I think some people are a bit confused about how the shell game works in this great piece of @nytimes reporting on the Trump Organization, so here& #39;s a quick model that will hopefully clarify it a bit: https://www.nytimes.com/interactive/2020/09/27/us/donald-trump-taxes.html">https://www.nytimes.com/interacti...

Imagine a real estate business, let& #39;s call it Prumt Tower. It& #39;s worth $80 million, and purchase was financed with a 70% loan and 30% equity:

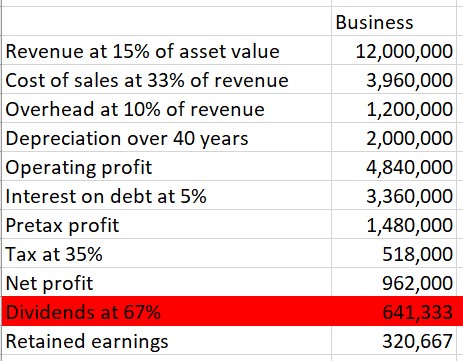

Here& #39;s one ordinary way you could run that business:

This is ... not great. Your return on equity is only about 1.3%. Until coronavirus hit and interest rates slumped, you& #39;d mostly be better off buying a 10-year U.S. Treasury bond yielding 2% or more.

You could improve things by charging a higher rent, reducing costs or getting a cheaper loan, but all those things are difficult!

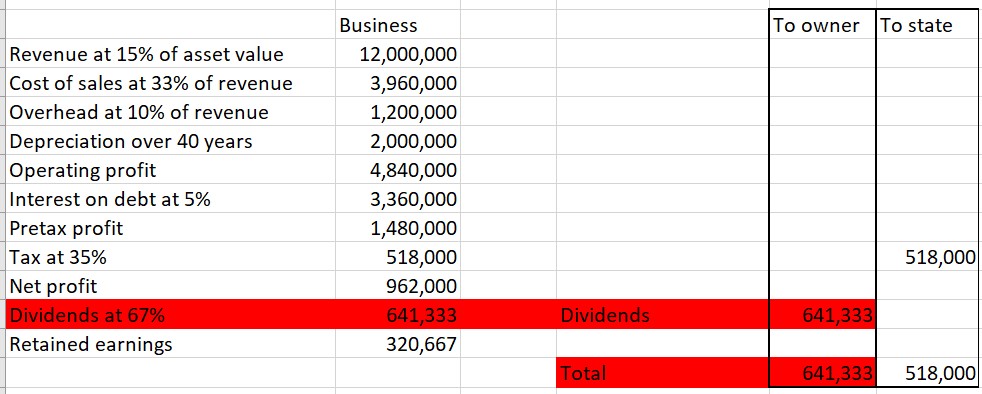

What you& #39;re getting out of the business is basically the dividends, which assuming you& #39;re retaining some earnings for future investment is a pretty paltry sum:

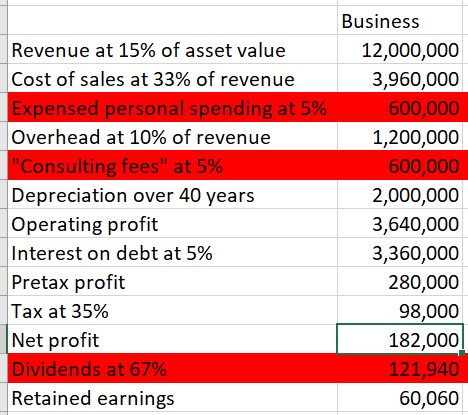

But let& #39;s try to put some self-dealing in there. Instead of just taking your dividends, let& #39;s say you fund your lavish lifestyle as a business expense, *adding* to your cost of sales. Let& #39;s also say you charge a consulting fee, adding to your overhead, and both of those are 5%:

Now look at what& #39;s happened to the split between what goes to the state and what goes to the owner.

Money going to the owner of Prumt Tower has doubled. Corporate taxes to the state have fallen ~80%.

Money going to the owner of Prumt Tower has doubled. Corporate taxes to the state have fallen ~80%.

To be sure, the consulting fee is income that could be taxed somewhere. But, for instance, it could go to a family member who doesn& #39;t have your income. Or it could go through an offshore jurisdiction. Either way you& #39;ve opened up fresh ways to reduce your taxes.

But let& #39;s say you really jack things up. You& #39;re earning a load of money from a reality TV show and branding deals that barely has any costs associated with it. Unlike real estate, this has a really good profit margin. So you have a lot of taxable profits which need offsetting.

So let& #39;s say instead of 5% you charge 20% in consulting fees and 20% on business expenses. Your business is your rich-guy brand, so conspicuous consumption is a legitimate business expense.

Now you& #39;re making substantial losses in your core business, but the money getting returned to you is even larger -- you& #39;re taking out 6 times more than you did when you had a business without bogus self-dealing expenses.

Meanwhile your business losses are building up a tax asset that you can offset against profits elsewhere. Rather than your business paying money to the state, the state is essentially paying money to your business.

That& #39;s not even looking at the sort of tricks you can get up to with related-party loans paid at above-market interest rates, which are one of the main tricks that can be used in these sorts of situations.

Now private sector and state tax auditors should be doing everything they can to make sure these loopholes don& #39;t get exploited. But clearly that doesn& #39;t happen: https://twitter.com/sam_rosenfeld/status/1310346931026178049?s=20">https://twitter.com/sam_rosen...

This is a very rough model so take it as such. But this is what Trump means when he describes other people as "mugs". There are enormous loopholes that business owners can use to extract money from the state, if the circumstances are right and they& #39;re aggressive enough. (ends)

This blew up a bit! As a couple of people pointed out, I clicked the wrong spreadsheet cell in calculating return on equity. It should be ~4% (still bad), the 1.3% is return on assets.

Also, it& #39;s really a pretty basic model. An important consideration is how he pays his interest bill in the final version. This is I suspect largely predicated on the fact that depreciation isn& #39;t a cash expense so you have cashflow that doesn& #39;t count towards taxable income.

At some point your chickens come home to roost if you behave like this. Your creditors will demand repayment of their principal. You& #39;ll need capital for fresh investments. But if things go well this can take a long time to play out.

The Trump empire seems to teeter towards bankruptcy every 10-15 years.

But as they say, if you owe $100 you have a problem; if you owe $100 million the bank has a problem.

Measured leniency is often the best way to extract cash from a delinquent debtor. Make them work for you.

But as they say, if you owe $100 you have a problem; if you owe $100 million the bank has a problem.

Measured leniency is often the best way to extract cash from a delinquent debtor. Make them work for you.

In the early 1990s he was saved by lenient creditors and a casino IPO; in the early 2000s by the fees and branding opportunities from the Apprentice; in the mid-2010s, seemingly, by a Presidential run.

Read on Twitter

Read on Twitter