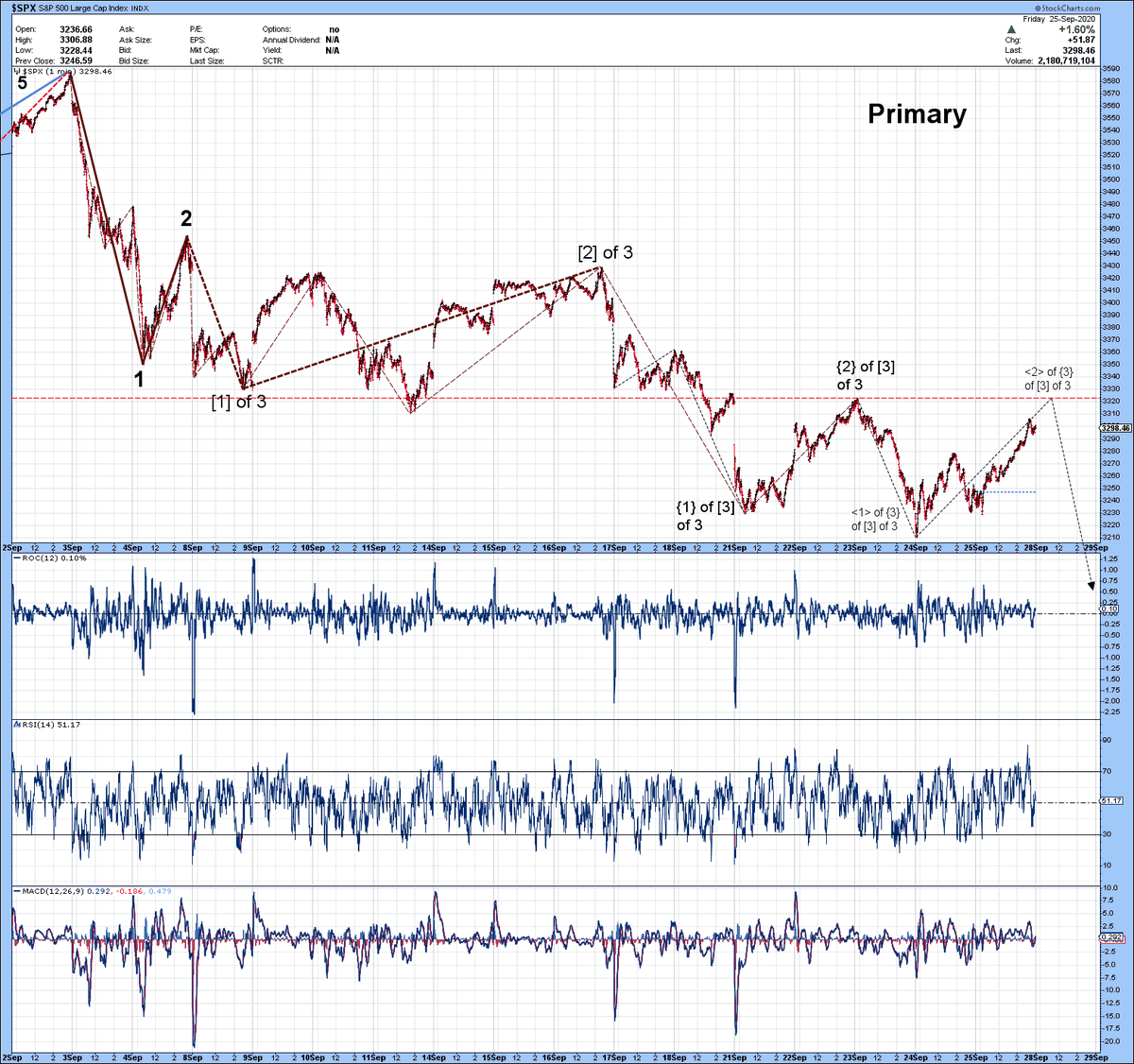

/1 Back from vacay, here& #39;s what I think is the highest-prob $spx chart.

But note it cannot go above 3323 or I& #39;ll need to do a full relabeling *and* there are multiple interps. for 21Sep through 25Sep.

ht @MotherCabriniNY @VlanciPictures @DereckCoatney @andykatz19 @Celiwaves

But note it cannot go above 3323 or I& #39;ll need to do a full relabeling *and* there are multiple interps. for 21Sep through 25Sep.

ht @MotherCabriniNY @VlanciPictures @DereckCoatney @andykatz19 @Celiwaves

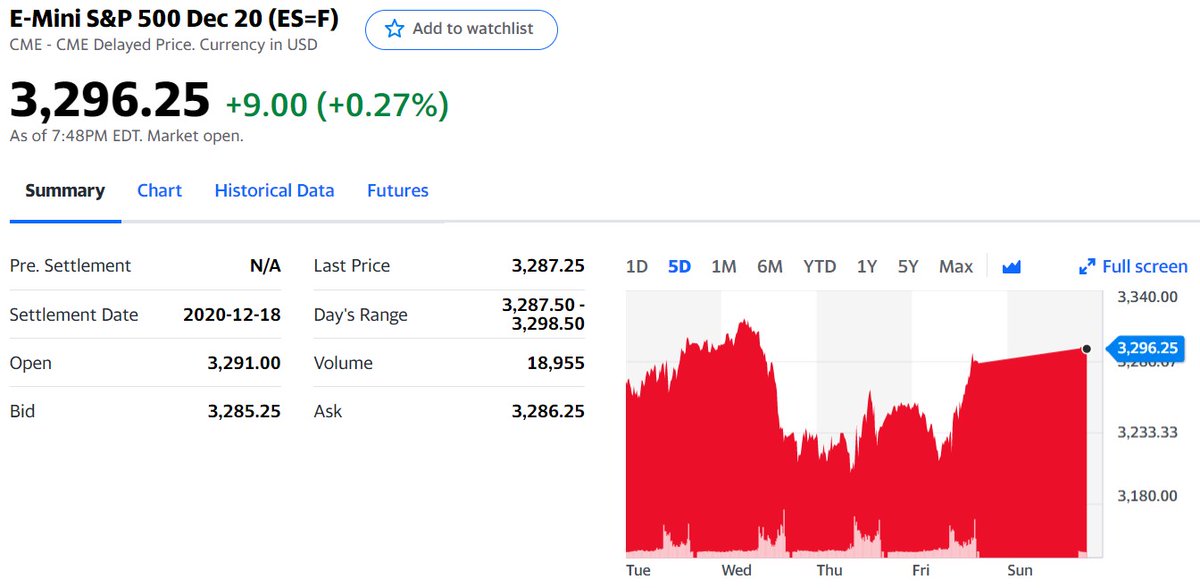

/2 If this $spx charting is correct, we should see $es_f show signs of serious weakness today/tomorrow... this follows because the "third of third" is usually the most dramatic and these labels suggest it happens early this week -- or time for a re-think.

#dyor #couldbewrong

#dyor #couldbewrong

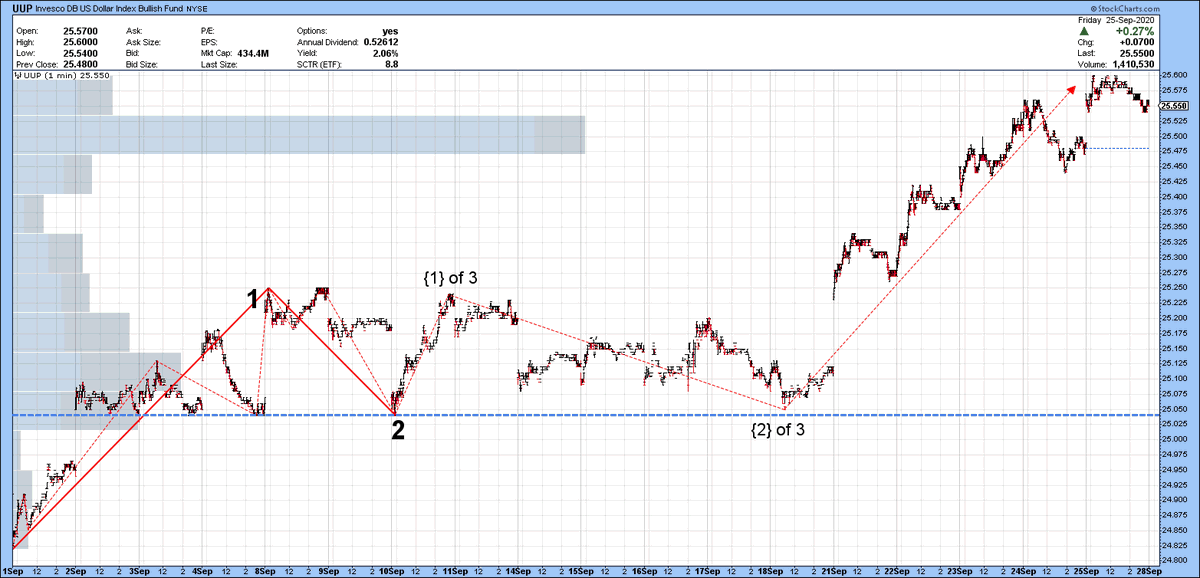

/3 One reason I favor the $spx charting in /1 is because the dollar has strengthened 2.2% (using $uup as proxy for $dxy) since 18Sep, implying S&P should be at ~3240 all else being equal -- and it is above that level

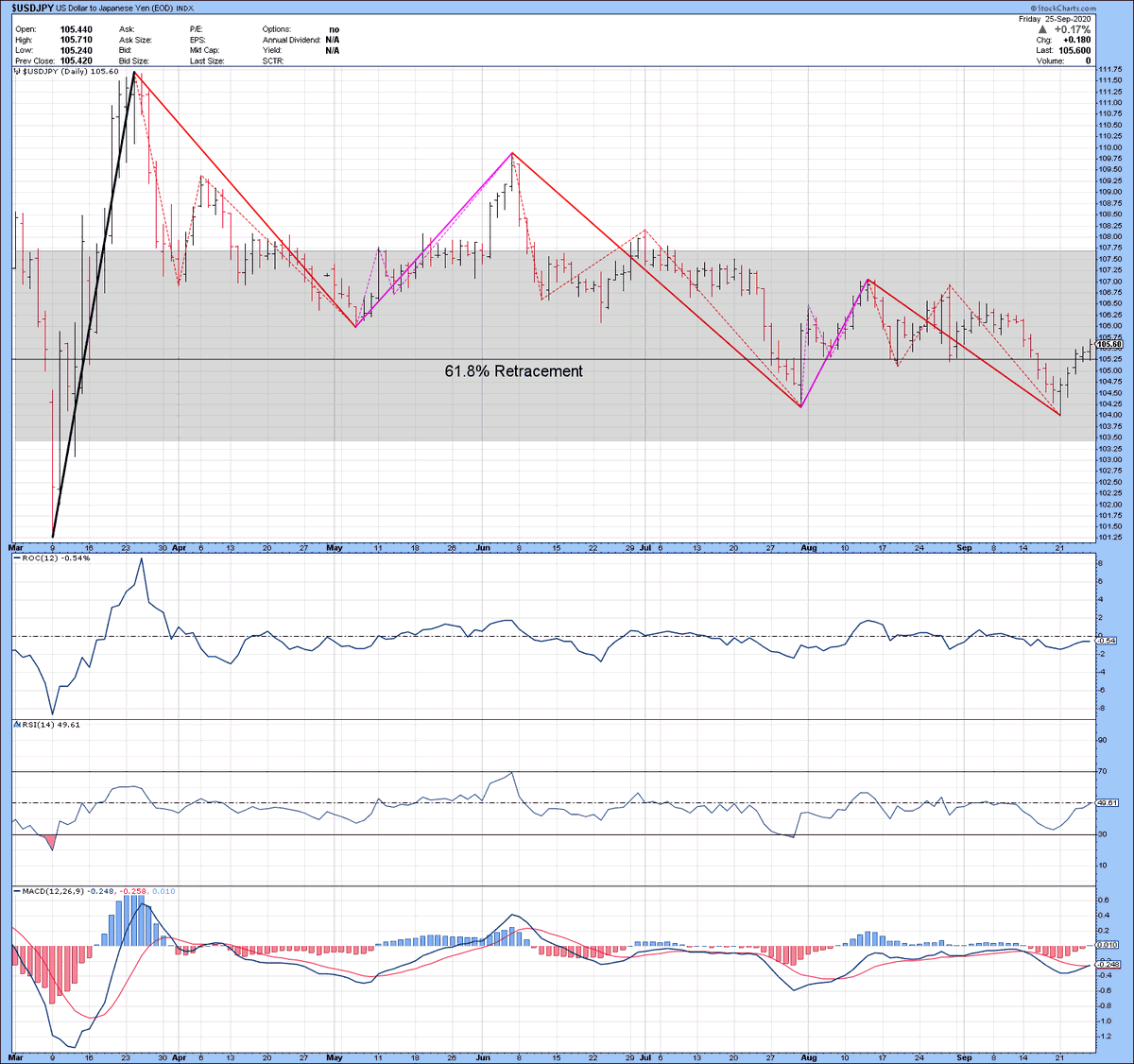

/4 And one reason $spx might go higher from here is $usdjpy. This  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> chart shows a completed ABC-X-ABC-Y-ABC correction (drawn in red and purple) from the 5-up impulse (drawn in black). *BUT* I am not confident the final ABC is complete...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> chart shows a completed ABC-X-ABC-Y-ABC correction (drawn in red and purple) from the 5-up impulse (drawn in black). *BUT* I am not confident the final ABC is complete...

/5 If $usdjpy has one more leg down, the carry trade could drive US equities higher before The Big  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">. Plus, ROC / RSI / MACD at daily scale in $usdjpy doesn& #39;t show "oversold" like it did last Feb.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">. Plus, ROC / RSI / MACD at daily scale in $usdjpy doesn& #39;t show "oversold" like it did last Feb.

#dyor #couldbewrong

#dyor #couldbewrong

Read on Twitter

Read on Twitter

chart shows a completed ABC-X-ABC-Y-ABC correction (drawn in red and purple) from the 5-up impulse (drawn in black). *BUT* I am not confident the final ABC is complete..." title="/4 And one reason $spx might go higher from here is $usdjpy. This https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> chart shows a completed ABC-X-ABC-Y-ABC correction (drawn in red and purple) from the 5-up impulse (drawn in black). *BUT* I am not confident the final ABC is complete..." class="img-responsive" style="max-width:100%;"/>

chart shows a completed ABC-X-ABC-Y-ABC correction (drawn in red and purple) from the 5-up impulse (drawn in black). *BUT* I am not confident the final ABC is complete..." title="/4 And one reason $spx might go higher from here is $usdjpy. This https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> chart shows a completed ABC-X-ABC-Y-ABC correction (drawn in red and purple) from the 5-up impulse (drawn in black). *BUT* I am not confident the final ABC is complete..." class="img-responsive" style="max-width:100%;"/>