We hear everywhere about, & #39;Margin of Safety& #39; in the investment community.

But what exactly is it?

Let& #39;s find out.

Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

But what exactly is it?

Let& #39;s find out.

Thread

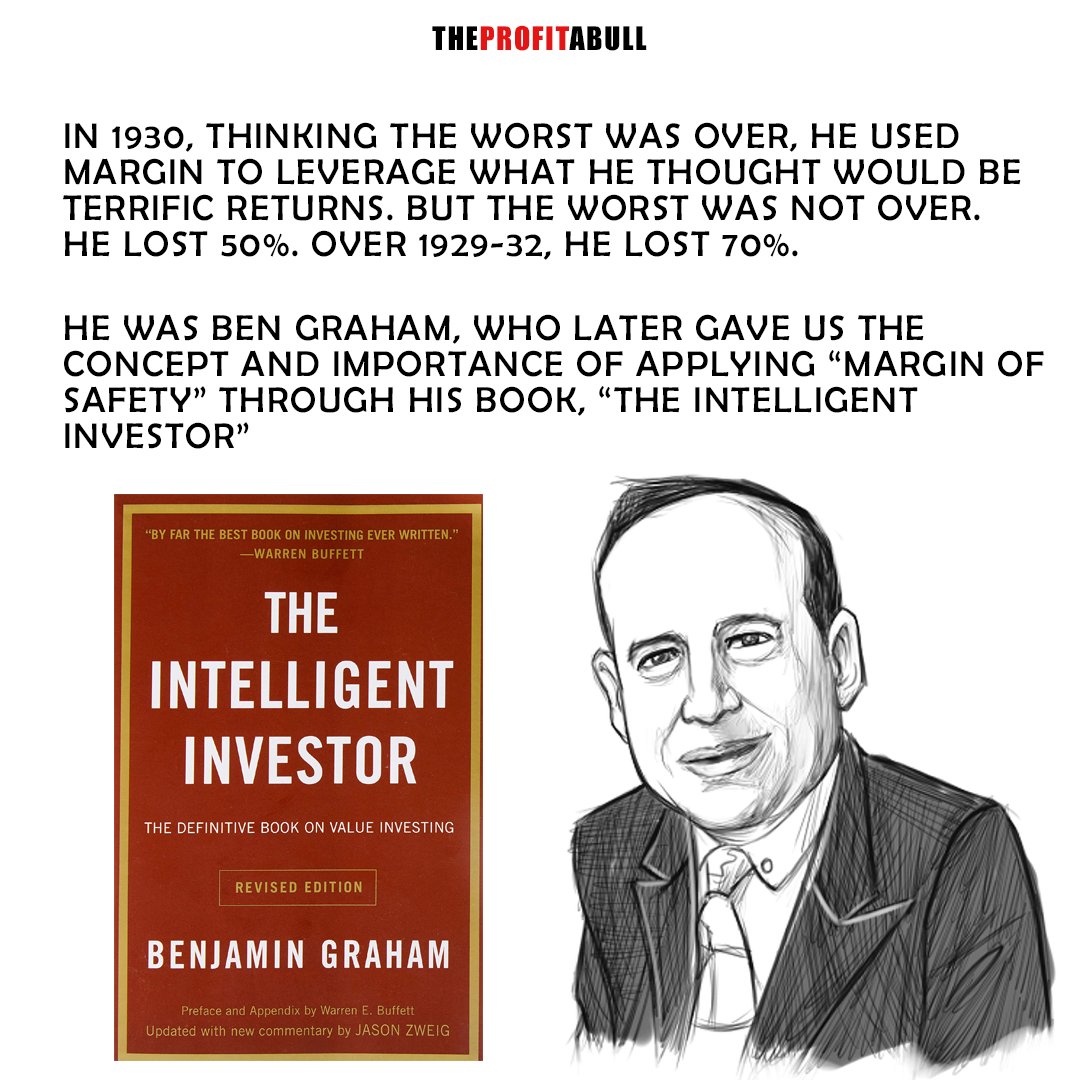

A mental model, borrowed from engineering, & #39;Margin of Safety& #39; has blended so well in the investment process of many greats.

It is being used more and more in making investment decisions.

It is being used more and more in making investment decisions.

“You build a bridge that 30,000-pound trucks can go across and then you drive 10,000-pound trucks across it. That is the way I like to go across bridges.”

- Ben Graham

- Ben Graham

When engineers are building a bridge they factor in the "unknown unknowns" - something which you don& #39;t know will happen.

Consider this fact:

Let& #39;s say you are driving a 9,800 pound truck and you come across a bridge.

Before crossing the bridge, you see a board saying that the bridge can handle load upto 10,000 pounds.

Will you cross the truck?

Let& #39;s say you are driving a 9,800 pound truck and you come across a bridge.

Before crossing the bridge, you see a board saying that the bridge can handle load upto 10,000 pounds.

Will you cross the truck?

You might cross it if the bridge is 6 inches above the crevice which it covers.

Now, let& #39;s say the bridge is over the Grand Canyon, will you still cross your truck?

There are high chances that you won& #39;t because there is little "margin of safety" for you to cross the bridge.

Now, let& #39;s say the bridge is over the Grand Canyon, will you still cross your truck?

There are high chances that you won& #39;t because there is little "margin of safety" for you to cross the bridge.

The same concept applies in investing.

If you are investing in the bonds of a company, you would want to be knowing whether there is a chance of the company defaulting its interest payments.

If you are investing in the bonds of a company, you would want to be knowing whether there is a chance of the company defaulting its interest payments.

You find a company that is earning a profits before paying interest and taxes (EBIT) of ₹300 crore and making annual interest payments worth ₹100 crore.

This means there is a room of ₹200 crore after which bondholders might start feeling that their interest payments might be defaulted.

There is a margin of safety of the profits getting eroded by ₹200 crore so that there is a default on the bonds issued.

There is a margin of safety of the profits getting eroded by ₹200 crore so that there is a default on the bonds issued.

Another case is when you are investing in stocks.

"You don’t try to buy something for $80 million that you think is worth $83,400,000."

- David Dodd

"You don’t try to buy something for $80 million that you think is worth $83,400,000."

- David Dodd

The concept works in a similar manner here as well.

Let& #39;s say you value a company to be worth ₹10,000 crore.

You wouldn& #39;t buy it if the market cap is ₹9,500 crore or even ₹9,000 crore.

Let& #39;s say you value a company to be worth ₹10,000 crore.

You wouldn& #39;t buy it if the market cap is ₹9,500 crore or even ₹9,000 crore.

You would want a big enough margin of safety when you are buying stocks because the unknowns are more in this case as compared to bonds.

Also, if your calculation is off by 10%, which happens very often in investing, then the company is worth only ₹9,000 crore.

Also, if your calculation is off by 10%, which happens very often in investing, then the company is worth only ₹9,000 crore.

This is why you need a bigger margin of safety.

So, if you find that company at say, ₹6,000 crore, you might consider buying it because in this you are getting a 40% margin of safety from your calculations.

So, if you find that company at say, ₹6,000 crore, you might consider buying it because in this you are getting a 40% margin of safety from your calculations.

This means even if your calculations are off by some percentage points, you are still protected by the huge margin of safety.

The concept of margin of safety can be applied in multiple forms.

You can consider "growth" as a margin of safety.

The concept of margin of safety can be applied in multiple forms.

You can consider "growth" as a margin of safety.

You calculate the present value of the company, without considering any growth in the future.

Now you buy the stock at this price, or below it, and if the company grows at any rate more than zero, this means you have bought the stock for cheap.

Now you buy the stock at this price, or below it, and if the company grows at any rate more than zero, this means you have bought the stock for cheap.

What this means is that you pay in full for the present value, and get the growth for free.

Growth acts a margin of safety in this case.

Growth acts a margin of safety in this case.

Now that you have understood about margin of safety, whenever you feel the urge to buy a stock which is rising, do ask yourself, "What is there in the current price that can go wrong for me?"

By doing this, you would not only kick the FOMO, but also not overpay for a stock.

By doing this, you would not only kick the FOMO, but also not overpay for a stock.

Read on Twitter

Read on Twitter " title="We hear everywhere about, & #39;Margin of Safety& #39; in the investment community.But what exactly is it?Let& #39;s find out.Threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="We hear everywhere about, & #39;Margin of Safety& #39; in the investment community.But what exactly is it?Let& #39;s find out.Threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" class="img-responsive" style="max-width:100%;"/>