What has COVID taught us about trends in food consumption? What are some of the less picked over investment ideas that will benefit under a number of future scenarios?

1/ In the early panic stages, there was significant stocking by households, particularly in shelf-stable food. A lot of this stuff can be ordered on Amazon (flats of canned tuna, chili). Hey, if you& #39;re gonna eat it at some point, and maybe the apocalypse is coming, why not?

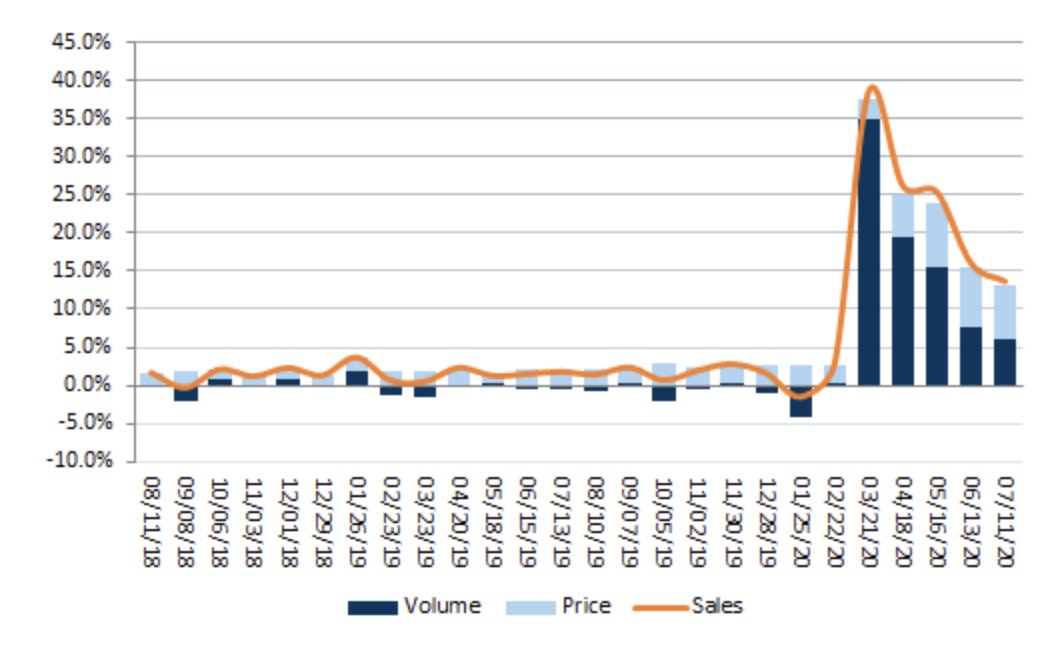

2/ Total U.S. food sales spiked up 30% in March and moderated somewhat into July. (Data from Nielsen).

3/ Through September, overall food volumes are +14% on a YoY basis and +12% on a YoY-SS basis. The strongest categories (where growth faded the least since reopenings) have been seasonings, pickles, relish, and baking. Interestingly, shelf-stable growth has faded the most:

4/ cereal, soup, canned fish, crackers - are only growing at mid-single digits YoY through last week. These categories were growing at 12-20% YoY as recently as mid-June. Could this all change if another lockdown phase occurs? Maybe. But keep in mind that these are non-perishable

5/ items and people bought a LOT of this stuff through the spring and summer. One category that has maintained higher growth rates is frozen foods. Catalina data shows frozen still growing at 20% YoY, with juice, fruit, meat/fish nearing 30% growth through September.

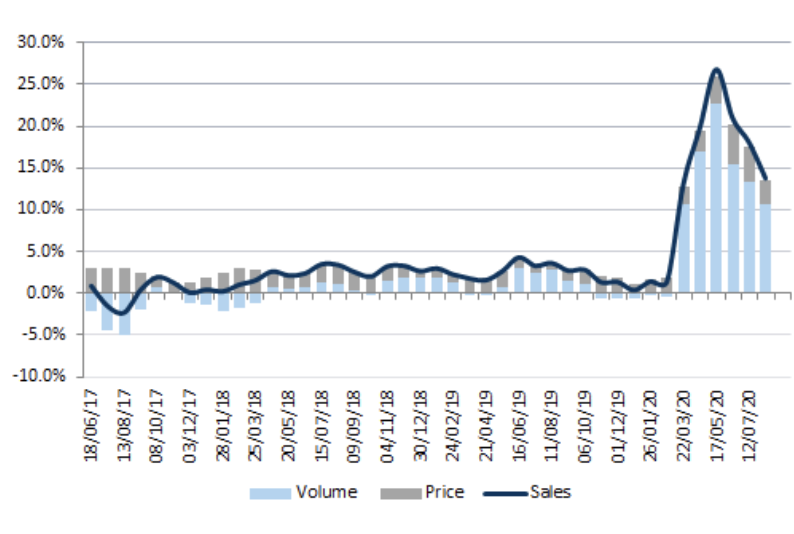

6/ Europe is similar, with frozen growing about 15% YoY according to Nielsen, outpacing other categories. What& #39;s interesting about the frozen market is that it is not something that Amazon can do very well. Traditionally, frozen grew at about 4% in N.A. and 2.5% in Europe.

7/ One reason for this has to do with differences in freezer capacity. N.A. freezer capacity growth has been about 4% in N.A. versus slightly -ve (pre-COVID) in Europe. 60% of Euro households have 142-340 litres of freezer space, while 53% of American homes are >600 litres.

8/ Figuring out the Euro frozen market is trickier than the U.S. Each country has its own cuisine preferences, there is higher fragmentation, and for the most part Europeans like eating out and buying groceries more often than Americans with their massive fridges/freezers.

9/ Solving for distribution and supply is not super easy. Which is partly why Europe is a more fragmented market. If you can figure this part out, there is a lot of opportunity. The food is also getting better. Remember the soggy frozen food from the & #39;80s and & #39;90s?

10/ We& #39;ve come a long way in terms of taste, nutrition, and presentation. There are lots of vegan and organic options and more international recipes. Food waste is also substantially much lower than for scratch-made and dining out.

11/ People will continue to eat fresh food, of course. Ordering in is expensive, and the restaurant business seems pretty messed up going forward. Amazon doesn& #39;t do frozen well (or at all where I live), and online grocery fulfillment is rapidly improving.

12/ Even as restaurants reopened across Europe, frozen has been growing fast. Through August, frozen seafood sales were up 56% YoY, and vegetables 26%. So how to play it? Nomad Foods has the #1 market share in Europe, second to Oetker, Frosta A.G., Nestle, and McCain. $NOMD

13/ They are the Euro frozen food pure-play and have successfully managed the distribution/product mix/supply equation across over 13 countries. NOMD grew through acquisition from & #39;15-now, but are posting huge organic growth rates in sales, earnings, and FCF.

14/ I& #39;m not going to dive deeply into Nomad in this thread, but it& #39;s extremely hard to find businesses growing earnings organically at 10% pre-Covid (26% Q2 YoY) with an 8-9% FCF yield, 30% GMs, 80%+ ROIC, and secular tailwinds.

15/ All while trading at 17x TTM EPS and 15x NTM. If you think COVID keeps hammering the dining business, there& #39;s even more upside. They have a dominant market position, on-trend product offerings, and a strong track record.

16/ Why do few people know about this Co.? I& #39;d guess it has to do with the U.S. listing, European business focus, and a multitude of brands, none of which are "Nomad". It& #39;s also interesting to note the very low ownership by passive indexers for a $5B cap Company.

17/ It& #39;s harder and harder to find good, stable businesses with reasonable valuations, secular tailwinds, a margin of safety, and real potential for large swathes of capital (passives) to enter the name.

18/ We all want the dining experience to return to "normal". Unfortunately, it& #39;s hard to see that happening any time soon. Ordering in is pricey, and many people are facing disposable income squeezes. The large players in the U.S. market are less attractive as conglomerates.

Read on Twitter

Read on Twitter