplin Point

"To counter investor concerns that it sells in unregulated markets where there’s no reliable data on key players or market shares, Caplin put out a detailed AR outlining the Latin American-

Contd.

Pharma market, est at $80B in 2014. Paarthipan says that even deep-pocketed competitors would be challenged to eat into Caplin’s share because product registrations take several months. Also bigger players do branding while Caplin’s products are plain vanilla generics."

Pharma market, est at $80B in 2014. Paarthipan says that even deep-pocketed competitors would be challenged to eat into Caplin’s share because product registrations take several months. Also bigger players do branding while Caplin’s products are plain vanilla generics."

Contd.

Fredun pharma has been on a registration spree over last 5 years. As on date the company would have almost 400 products registered and further 400 registrations will come in next 2-3 years which going by Caplin words are entry barriers.

Fredun pharma has been on a registration spree over last 5 years. As on date the company would have almost 400 products registered and further 400 registrations will come in next 2-3 years which going by Caplin words are entry barriers.

New Development

The company last year had set up two new departments of Ointments & Pellets and successfully obtained WHO cGMP certificate & FDA approvals for both the units. They expect to do a business of around 60 crores from this new units only in next 2-3 years.

The company last year had set up two new departments of Ointments & Pellets and successfully obtained WHO cGMP certificate & FDA approvals for both the units. They expect to do a business of around 60 crores from this new units only in next 2-3 years.

New Development (Contd.)

The company is quite positive on its new formulations of ointments and pellets in the export market along with its prime exports of anti-retrovirals (ARVs) that also seem to work in treating novel coronavirus.

The company is quite positive on its new formulations of ointments and pellets in the export market along with its prime exports of anti-retrovirals (ARVs) that also seem to work in treating novel coronavirus.

Anti-diabetic Opportunity

The company& #39;s 25% revenues comes from Anti-diabetic products. The number of Indians with diabetes is projected to reach 73M in 2025. The costs of treating such patients are currently estimated at $420 PPPY which translates to total bill of $30B by 2025.

The company& #39;s 25% revenues comes from Anti-diabetic products. The number of Indians with diabetes is projected to reach 73M in 2025. The costs of treating such patients are currently estimated at $420 PPPY which translates to total bill of $30B by 2025.

Niche Products

The company is currently focusing on niche products. They are doing niche products in Anti-diabetes which only 1-2 players in India have the licenses to do. They are also into Anti-retrovirals which hardly handful of companies have the licenses to do.

The company is currently focusing on niche products. They are doing niche products in Anti-diabetes which only 1-2 players in India have the licenses to do. They are also into Anti-retrovirals which hardly handful of companies have the licenses to do.

Focus areas

Going forward, the company& #39;s focus will be more on marketing strategies and brand building. Some of its brands are already leading and comes among the topmost brands in countries like Nigeria, Myanmar and Srilanka.

Going forward, the company& #39;s focus will be more on marketing strategies and brand building. Some of its brands are already leading and comes among the topmost brands in countries like Nigeria, Myanmar and Srilanka.

Largest Shareholder

Nikhil Vora, also known for his great track record for investments in consumer related companies, is one of the largest shareholder in Fredun pharma. He is holding around 6% stake in it which itself speaks a lot about its corporate Governance.

Nikhil Vora, also known for his great track record for investments in consumer related companies, is one of the largest shareholder in Fredun pharma. He is holding around 6% stake in it which itself speaks a lot about its corporate Governance.

Company Update

The company is planning to clear all its short term debt in next 18-24 months and will become completely debt free in next 3-5 years.

The company is planning to clear all its short term debt in next 18-24 months and will become completely debt free in next 3-5 years.

Receipt of Awards

During last few years, the company has received numerous awards and achievements :-

• "Best Healthcare Brands of 2019" at Economic Times Heathcare Brands

• Fredun Medhora, MD of the co received award "Indian Affairs Pharma Entrepreneur of the year 2019"

During last few years, the company has received numerous awards and achievements :-

• "Best Healthcare Brands of 2019" at Economic Times Heathcare Brands

• Fredun Medhora, MD of the co received award "Indian Affairs Pharma Entrepreneur of the year 2019"

Receipt of Award (Contd.)

• "Elite customer Award" for the year 2018-19

• "Emerging Company of the year 2019" from Zee Business presents - National Healthcare Leadership.

• "Elite customer Award" for the year 2018-19

• "Emerging Company of the year 2019" from Zee Business presents - National Healthcare Leadership.

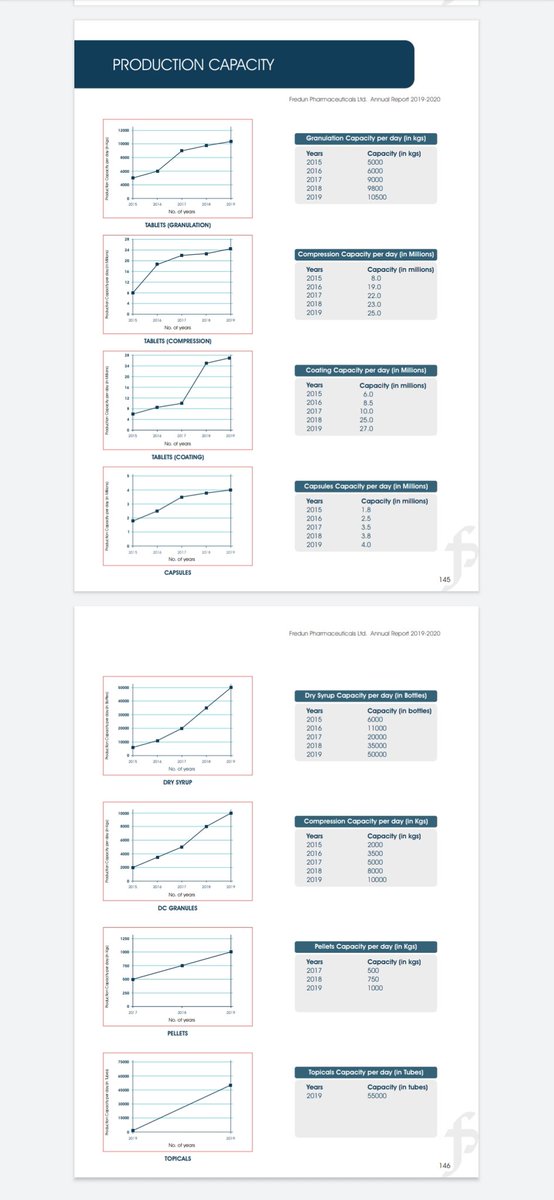

Here& #39;s closing it with a snapshot of the latest AR. It shows that the co has expanded the production capacity by more than 500% in last few years.The co aims to grow at 25-30 per cent in next 4-5 years, & they seems to understand the balance between scalability and sustainability

Read on Twitter

Read on Twitter