Topic for today& #39;s thread is PM-CARES Fund as suggested by @nimbu_mirchee I am trying to put all the information available in public domain about this fund. This is for general understanding only. I will try my best to keep it simple to understand as well. Let& #39;s go

Before we go into PM-CARES fund, lets first understand similar fund i.e. PMNRF so that we can understand why there was need for new fund. so, Prime Minister’s National Relief Fund was instituted in 1948 by then PM Jawaharlal Nehru, to assist displaced persons from Pakistan

PMNRF is currently used to tackle natural calamities and to help with medical treatment like kidney transplantation, cancer treatment and acid attacks. PMNRF is also registered as a trust and have PM as chairman with members as FICCI chairman, Congress President and TATA trust

PMNRF accepts only voluntary donations by institutions and individuals. Contributions flowing out of the balance sheets of the Public Sector Undertakings (PSU’s) or from the budgetary sources of Government are not accepted. 100% Income Tax exemption and CSR eligibility as well.

PMNRF is also not audited by C&AG and is audited by 3rd party CA Firms like any other trust. PMNRF does not require approval from Parliament and can receive foreign contributions. They are exempted from the Foreign Contribution Regulation Act (FCRA).

So why a new fund was set up? Well the answer lies in the utilization pattern of PMNRF. The corpus fund of PMNRF could be invested in various forms with scheduled commercial banks and other agencies. Because of this there is low liquidity of only 15% in the PMNRF.

As per reports, bulk of the corpus fund of PMNRF is invested in State Development Loans, Fixed Deposits etc. which means utilization is difficult in case of emergency like COVID 19 as these loans cant be called back overnight. hence the need of a new fund i.e. PM-CARES

Constitution : Prime Minister’s Citizen Assistance and Relief in Emergency Situation Fund (PM-CARES) was created on March 28th, 2020.

Ex-officio Chairman : PM

ex-officio Trustees : Defence Minister, Home Minister, Finance Minister

3 more trustees could be nominated by Chairman

Ex-officio Chairman : PM

ex-officio Trustees : Defence Minister, Home Minister, Finance Minister

3 more trustees could be nominated by Chairman

It is a public charitable trust like PMNRF,enjoying similar Tax Exemptions,CSR eligibility and FCRA exemption. While PMNRF is used for all natural calamities, PM CARES fund is exclusively used for COVID19 purposes.

Upto this, there is no issue with PM-CARES. Lets talk about them.

First one is Audit.

Supreme Court said that being a public charitable trust, “there is no occasion for audit of PM-CARES Fund by CAG”. PM-CARES Fund be audited by an independent auditor just like PMNRF

First one is Audit.

Supreme Court said that being a public charitable trust, “there is no occasion for audit of PM-CARES Fund by CAG”. PM-CARES Fund be audited by an independent auditor just like PMNRF

2nd is Transfer of funds to NDRF.

SC also refused to order transfer of funds from PM-CARES to National Disaster Response Fund as it does not receive any Budgetary support or any Govt money.

Though on this, there are reports of PM-CARES being allowed to take donations from PSUs

SC also refused to order transfer of funds from PM-CARES to National Disaster Response Fund as it does not receive any Budgetary support or any Govt money.

Though on this, there are reports of PM-CARES being allowed to take donations from PSUs

3rd is RTI applicability

The PMO has denied a Right to Information request related to the PM-CARES Fund on the grounds that providing it would “disproportionately divert the resources of the office” under Section 7(9) of the Right to Information Act, 2005

The PMO has denied a Right to Information request related to the PM-CARES Fund on the grounds that providing it would “disproportionately divert the resources of the office” under Section 7(9) of the Right to Information Act, 2005

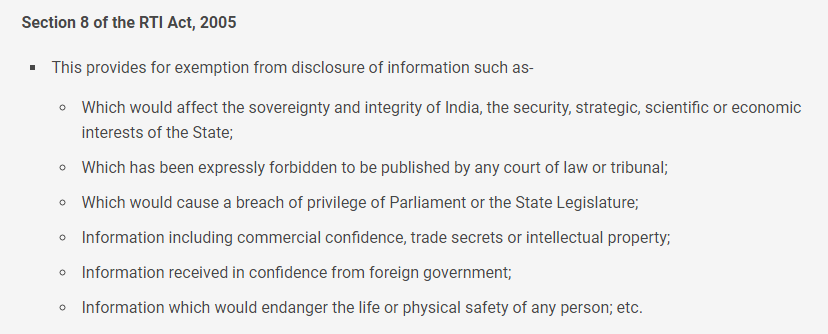

According to Sec 7(9) of the RTI Act, “an information shall ordinarily be provided in the form in which it is sought unless it would disproportionately divert the resources of the public authority or would be detrimental to the safety or preservation of the record in question.”

Central Information Commission criticized it as misuse of Section 7(9). Kerala HC in 2010 said that Sec7(9) doesnt exempt any public authority from disclosing information. It only gives discretion to provide the info in a form other than the form in which the info is sought for.

Section 8 (1) of RTI act lists the various valid reasons for exemption against furnishing information under the Act and not Section 7(9).

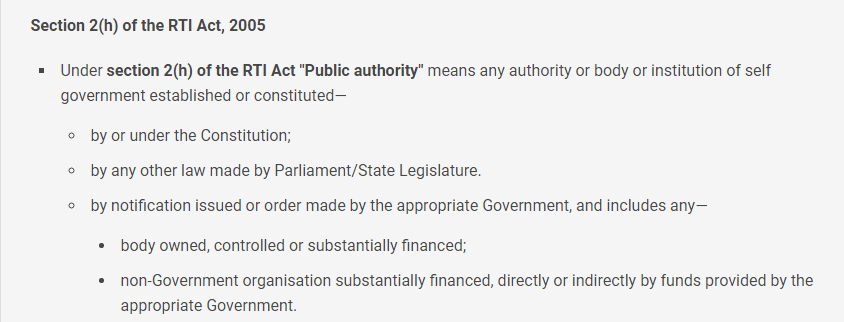

Earlier, the PMO had said that the PM-Cares Fund is not a public authority under the ambit of Section 2(h) of the RTI Act, 2005

Earlier, the PMO had said that the PM-Cares Fund is not a public authority under the ambit of Section 2(h) of the RTI Act, 2005

Here I am attaching what Section 2(h) includes in definition of Public Authority and what are the valid reasons for exemption from RTI act under Section 8.

Recently, The SC has ruled that the office of the Chief Justice of India is a public authority under the RTI Act, 2005

Recently, The SC has ruled that the office of the Chief Justice of India is a public authority under the RTI Act, 2005

If, as being reported, PM-CARES is allowed donations from PSUs, it is a public authority, being financed indirectly by funds provided by appropriate govt as per section 2(h) of RTI Act. No information of detailed trust deed is available in public domain as of yet to verify this.

If it is not a public authority as per definition of RTI Act, sadly it wont come under RTI Act. PMO website have this one line only --> "The fund consists entirely of voluntary contributions from individuals/organizations and does not get any budgetary support."

The same ambiguity is also there under PMNRF fund as well. In question of RTI Act applicability on PMNRF as well, some Justices from the Delhi High Court Bench held PMNRF as a public authority, whereas some Justices held that PMNRF is not a public authority.

4th is Corporate Social Responsibility(CSR) expenditure

Under Companies Act,2013,companies with a minimum net worth of 500cr or turnover of 1,000cr, or net profit of 5cr are required to spend at least 2% of their average profit for previous 3years on CSR activities every year.

Under Companies Act,2013,companies with a minimum net worth of 500cr or turnover of 1,000cr, or net profit of 5cr are required to spend at least 2% of their average profit for previous 3years on CSR activities every year.

Govt has allowed uncapped corporate donations to the PM-CARES fund to count as CSR expenditure while donations to PMNRF or the CM’s Relief Funds are capped. This goes against previous guidelines stating that CSR should not be used to fund government schemes.

Since Companies are getting 100% income tax exemptions for the donation and also setting it off against CSR Liabilities, this results in double benefit. Even govt panels have called it a regressive incentive. Companies should be getting either tax benefit or CSR setoff, not both

5th one is Foreign Contribution

Central Government has decided to accept contributions from abroad, irrespective of the nationalities, to PM-CARES Fund. Now the foreign governments, NGOs, and nationals can contribute. In the past 16 years India has not accepted any foreign aid.

Central Government has decided to accept contributions from abroad, irrespective of the nationalities, to PM-CARES Fund. Now the foreign governments, NGOs, and nationals can contribute. In the past 16 years India has not accepted any foreign aid.

After tsunami hit India in December2004, govt felt that it could cope up on its own. Since then, India has followed the policy of not accepting aid from foreign govts. In 2018,govt refused to accept foreign aid to flood-ravaged Kerala following the disaster aid policy set in 2004

Govt has said that the contribution to PM-CARES is not “aid” and the foreign contribution is “only” applicable to the PM-CARES fund and not any other fund like the PMNRF.

There are questions being raised on FCRA Exemptions. Sec 50 of FCRA allows Central govt to issue orders exempting any org(apart from political parties) from the provisions of FCRA if it feels it necessary or expedient in public interest, sub to conditions specified in the order.

In July 2011, the Home Ministry issued an order exempting all bodies established by a Central or State Act which are required to have their accounts audited by the CAG. Earlier this year, on January 30, 2020, it issued a fresh order superseding the previous one

This fresh order included organisations established by any administrative or executive order of the Central Government or any State Government and wholly owned by the respective Government and having their accounts audited by CAG to be exempted from FCRA

As per govt& #39;s reasons given to deny information under RTI Act, PM-CARES is not public authority, it contradicts here with FCRA Exemption. PM-CARES doesn& #39;t satisfy conditions mentioned in January order for FCRA exemptions if you go by the denial of govt to include it in RTI act

Now you can see how PMO tried to ditch RTI by earlier invoking Section 2(h) by saying that PM-CARES is not public authority and now when contradicting with FCRA Exemption, It is using Sec 7(9) saying it would “disproportionately divert the resources of the office”

Ministry of Home Affairs was the party to FCRA Exemption RTI so to dodge that bullet, Home Ministry said it had to “seek the consent” of PM CARES before giving out the information, as it would be considered a “third party” under the RTI Act.

Funny thing is the 3rd Party clause used by MHA adds that “except in the case of trade or commercial secrets protected by law, disclosure may be allowed if the public interest in disclosure outweighs in importance any possible harm or injury to the interests of such third party”.

Now to dodge this bullet, MHA also referenced Section 8(1)(e), which allows the denial of information “available to a person in his fiduciary relationship, unless the competent authority is satisfied that the larger public interest warrants the disclosure of such information”.

The length this govt is going to deprive PM-CARES of transparency and accountability is astonishing. I am not questioning intents or constitution or exemptions this fund has received. For someone who have given my money in donation, I would seek transparency too. End of thread.

Read on Twitter

Read on Twitter