CMP Rs 3639

#Thread #stock #LowfreeFloat

1 week changed Perception from Market #Darling to #manipulation

Presenting my Thought Process.

@Atulsingh_Asan @AnyBodyCanFly @saketreddy @varinder_bansal @abhymurarka

1

Let’s do some self-introspection before raising fingers->

Is business sustainable?

Are fundamentals good?

Did anything change in fundamentals during last 1 week?

Why did share price rise so much?

Why did it fall so much?

If all is well, Is this opportunity?

Let’s dig-in ! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

2

Is business sustainable?

Are fundamentals good?

Did anything change in fundamentals during last 1 week?

Why did share price rise so much?

Why did it fall so much?

If all is well, Is this opportunity?

Let’s dig-in !

2

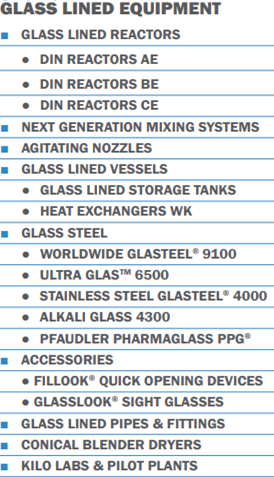

Manufactures corrosion resistant glass-lined equipment used primarily in the chemical, pharmaceutical and allied industries.

Now it is diversified & is much more than glass-lined Equipment.

3

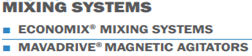

Also manufactures flouro-polymer products and other chemical process equipment such as agitated nutsche filters, Magnetic Drive Agitators, Filter Dryers, Spherical Dryers, Paddle Dryers, wiped film evaporators, engineered systems and mixing systems.

4

4

Glass-lined Equipment means Glass Coated Steel Equipment. Inner Line is glass where chemicals are stored and outer is Steel container for Sturdiness, Durability, Storage & Safe Transportation & Handling. Also avoids corrosion.

5

5

Glass-Lined Equipment

Heavy Engineering

Proprietary Products

6

There are only 4-5 players in Glass-Lined Equipment and GMM Pfaudler has 55% Market Share and is highest margin (~22%) business & contributes to 60% of revenue.

7

7

Why GMM is so much dominant in Glass-Lined Equipment?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Because their Quality is Excellent. Pharma & Chemical companies can’t compromise on this aspect due to risks these chemicals carry.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Because their Quality is Excellent. Pharma & Chemical companies can’t compromise on this aspect due to risks these chemicals carry.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">They have big capacities and so they are in position to execute big orders.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">They have big capacities and so they are in position to execute big orders.

8

8

9

10

It caters to customers in petrochemicals, oil & gas, chemicals & fertilizers.

It has 2 products – Heat Exchangers & Pressure Vessels.

11

This segment is kind of linked with Glass-lined business. If Glass-lines is doing well this also does well.

It can be divided into 3 categories –>

12

Mavag AG which they acquired in Switzerland in 2008 belongs to this segment.

13

14

Acquired Industrial Mixing Solution segment of Sudarshan Chemicals for expansion. It’s small business (50-60 Cr).

15

15

Wiped Film Evaporators – Used in Food Processing, Pharmaceutical, Fine Chemicals, Polymers & Resins, Fats & oils and Petrochemicals

16

Temperature Controlled Units – Used in pharmaceutical, chemical, biotech, food, flavor & fragrance and nutraceutical industries. They provide systems to service alloy or glass lined reactors.

17

17

Export is 22% & 78% are used by customers in India.

Major Agro-chemical, Pharma Companies are its Customers->

SRF

PI Industries

Aarti Industries

Sumitomo Chemicals

Clariant

Bayer Cropscience

Lupin

Sun pharma

Cipla

Rallis India

IPCA

Coromondal International

Thermax

18

Major Agro-chemical, Pharma Companies are its Customers->

SRF

PI Industries

Aarti Industries

Sumitomo Chemicals

Clariant

Bayer Cropscience

Lupin

Sun pharma

Cipla

Rallis India

IPCA

Coromondal International

Thermax

18

Excel Cropcare

Unichem

Ion Exchange

GSFC

... list is long

Growth in Pharma, Chemical & Agro-chemical Industry is directly linked to GMM& #39;s growth.

19

Unichem

Ion Exchange

GSFC

... list is long

Growth in Pharma, Chemical & Agro-chemical Industry is directly linked to GMM& #39;s growth.

19

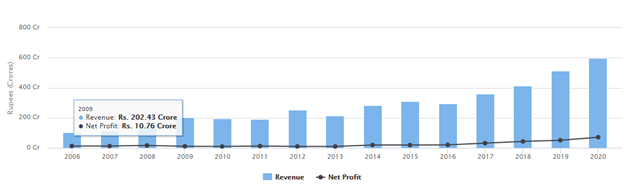

50% of Revenue comes from Chemical sector & 30% from Pharma. Earlier Pharma share was 50-60% now Chemical is dominating.

We all know how Pharma & chemical industry has been in focus. Both sectors are doing Capex. They all need these Glass-lined Equipment.

20

We all know how Pharma & chemical industry has been in focus. Both sectors are doing Capex. They all need these Glass-lined Equipment.

20

Covid & Shift from China has also boosted them.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">So Business is sustainable & GMM has dominant market share!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">So Business is sustainable & GMM has dominant market share!

21

21

GMM stands for Gujarat Machinery Manufacturers founded by Mr Ashok Patel in 1962.

Listed on BSE in 1963.

Join venture with Pfaudler Inc, USA in 1987 & got 40% Equity ; increased to 51% in 1999.

22

Ownership of Pfaudler Inc has changed several hands & currently it’s owned by German Private Equity Fund Deustsche Beteiligungs AG (DBAG) since 2014.

23

23

Earlier GMM business was India concentrated. It has done some acquisitions and diversified its business too which helped gaining International clients.

Like in 2008 they acquired Mavag AG (engineered equipment) in Switzerland.

24

Like in 2008 they acquired Mavag AG (engineered equipment) in Switzerland.

24

Current MD, Mr Tarak Patel is son of Ashok Patel.

He joined company in 2001.

In 2005 he became VP of sales and in 2007 became Executive Director.

He is MD for last 5 years.

Under his leadership company stands where it is.

25

He joined company in 2001.

In 2005 he became VP of sales and in 2007 became Executive Director.

He is MD for last 5 years.

Under his leadership company stands where it is.

25

Fundamentals!

I evaluate Fundamentals of a Business on following parameters->

Quality

Growth

Efficiency

Profitability

Solvency

Financial Trend

GMM Pfaudler is Top-notch on all these parameters! Let’s check how!

26

I evaluate Fundamentals of a Business on following parameters->

Quality

Growth

Efficiency

Profitability

Solvency

Financial Trend

GMM Pfaudler is Top-notch on all these parameters! Let’s check how!

26

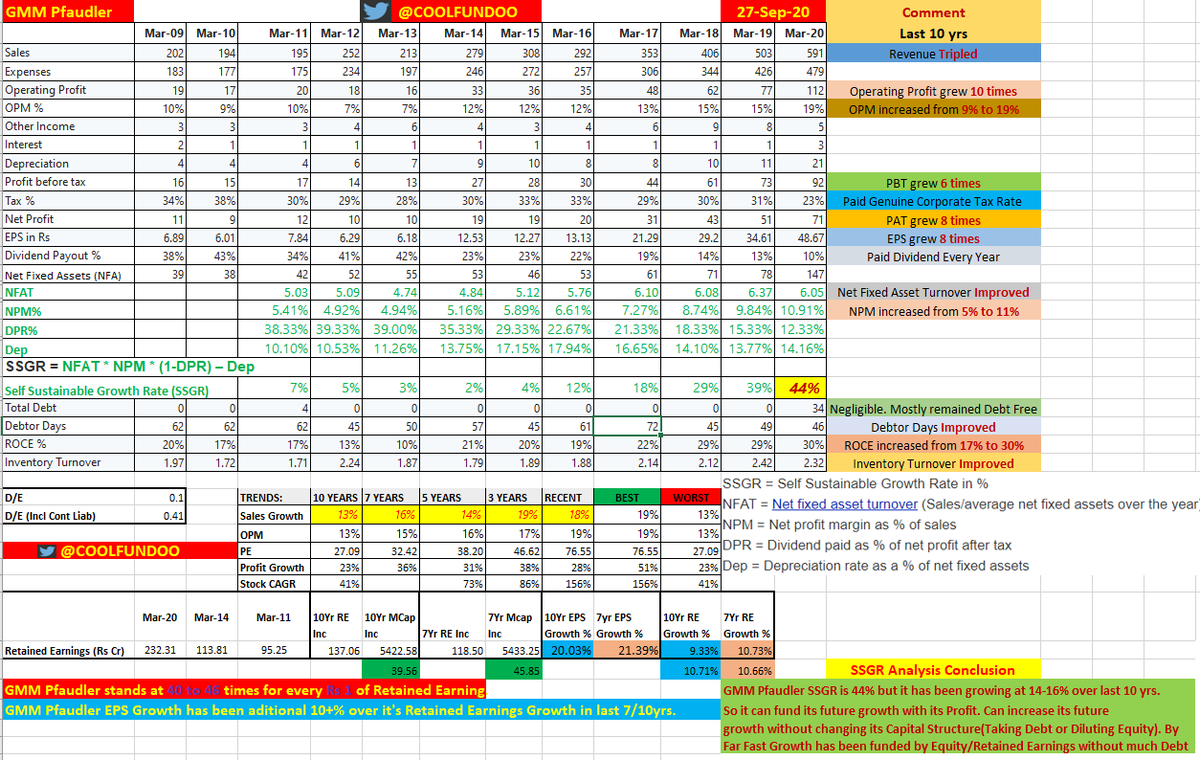

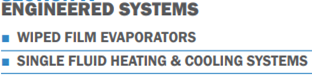

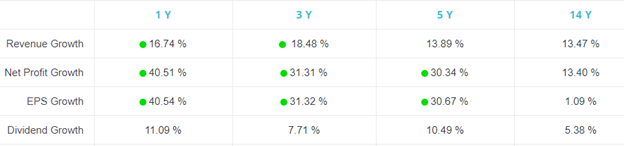

Sales & Profit Growth  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

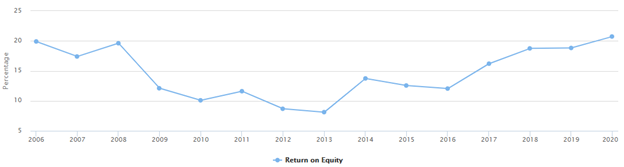

ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

27

Profit Growth > Sales Growth

ROE, Stock CAGR

27

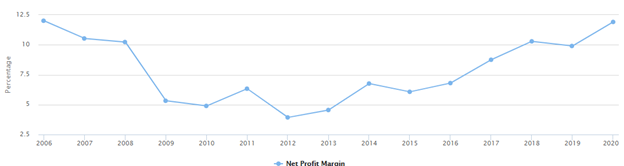

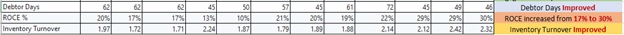

ROCE = 30%

In last 10yrs.

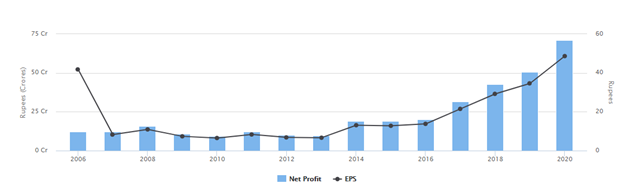

Last 10yrs ->

Revenue Tripled

Operating Profit grew 10 times

OPM increased from 9% to 19%

NPM increased from 5% to 11%

PBT grew 6 times

PAT grew 8 times

EPS grew 8 times

ROCE increased from 17% to 30%

Paid Dividend Every Year

28

In last 10yrs.

Last 10yrs ->

Revenue Tripled

Operating Profit grew 10 times

OPM increased from 9% to 19%

NPM increased from 5% to 11%

PBT grew 6 times

PAT grew 8 times

EPS grew 8 times

ROCE increased from 17% to 30%

Paid Dividend Every Year

28

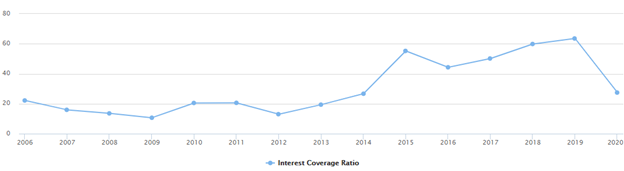

Negligible Debt (D/E 0.1). Mostly remained Debt Free

Net Fixed Asset Turnover Improved

Paid Genuine Corporate Tax Rate

Receivables Days Improved (62 to 46)

Inventory Turnover Improved (1.71 to 2.32)

29

Net Fixed Asset Turnover Improved

Paid Genuine Corporate Tax Rate

Receivables Days Improved (62 to 46)

Inventory Turnover Improved (1.71 to 2.32)

29

During last 10yrs, for every Rs 1 of Retained Earnings invested in business, GMM Pfaudler rewarded shareholders with 46 times Market Capitalization.

It’s Retained Earnings grew at 9.33% CAGR but EPS grew at 20.03%.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Incredible feat.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Incredible feat.

30

It’s Retained Earnings grew at 9.33% CAGR but EPS grew at 20.03%.

30

It proves GMM is utilizing its retained earnings well.

These are Warren Buffet’s favorite matrix when he looks at businesses.

31

These are Warren Buffet’s favorite matrix when he looks at businesses.

31

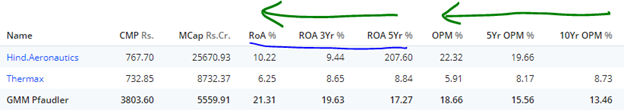

Return on Assets = 21.31% RoA 3yr = 19.63% , RoA 5yr = 17.27%

OPM = 18.66%, 5yr OPM = 15.66%, 10yr OPM = 13.46%

So RoA & OPM has been great and on Increasing Trend.

32

OPM = 18.66%, 5yr OPM = 15.66%, 10yr OPM = 13.46%

So RoA & OPM has been great and on Increasing Trend.

32

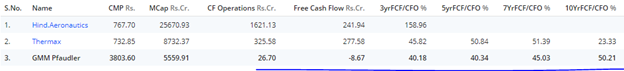

10yr Aggregate:

CFO = Rs 289 Cr

Net Profit = Rs 285 Cr

EBITDA: 450.60 Cr

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">So GMM’s Cumulative CFO is similar in fact little higher than its PAT. So, it was able to convert all its PAT in to Cash flow.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">So GMM’s Cumulative CFO is similar in fact little higher than its PAT. So, it was able to convert all its PAT in to Cash flow.

No creative accounting with financial numbers.

33

CFO = Rs 289 Cr

Net Profit = Rs 285 Cr

EBITDA: 450.60 Cr

No creative accounting with financial numbers.

33

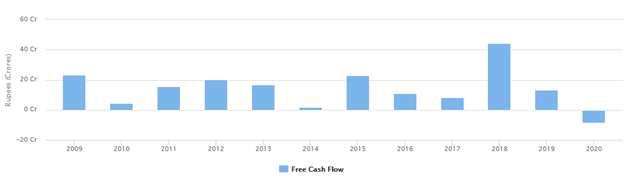

FCF has been fluctuating but it has always remained +ive. In FY20 FCF was -8.67Cr.

People are concerned over this. Look at Fixed assets it has increased from 78Cr to 147Cr.

So, GMM is doing huge Capex to fulfill its huge order backlog - just normal course of business.

34

People are concerned over this. Look at Fixed assets it has increased from 78Cr to 147Cr.

So, GMM is doing huge Capex to fulfill its huge order backlog - just normal course of business.

34

So, it’s Cumulative Historical FCF wrt CFO has been good. Around 40-50% of Cash Flow converted to FCF.

35

35

Promoter holding is 75% after OFS it stands at 54.95%.

No Equity Dilution in last 12 yrs (except current OFS).

No Pledge Shares (Good)

Excellent Growth in Revenue, Net Profit & EPS.

Net Profit & EPS growth are going hand-in-hand(Good Sign)

PHENOMENAL GROWTH

37

No Equity Dilution in last 12 yrs (except current OFS).

No Pledge Shares (Good)

Excellent Growth in Revenue, Net Profit & EPS.

Net Profit & EPS growth are going hand-in-hand(Good Sign)

PHENOMENAL GROWTH

37

Net Profit vs Revenue are going hand-in-hand which indicates that company is able to maintain cost & beat competition if any thereby increased margin along with Revenue.

REMARKABLE PERFRORMANCE!

38

REMARKABLE PERFRORMANCE!

38

GMM Pfaudler modernization/Capacity Expansion.

In last 4 years 3 plants modernized. DBAG has spent $23 million to get 3 new facilities. Old Plant in Germany Shutdown. Plant in China relocated. Italy plant was shutdown and a new one purchased.

39

In last 4 years 3 plants modernized. DBAG has spent $23 million to get 3 new facilities. Old Plant in Germany Shutdown. Plant in China relocated. Italy plant was shutdown and a new one purchased.

39

After this Pfaudler international business acquisitions all these plants belong to GMM Pfaudler. All these no. are expected to reflect in coming quarters.

40

40

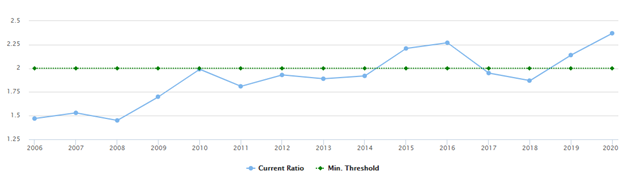

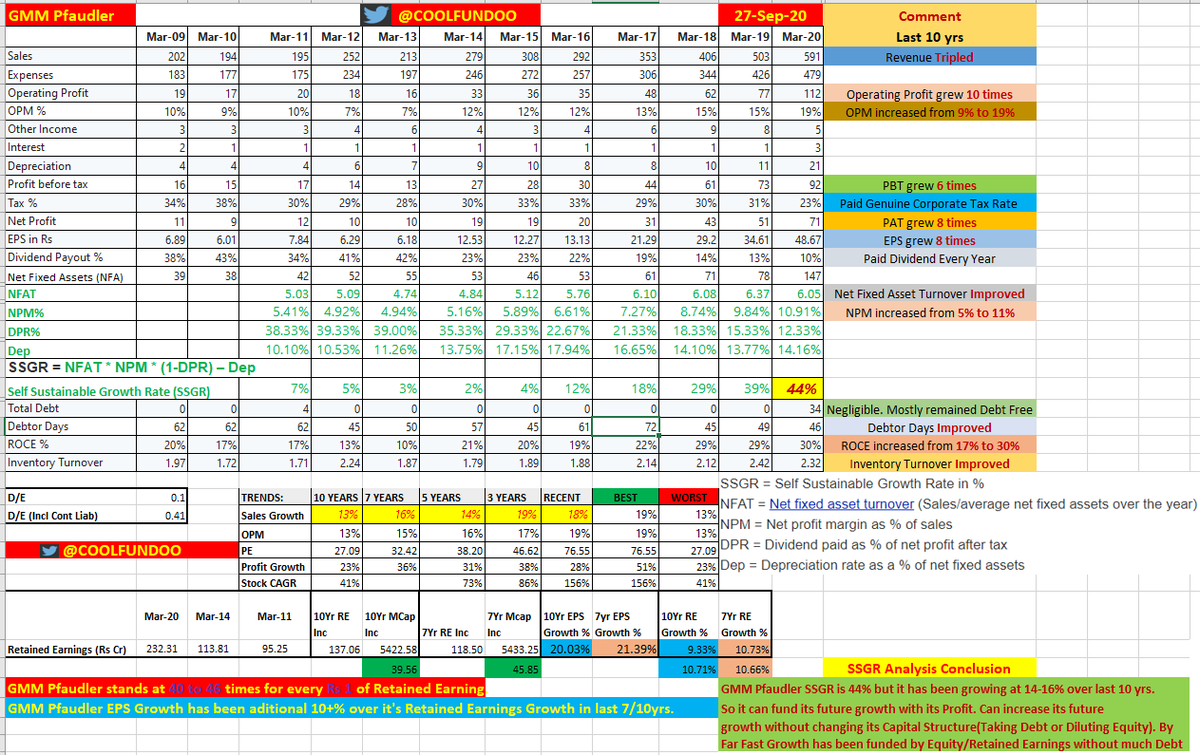

Debt to Equity is very low (0.1) and most of the time remained Debt free.

Current Ratio & Interest Coverage Ratio has always been great. Altman Z-score = 21.33 well above my comfort level of 2.5

All this gives great SENSE of SAFETY. Hence No SOLVENCY ISSUE.

41

Current Ratio & Interest Coverage Ratio has always been great. Altman Z-score = 21.33 well above my comfort level of 2.5

All this gives great SENSE of SAFETY. Hence No SOLVENCY ISSUE.

41

Receivables Days Declined. Inventory Turnover Increased. ROCE is rising.

Net Fixed Asset Turnover(NFAT) has been rising. Asset Turnover Ratio = 1.57 (>1).

5yr Sales CAGR Vs Receivables CAGR ~16% (Great)

5yr Avg Other Income vs Net Profit = 0.21 (Good)

42

Net Fixed Asset Turnover(NFAT) has been rising. Asset Turnover Ratio = 1.57 (>1).

5yr Sales CAGR Vs Receivables CAGR ~16% (Great)

5yr Avg Other Income vs Net Profit = 0.21 (Good)

42

Cash Conversion Cycle -> 191 (2011) to 181 (2020) Very little improvement

Working Capital Days -> 122 (2011) to 69 (2020) -> Fantastic

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GREAT EFFICIENCY!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GREAT EFFICIENCY!

43

Working Capital Days -> 122 (2011) to 69 (2020) -> Fantastic

43

GMM Pfaudler SSGR is 44% but it has been growing at 14-16% over last 10 yrs.

So it can fund its future growth with its Profit. Can increase its future growth without changing its Capital Structure(Taking Debt or Diluting Equity).

44

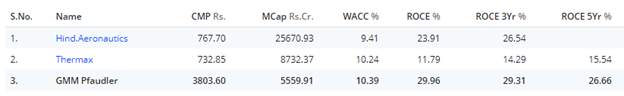

By Far Fast Growth has been funded by Equity/Retained Earnings without much Debt.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">WACC vs ROCE

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">WACC vs ROCE

GMM Pfaudler ROCE is much greater than its Cost of Capital (WACC).

To learn more about WACC concept please see this #screener thread –>

https://twitter.com/Coolfundoo/status/1300004415013879809?s=20

45">https://twitter.com/Coolfundo...

GMM Pfaudler ROCE is much greater than its Cost of Capital (WACC).

To learn more about WACC concept please see this #screener thread –>

https://twitter.com/Coolfundoo/status/1300004415013879809?s=20

45">https://twitter.com/Coolfundo...

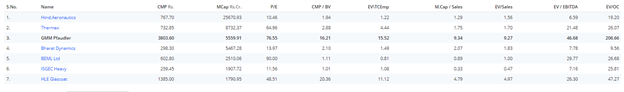

Even after 45% fall from 52W High, GMM Pfaudler Valuations are Expensive in Absolute terms, with Past History & in Comparison with its Peers.

It’s Current PE = 76.55 >3Yr PE (24.46) > 5Yr PE (23.47) > 10Yr PE (19.19)

46

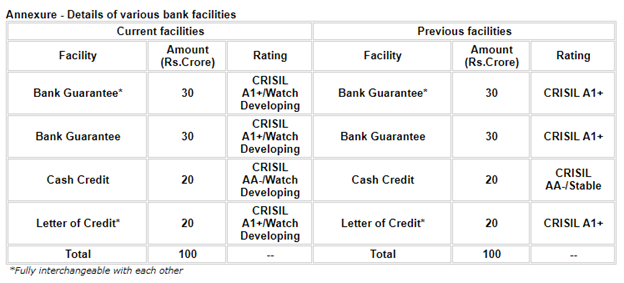

CRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.

Otherwise it had good Credit Rating.

47

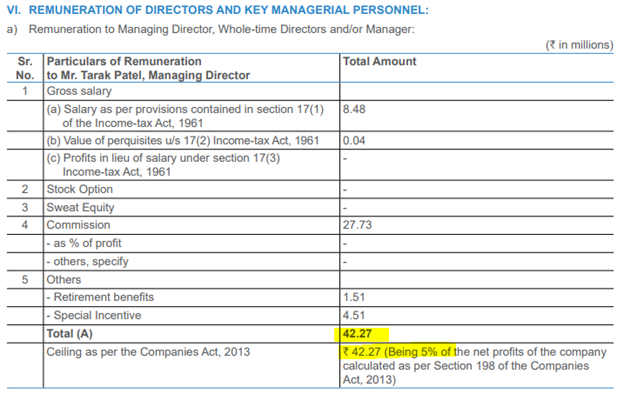

Mr. Tarak Patel remuneration seems on higher side as per net profit of company. He is drawing maximum remuneration as per allowed limit, though company claims its 5% of net profit but it is 5.91%.

48

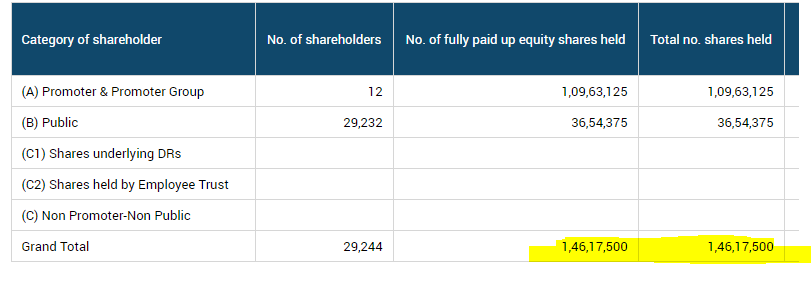

GMM Pfaudler has been closely held company. Promoters held 75%. It has very little free float (just 36 Lakh shares available in Public Domain). ~ 29K people hold its share.

49

In last 13 yrs they didn’t dilute any Equity. Most of the time remained Debt free. Even during this COVID time they took 11Cr of debt just for Working Capital requirement. So, all this growth they achieved through internal accruals using their retained earnings.

50

50

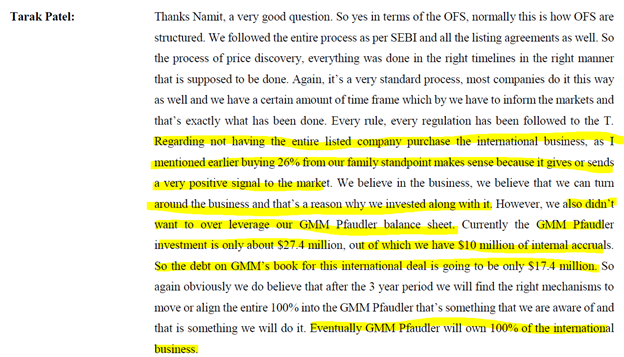

On 22 Sep-23 Sep 2020, OFS they sold shares at Rs 3500/share. Let’s look at its rational & Management reason/clarification/commitment.

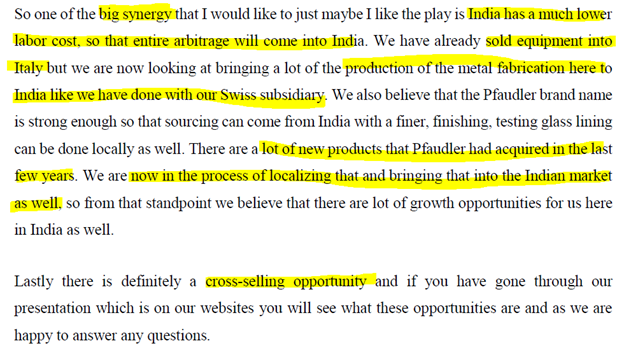

GMM Pfaudler has recently acquired international business of Pfaudler Inc (global parent)

51

GMM Pfaudler has recently acquired international business of Pfaudler Inc (global parent)

51

Pfaudler Inc is owned by German Private Equity Fund Deustsche Beteiligungs AG (DBAG) since 2014.

Any PE fund invests in a business to monetize it in future. Like Blackrock acquired Mastek & Essel Propack. They will help it grow with their money, contacts & guidance.

52

Any PE fund invests in a business to monetize it in future. Like Blackrock acquired Mastek & Essel Propack. They will help it grow with their money, contacts & guidance.

52

But after some time (you like it or not) when the plant becomes a fruit-laden tree they will monetize it some or all of it. They are not for charity. Same is true with IPOs (which are more popular than OFS).

53

53

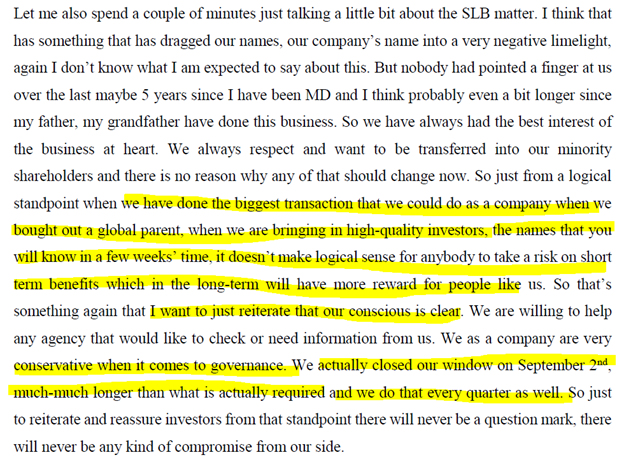

So as part of larger transaction when this was a good liquidity event for DBAG and being financial investors, they grabbed the opportunity.

So DBAG sold 18% & Patel Family (GMM promoter) sold 2%.

54

So DBAG sold 18% & Patel Family (GMM promoter) sold 2%.

54

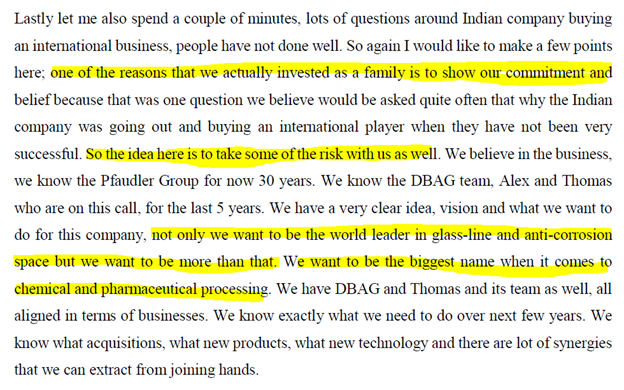

Patel family is not keeping this money with themselves they are going to invest this directly into International business.

Now GMM Pfaudler acquired Pfaudler International business in $50.4 Million which was generating $175 Million in revenue. Feels like pretty good bargain.

55

Now GMM Pfaudler acquired Pfaudler International business in $50.4 Million which was generating $175 Million in revenue. Feels like pretty good bargain.

55

By this way DBAG monetized additional funds from GMM Pfaudler.

After this transaction DBAG will hold 32% & Patel Family will own ~22% both will have lock-in period of 3 years. So, no dilution for next 3 years.

56

After this transaction DBAG will hold 32% & Patel Family will own ~22% both will have lock-in period of 3 years. So, no dilution for next 3 years.

56

After 3 years DBAG can monetize again but Patel Family is saying that they will remain committed to business. In-fact they are saying that they are planning to increase their stake to ~30%.

57

57

Bringing High Quality Investors & Increasing Free Float

With this transaction the free Float of company will increase to ~45%. 3 to 5 Money Managers from US & 3 to 5 MF from India will pick up the stake.

Opening up for new investors to come in also gives international appeal.

58

With this transaction the free Float of company will increase to ~45%. 3 to 5 Money Managers from US & 3 to 5 MF from India will pick up the stake.

Opening up for new investors to come in also gives international appeal.

58

GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.

60

GMM Pfaudler has just 36 Lakh shares available in Public Domain. ~29K people hold its share.

We learnt from above that Fundamentals of GMM are very strong and it is Low free float stocks so small interest

61

from few investors make price to go up due to demand supply mis-match. News after news regarding pharma & chemical sectors boost, strong order book & global parent international business acquisition spurt the demand of its shares.

62

62

Equity Dilution via OFS(at Rs 3500 when its recent high was Rs 6900+), SLB, Rumors & Low Free Float are major factors for price fall which is still in lower circuit.

You can see my Low free float #screener Thread here ->

https://twitter.com/Coolfundoo/status/1309725609841635328?s=20

63">https://twitter.com/Coolfundo...

I don’t know for sure. OFS is set at Rs 3500. So all these big reputed institutions & Mutual funds must have done due diligence for price discovery, all business aspects before agreeing to it.

64

They are usually long term investors (min 7 to 10yrs) and actually gauge at business potential in long run. So may be around that price it could form a base. Or it may continue going down & form a base based on this Qtr results.

65

65

GMM Pfaudler had lately seen lot of rumors/confusion. Wo kehte hai na ‘Baal ki Khaal nikalna’ .

Even if somebody tries to make genuine selfless effort to clear the air, they are being trolled.

@Atulsingh_Asan made one such act.

66

@Atulsingh_Asan

Why I say ‘selfless’ -> He sold out GMM Pfaudler shares 6 months back. I wasn’t active on twitter then but I read he mentioned this in his tweet.

67

Why I say ‘selfless’ -> He sold out GMM Pfaudler shares 6 months back. I wasn’t active on twitter then but I read he mentioned this in his tweet.

67

If you have made this far on the #thread you would have learnt that GMM Pfaudler is Fundamentally very strong quality business with strong order backlog. They have been doing capex (investing in the business) ,doing acquisitions

68

to increase capacity as fast as possible to meet growing demand from Pharma & Chemical sectors. There is enough demand coming from Pharma & chemical sectors you can gauge it from the Capex these companies are doing.

69

69

GMM is world class leader & have 55% market share in Glass-lined Equipment & able to charge premium due to its superior technology & huge order execution capacity.

Promoters have been doing everything right until a week back when they have been made out as villain.

70

Promoters have been doing everything right until a week back when they have been made out as villain.

70

They made an attempt to clear the air by coming on TV & doing conference calls.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">They explained the reasons for OFS, their commitment for the business & DBAG monetization.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">They explained the reasons for OFS, their commitment for the business & DBAG monetization.

71

71

Promoter made a point that this transaction will increase free float.

Valuation has been always been high. Now I see bunch of big institutional guys have done their due diligence & arrived at a price (Rs 3500).

72

If promoters are to believe, these institutions are no jokers so in long run it will be business as usual. GMM should benefit from new synergies, Modernization of plants, getting rid of old plants & capacity addition.

73

73

Though there is 3yr lock-in but another selling from Private Equity DBAG can’t be ruled out in which case Promoter has plan to increase their stake.

74

74

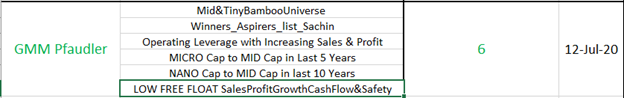

It has appeared many of my screeners due to its fundamentals and is part of my Screening Technique based portfolio->

https://twitter.com/Coolfundoo/status/1283038612855173131?s=20

75">https://twitter.com/Coolfundo...

https://twitter.com/Coolfundoo/status/1283038612855173131?s=20

75">https://twitter.com/Coolfundo...

My Understanding of OFS Story !

DBAG German PE fund owns Pfaudler Inc USA since 2014

Pfaudler owns 50.44% in GMM as Foreign promoter

DBAG did lot of improvements, invested money, provided guidance, hence helped grow Pfaudler Inc

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">3 new facilities (DBAG spent $23million)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">3 new facilities (DBAG spent $23million)

76

DBAG German PE fund owns Pfaudler Inc USA since 2014

Pfaudler owns 50.44% in GMM as Foreign promoter

DBAG did lot of improvements, invested money, provided guidance, hence helped grow Pfaudler Inc

76

3 plants modernized

German & Italy old plants shutdown

Italy new plant purchased

China plant relocated

DBAG invested all this money not for charity.

77

German & Italy old plants shutdown

Italy new plant purchased

China plant relocated

DBAG invested all this money not for charity.

77

So DBAG being a financial entity might have communicated to Indian Promoters(Patel family) its intent to monetize its investment (some or all).

They could have simply sold Pfaudler Inc same way they bought but may be they weren& #39;t getting buyers/good deal.

78

They could have simply sold Pfaudler Inc same way they bought but may be they weren& #39;t getting buyers/good deal.

78

Patel family didn& #39;t want Pfaudler Inc to go to new firm that too after so much Modernization. So, must have offered to buy majority stake.

GMM was already paying Pfaudler Inc 1% of sale who know what would be terms when someone else acquires Pfaudler Inc & squeeze out more.

79

GMM was already paying Pfaudler Inc 1% of sale who know what would be terms when someone else acquires Pfaudler Inc & squeeze out more.

79

80

Now these transactions requires money

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">On 20Aug2020 GMM Pfuadler acquired 54% controlling stake in 9 Pfaudler Group companies across USA, Europe, Brazil & China for 205 Cr($27.4m).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">On 20Aug2020 GMM Pfuadler acquired 54% controlling stake in 9 Pfaudler Group companies across USA, Europe, Brazil & China for 205 Cr($27.4m).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GMM Pfaudler got 34.4% directly & balance 19.6% via MAVAG AG its wholly owned subsidiary.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GMM Pfaudler got 34.4% directly & balance 19.6% via MAVAG AG its wholly owned subsidiary.

81

81

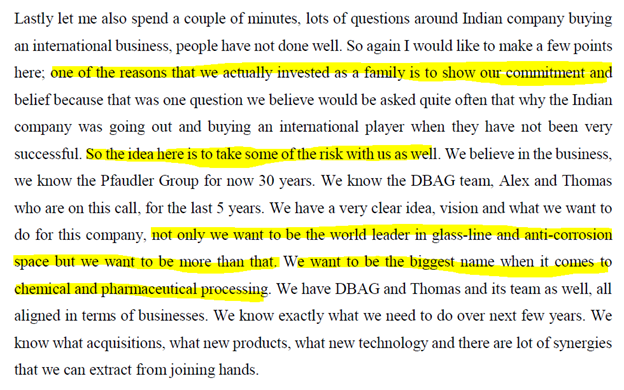

Patel Family took 26% stake in Pfaudler Group

In total 80% of Pfaudler Grp was sold

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Notable point Patel family(promoters) spent their own money to buy 26% stake

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Notable point Patel family(promoters) spent their own money to buy 26% stake

They could have purchased entire 80% via GMM

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">MD said they did this to show their own commitment to business

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">MD said they did this to show their own commitment to business

82

In total 80% of Pfaudler Grp was sold

They could have purchased entire 80% via GMM

82

MD said GMM Pfaudler is going to raise the stake to 100% in Pfaudler Group after 3yrs.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">For this to happen GMM (holds 54%) has to buy 20% from Pfaudler Grp & 26% from Patel family.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">For this to happen GMM (holds 54%) has to buy 20% from Pfaudler Grp & 26% from Patel family.

83

83

Now here comes OFS part.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">DBAG is monetizing & now Patel family also needs money to buy 26% in Pfaudler International.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">DBAG is monetizing & now Patel family also needs money to buy 26% in Pfaudler International.

Selling in market isn& #39;t an option it will be disaster nor they will get enough money out of it.

84

Selling in market isn& #39;t an option it will be disaster nor they will get enough money out of it.

84

GMM Pfaudler business is doing well & has rich valuations.

It has been closely held by Promoters(75%) and people are also complaining about its low free float.

Institutions/MF are interested to buy but unable to do so because of low free float.

85

It has been closely held by Promoters(75%) and people are also complaining about its low free float.

Institutions/MF are interested to buy but unable to do so because of low free float.

85

One OFS move (at Rs 3500)

1) Fetched money to DBAG (sold 17.76%)

2) Fetched money to Patel Family (sold 2.29%) to buy 26% stake Pfaudler International

3) Public float gone up from 25% to 45.05%

4) Brought reputed MF/Institutions

86

It& #39;s going to be boring just bear with me.

Tweet 81

Assuming Patel family got 26% stake on same valuation.

87

Again refer to Tweet 86 https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

Patel family sold 2.29% in GMM Pfaudler.

Total shares in GMM = 14617500

2.29% of shares = 292350

Value of 2.29% shares sold = 292350 * Rs 3500 = 102.3 Cr

Just good enough to cover acquisition cost (98.7Cr) stake in Pfaudler international.

88

Patel family sold 2.29% in GMM Pfaudler.

Total shares in GMM = 14617500

2.29% of shares = 292350

Value of 2.29% shares sold = 292350 * Rs 3500 = 102.3 Cr

Just good enough to cover acquisition cost (98.7Cr) stake in Pfaudler international.

88

DBAG which still holds 32.68% in GMM may push for another monetization

GMM also wants to inc 54% stake in Pfaudler Grp to 100%

89

Pfaudler Grp all modernization money will start flowing into GMM P&L after few quarters. 3yrs later it& #39;s valuation will increase.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Patel family will sell it& #39;s 26% stake in Pfaudler Grp to GMM in some manner & use Some or All of money to increase it& #39;s stake in GMM to 30%.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Patel family will sell it& #39;s 26% stake in Pfaudler Grp to GMM in some manner & use Some or All of money to increase it& #39;s stake in GMM to 30%.

90

90

DBAG may again go with OFS route or direct Promoter sell to Patel family(if agreed between 2).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">If it goes via another OFS route

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">If it goes via another OFS route

Again price fall like today may happen

91

Again price fall like today may happen

91

92

Notable point is GMM Pfaudler is now a bigger entity with

100% of Pfaudler Grp (Global parent) as its subsidiary.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Indian promoters (Patel Family) have actually increased their stakes.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Indian promoters (Patel Family) have actually increased their stakes.

So all this happened because Foreign promoters (PE fund) wanted to exit (monetize).

93

100% of Pfaudler Grp (Global parent) as its subsidiary.

So all this happened because Foreign promoters (PE fund) wanted to exit (monetize).

93

I rest my case here !

94

Read on Twitter

Read on Twitter GMM PFAUDLERCMP Rs 3639 #Thread #stock #LowfreeFloat1 week changed Perception from Market #Darling to #manipulationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Snippet of SSGR Analysis!Presenting my Thought Process. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> @Atulsingh_Asan @AnyBodyCanFly @saketreddy @varinder_bansal @abhymurarka 1" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GMM PFAUDLERCMP Rs 3639 #Thread #stock #LowfreeFloat1 week changed Perception from Market #Darling to #manipulationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Snippet of SSGR Analysis!Presenting my Thought Process. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> @Atulsingh_Asan @AnyBodyCanFly @saketreddy @varinder_bansal @abhymurarka 1" class="img-responsive" style="max-width:100%;"/>

GMM PFAUDLERCMP Rs 3639 #Thread #stock #LowfreeFloat1 week changed Perception from Market #Darling to #manipulationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Snippet of SSGR Analysis!Presenting my Thought Process. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> @Atulsingh_Asan @AnyBodyCanFly @saketreddy @varinder_bansal @abhymurarka 1" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GMM PFAUDLERCMP Rs 3639 #Thread #stock #LowfreeFloat1 week changed Perception from Market #Darling to #manipulationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Snippet of SSGR Analysis!Presenting my Thought Process. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> @Atulsingh_Asan @AnyBodyCanFly @saketreddy @varinder_bansal @abhymurarka 1" class="img-responsive" style="max-width:100%;"/>

GMM Business!Manufactures corrosion resistant glass-lined equipment used primarily in the chemical, pharmaceutical and allied industries.Now it is diversified & is much more than glass-lined Equipment. 3" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GMM Business!Manufactures corrosion resistant glass-lined equipment used primarily in the chemical, pharmaceutical and allied industries.Now it is diversified & is much more than glass-lined Equipment. 3" class="img-responsive" style="max-width:100%;"/>

GMM Business!Manufactures corrosion resistant glass-lined equipment used primarily in the chemical, pharmaceutical and allied industries.Now it is diversified & is much more than glass-lined Equipment. 3" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">GMM Business!Manufactures corrosion resistant glass-lined equipment used primarily in the chemical, pharmaceutical and allied industries.Now it is diversified & is much more than glass-lined Equipment. 3" class="img-responsive" style="max-width:100%;"/>

Filtration & Dryers – Filters used to separate solids from liquid. Dryers mainly used in API (Pharma)- Around 400 Cr business.Mavag AG which they acquired in Switzerland in 2008 belongs to this segment.13" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Filtration & Dryers – Filters used to separate solids from liquid. Dryers mainly used in API (Pharma)- Around 400 Cr business.Mavag AG which they acquired in Switzerland in 2008 belongs to this segment.13" class="img-responsive" style="max-width:100%;"/>

Filtration & Dryers – Filters used to separate solids from liquid. Dryers mainly used in API (Pharma)- Around 400 Cr business.Mavag AG which they acquired in Switzerland in 2008 belongs to this segment.13" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Filtration & Dryers – Filters used to separate solids from liquid. Dryers mainly used in API (Pharma)- Around 400 Cr business.Mavag AG which they acquired in Switzerland in 2008 belongs to this segment.13" class="img-responsive" style="max-width:100%;"/>

Mixing Systems (Mixion) – They have 9 products in this segment. Applications in Pharma, Paints, Biodester & Fermenters, Food & Beverages, Oil & Gas, Chemical, Minerals & Metals, Pulp & Paper, Hydrogenation, Petrochemical, Sugar & Power Generation.14" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Mixing Systems (Mixion) – They have 9 products in this segment. Applications in Pharma, Paints, Biodester & Fermenters, Food & Beverages, Oil & Gas, Chemical, Minerals & Metals, Pulp & Paper, Hydrogenation, Petrochemical, Sugar & Power Generation.14" class="img-responsive" style="max-width:100%;"/>

Mixing Systems (Mixion) – They have 9 products in this segment. Applications in Pharma, Paints, Biodester & Fermenters, Food & Beverages, Oil & Gas, Chemical, Minerals & Metals, Pulp & Paper, Hydrogenation, Petrochemical, Sugar & Power Generation.14" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Mixing Systems (Mixion) – They have 9 products in this segment. Applications in Pharma, Paints, Biodester & Fermenters, Food & Beverages, Oil & Gas, Chemical, Minerals & Metals, Pulp & Paper, Hydrogenation, Petrochemical, Sugar & Power Generation.14" class="img-responsive" style="max-width:100%;"/>

Engineered Segment – 2 CategoriesWiped Film Evaporators – Used in Food Processing, Pharmaceutical, Fine Chemicals, Polymers & Resins, Fats & oils and Petrochemicals16" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Engineered Segment – 2 CategoriesWiped Film Evaporators – Used in Food Processing, Pharmaceutical, Fine Chemicals, Polymers & Resins, Fats & oils and Petrochemicals16" class="img-responsive" style="max-width:100%;"/>

Engineered Segment – 2 CategoriesWiped Film Evaporators – Used in Food Processing, Pharmaceutical, Fine Chemicals, Polymers & Resins, Fats & oils and Petrochemicals16" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Engineered Segment – 2 CategoriesWiped Film Evaporators – Used in Food Processing, Pharmaceutical, Fine Chemicals, Polymers & Resins, Fats & oils and Petrochemicals16" class="img-responsive" style="max-width:100%;"/>

Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27" title="Sales & Profit Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27">

Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27" title="Sales & Profit Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27">

Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27" title="Sales & Profit Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27">

Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27" title="Sales & Profit Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> Profit Growth > Sales Growth https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> ROE, Stock CAGR https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up"> 27">

Incredible feat.30" title="During last 10yrs, for every Rs 1 of Retained Earnings invested in business, GMM Pfaudler rewarded shareholders with 46 times Market Capitalization. It’s Retained Earnings grew at 9.33% CAGR but EPS grew at 20.03%. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Incredible feat.30" class="img-responsive" style="max-width:100%;"/>

Incredible feat.30" title="During last 10yrs, for every Rs 1 of Retained Earnings invested in business, GMM Pfaudler rewarded shareholders with 46 times Market Capitalization. It’s Retained Earnings grew at 9.33% CAGR but EPS grew at 20.03%. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Incredible feat.30" class="img-responsive" style="max-width:100%;"/>

SSGR AnalysisGMM Pfaudler SSGR is 44% but it has been growing at 14-16% over last 10 yrs.So it can fund its future growth with its Profit. Can increase its future growth without changing its Capital Structure(Taking Debt or Diluting Equity). 44" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">SSGR AnalysisGMM Pfaudler SSGR is 44% but it has been growing at 14-16% over last 10 yrs.So it can fund its future growth with its Profit. Can increase its future growth without changing its Capital Structure(Taking Debt or Diluting Equity). 44" class="img-responsive" style="max-width:100%;"/>

SSGR AnalysisGMM Pfaudler SSGR is 44% but it has been growing at 14-16% over last 10 yrs.So it can fund its future growth with its Profit. Can increase its future growth without changing its Capital Structure(Taking Debt or Diluting Equity). 44" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">SSGR AnalysisGMM Pfaudler SSGR is 44% but it has been growing at 14-16% over last 10 yrs.So it can fund its future growth with its Profit. Can increase its future growth without changing its Capital Structure(Taking Debt or Diluting Equity). 44" class="img-responsive" style="max-width:100%;"/>

WACC vs ROCEGMM Pfaudler ROCE is much greater than its Cost of Capital (WACC). To learn more about WACC concept please see this #screener thread –> https://twitter.com/Coolfundo..." title="By Far Fast Growth has been funded by Equity/Retained Earnings without much Debt.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">WACC vs ROCEGMM Pfaudler ROCE is much greater than its Cost of Capital (WACC). To learn more about WACC concept please see this #screener thread –> https://twitter.com/Coolfundo..." class="img-responsive" style="max-width:100%;"/>

WACC vs ROCEGMM Pfaudler ROCE is much greater than its Cost of Capital (WACC). To learn more about WACC concept please see this #screener thread –> https://twitter.com/Coolfundo..." title="By Far Fast Growth has been funded by Equity/Retained Earnings without much Debt.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">WACC vs ROCEGMM Pfaudler ROCE is much greater than its Cost of Capital (WACC). To learn more about WACC concept please see this #screener thread –> https://twitter.com/Coolfundo..." class="img-responsive" style="max-width:100%;"/>

VALUATION!Even after 45% fall from 52W High, GMM Pfaudler Valuations are Expensive in Absolute terms, with Past History & in Comparison with its Peers.It’s Current PE = 76.55 >3Yr PE (24.46) > 5Yr PE (23.47) > 10Yr PE (19.19)46" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">VALUATION!Even after 45% fall from 52W High, GMM Pfaudler Valuations are Expensive in Absolute terms, with Past History & in Comparison with its Peers.It’s Current PE = 76.55 >3Yr PE (24.46) > 5Yr PE (23.47) > 10Yr PE (19.19)46" class="img-responsive" style="max-width:100%;"/>

VALUATION!Even after 45% fall from 52W High, GMM Pfaudler Valuations are Expensive in Absolute terms, with Past History & in Comparison with its Peers.It’s Current PE = 76.55 >3Yr PE (24.46) > 5Yr PE (23.47) > 10Yr PE (19.19)46" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">VALUATION!Even after 45% fall from 52W High, GMM Pfaudler Valuations are Expensive in Absolute terms, with Past History & in Comparison with its Peers.It’s Current PE = 76.55 >3Yr PE (24.46) > 5Yr PE (23.47) > 10Yr PE (19.19)46" class="img-responsive" style="max-width:100%;"/>

Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47">

Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47">

Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47">

Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Credit RatingCRISIL has put on its rating on watch due to ongoing development of Pfaudler international business acquisition.Otherwise it had good Credit Rating. 47">

MD RemunerationMr. Tarak Patel remuneration seems on higher side as per net profit of company. He is drawing maximum remuneration as per allowed limit, though company claims its 5% of net profit but it is 5.91%. 48" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">MD RemunerationMr. Tarak Patel remuneration seems on higher side as per net profit of company. He is drawing maximum remuneration as per allowed limit, though company claims its 5% of net profit but it is 5.91%. 48" class="img-responsive" style="max-width:100%;"/>

MD RemunerationMr. Tarak Patel remuneration seems on higher side as per net profit of company. He is drawing maximum remuneration as per allowed limit, though company claims its 5% of net profit but it is 5.91%. 48" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">MD RemunerationMr. Tarak Patel remuneration seems on higher side as per net profit of company. He is drawing maximum remuneration as per allowed limit, though company claims its 5% of net profit but it is 5.91%. 48" class="img-responsive" style="max-width:100%;"/>

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Question around GMM Pfaudler buying Pfaudler International Business?GMM Pfaudler was giving away 1% of sales to Pfaudler Inc. I think this is now going to stop and every rupee of the international business will flow into GMM Pfaudler balance sheet.60">

Patel family sold 2.29% in GMM Pfaudler. Total shares in GMM = 146175002.29% of shares = 292350Value of 2.29% shares sold = 292350 * Rs 3500 = 102.3 CrJust good enough to cover acquisition cost (98.7Cr) stake in Pfaudler international.88" title="Again refer to Tweet 86https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">Patel family sold 2.29% in GMM Pfaudler. Total shares in GMM = 146175002.29% of shares = 292350Value of 2.29% shares sold = 292350 * Rs 3500 = 102.3 CrJust good enough to cover acquisition cost (98.7Cr) stake in Pfaudler international.88" class="img-responsive" style="max-width:100%;"/>

Patel family sold 2.29% in GMM Pfaudler. Total shares in GMM = 146175002.29% of shares = 292350Value of 2.29% shares sold = 292350 * Rs 3500 = 102.3 CrJust good enough to cover acquisition cost (98.7Cr) stake in Pfaudler international.88" title="Again refer to Tweet 86https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">Patel family sold 2.29% in GMM Pfaudler. Total shares in GMM = 146175002.29% of shares = 292350Value of 2.29% shares sold = 292350 * Rs 3500 = 102.3 CrJust good enough to cover acquisition cost (98.7Cr) stake in Pfaudler international.88" class="img-responsive" style="max-width:100%;"/>