1) Last night CoinGecko listed yTrump.

yTrump = tokenized YES shares from Augur’s market on whether Trump will win the 2020 election.

Augur TVL has nearly doubled in the past 24 hours and this is not a coincidence...

yTrump = tokenized YES shares from Augur’s market on whether Trump will win the 2020 election.

Augur TVL has nearly doubled in the past 24 hours and this is not a coincidence...

2) first a little context...

Prediction markets are cool.

Open prediction markets are *really* cool.

And tokenized shares on open prediction markets are even cooler…

Prediction markets are cool.

Open prediction markets are *really* cool.

And tokenized shares on open prediction markets are even cooler…

3) Prediction markets price future states of reality.

For example, yTrump signals the market’s perceived probability that Trump will win the election.

If it’s trading at .46 DAI, it signals ~46% odds...

For example, yTrump signals the market’s perceived probability that Trump will win the election.

If it’s trading at .46 DAI, it signals ~46% odds...

4) Prediction markets suck in information and crowdsourced insight with skin-in-the game incentives to drive more accurate forecasts whether on elections, the economy or anything.

*BUT*

The experiment of prediction markets has mostly been a dud...so far...

*BUT*

The experiment of prediction markets has mostly been a dud...so far...

5) Centralized markets have suffered from closed access, censorship and limited liquidity as Kenneth Arrow, @robinhanson, @PTetlock et al. wrote in "The Promise of Prediction Markets" https://mason.gmu.edu/~rhanson/PromisePredMkt.pdf">https://mason.gmu.edu/~rhanson/...

6) Augur fixes this.

(and Ethereum too!)

Augur is a radically decentralized PM protocol.

Market creation, trading, settlement are all open & censorship-resistant.

Augur is governed by code, driven by community, and fueled by incentives.

It is owned by everyone who uses it...

(and Ethereum too!)

Augur is a radically decentralized PM protocol.

Market creation, trading, settlement are all open & censorship-resistant.

Augur is governed by code, driven by community, and fueled by incentives.

It is owned by everyone who uses it...

7) Augur outcome shares are a new financial primitive that confer exposure to or insurance against future states of reality.

They are borderless and uncensorable and when tokenized into ERC20, transferrable and composable...

They are borderless and uncensorable and when tokenized into ERC20, transferrable and composable...

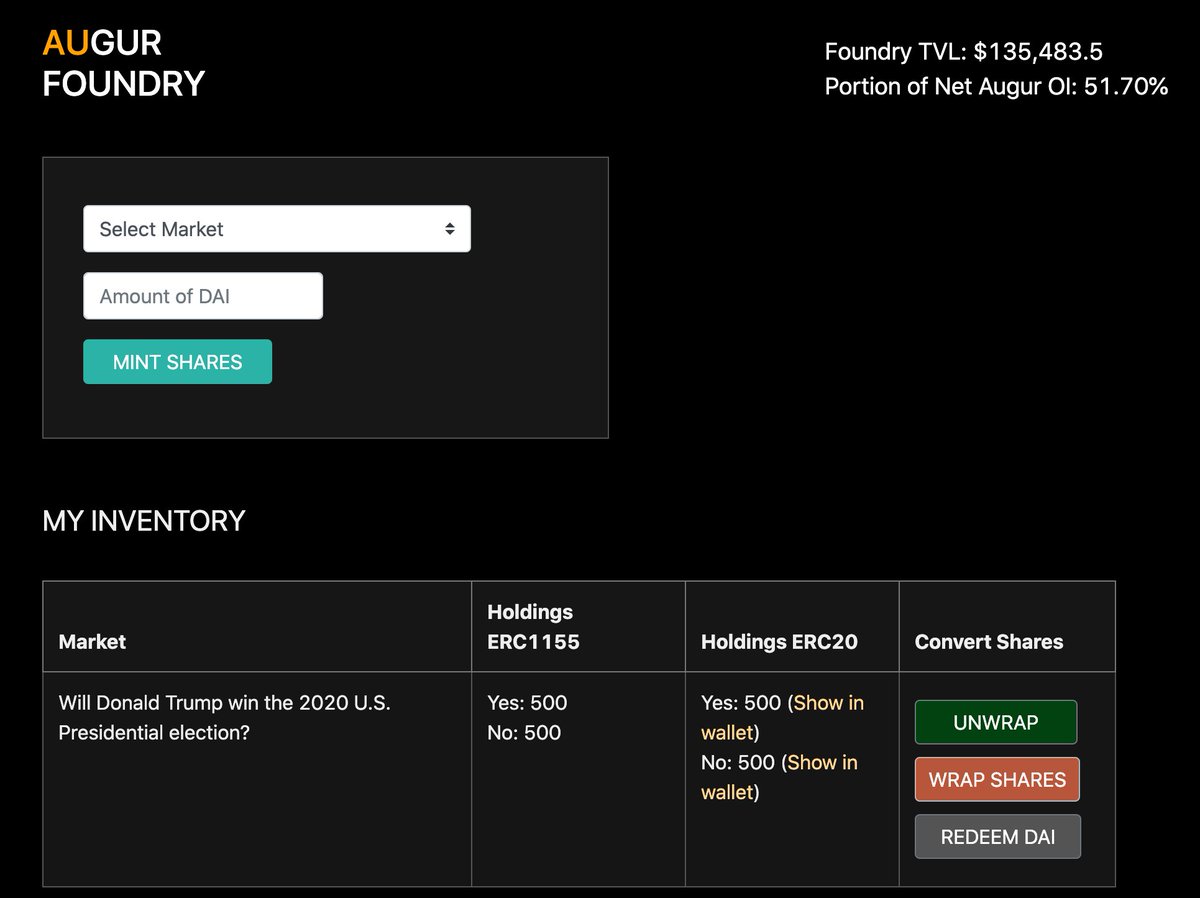

8) AugurDAO recently released http://foundry.finance"> http://foundry.finance a facility for minting, wrapping, and settling outcome shares.

By tokenizing them into ERC20, these outcome shares can now dance with the rest of DeFi...

By tokenizing them into ERC20, these outcome shares can now dance with the rest of DeFi...

9) The UI makes it easy for liquidity providers to come along, mint shares and throw them into automated exchanges like Balancer, Layer 2s, or broker them in other ways...

10) We’re starting off with just ONE market.

This may seem strange.

The more markets the better, right?

Not so fast…

This may seem strange.

The more markets the better, right?

Not so fast…

11) "Markets on everything" may be the end goal but not a great starting point as it results in fractured liquidity, complicated UX, paradox of choice, and sometimes scam markets.

Especially when liquidity formation is costly, focus and constraint wins...

Especially when liquidity formation is costly, focus and constraint wins...

12) So to start off we’re building liquidity and network effects around *one* market on the single most predicted event in the world: The U.S. Presidential Election...

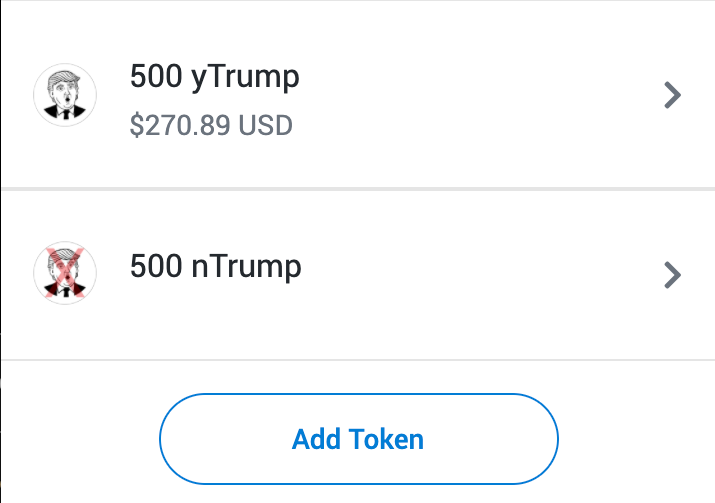

13) If the market resolves YES (Trump wins the election), each yTrump token settles for one DAI and each nTrump token pays out zero.

If it resolves NO, each nTrump token settles for one DAI and yTrumps pay out zero...

If it resolves NO, each nTrump token settles for one DAI and yTrumps pay out zero...

14) As we’ve seen in recent years, polls and pundits aren’t always great at predicting things.

Will open prediction markets fare better?

We’ll find this out in the coming weeks, months, and years as these markets become more and more frictionless...

Will open prediction markets fare better?

We’ll find this out in the coming weeks, months, and years as these markets become more and more frictionless...

15) $yTrump is on @coingecko & hopefully nTrump soon too.

The price signal should improve as more liquidity enters.

It needs to be liquid enough that traders can profit by arbing away mispricings.

It isn’t quite there yet, but should be soon! https://www.coingecko.com/en/coins/yes-trump-augur-prediction-token">https://www.coingecko.com/en/coins/...

The price signal should improve as more liquidity enters.

It needs to be liquid enough that traders can profit by arbing away mispricings.

It isn’t quite there yet, but should be soon! https://www.coingecko.com/en/coins/yes-trump-augur-prediction-token">https://www.coingecko.com/en/coins/...

Read on Twitter

Read on Twitter