1/ The New York Times #TrumpTaxReturns story is terrific. I had about a million thoughts as I was reading though. I& #39;ll be annotating those here, in this thread, for the next few hours. https://www.nytimes.com/interactive/2020/09/27/us/donald-trump-taxes.html?referringSource=articleShare">https://www.nytimes.com/interacti...

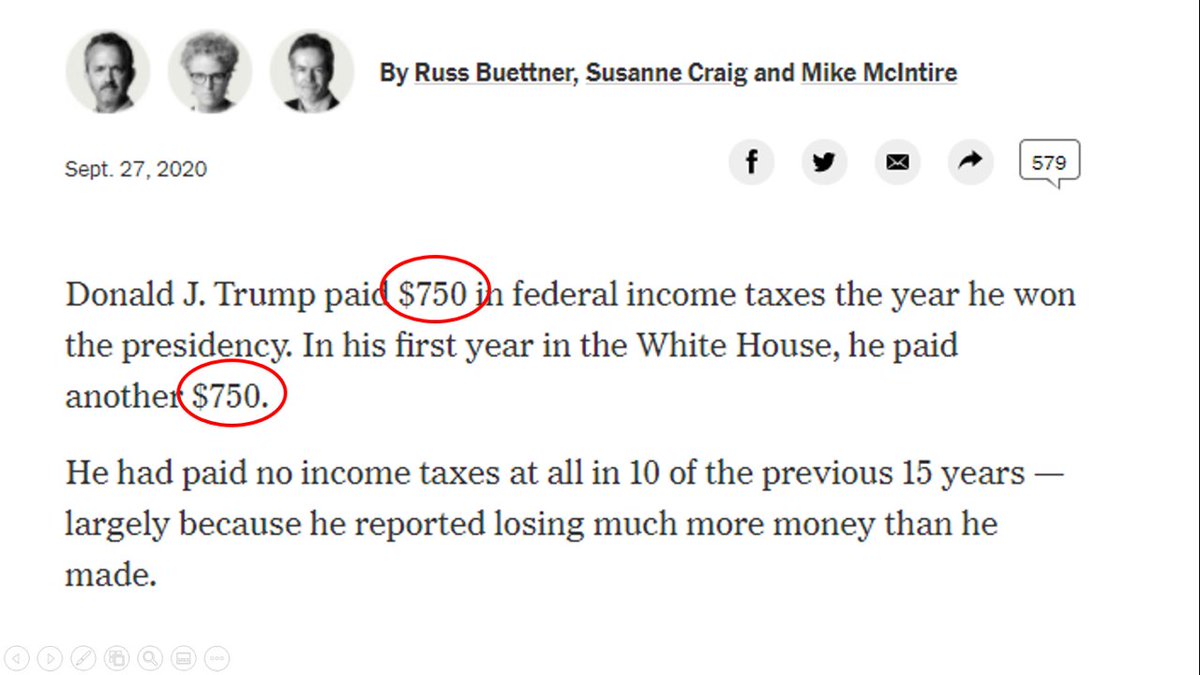

2/ Story starts with this bombshell, that Trump paid just $750 in taxes in 2016 and another $750 in 2017. Shocking numbers for someone who we estimate is worth $2.5B. (Yes, you can still be really rich and disclose a tiny income or even huge losses. More on his net worth later.)

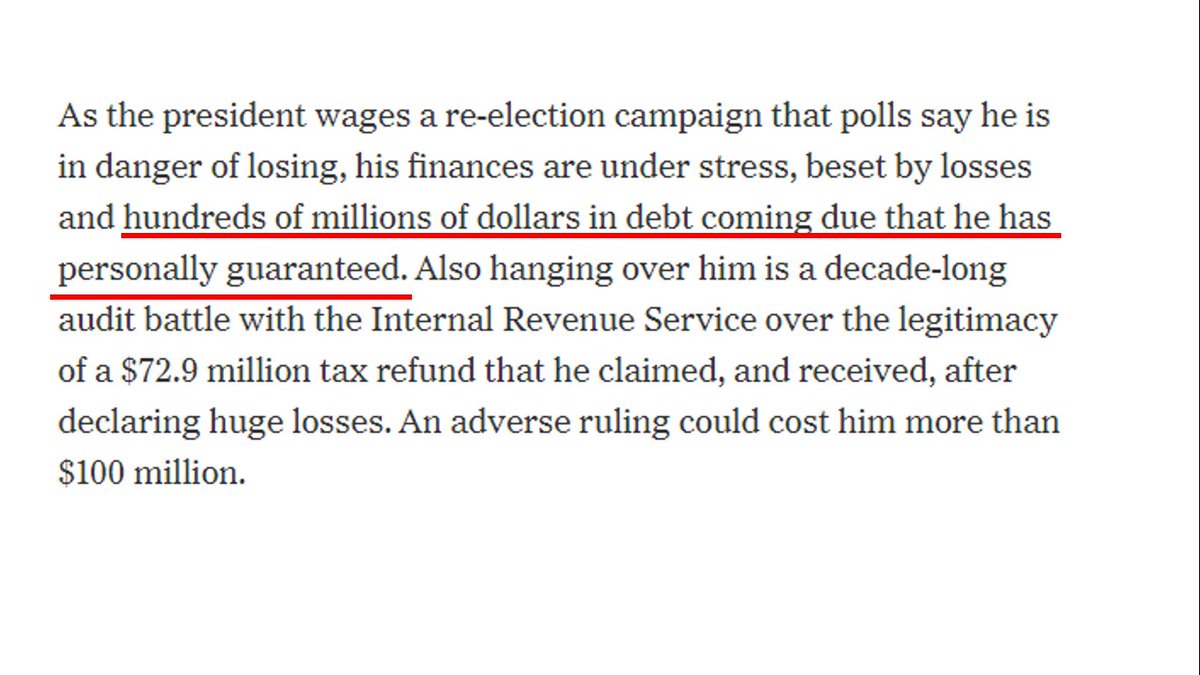

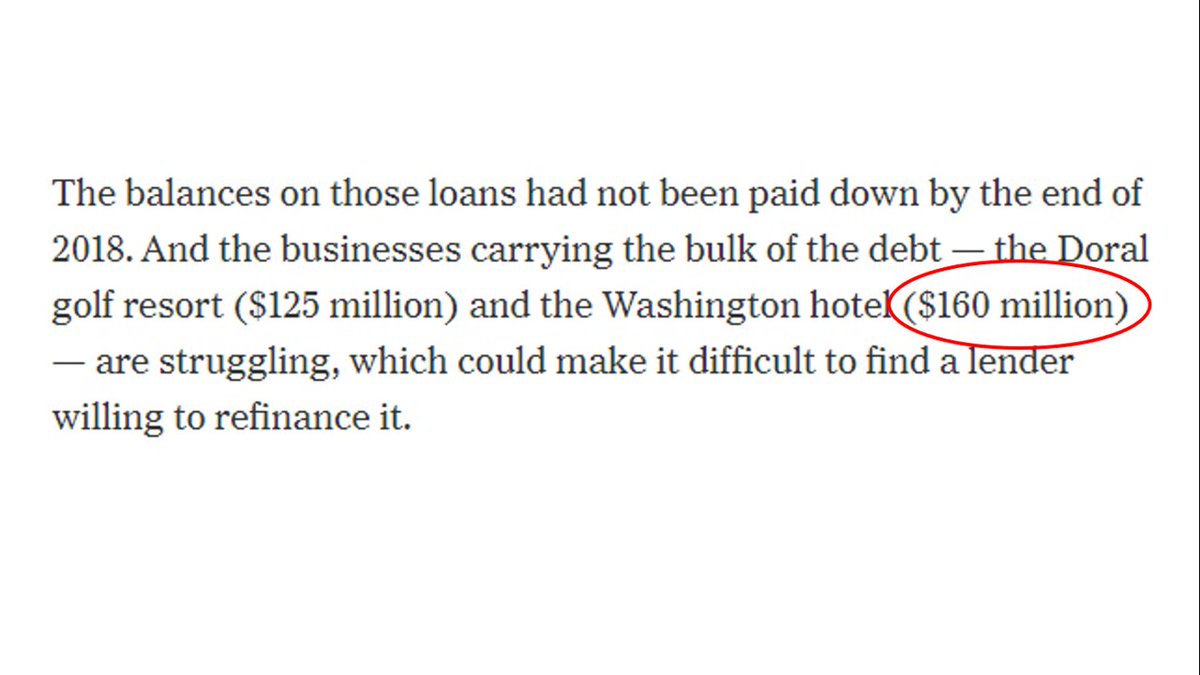

3/ Then we get to this part about the current state of his business, which highlights the amount of debt that Trump has coming due. We actually already know a lot about his debt -- far more than most people who follow the news might think. Let& #39;s pause here and dig into it.

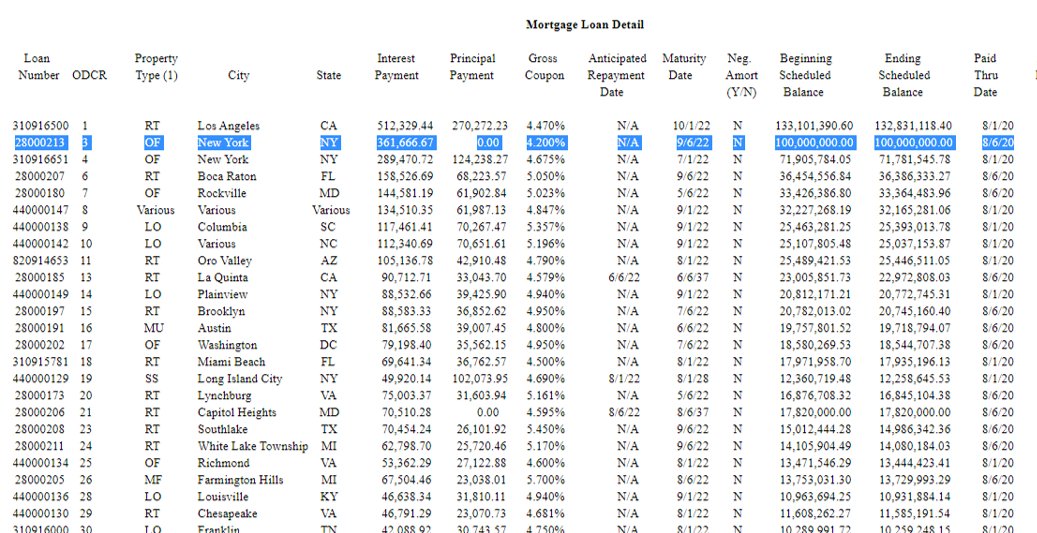

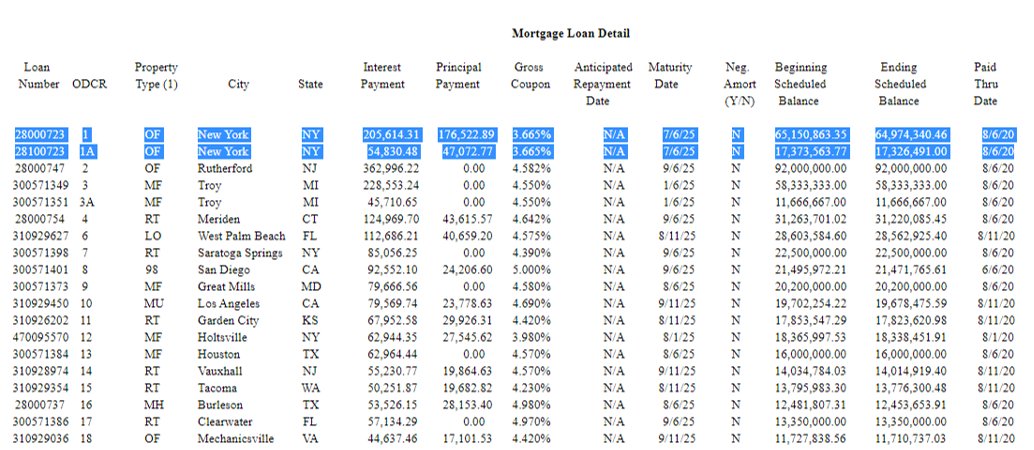

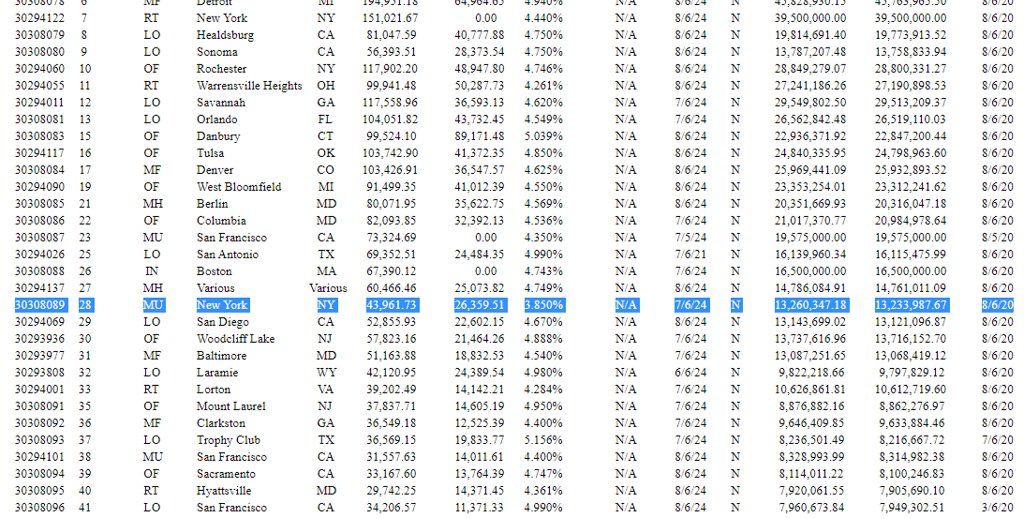

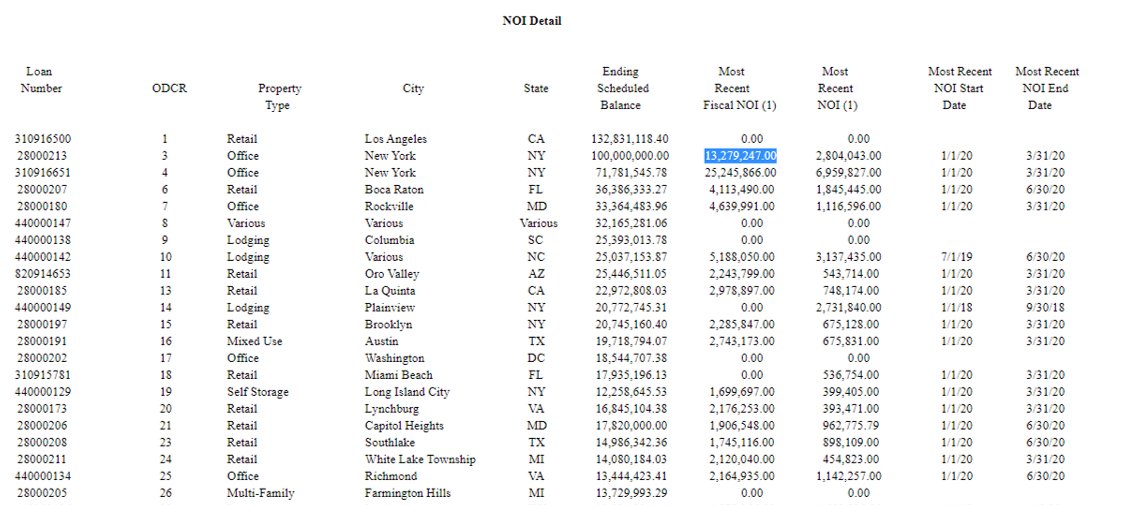

4/ We& #39;ll start at Trump& #39;s old home, Trump Tower, where he owes $100M. This document shows that it has a $100M loan against it, with a 4.2% interest rate, due 9/6/2022. Trump, as you can see, has not paid down a dime of the principal.

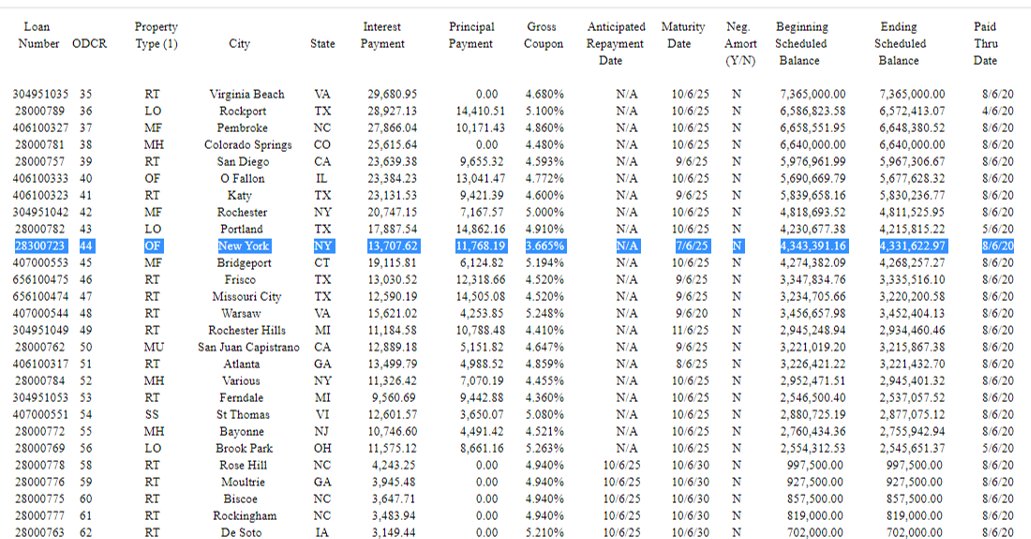

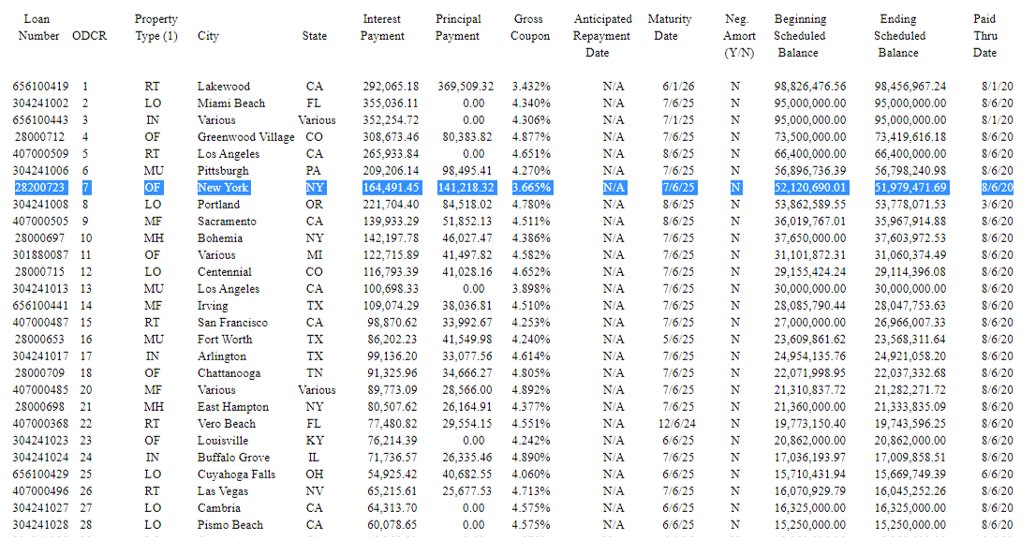

5/ Then we& #39;ll go to 40 Wall Street, where he owes $139M, split into several chunks. You can see the interest rate on all are 3.665%, and all of those come due on 7/6/25. Total debt accounted for so far: $239M million.

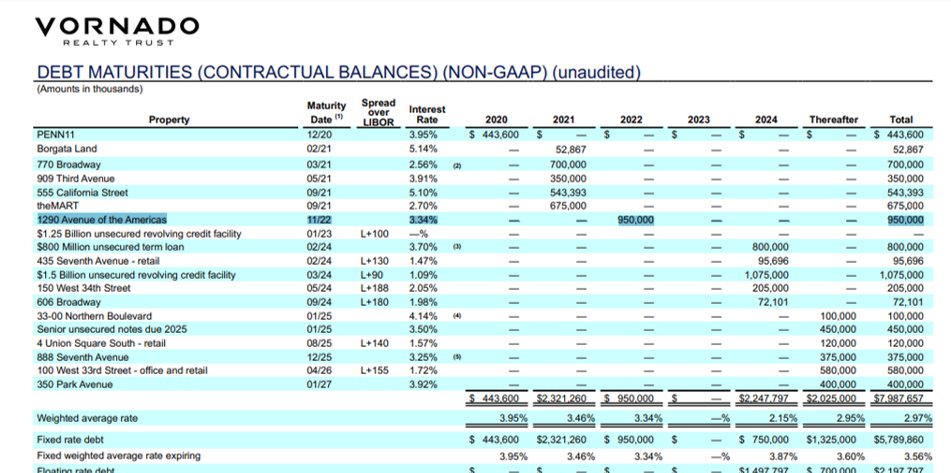

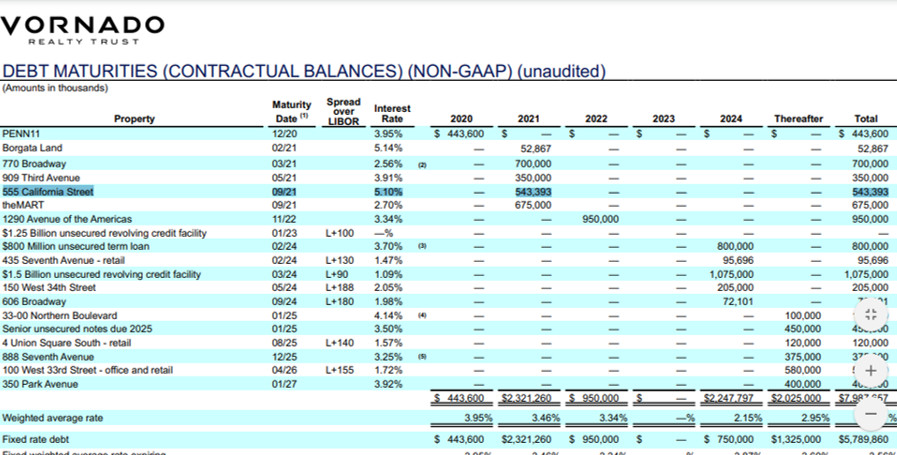

6/ We& #39;ll next look at 1290 Ave. of the Americas, in which Trump owns a 30% interest alongside publicly traded Vornado. VNO discloses that there& #39;s $950M of debt against it in doc below. Due in Nov 2022. Trump& #39;s 30% share then equals $285M. Total debt accounted for so far: $524M.

7/ Then we& #39;ll consider 555 California St., in which Trump also owns a 30% interest alongside Vornado. VNO discloses there& #39;s $543M against that building, with a 5.1% interest rate, due Sep 2021. Trump& #39;s 30% share is then 0.3 * 543 = $163M. Total debt accounted for so far: $687M.

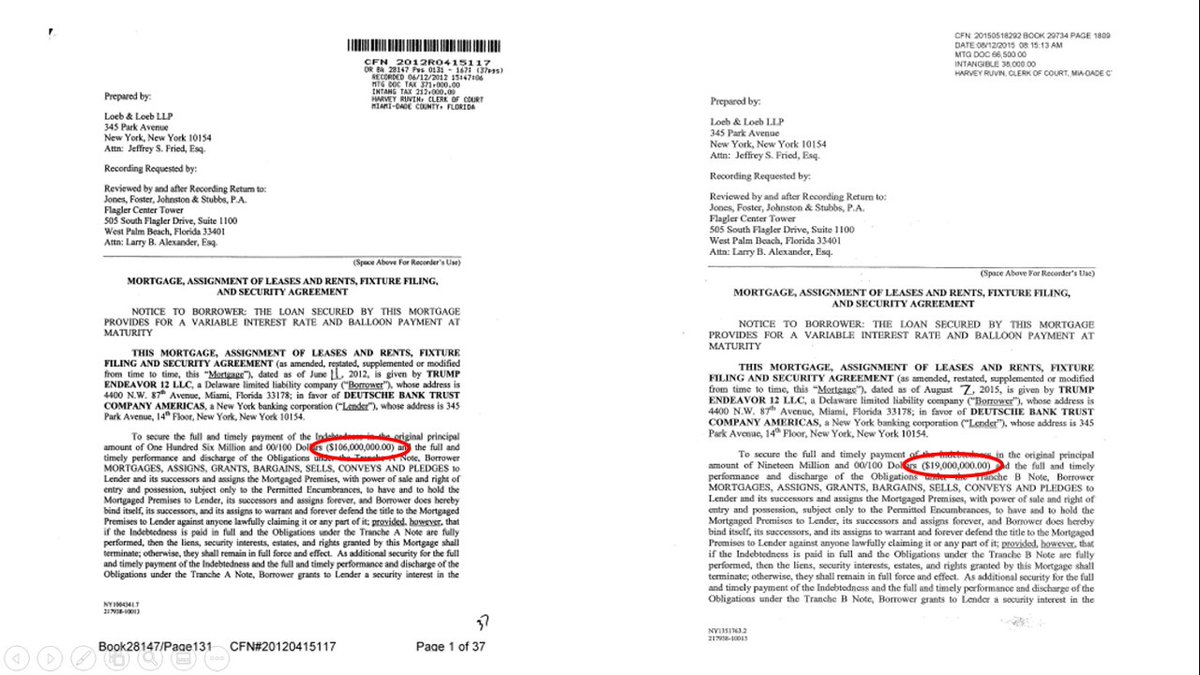

8/ Now let& #39;s look at Doral, Trump& #39;s golf resort in Miami. It has 2 mortgages against it, totaling $125M. Both mature in 2023 and have variable interest rates. You can see the first pages of the mortgages, with the amounts circled, here. Total debt accounted for so far: $812M

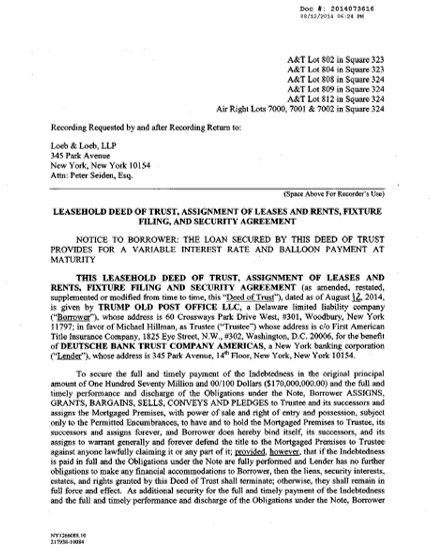

9/ There& #39;s also a loan against the DC hotel. The mortgage, which you can see below, lists it at $170M. The NYT reports that the balance is $160M. Trump may have paid down some principal here. We& #39;ll use the NYT figure for our tally. Total debt accounted for so far: $972M.

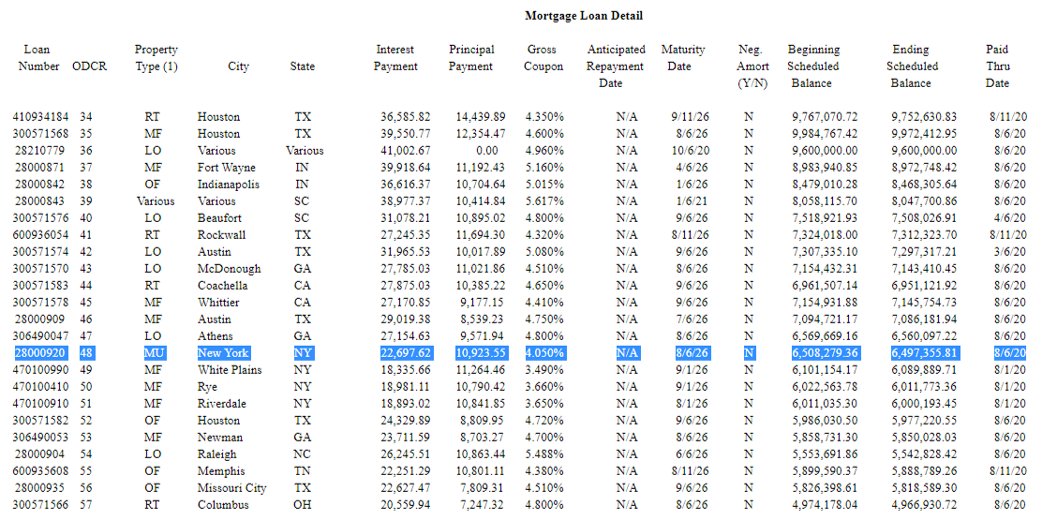

10/ In New York, Trump owes a combined of $20M against a two smaller properties, Trump Plaza ($13.2M) and Trump International Hotel & Tower ($6.5M). Total debt accounted for so far: $992M

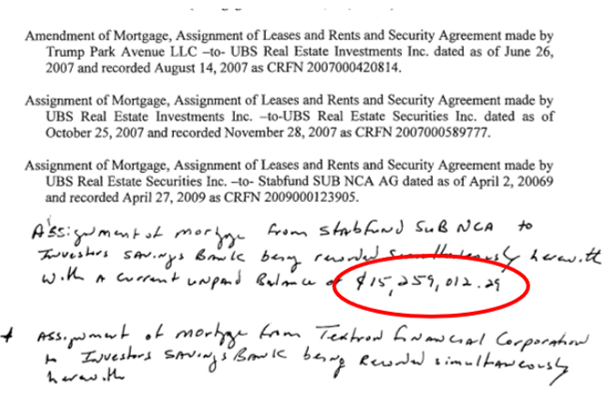

11/ At Trump Park Ave, where Ivanka and Jared used to live (in a condo owned by Donald), there& #39;s another loan, which was at $15.3M in 2010, according to the doc below. Trump has been paying that one down. Probably closer to $10M now. Total debt accounted for so far: $1 billion.

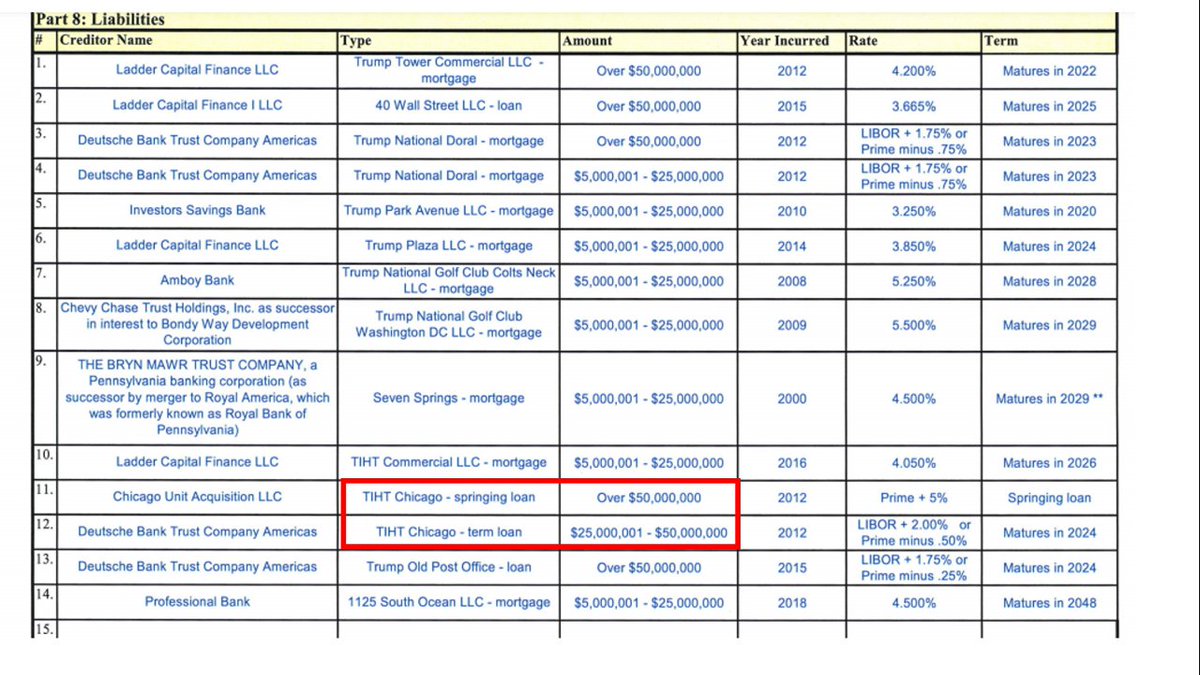

12/ In Chicago, Trump lists two loans on his financial disclosure report. One for $25-50M and one for $50M+. These are complex liabilities that I won& #39;t go too much into right now, but that& #39;s another $75M+ in debt. Total debt accounted for so far: $1.1 billion.

13/ Trump has other small loans against a golf club in DC, one in New Jersey and a couple of mansions. Those add up to about another $35M or so in additional debt. The total accounted for still rounds to $1.1 billion. A lot of that, as the NYT story says, is coming due soon.

14/ Going to to take a break to write a story. I& #39;ll be back when I& #39;m done, with a LOT more to say about this great reporting from the New York Times. https://www.nytimes.com/interactive/2020/09/27/us/donald-trump-taxes.html?referringSource=articleShare">https://www.nytimes.com/interacti...

15/ And... we& #39;re back. 14 hours and a whole lot of math later, Donald Trump is still a billionaire, which makes the $750 tax payment even more scandalous. Lots more to dive into. #fa7c17228850">https://www.forbes.com/sites/danalexander/2020/09/28/yes-donald-trump-is-still-a-billionaire-that-makes-his-750-tax-payment-even-more-scandalous/ #fa7c17228850">https://www.forbes.com/sites/dan...

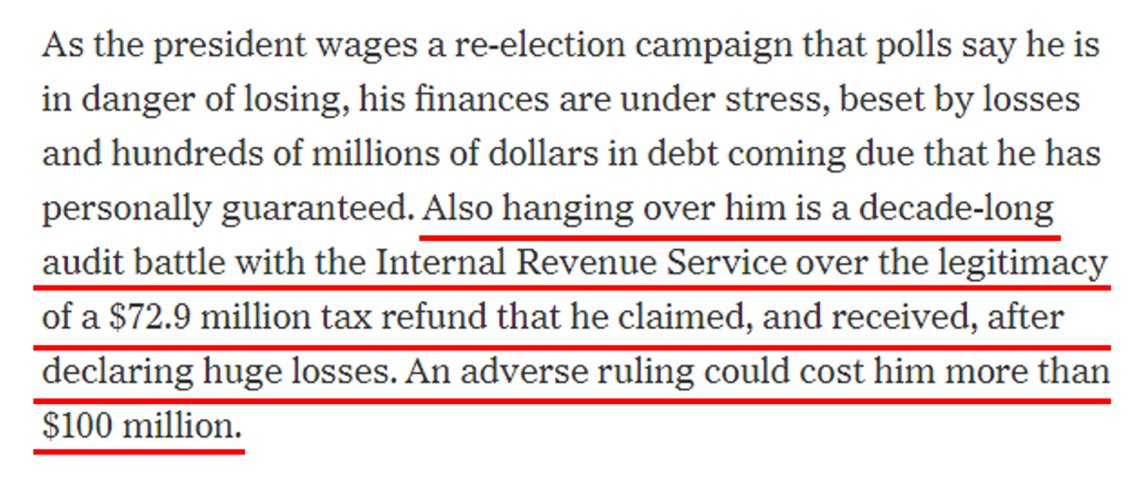

16/ Okay, we& #39;ve made it to the 3rd paragraph of the Times story. Let& #39;s keep moving. This next line, about the possibility that an adverse ruling could cost Trump $100M, is a huge scoop. It& #39;s also exactly the sort of reason why everyone was so eager to see Trump& #39;s tax documents.

17/ We peg Trump& #39;s cash pile at an estimated $160M. A $100M hit would be absolutely devastating. Also, remember the other $100M that Trump was supposedly thinking of putting into his campaign? Seems even more far-fetched now. https://www.bloomberg.com/news/articles/2020-09-08/trump-weighs-putting-up-to-100-million-of-his-cash-into-race">https://www.bloomberg.com/news/arti...

18/ A key point that the Times says explicitly: Tax returns don& #39;t tell you how rich someone is. Let& #39;s dig in a little deeper on this one.

19/ Figuring out Trump& #39;s net worth is just a big math equation. You add up the assets and then you subtract the debt. Since we& #39;ve already spent a lot of time on the debt, let& #39;s look closer at the assets. In order to value them, you want to know their net operating income.

20/ Here& #39;s where you& #39;ll see a big discrepancy from the NYT story. Taxable income takes into account a lot of financial gimmicks. Operating income cuts through that and focuses on the profitability of the actual businesses.

21/ We& #39;ll start, again, inside Trump Tower. In 2019, it produced a net operating income of $13.3 million, as you can see on the document below.

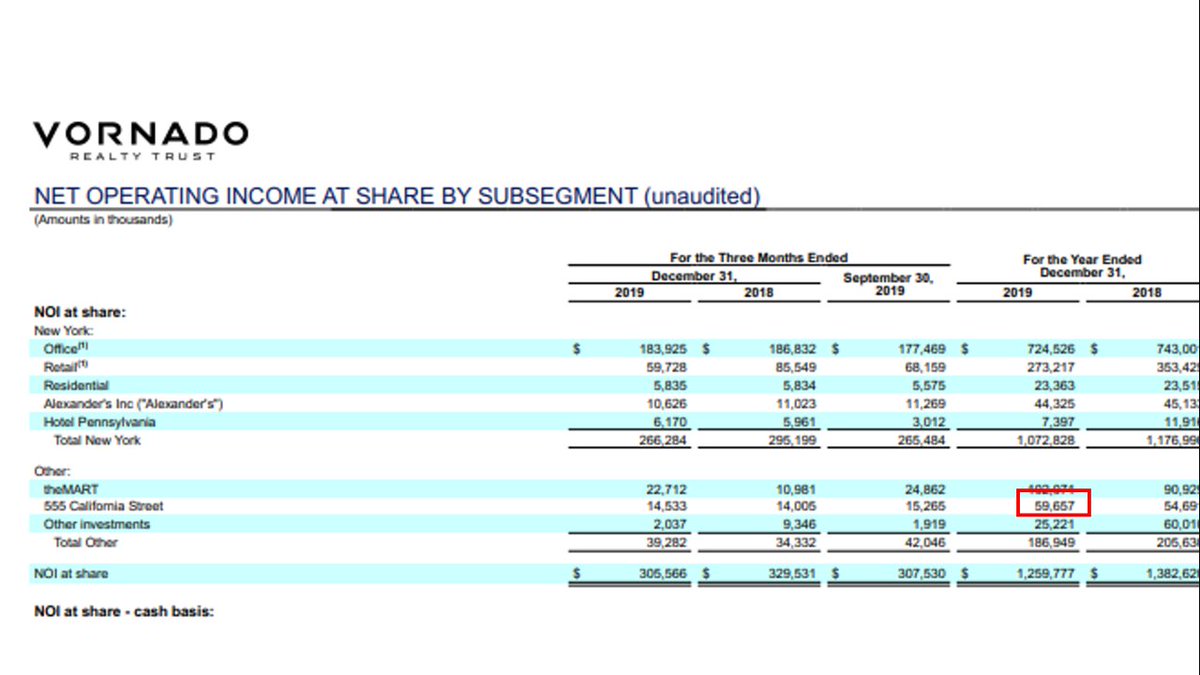

22/ At 555 California Street, Trump& #39;s partner Vornado disclosed 2019 net operating income of $60 million for its 70% share. Trump& #39;s 30% then works out to $25.6 million. Total operating profit so far: $38.9 million.

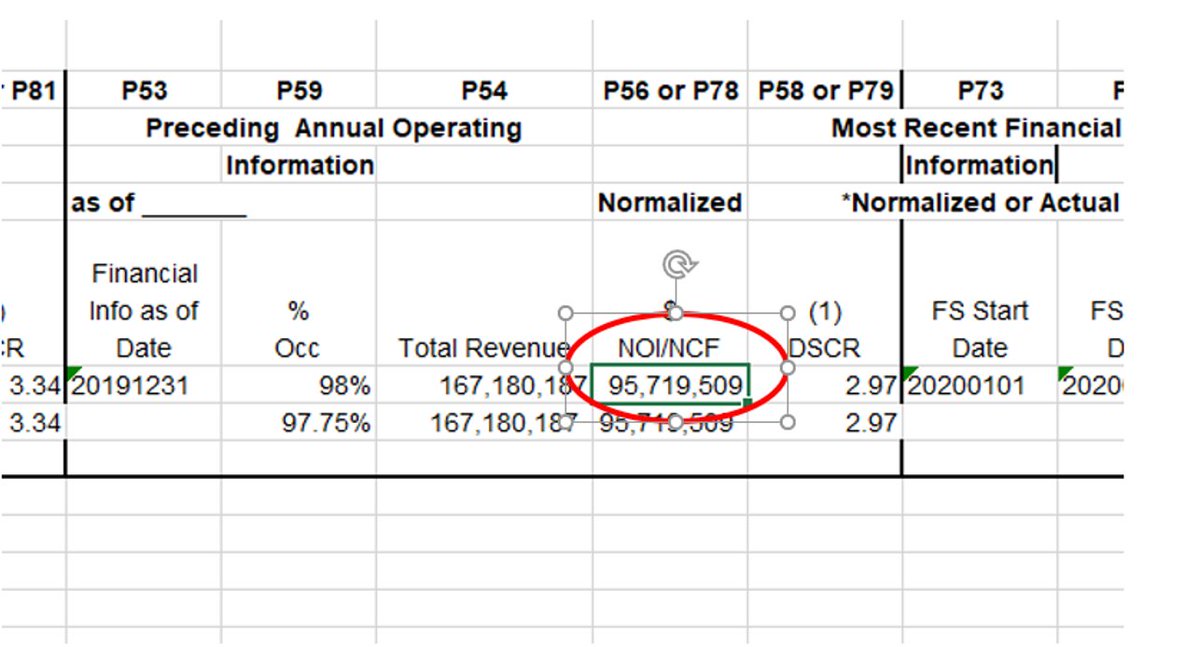

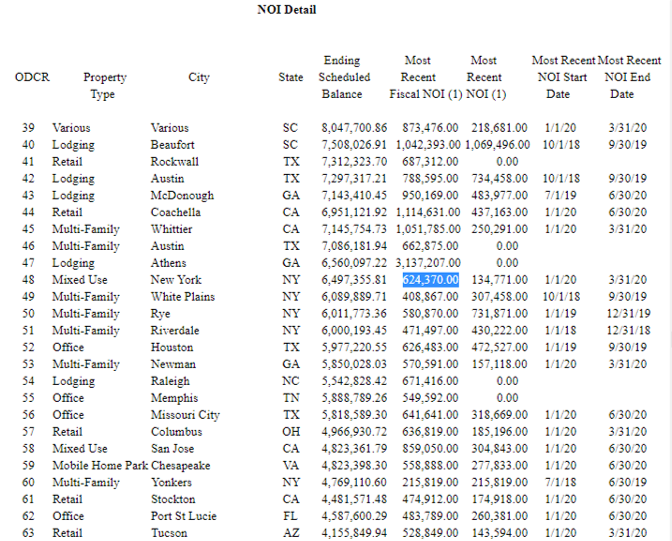

23/ A document connected to the debt on 1290 Avenue of the Americas, where Trump also owns a 30% stake alongside Vornado, lists net operating income of $96M. So Trump& #39;s cut of that would be $28.7M. Total operating profit so far: $67.6M.

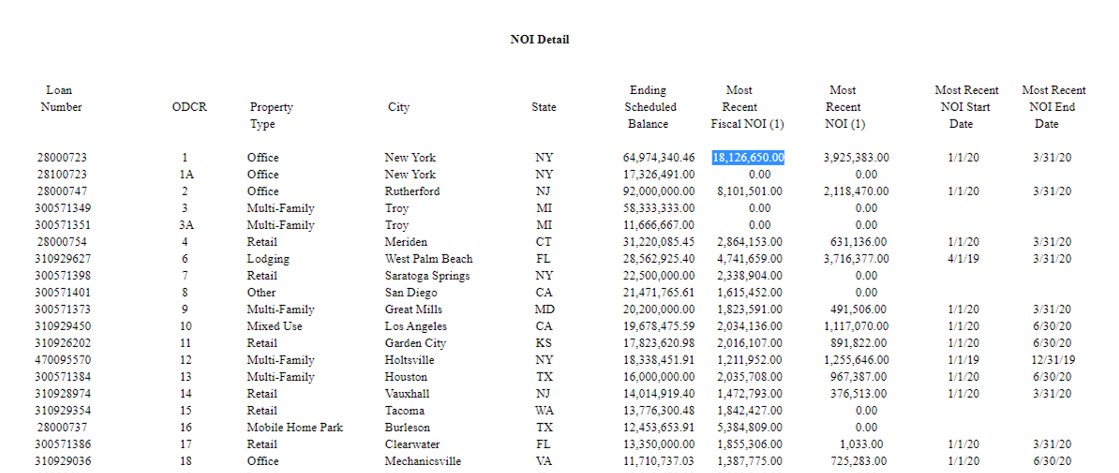

24/ 40 Wall Street, a skyscraper the president controls in downtown Manhattan, produced net operating income of $18.1 million in 2019, as you can see here. Total operating profit so far: $85.7M.

25/ A spokesperson for the Trump Organization told me in September 2019 that 6 East 57th Street, formerly known as Niketown, generated $10.7M of profit annually. Total tally so far: $96.4M.

26/ Trump Plaza, a property the president controls on Third Avenue in New York City, turned an operating profit of $1.7 million in 2019, as you can see here. Total now at $98.1M.

The president has leased the garage, restaurant space, and antennas at Trump International Hotel & Tower in Columbus Circle, on the southwest corner of Central Park, for a while now. That produced net operating income of $600,000 in 2019. Total tally so far: $98.7M.

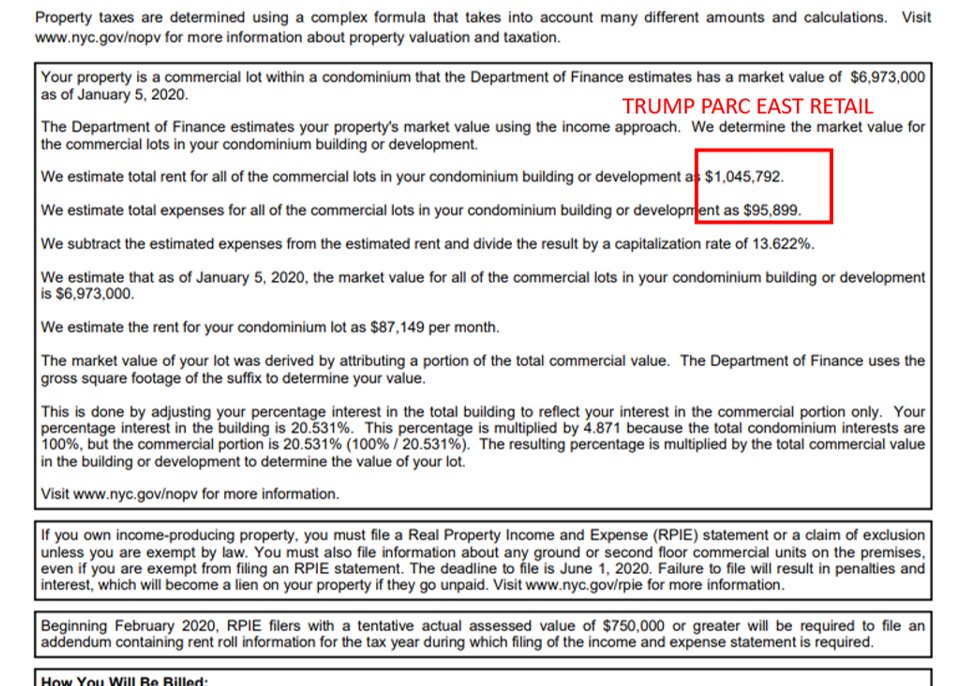

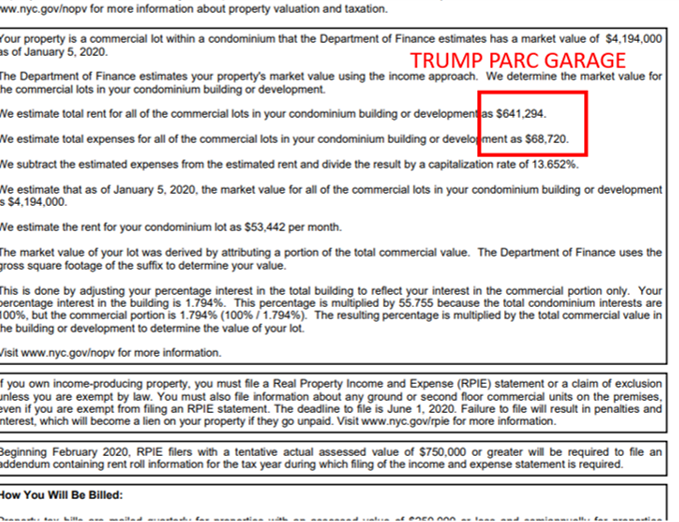

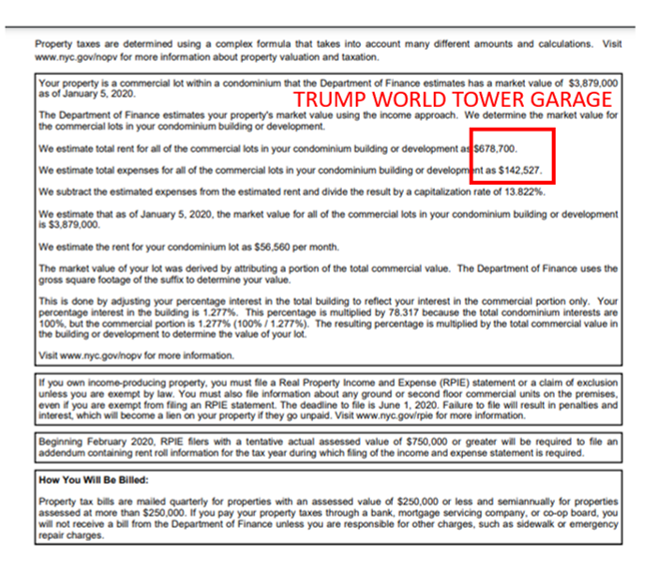

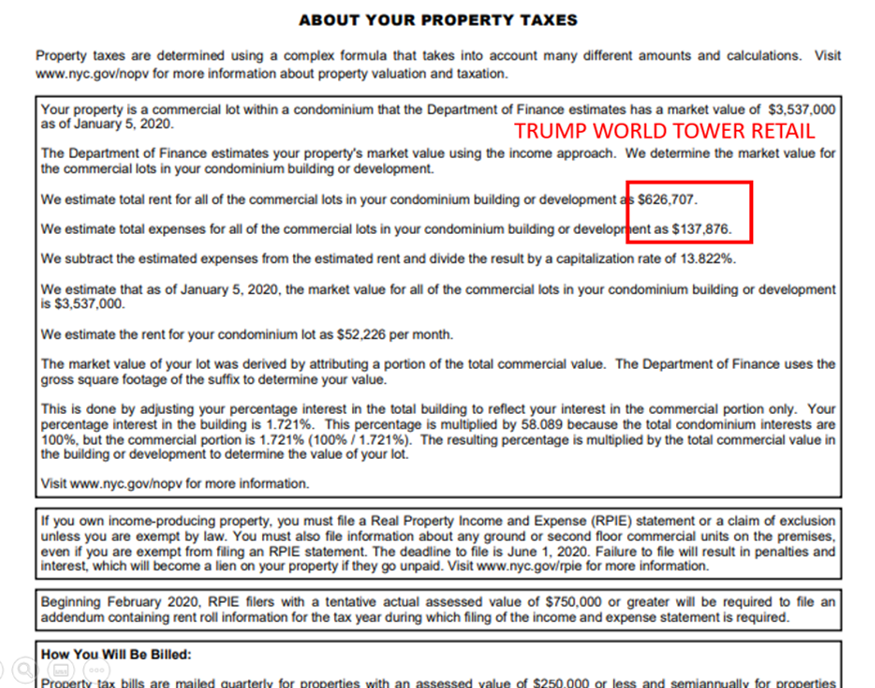

28/ Trump has a handful of other properties, where NYC estimates net operating income. That includes the commercial spaces in Trump World Tower ($1M), Trump Parc ($600K), Trump Parc East ($900K) and Trump Park Avenue (~$2.4M). Brings tally to $103.6M

29/ Some of those buildings also include luxury apartments that Trump still owns. That& #39;s the case at Trump Park Avenue (17 units), Trump Parc East (12), Trump World Tower (1) Trump Int& #39;l H&T (1), Trump Plaza (2). We& #39;ll come back to the Trump Tower penthouse.

30/ If you add up the value of all of those buildings, before subtracting debt, you get an estimated $2.3 billion. So that& #39;s a big chunk of the president& #39;s assets.

31/ But there& #39;s more, in Vegas, Chicago, DC, Miami, Palm Beach, and so on. I& #39;ll spare you the details on each one of those assets. But if you want to review the final numbers, you can see them here: #220e2ee02363">https://www.forbes.com/sites/danalexander/2020/09/08/trumps-net-worth-drops-600-million-in-a-year-to-25-billion/ #220e2ee02363.">https://www.forbes.com/sites/dan...

32/ Back to the Times story, which we& #39;ve still only just begun. But first, a break. Heading on CNN to talk about Trump& #39;s money around 2ish. https://www.nytimes.com/interactive/2020/09/27/us/donald-trump-taxes.html?action=click&module=Spotlight&pgtype=Homepage">https://www.nytimes.com/interacti...

Read on Twitter

Read on Twitter