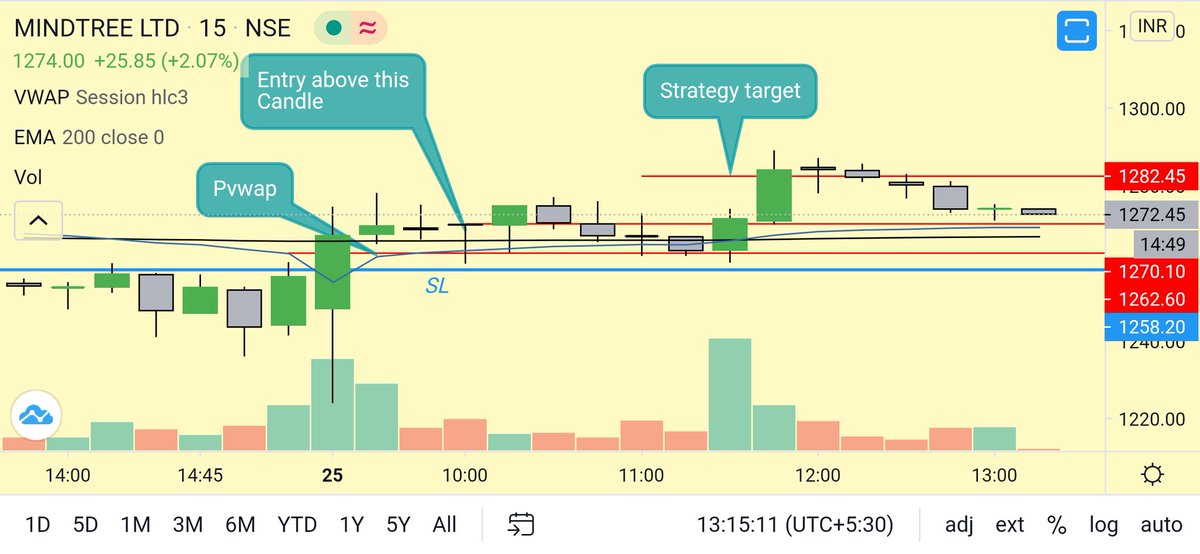

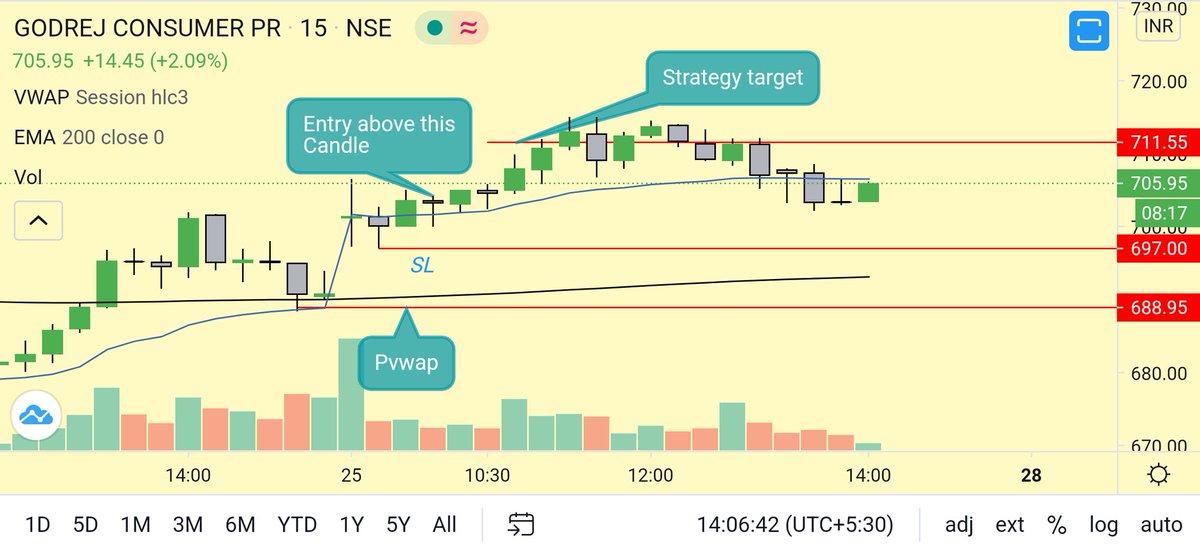

Simple vwap strategy I use if price is above 200 ema in 15 minutes timeframe and above pvwap then buy entry triggered if 15 minute candle close above vwap and next immediate candle should break it& #39;s high SL is 1% of stock price from entry target is 1% of stock frm entry

(1/n)

(1/n)

Pvwap is nothing but value of vwap at last 15 minute candle in previous day so we call it previous day closing vwap(pvwap)

Now I follow simple rules to use this strategy as follows

1 If price is below 200 ema in 15 minutes chart then I avoid taking long trade

(2/n)

Now I follow simple rules to use this strategy as follows

1 If price is below 200 ema in 15 minutes chart then I avoid taking long trade

(2/n)

2 if price open gap up then I also avoid taking straight long trade in this case I can wait for if second

Entry triggered as per this vwap strategy

(3/n)

Entry triggered as per this vwap strategy

(3/n)

3 suppose if entry triggered at 510 then my Stoploss would be around 505 and I also check if 505 value is still present above vwap at that time then I also avoid taking long trade here

(4/n)

(4/n)

So basically I check if value of my Stoploss is coming above or below vwap becoz if it would be above vwap than I avoid becoz many times price retrace toward vwap to test demand and in that case my SL will be hit for sure

(5/n)

(5/n)

My thread broke actually so here are rest of tweets of this thread https://twitter.com/axehunt/status/1309418007882465281?s=19">https://twitter.com/axehunt/s...

Read on Twitter

Read on Twitter