Seeing a lot of "The Rich Don& #39;t Pay Taxes" takes tonight. So let& #39;s go to the CBO, IRS, and OECD data.

These are based on actual taxes paid - including loopholes.

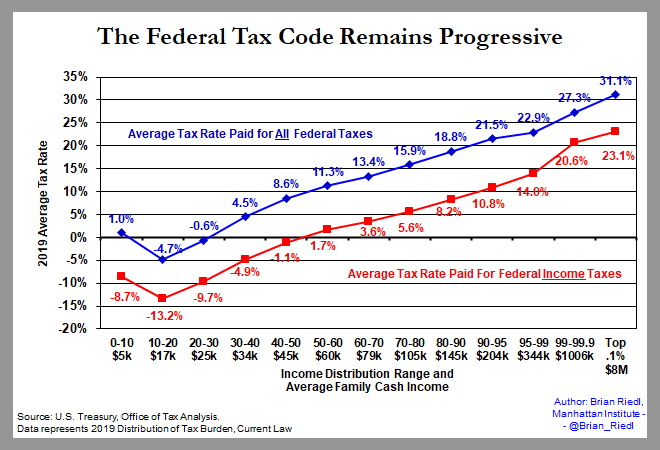

Clearly, federal tax rates rise significantly with income. (1/)

These are based on actual taxes paid - including loopholes.

Clearly, federal tax rates rise significantly with income. (1/)

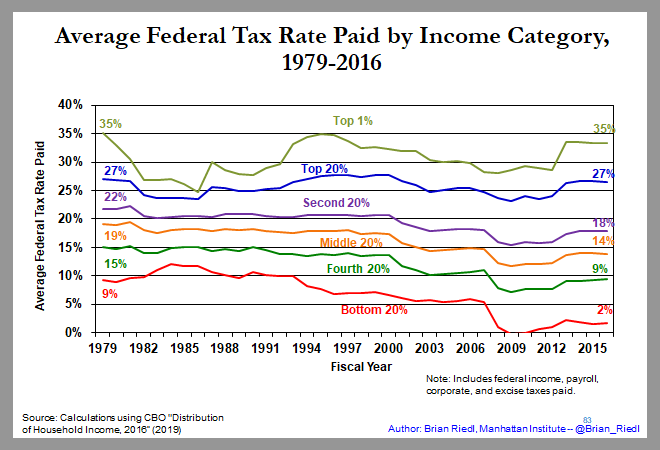

In 2016, the top 1% paid an effective 35% total tax rate - same as in 1979 when we had 70% marginal tax brackets.

(Rates are surely a bit lower with the 2017 tax cuts, but this is the latest CBO data) (2/)

(Rates are surely a bit lower with the 2017 tax cuts, but this is the latest CBO data) (2/)

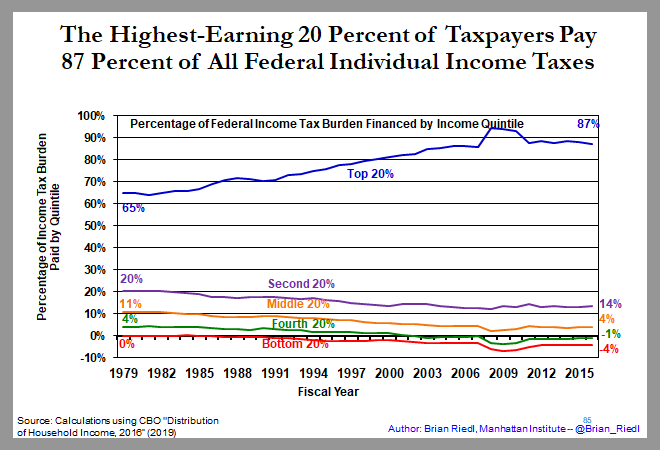

And the top-earning 20% pays 87% of all federal income taxes.

The top-earning 40% pay 101% of all federal income taxes. (4/)

The top-earning 40% pay 101% of all federal income taxes. (4/)

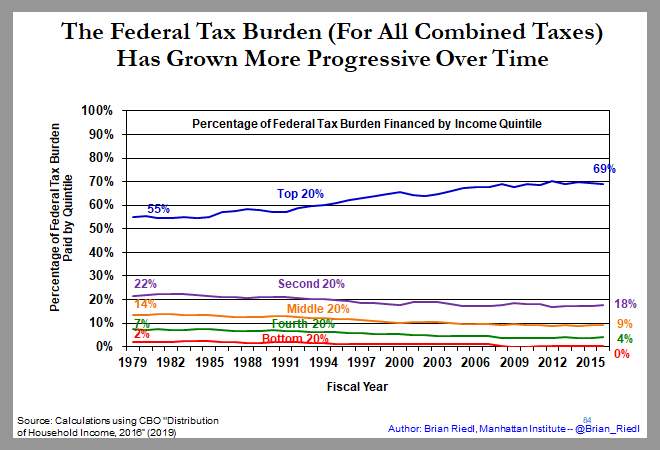

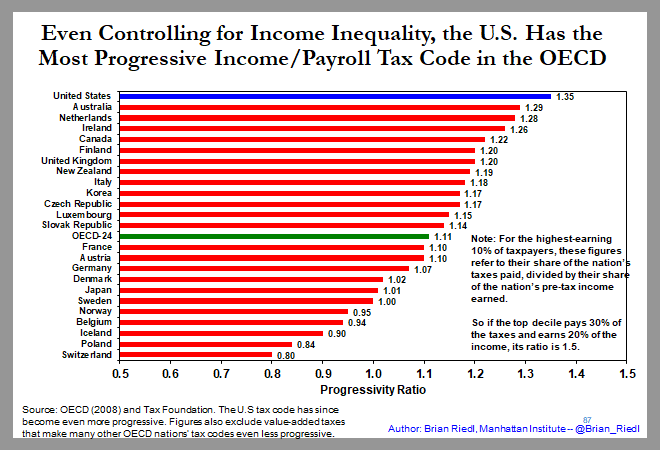

Nope, this is not merely a function of the rich earning a higher share of the income than earlier.

Even if you divide each group& #39;s share of all federal taxes by its share of the income, the federal tax code has become more progressive (5/)

Even if you divide each group& #39;s share of all federal taxes by its share of the income, the federal tax code has become more progressive (5/)

Read on Twitter

Read on Twitter