If you have been reading this article on @CBCNews https://www.cbc.ca/news/politics/free-automatic-tax-returns-benefits-1.5739678">https://www.cbc.ca/news/poli... you may be interested in some additional information about that 12% non-filing estimate. Here& #39;s a thread. 1/n

In a paper out now in @canpublicpolicy, @saulschwartz & I estimate the share of Canadians who don& #39;t file a tax return, describe who they are and add up the benefits left on the table by non-filers. This builds on earlier work, i.e. this for @prospercan: https://learninghub.prospercanada.org/wp-content/uploads/2018/06/J-Robson-FE-Pov-Red-TofC-FINAL-Jul-2017.pdf">https://learninghub.prospercanada.org/wp-conten...

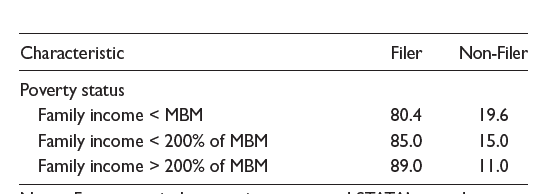

Neither @StatCan_eng nor @CanRevAgency publish official estimates, yet, of non-filing or eligible non-participation in benefits linked to filing. So, we develop our own estimates using the income source matching variable in the Survey of Financial Security.

StatCan uses tax data to fill in income values in most surveys now. We deem someone a non-filer if that matching fails. There will be error (person filed but gave bad matching info on the survey; no SIN found so no match possible). Note: if no SIN, how likely is it they file?

In our data, we can& #39;t see these variations, just the final result (match/not match). Some other surveys (Census) also access tax slips, not just T1 returns.

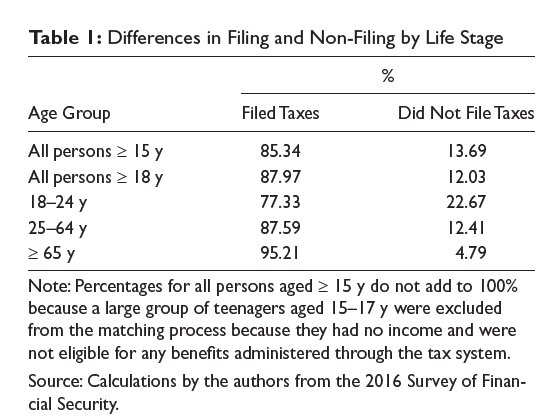

So, with those disclaimers, what do we find? That 12% figure you& #39;re hearing = our estimate 4 work-age adults. Age matters.

So, with those disclaimers, what do we find? That 12% figure you& #39;re hearing = our estimate 4 work-age adults. Age matters.

And, because we find this gender difference, we run our multivariate models separately for men vs women (no, the survey did not include other genders). The presence of kids, marital status, etc.. might matter differently by gender. TLDR, yes, that& #39;s what we find.

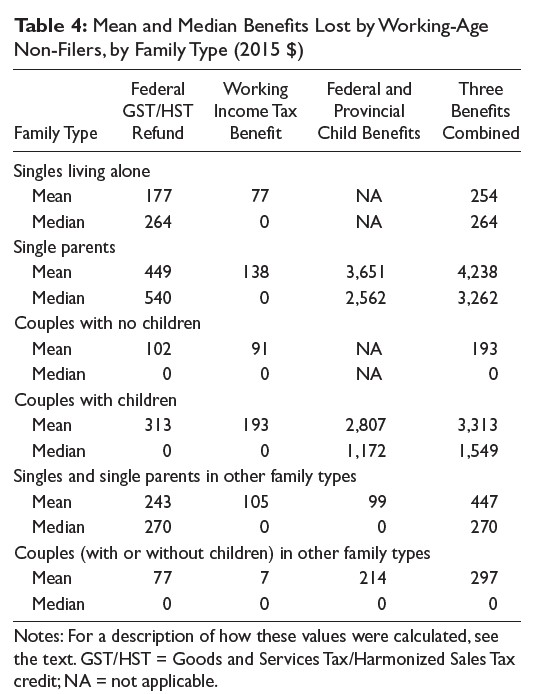

Next, we look at the $ values of cash benefits that non-filers would be missing. Note: we look at just 3 groups of benefits (GST credit, child credits, CWB) and using the 2015 benefit values. These benefits have increased in value since (esp child benefits).

If you are single with no dependents, maybe the cost (time, fees, stress) of filing a return to get $254 in benefits doesn& #39;t seem worth it. OTOH, it& #39;s harder to use a c/b model to explain why a single parent wouldn& #39;t want $4,238 in more money.

But even small amounts add up. We give a conservative estimate of $1.7B in benefits unpaid due to non-filing. We also talk about potential implications for accuracy of admin data that sets poverty lines, models policy impacts, etc..

But whether you are a progressive who cares about poverty reduction, or a conservative who cares about integrity/fraud in programs like CERB, you should want tax data to be as complete as possible.

If $4,200 isn& #39;t enough to induce someone to file, then maybe we have a broader problem that information alone isn& #39;t going to fix.

Anyway, here& #39;s a link to the full paper: https://www.utpjournals.press/doi/full/10.3138/cpp.2019-063">https://www.utpjournals.press/doi/full/...

Anyway, here& #39;s a link to the full paper: https://www.utpjournals.press/doi/full/10.3138/cpp.2019-063">https://www.utpjournals.press/doi/full/...

Read on Twitter

Read on Twitter