1/ Little Book of Market Myths: How to Profit by Avoiding the Investing Mistakes Everyone Else Makes (Ken Fisher)

"Investing is 2/3 avoiding mistakes, 1/3 doing something right. Avoid mistakes, and you likely do better than most professionals." (p. 10)

https://www.amazon.com/Little-Book-Market-Myths-Investing-ebook/dp/B00B021KQK/">https://www.amazon.com/Little-Bo...

"Investing is 2/3 avoiding mistakes, 1/3 doing something right. Avoid mistakes, and you likely do better than most professionals." (p. 10)

https://www.amazon.com/Little-Book-Market-Myths-Investing-ebook/dp/B00B021KQK/">https://www.amazon.com/Little-Bo...

2/ Note: Some of the myths treated in this book may have been busted in a better fashion than others.

We should indeed question "truths" we& #39;ve been told. The author would probably encourage us to do this with content of his book as well to as any other material we read.

We should indeed question "truths" we& #39;ve been told. The author would probably encourage us to do this with content of his book as well to as any other material we read.

3/ "Investors make mistakes because they think they’re making smart decisions, ones they’ve made plenty of times and have seen other smart people make.

"After all, what sense does it make to question something that “everyone knows”? Or something that’s common sense?

"After all, what sense does it make to question something that “everyone knows”? Or something that’s common sense?

4/ "Question *everything* you think you know. Start with things you read in the paper or hear on TV and nod along with.

"This may save you from a costly mistake. That’s not humiliating; it& #39;s beautiful.

"Most people prefer the easy route: never questioning or being humiliated.

"This may save you from a costly mistake. That’s not humiliating; it& #39;s beautiful.

"Most people prefer the easy route: never questioning or being humiliated.

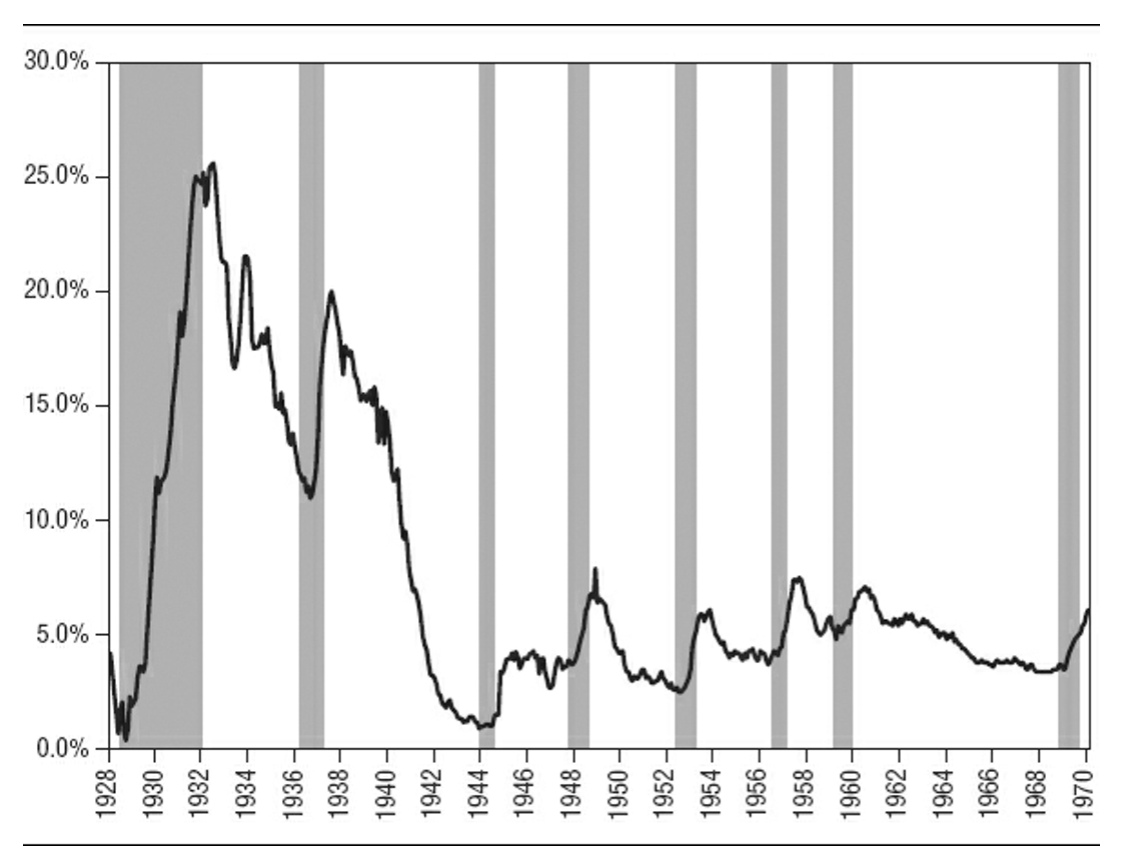

5/ "For example, as I show in Chapter 12, unemployment is a lagging indicator and not indicative of future economic or market direction. Amazingly, recessions start when unemployment is at or near cyclical lows, not the reverse.

"Few question this myth, so it endures." (p. 10)

"Few question this myth, so it endures." (p. 10)

6/ "In 1798, Malthus predicted food production would soon peak.

"Yet, six billion more people later, in much of the developed world, the greater problem is obesity. Yes, in some emerging nations, famine is still a problem; that’s mostly a factor of corruption and infrastructure.

"Yet, six billion more people later, in much of the developed world, the greater problem is obesity. Yes, in some emerging nations, famine is still a problem; that’s mostly a factor of corruption and infrastructure.

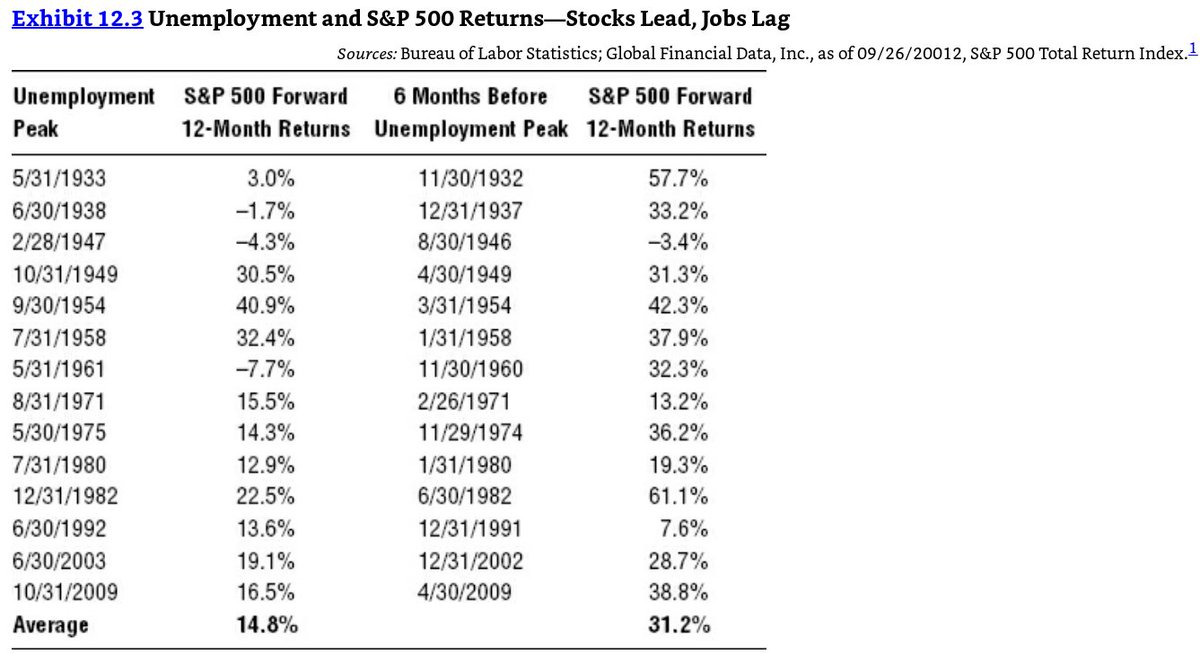

7/ "Folks with dire forecasts are usually wrong because they rely on poor assumptions that ignore future innovations.

"My favorite was the fellow who, in 1894, predicted London’s growth would require so much horse power, by 1950, London would be covered in nine feet of manure.

"My favorite was the fellow who, in 1894, predicted London’s growth would require so much horse power, by 1950, London would be covered in nine feet of manure.

8/ "How could he have predicted the combustion-engine revolution?

"The popular 1968 book Population Bomb predicted famine would kill hundreds of millions in the 1970s. That didn’t happen, thanks to dwarf wheat—not to mention the previous millennia of agricultural innovation.

"The popular 1968 book Population Bomb predicted famine would kill hundreds of millions in the 1970s. That didn’t happen, thanks to dwarf wheat—not to mention the previous millennia of agricultural innovation.

9/ "Folks who believe ardently Peak Oil (the point at which conventional oil production peaks) will be the death of us miss this, too.

"Technological advances have allowed us to discover and extract more oil and natural gas." (p. 24)

More on this: https://twitter.com/ReformedTrader/status/1293238722700259328">https://twitter.com/ReformedT...

"Technological advances have allowed us to discover and extract more oil and natural gas." (p. 24)

More on this: https://twitter.com/ReformedTrader/status/1293238722700259328">https://twitter.com/ReformedT...

10/ "In 1980, global GDP was $10.7 trillion; now it’s $71.3 trillion. Life expectancies have extended. Per capita income has skyrocketed across many emerging markets.

"We conceive of progress as linear, when it’s really exponential—the collision of multiple technologies." (p.25)

"We conceive of progress as linear, when it’s really exponential—the collision of multiple technologies." (p.25)

11/ "The deleterious impact of opportunity cost may not be obvious for some time. Twenty years of too-low returns is hard to make up—particularly if you’re taking cash flow out of the portfolio.

"Yet most investors don& #39;t think much about opportunity cost." (p. 41)

"Yet most investors don& #39;t think much about opportunity cost." (p. 41)

12/ "Stock returns are variable.

"The most common result for the S&P 500 (37.2% of all years) is years when stocks finish up huge—over 20%. Next, stocks are most commonly up between 0% and 20%—but rarely are they near 10% on the nose." (p. 67)

"The most common result for the S&P 500 (37.2% of all years) is years when stocks finish up huge—over 20%. Next, stocks are most commonly up between 0% and 20%—but rarely are they near 10% on the nose." (p. 67)

13/ "After taxes, you should be agnostic about the source of your cash flow. It doesn’t matter whether it& #39;s from dividends, a coupon, or the sale of a security.

"What should concern you most is remaining optimally invested based on a benchmark appropriate for you." (p. 72)

"What should concern you most is remaining optimally invested based on a benchmark appropriate for you." (p. 72)

14/ "There’s nothing inherently better a dividend—it’s just a different way of generating shareholder value.

"When a firm pays a dividend, the share price falls by about the amount of the dividend. After all, the firm is giving away a valuable asset—cash." (p. 74)

"When a firm pays a dividend, the share price falls by about the amount of the dividend. After all, the firm is giving away a valuable asset—cash." (p. 74)

15/ "When PG&E fell, its dividend yield rose (past payments / current stock price). Then PG&E suspended the dividend altogether.

"Now-defunct Lehman Brothers paid a dividend in August 2008—just weeks before imploding. Dividends don’t necessarily signal safety." (p. 74)

"Now-defunct Lehman Brothers paid a dividend in August 2008—just weeks before imploding. Dividends don’t necessarily signal safety." (p. 74)

16/ "Whether in retirement or 40 years out, investors should care more about total return—i.e., price appreciation plus dividends—rather than just dividend yield.

"That allows you to pick a benchmark based on your goals and time horizon, not just on a dividend yield." (p. 75)

"That allows you to pick a benchmark based on your goals and time horizon, not just on a dividend yield." (p. 75)

17/ "Small-cap outperformance ignores huge bid–ask spreads in the 1930s and 1940s—sometimes up to 30% of the purchase price." (p. 78)

Related research:

There Is No Size Effect: Daily Edition

https://twitter.com/ReformedTrader/status/1307831560033333249

Fact,">https://twitter.com/ReformedT... Fiction, and the Size Effect https://twitter.com/ReformedTrader/status/1288597830202843136">https://twitter.com/ReformedT...

Related research:

There Is No Size Effect: Daily Edition

https://twitter.com/ReformedTrader/status/1307831560033333249

Fact,">https://twitter.com/ReformedT... Fiction, and the Size Effect https://twitter.com/ReformedTrader/status/1288597830202843136">https://twitter.com/ReformedT...

18/ "If you don’t have a fundamental reason for favoring something other than it’s been hot, you’re probably just chasing heat (likely a long-term losing strategy). Don’t fall in perma-love. That bias will blind you to reality." (p. 83)

More on this: https://twitter.com/ReformedTrader/status/1116523225884708864">https://twitter.com/ReformedT...

More on this: https://twitter.com/ReformedTrader/status/1116523225884708864">https://twitter.com/ReformedT...

19/ "Bull markets often start before economic contractions bottom. Stocks boom when everyone expects Armageddon but it doesn’t actually happen. People realize reality isn’t so dire. The panic was overdone." (p. 88)

Related research: https://twitter.com/ReformedTrader/status/1284561910193467394">https://twitter.com/ReformedT...

Related research: https://twitter.com/ReformedTrader/status/1284561910193467394">https://twitter.com/ReformedT...

20/ "The silver lining to recessions is that many firms see huge productivity gains as remaining employees learn to make do with less. Those productivity gains are what let firms see huge earnings growth off even small top-line sales increases." (p. 101)

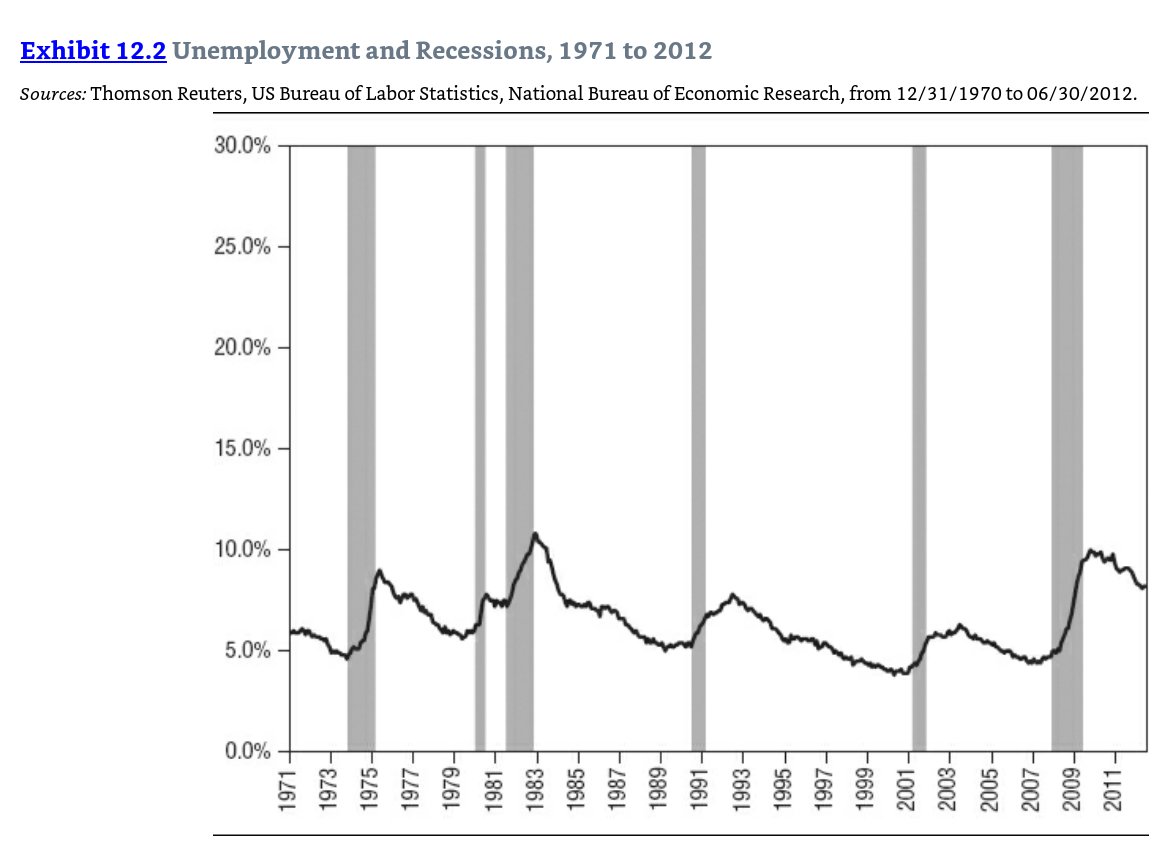

21/ "Unemployment often rises after recessions and stays high for many months or even years. This is normal and should be expected.

"Recessions start at or near cyclical unemployment lows. This isn’t what would happen if low unemployment were an economic panacea." (p. 103)

"Recessions start at or near cyclical unemployment lows. This isn’t what would happen if low unemployment were an economic panacea." (p. 103)

22/ "Stock returns average 14.8% 12 months after an unemployment peak. Six months *before* the peak, the subsequent 12-month average return was 31.2%.

"Unemployment is typically high as a recession is ending and just after. Stocks move first—and fast." (p. 105)"

"Unemployment is typically high as a recession is ending and just after. Stocks move first—and fast." (p. 105)"

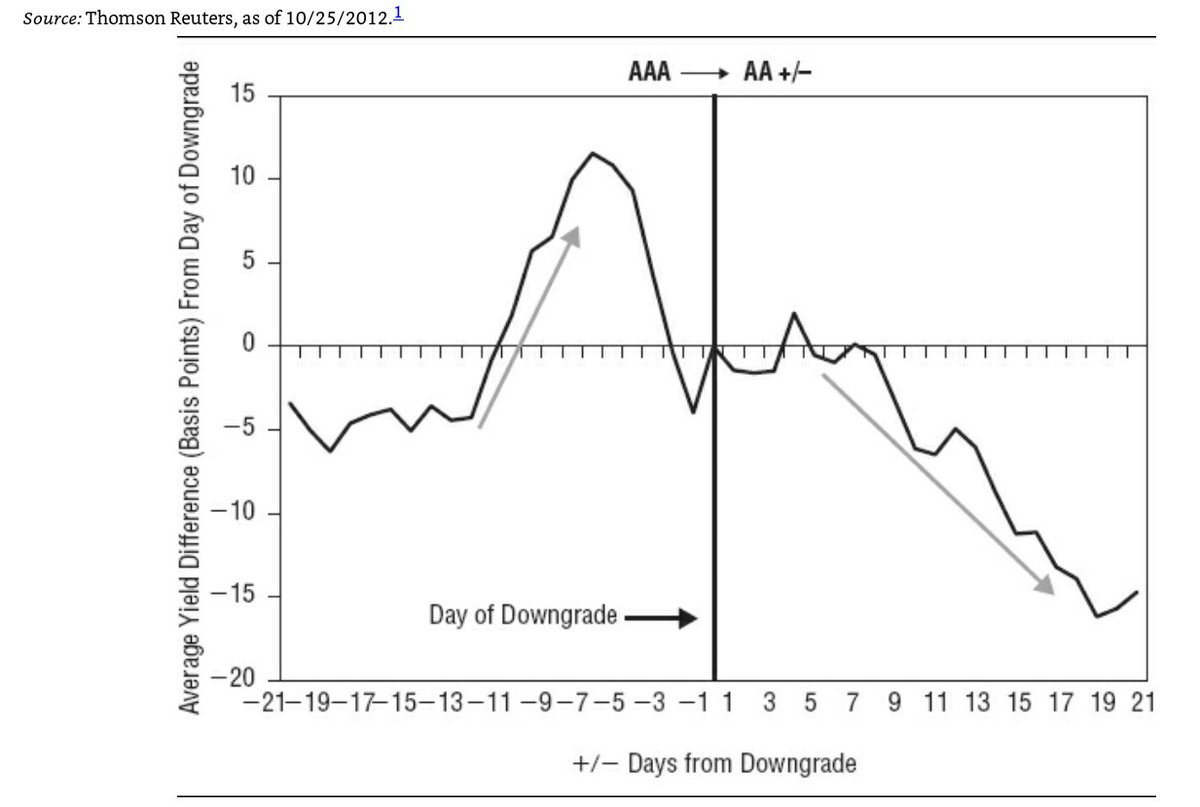

23/ "12 instances when nations have been downgraded from AAA: Belgium, Ireland, Finland, Italy, Portugal, and Spain in 1998; Japan in 2001; Spain and Ireland again in 2009; U.S. in 2011; France and Austria in 2012.

"On average, 10-year rates fall after the ratings cut." (p. 123)

"On average, 10-year rates fall after the ratings cut." (p. 123)

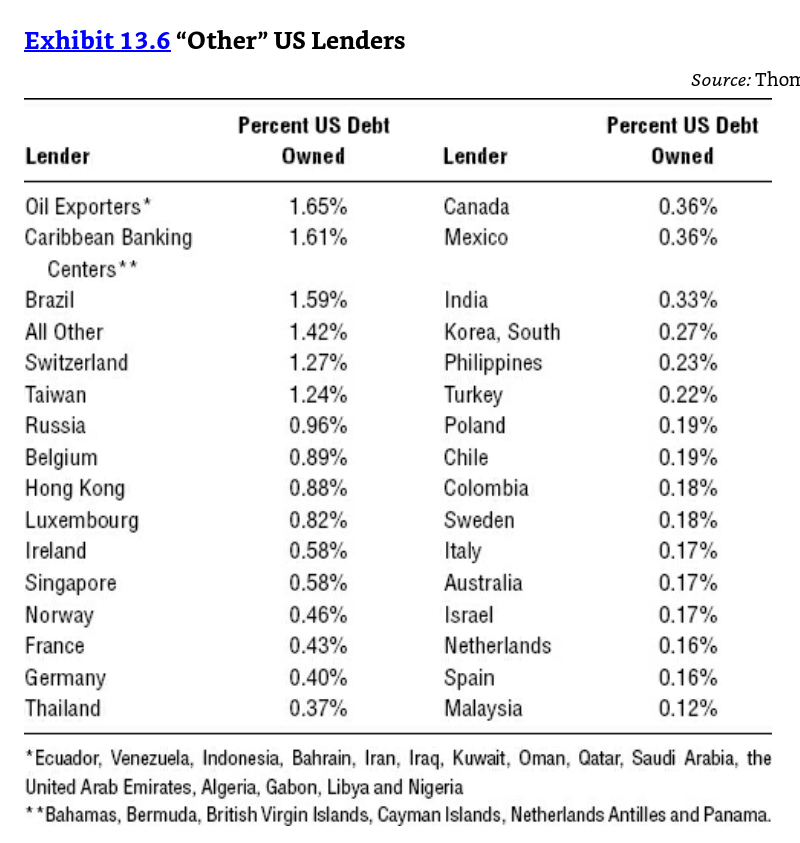

24/ "The largest chunk of U.S. government debt—36.2%—is held by domestically: individuals, corporations, charities, banks, mutual funds and other entities. The federal government itself owns 30.2% via intra-governmental agencies. Just 33.6% is held by foreign investors." (p. 126)

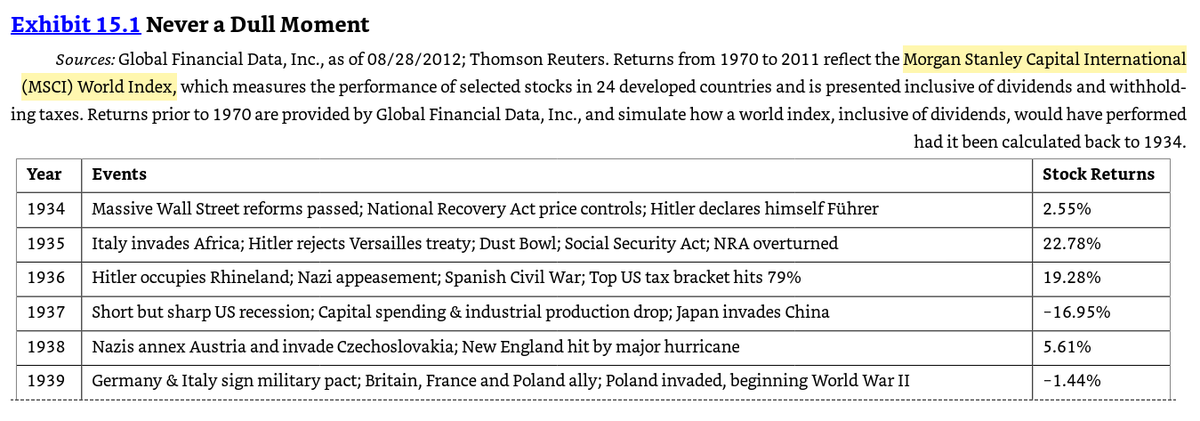

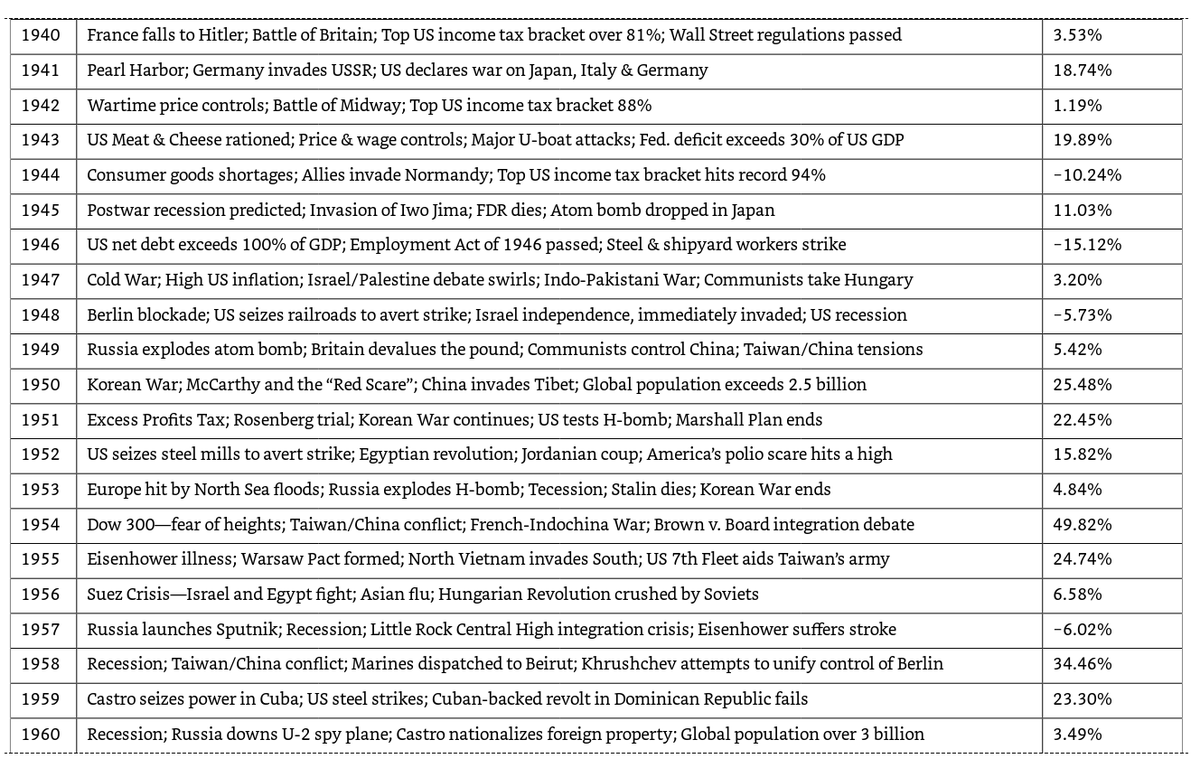

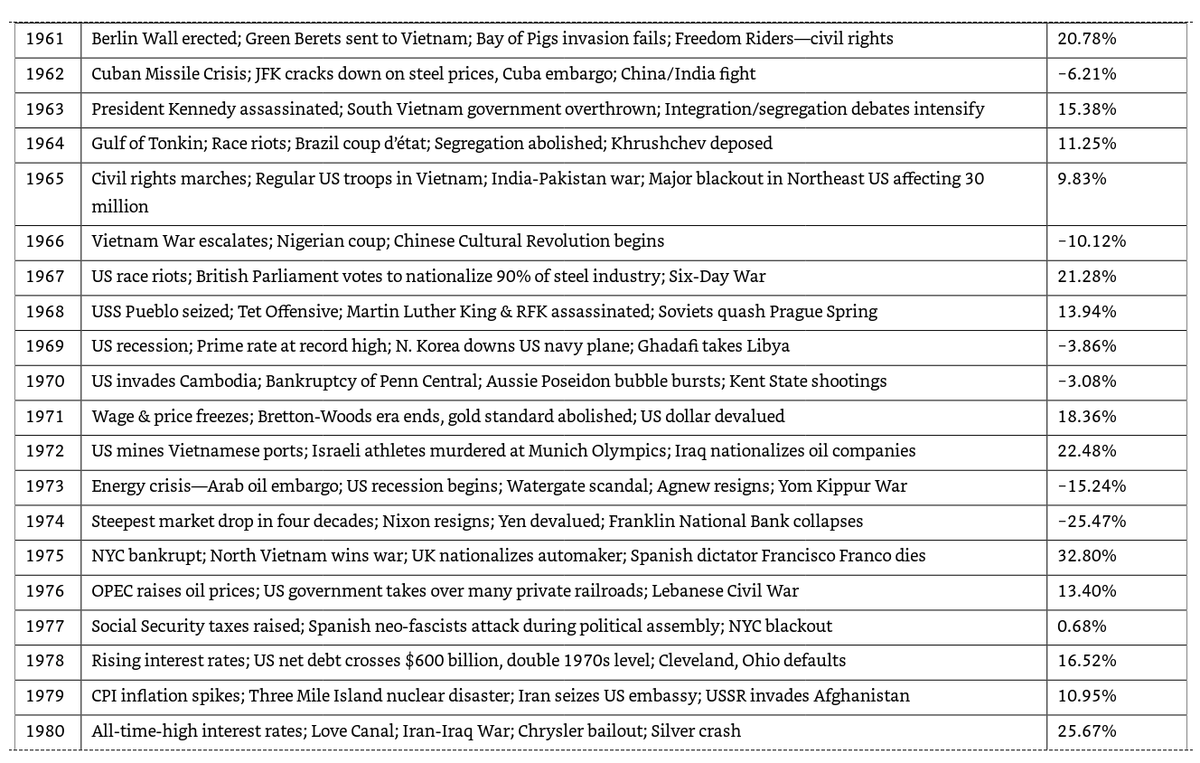

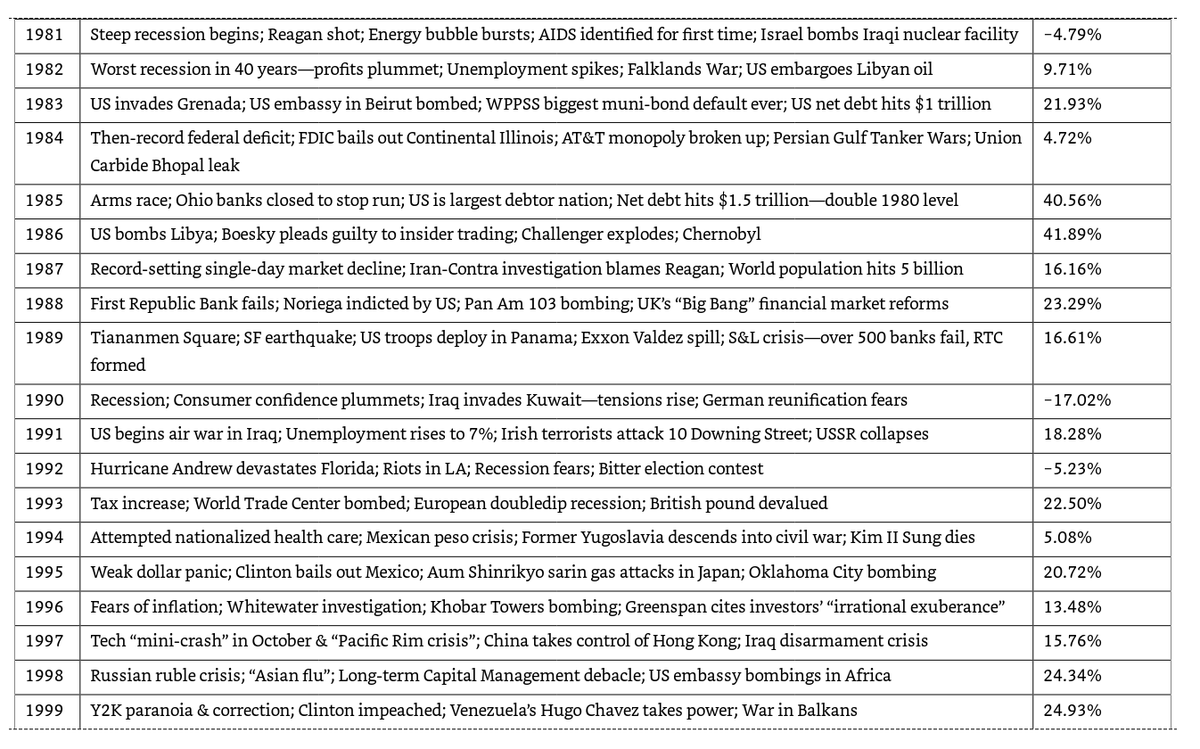

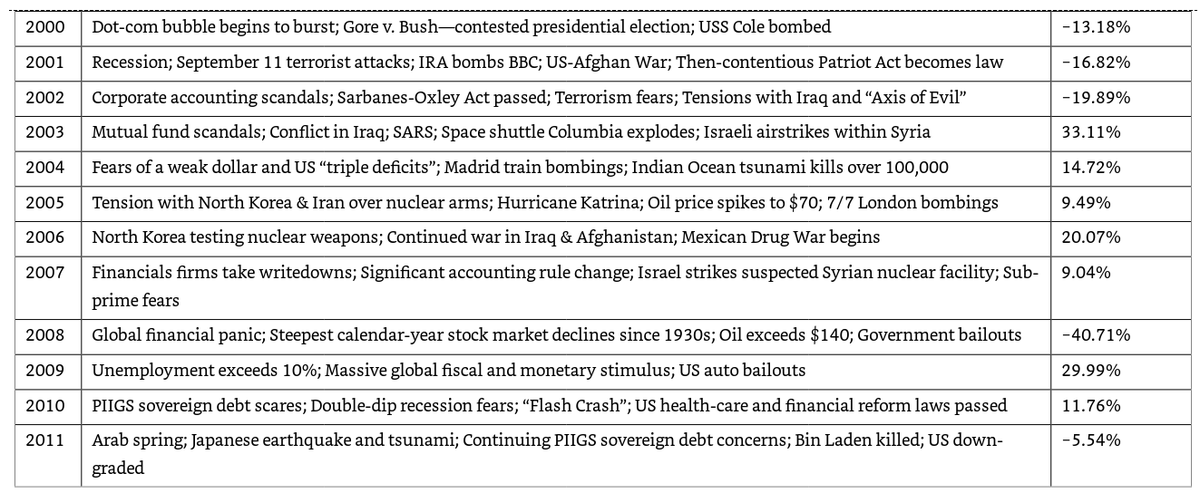

25/ "People inflate current events in their mind and misremember past events. Think geopolitics are tense now? What about the Cold War? The Cuban Missile Crisis, when missiles were actually aimed at our beds?

"Think debt is high now? It was well over 100% of GDP in after WWII.

"Think debt is high now? It was well over 100% of GDP in after WWII.

26/ "Remember Chernobyl? That accident put Japan’s much better contained one in 2011 to shame.

"In the US, we’ve seen long periods of food rationing and gas rationing—not just in response to short-lived natural disasters.

"In the US, we’ve seen long periods of food rationing and gas rationing—not just in response to short-lived natural disasters.

27/ "We’ve been hit on our own soil in Hawaii, New York and DC and had embassies attacked overseas multiple times.

"We’ve had oil shocks, strikes, recessions, riots, hyperinflation, deflation. Accounting scandals. Impeachments. Homegrown terror attacks on our own soil.

"We’ve had oil shocks, strikes, recessions, riots, hyperinflation, deflation. Accounting scandals. Impeachments. Homegrown terror attacks on our own soil.

28/ "Outside of the start of WWII in Europe, geopolitical tensions—even outright major terror attacks and the start of wars—have had a fleeting, and not necessarily negative, impact on stocks.

"If you’re waiting for things to “calm down,” you’ll be waiting a long time indeed.

"If you’re waiting for things to “calm down,” you’ll be waiting a long time indeed.

29/ "If you didn’t invest during periods of turmoil, you wouldn’t spend much time invested at all.

"Scary things are a constant in the world. Ones that are well known get priced into the market quickly. Their presence is just as often good, not bad, for stocks." (p. 145)

"Scary things are a constant in the world. Ones that are well known get priced into the market quickly. Their presence is just as often good, not bad, for stocks." (p. 145)

30/ "News easily available online, in print or on TV, is likely already largely reflected in current stock prices. It& #39;s so fast that your chance to trade on it has likely passed. The longer something appears as a headline story, the more its power to move markets has been sapped.

31/ "Look for sentiment extremes. Extreme euphoria is typically bad—you see it at nearly every bull market top. Extreme negativity is characteristic of a bear market bottoming.

"In-between sentiment is normal and swings broadly within a bull market over short periods." (p. 149)

"In-between sentiment is normal and swings broadly within a bull market over short periods." (p. 149)

32/ "Whether stocks are falling or rising, often it’s some group of factors other than what’s widely discussed in media making that move happen.

"If everyone is focused on something in the news, you know you can safely ignore that and look the other way." (p. 148)

"If everyone is focused on something in the news, you know you can safely ignore that and look the other way." (p. 148)

33/ "Negative news gains eyeballs (and sells advertisements).

"Highlighting positives can sap profits. So if you think, “All I hear or read is bad news!” that’s probably true! But it’s not necessarily because all is bad in the world. It’s just media firms making money." (p. 151)

"Highlighting positives can sap profits. So if you think, “All I hear or read is bad news!” that’s probably true! But it’s not necessarily because all is bad in the world. It’s just media firms making money." (p. 151)

34/ "When you read the news, always put data in proper context and ignore the author’s point of view.

"Avoid thinking, “Well, I typically agree with this set of people, which means they’re always right.” Vary what you read. Be an equal-opportunity skeptic." (p. 152)

"Avoid thinking, “Well, I typically agree with this set of people, which means they’re always right.” Vary what you read. Be an equal-opportunity skeptic." (p. 152)

Read on Twitter

Read on Twitter