**THREAD**

Compounding is the secret sauce -

Ownership of great businesses produces wealth; short-term zigs and zags are background noise.

Long-term charts of my holdings (return since their IPO) -

1) $BABA ~3-bagger

Compounding is the secret sauce -

Ownership of great businesses produces wealth; short-term zigs and zags are background noise.

Long-term charts of my holdings (return since their IPO) -

1) $BABA ~3-bagger

2) $AYX - ~8-bagger

3) $CRWD - ~4-bagger

4) $DDOG - ~4-bagger

5) $DOCU - ~7-bagger

6) $ETSY - ~7-bagger

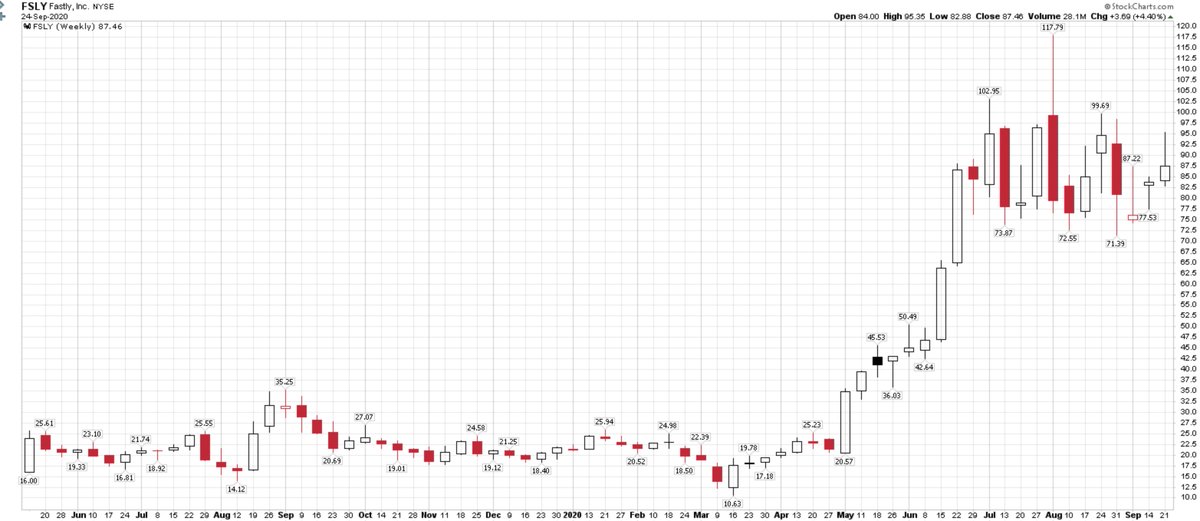

7) $FSLY - ~7-bagger

8) $MELI - ~44-bagger

9) $OKTA - ~12-bagger

10) $ROKU - ~13-bagger

11) $SE - ~9-bagger

12) $SHOP - ~40-bagger

13) $SQ - ~17-bagger

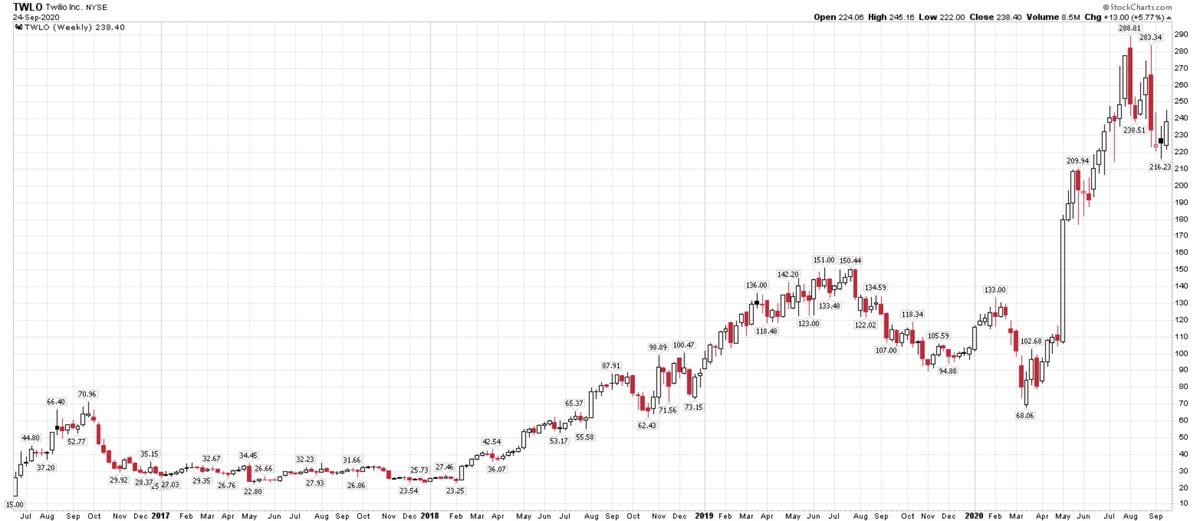

14) $TWLO - ~16-bagger

15) $ZM - ~13-bagger

I& #39;ve left out my recent listings due to lack of track record.

Lesson --> buy high-growth compounders + sit tight.

I& #39;ve left out my recent listings due to lack of track record.

Lesson --> buy high-growth compounders + sit tight.

16) In the interest of full disclosure, I also picks lemons sometimes (when I& #39;m either wrong about the business or the management) but nowadays, I don& #39;t stay wrong.

I sell when (i) company growth slows down permanently (ii) management misbehaves or changes...

I sell when (i) company growth slows down permanently (ii) management misbehaves or changes...

17) (iii) hyper-growth companies come along (new listings).

This summer, after a tripling of my entire portfolio in just 4 months(!), I also partially took profits (deviated from my system) which was a mistake. Yes, I still do dumb things.

Hope this has been helpful

THE END.

This summer, after a tripling of my entire portfolio in just 4 months(!), I also partially took profits (deviated from my system) which was a mistake. Yes, I still do dumb things.

Hope this has been helpful

THE END.

Read on Twitter

Read on Twitter