"A great business at a fair price is superior to a fair business at a great price." --Charlie Munger

Let& #39;s walk through the mathematical proof of why Charlie is right, and also explore why this might be very dangerous advice. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😵" title="Benommenes Gesicht" aria-label="Emoji: Benommenes Gesicht"> #sacrilege

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😵" title="Benommenes Gesicht" aria-label="Emoji: Benommenes Gesicht"> #sacrilege

Let& #39;s walk through the mathematical proof of why Charlie is right, and also explore why this might be very dangerous advice.

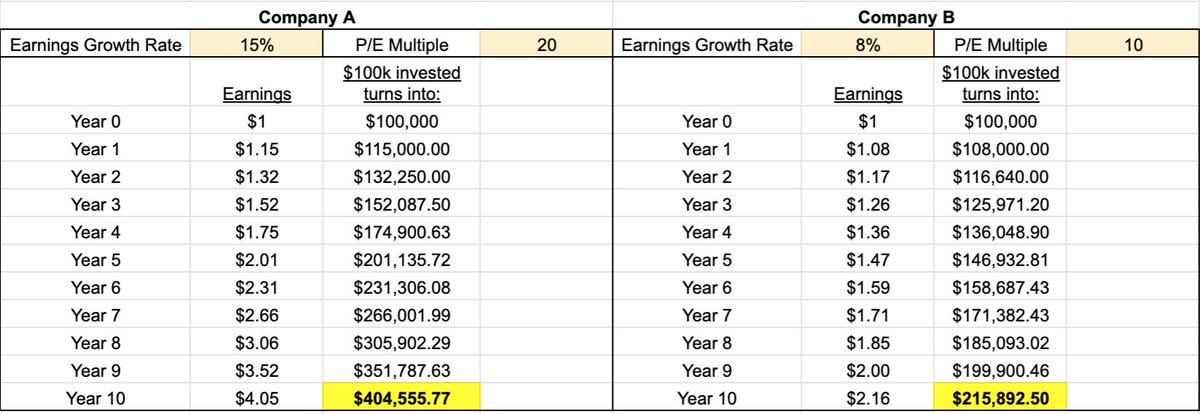

Company A: earns $1/share, growing earnings at 20%, selling for 20x P/E.

We invest $100k to buy 5k shares.

Company B: earns $1/share, growing earnings at 8%, selling for 10x P/E.

We invest $100k to buy 10k shares.

We invest $100k to buy 5k shares.

Company B: earns $1/share, growing earnings at 8%, selling for 10x P/E.

We invest $100k to buy 10k shares.

After 10 years, Charlie is proven right.

An investment in Company A turns into $405k compared to $216k for Company B.

Low P/E "value investing" is dead!

... but what if we& #39;re a little wrong about the business?

An investment in Company A turns into $405k compared to $216k for Company B.

Low P/E "value investing" is dead!

... but what if we& #39;re a little wrong about the business?

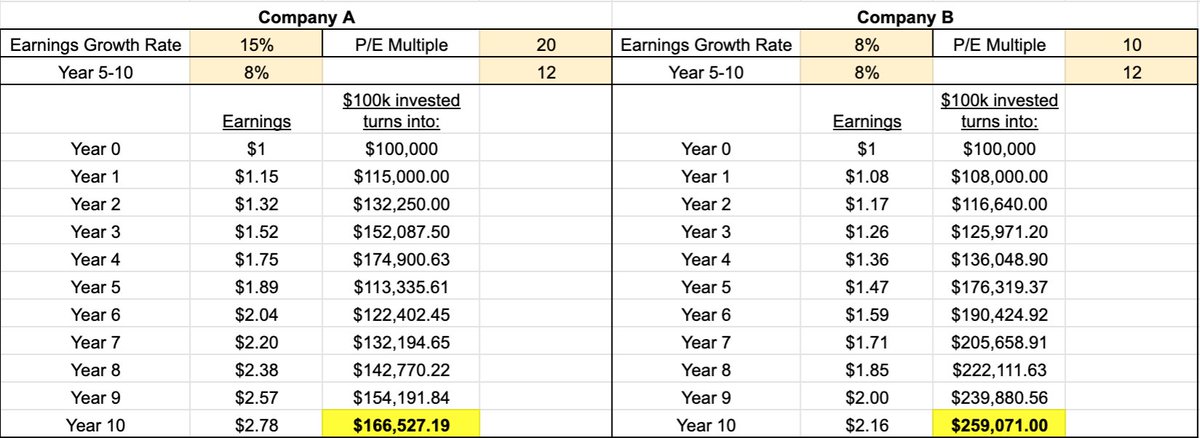

What if starting in Year 5, the competition picks up, or success breeds a little complacency?

Let& #39;s change the earnings growth rate for Years 5-10 for Company A to a still healthy 8%.

Unfortunately, a lower growth rate invites a lower multiple, so let& #39;s lower that to 12x.

Let& #39;s change the earnings growth rate for Years 5-10 for Company A to a still healthy 8%.

Unfortunately, a lower growth rate invites a lower multiple, so let& #39;s lower that to 12x.

Company B keeps chugging along, growing earnings by 8%. As a reward for their consistency, they get a 12x multiple in Years 5-10.

An investment in Company A now gives us $167k while Company B grows to $259k.

Wait, I thought "value" investing was dead?

An investment in Company A now gives us $167k while Company B grows to $259k.

Wait, I thought "value" investing was dead?

The moral of this story is you need to be an exceptional business analyst (like Munger), and be right about the quality of the business, to pay exceptional prices.

You have less margin for error with high starting prices.

You have to earn the right to pay that high multiple.

You have less margin for error with high starting prices.

You have to earn the right to pay that high multiple.

That& #39;s why Buffett can say, "price is my due diligence."

Or maybe we reduce this even further for the Robinhood crowd:

You can buy more shares with a lower starting price. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

Or maybe we reduce this even further for the Robinhood crowd:

You can buy more shares with a lower starting price.

Read on Twitter

Read on Twitter