The game of low float. It is an old trick but some of the players have mastered this. Let& #39;s understand how it is played and what is the risk and lesson for us?

The game starts with identifying a good company with a low float. What is a good company and what is a low float?

1/n

The game starts with identifying a good company with a low float. What is a good company and what is a low float?

1/n

A good company: clean balance sheet, growth of 20%+ in topline and bottom line, good cash flow, low or no debt. They may or may not have any "moat" to support the valuations but how does it matter?

2/n

2/n

What is low float: Float is the available shares after removing promoter, KMPs, HNIs, large institutional holdings, shares held in non-dematerialized form. The available float in such cases could be as low as below 10%.

3/n

3/n

You corner this share. The stock will move up rapidly due to low available float. Then you come on media channels, open your holding for public view, talk big abt your investment strategy, get gullible investors to believe you.

4/n

4/n

You invest for 10 years but talk abt your invested stocks on media channels 10 times in a week. You get visibility everywhere. Use the principle of "jo dikhta hai wo bikta hai".

5/n

5/n

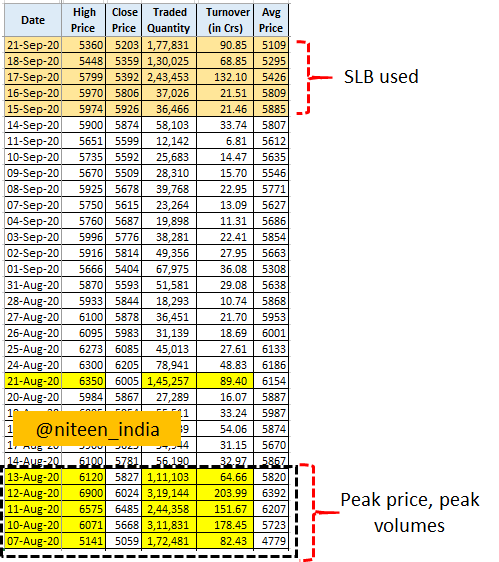

In a recent case of corrosion-resistant glasslined equip mfg, stk moved up 4X in a span of 12 mth before getting a top. At peak price, PE was 120, mkt cap was 13X of sales. The company was trading at the historically highest level of opt profit. It is not a rocket science biz

6/n

6/n

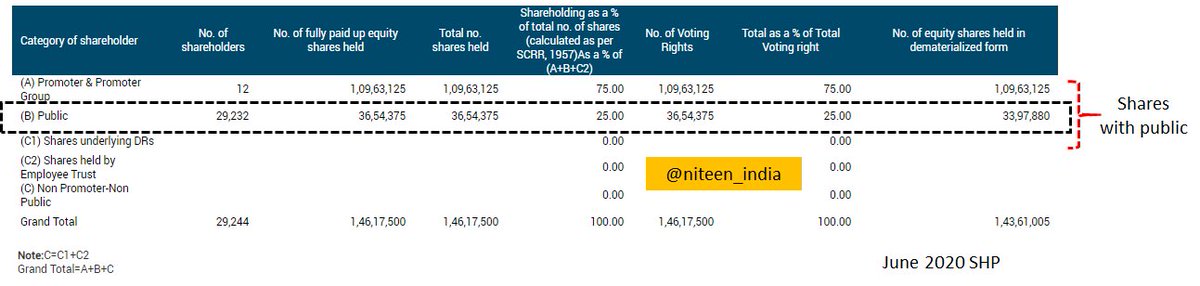

The stock had a low float. Only 33,97,880 shares were available in the public category in Demat form as per Jun 2020 SHP.

7/n

7/n

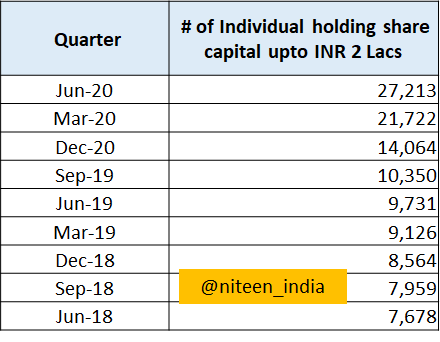

Another important aspect is how pigs come to get slaughtered. Here is an example. As per shareholding pattern report "Individual holding share capital upto Rs. 2 Lacs" have gone up almost 4X in the last 2 years

June 2020: 27213

June 2019: 9731

June 2018: 7678

June 2017: 7197

8/n

June 2020: 27213

June 2019: 9731

June 2018: 7678

June 2017: 7197

8/n

Not a single quarter when "Individual holding share capital upto Rs. 2 Lacs" came down during the last 9 quarters.

9/n

9/n

Bull markets r crazy, they suck everything. The volumes and price will be at peak levels so will the valuations. One wrong thing would lead everything to fall apart like a pack of cards. The excuse could come from anywhere mostly unknown, we will only find it in hindsight.

10/n

10/n

The company has a strong balance sheet and has been doing great during the last few years. The question is "do such valuations sustain"? If not then what is the risk for the investors?

11/n

11/n

Risk

The low float is a double-edged sword. When it is moving up all hunky-dory. But if one of the quarters go bad then it may lead to disaster and permanent loss.

12/n

The low float is a double-edged sword. When it is moving up all hunky-dory. But if one of the quarters go bad then it may lead to disaster and permanent loss.

12/n

This has happened many a time in the past as recently as one of the leading NBFCs which is again a great company, no doubt. The valuations were astronomically high. Before people could take exit, the stock was down 60%.

13/n

13/n

Stk price up/down is a part of mkt. There wud hardly be an investment where returns were only positive fm time one invested. What we have to worry abt is perma loss and not temp price reduction.

A great co bought at bad valuation cud lead to such possibilities of perma loss.

14/n

A great co bought at bad valuation cud lead to such possibilities of perma loss.

14/n

Lessons for common investors: never ask a barber if u need a haircut. Take all free stories with a bagful of salt esp when they are all around u. Most likely u r amongst pigs to get slaughtered. No free luncheon here. Remember, if it is free u are the product.

15/15

15/15

Read on Twitter

Read on Twitter