An health insurance tutorial thread:

Q: If your provider charges you $10,000 for a service, how much am I going to pay?

A: It depends! Especially on whether it& #39;s in network or not.

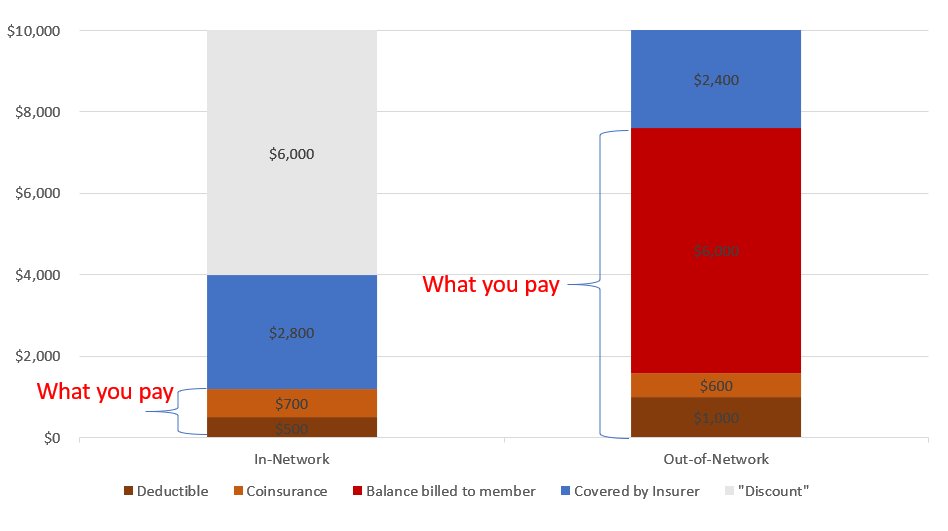

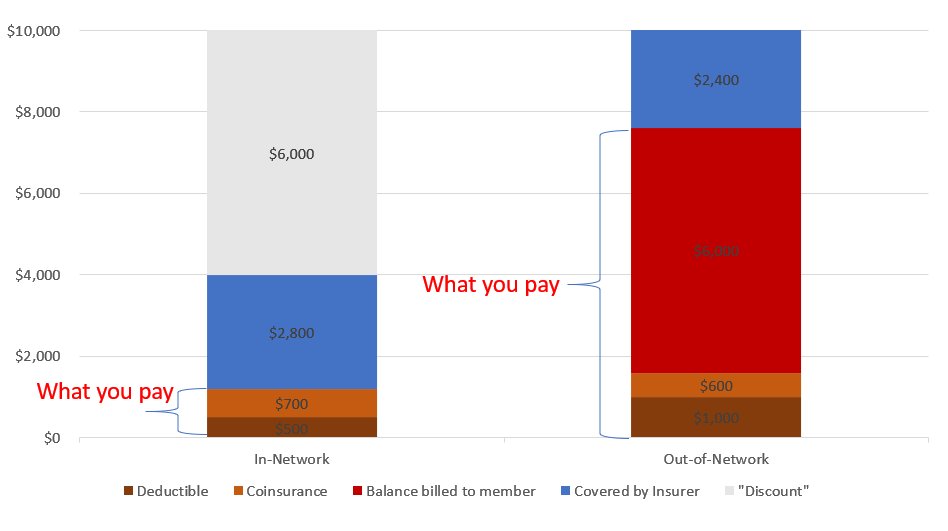

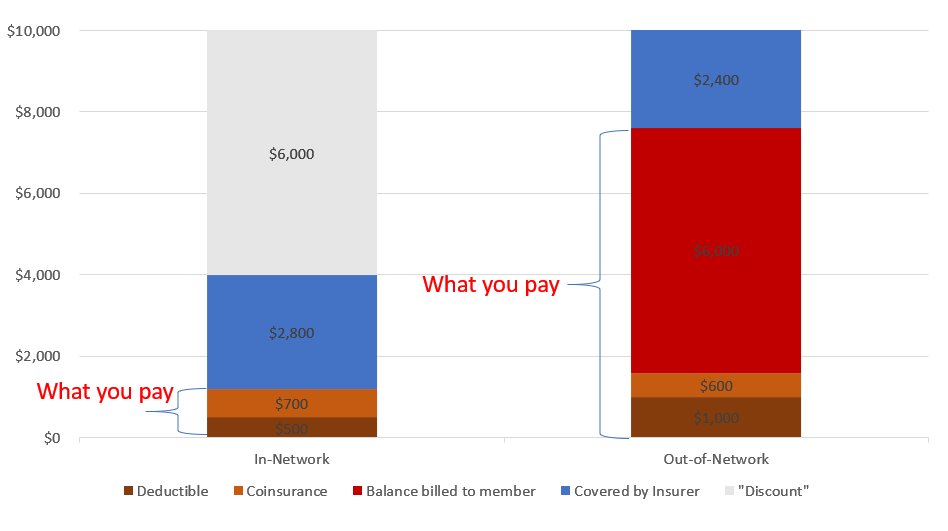

The chart below assumes a $10K covered charge, a $500/$1000 deductible, and 20%/20% coinsurance.

Q: If your provider charges you $10,000 for a service, how much am I going to pay?

A: It depends! Especially on whether it& #39;s in network or not.

The chart below assumes a $10K covered charge, a $500/$1000 deductible, and 20%/20% coinsurance.

First, let& #39;s define "it"

"it" is a provider performing a covered procedure. For example If you go to the doctor, you& #39;re hospitalized with an illness, you will be dealing with several providers performing multiple procedures: the doctor(s), the hospital, and the lab.

"it" is a provider performing a covered procedure. For example If you go to the doctor, you& #39;re hospitalized with an illness, you will be dealing with several providers performing multiple procedures: the doctor(s), the hospital, and the lab.

Each of these procedures will be adjudicated by the insurance company into three categories:

1. Covered

2. Not-covered

3. Bullshit.

The third is not the official name, but it& #39;s helpful to understand.

We& #39;re going to take those out of order:

1. Covered

2. Not-covered

3. Bullshit.

The third is not the official name, but it& #39;s helpful to understand.

We& #39;re going to take those out of order:

Non-covered charges are those deemed "experimental" or "not medically necessary". Your insurer will not pay these at all and it won& #39;t count towards your deductible, plus your provider will still try to make you pay the full amount. This is very bad, try to avoid this.

Bullshit charges are things like unbundling a service into smaller pieces to get more money. If your provider gives you a 30 minute treatment, but charge it as a 15 minute exam and an injection and a consult and a monitoring period your insurer will call bullshit.

That leaves us with covered charges. Covered charges are things your insurance agrees was medically necessary and part of your coverage. These claims are set to pay, but only as much as they owe, which may mean $0.

Back to our hypo: $10K covered charge from a single provider.

Back to our hypo: $10K covered charge from a single provider.

As part of your insurance you will have a deductible; a percentage coinsurance and/or flat dollar copays; and an out of pocket maximum. We& #39;re only going to talk about the deductible and coinsurance for now.

The deductible is the amount you pay out-of-pocket for covered charges before your insurance pays anything. Your insurance may have just a individual deductible, just a family deductible, or both. If it has both, your individual applies until it is met, or the family one is met.

Once the deductible is paid, the coinsurance kicks in, which is where you pay a fraction of the allowed amount and the insurer pays the rest.

Oh hey, I& #39;ve introduced a new term. You may know it as the insurance "discount", in gray.

Oh hey, I& #39;ve introduced a new term. You may know it as the insurance "discount", in gray.

Every health insurer, public or private, has a list of procedures and how much they think they should pay for those procedures. All payments the insurance company makes are based on those amounts. In-network providers agree to use that amount, plus or minus specific deals.

Out-of-network providers haven& #39;t agreed to shit and this is a problem. But let& #39;s math out In network first:

From $10K charge the allowed amount is, e.g., $4K. So $6K is discounted, You pay the first $.5K, 20% of the next $3.5k, ($.7K). Insurance pays the rest ($2.8K)

From $10K charge the allowed amount is, e.g., $4K. So $6K is discounted, You pay the first $.5K, 20% of the next $3.5k, ($.7K). Insurance pays the rest ($2.8K)

All told, you& #39;re out $1,200 for a service your provider said was $10,000.

But what if your provider is out-of-network?

First, you need to consult a completely different set of deductibles and coinsurance, In our hypo, the deductible is 2x, but the coinsurance is the same.

But what if your provider is out-of-network?

First, you need to consult a completely different set of deductibles and coinsurance, In our hypo, the deductible is 2x, but the coinsurance is the same.

Just as before, we use a $4K allowed amount. You pay the first $1K, and 20% of the next $3K, or $.6K. The insurer then sends the provider the 80% or $2.4K.

AND THEN THE PROVIDER BILLS YOU $6,000 and you end up owing $7,600 on a $10,000 charge.

AND THEN THE PROVIDER BILLS YOU $6,000 and you end up owing $7,600 on a $10,000 charge.

This is referred to as balance billing and when it happens people get extremely mad at their insurance company. And as a general rule your insurance company can& #39;t do shit about it because they have no legal relationship with the provider who is charging you.

This is true even and especially when your provider gives you noncommital answers about you filing for reimbursement or that they& #39;ll "work with your insurance company". They& #39;re pulling a capitalism on you and making you take all the risk.

There are exceptions that I& #39;m not getting into, like having to go to an out of network provider in a true emergency and providers with multi-tiered networks. If you have the power to avoid out-of-network providers you absolutely should.

I prefer skepticism. As in patients need to be skeptical of their doctors, hospitals, labs, durable medical equipment providers and pharmacies the same way they are of any other service provider. I trust my doctor to look after my health, not my wallet. https://twitter.com/jason_crypto/status/1309205770475626496?s=19">https://twitter.com/jason_cry...

If you& #39;re willing to accept in network rates, forgo balance billing, eat the risk and put that all in writing than you are a truly extraordinary provider and should be applauded for it.

Although I& #39;m not sure why you& #39;re not in network at that point. https://twitter.com/jason_crypto/status/1309205054449160192?s=19">https://twitter.com/jason_cry...

Although I& #39;m not sure why you& #39;re not in network at that point. https://twitter.com/jason_crypto/status/1309205054449160192?s=19">https://twitter.com/jason_cry...

Unless you& #39;re saying you were expected to eat a 40% cut on top of the in network rates at which point, and this is totally sincere good job, you won at capitalism!

Between provider and insurer we should prefer whoever happens to be helping the patient.

Between provider and insurer we should prefer whoever happens to be helping the patient.

What I don& #39;t understand is if your business model is now get in network rates without being in network and also don& #39;t balance bill, how are you anything but worse off? https://twitter.com/jason_crypto/status/1309246747365998592?s=19">https://twitter.com/jason_cry...

Got it, I refer you to my previous comments on extraordinary providers and winning at capitalism. https://twitter.com/jason_crypto/status/1309247653868339200?s=19">https://twitter.com/jason_cry...

Read on Twitter

Read on Twitter