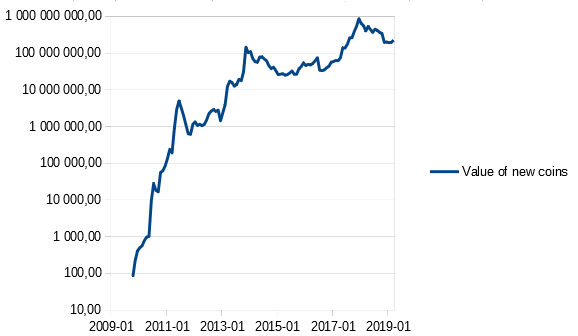

2/ Here is a plot of the USD value of newly minted bitcoins each month. While not actually very stable at any point, it& #39;s not trending much higher since November 2013, a time period of almost seven years.

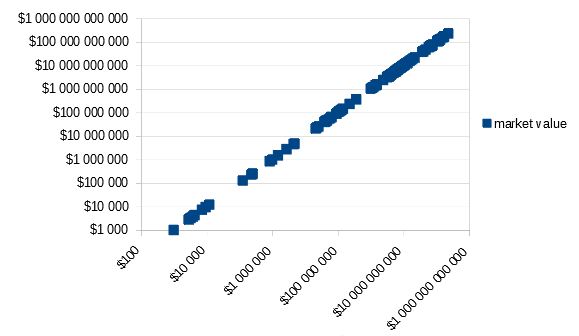

3/ Now let& #39;s construct a graph of the market cap of bitcoin against the market cap of bitcoin. It seems to show a perfect correlation and cointegration but this is not very meaningful since both axis are the same.

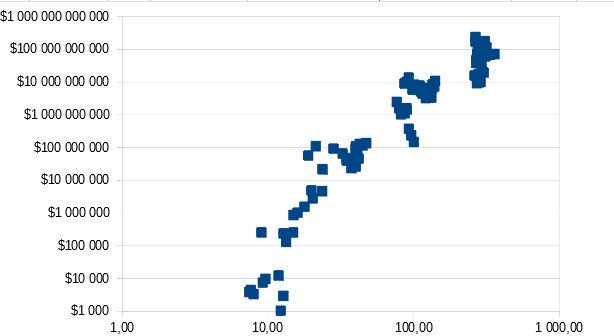

4/ Now let& #39;s combine these two pics by dividing each data point of the dummy dual axis market cap pic by the value of newly minted coins at that month. The x-axis stays the same showing the market cap. The y-axis becomes the market cap divided by newly minted coins, that& #39;s S2F!

6/ Note that the variation in the first pic of this thread, in the value of newly minted bitcoins, is smaller than the variation in the dual axis market cap pic, especially during the last seven years.

7/ Therefore the S2F model is dominated by the dummy relationship between market cap and market cap. That& #39;s the source of the correlation and the cointegration of the model.

8/ If we& #39;ll instead model the future price of bitcoin based on the monthly value of newly minted bitcoins to be stable or slightly rising, we do get price appreciation around the halvenings, but the effect is much smaller.

9/ If the value of newly minted bitcoins would be stable, that would mean BTC price only doubling every four years.

Read on Twitter

Read on Twitter