Political pundits often refer to tax systems in Scandinavian countries like #Denmark and #Sweden.

But how do Scandinavian countries really pay for their government spending?

https://tax.foundation/scandinavian

THREAD">https://tax.foundation/scandinav... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

But how do Scandinavian countries really pay for their government spending?

https://tax.foundation/scandinavian

THREAD">https://tax.foundation/scandinav...

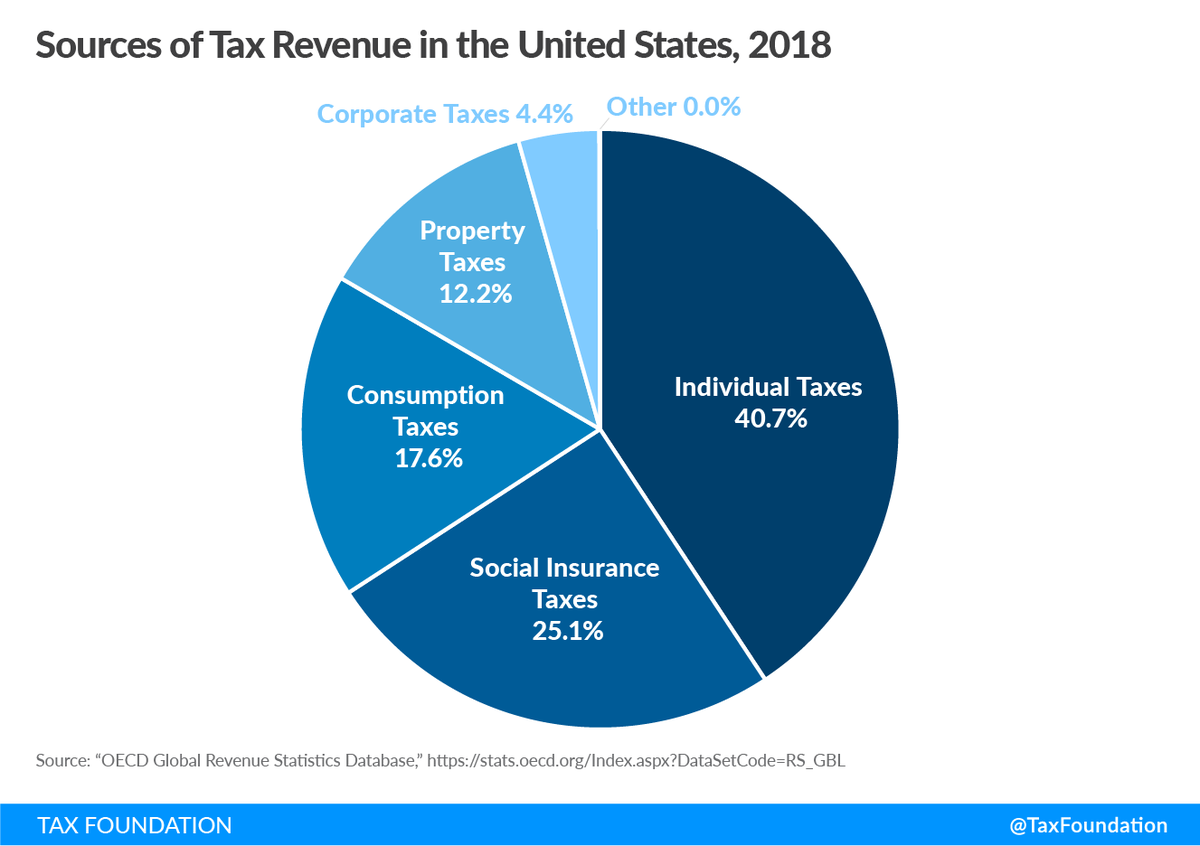

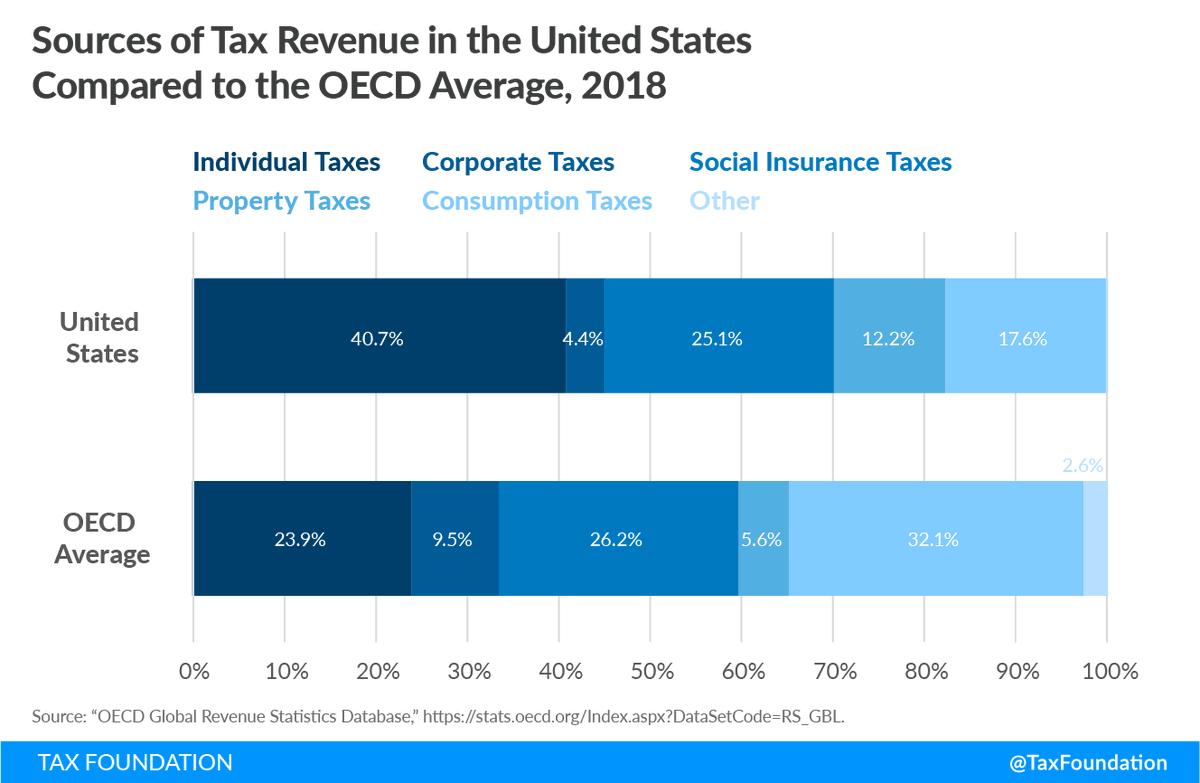

If the U.S. were to raise taxes in a way that mirrors Scandinavian countries, taxes—especially on the middle class—would increase through a new VAT and higher social security contributions and personal income taxes. /2

If the U.S. were to raise taxes in a way that mirrors Scandinavian countries, business and capital taxes would not necessarily need to be increased.

In fact, the corporate income tax rate would decline. /3

In fact, the corporate income tax rate would decline. /3

Business taxes are a less reliable source of revenue (unless your country is situated on top of oil).

Scandinavian countries don& #39;t place above-average tax burdens on capital income and focus taxation on labor and consumption. /4

Scandinavian countries don& #39;t place above-average tax burdens on capital income and focus taxation on labor and consumption. /4

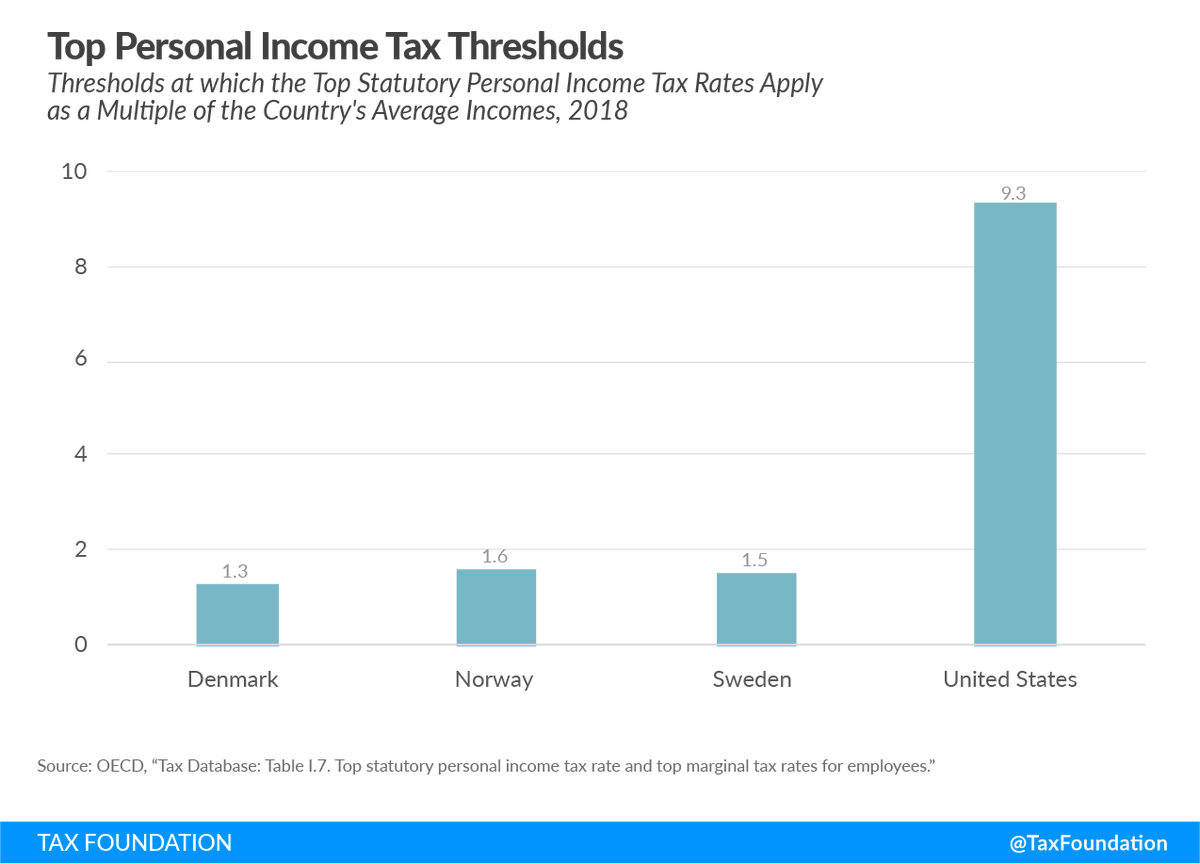

Scandinavian countries tend to levy top personal income tax rates on (upper) middle-class earners.

Denmark, Norway and Sweden have relatively flat income tax systems. /5

Denmark, Norway and Sweden have relatively flat income tax systems. /5

If the U.S. taxed personal income in the same way that Denmark does, all income over $65,000 would be taxed at 55.9 percent. /6

It’s no surprise that taxes in Scandinavian countries are structured this way.

In order to raise a significant amount of revenue, the tax base needs to be broad:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Higher consumption taxes (VAT)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Higher consumption taxes (VAT)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Higher taxes on middle-income taxpayers via social security contributions. /7

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Higher taxes on middle-income taxpayers via social security contributions. /7

In order to raise a significant amount of revenue, the tax base needs to be broad:

The US relies much less on consumption taxes than other OECD countries.

All OECD countries, except the US, levy value-added taxes (VAT) at relatively high rates: https://tax.foundation/2VbGkwm ">https://tax.foundation/2VbGkwm&q... /8

All OECD countries, except the US, levy value-added taxes (VAT) at relatively high rates: https://tax.foundation/2VbGkwm ">https://tax.foundation/2VbGkwm&q... /8

The US relies much less on consumption taxes than other OECD countries.

All OECD countries, except the US, levy value-added taxes (VAT) at relatively high rates: https://tax.foundation/2VbGkwm ">https://tax.foundation/2VbGkwm&q... /end

All OECD countries, except the US, levy value-added taxes (VAT) at relatively high rates: https://tax.foundation/2VbGkwm ">https://tax.foundation/2VbGkwm&q... /end

Read on Twitter

Read on Twitter " title="Political pundits often refer to tax systems in Scandinavian countries like #Denmark and #Sweden.But how do Scandinavian countries really pay for their government spending? https://tax.foundation/scandinav... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Political pundits often refer to tax systems in Scandinavian countries like #Denmark and #Sweden.But how do Scandinavian countries really pay for their government spending? https://tax.foundation/scandinav... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>