Two new energy transition SPAC mergers announced in the last week - ChargePoint and XL Fleet. So, it& #39;s time for SPACattack v2.

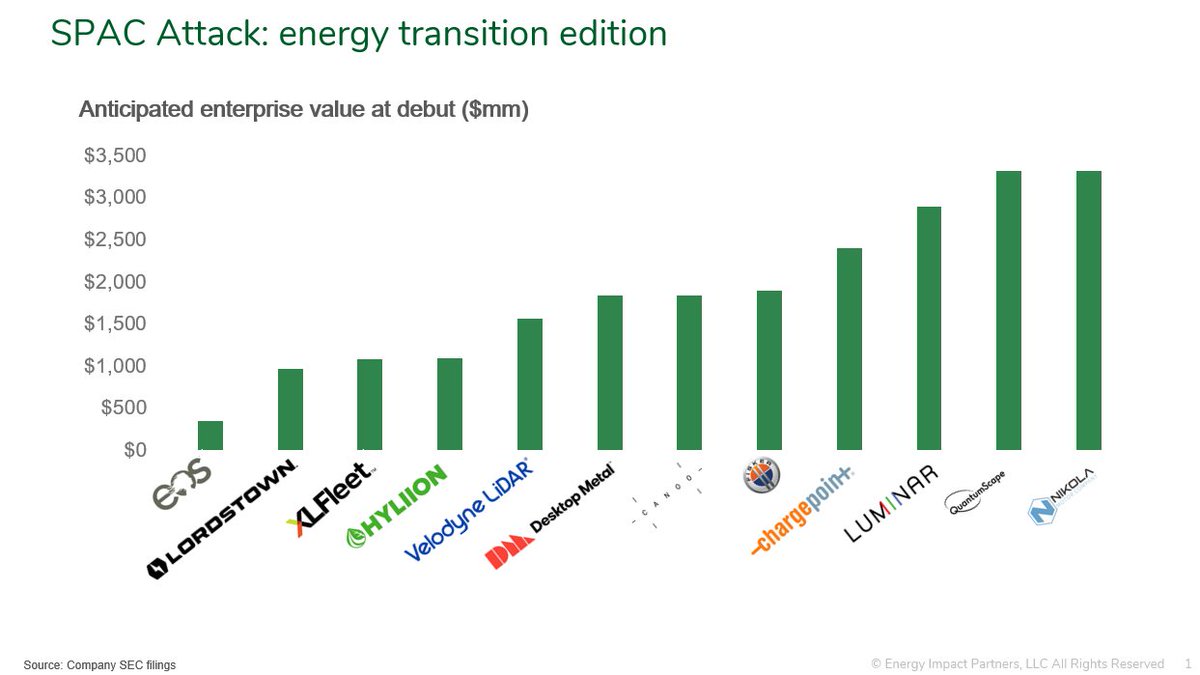

First, enterprise value.

First, enterprise value.

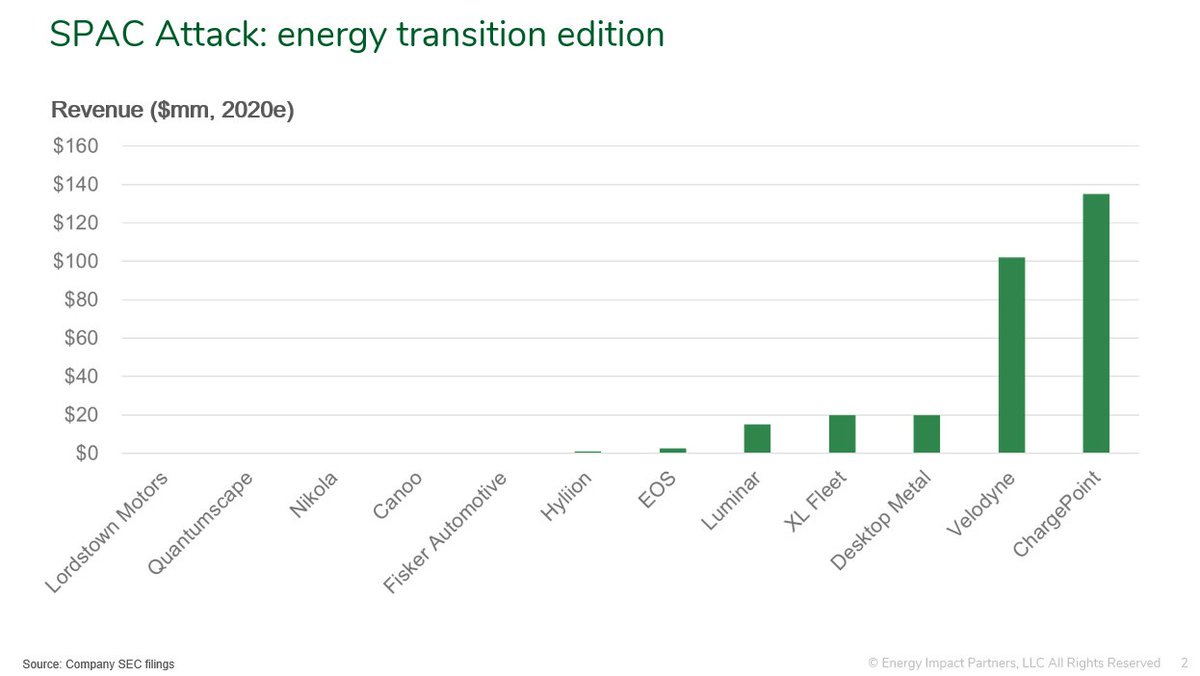

To buck the trend, both of our new SPAC targets have actual revenue! ChargePoint in particular has a much bigger current commercial business than the rest of the pack.

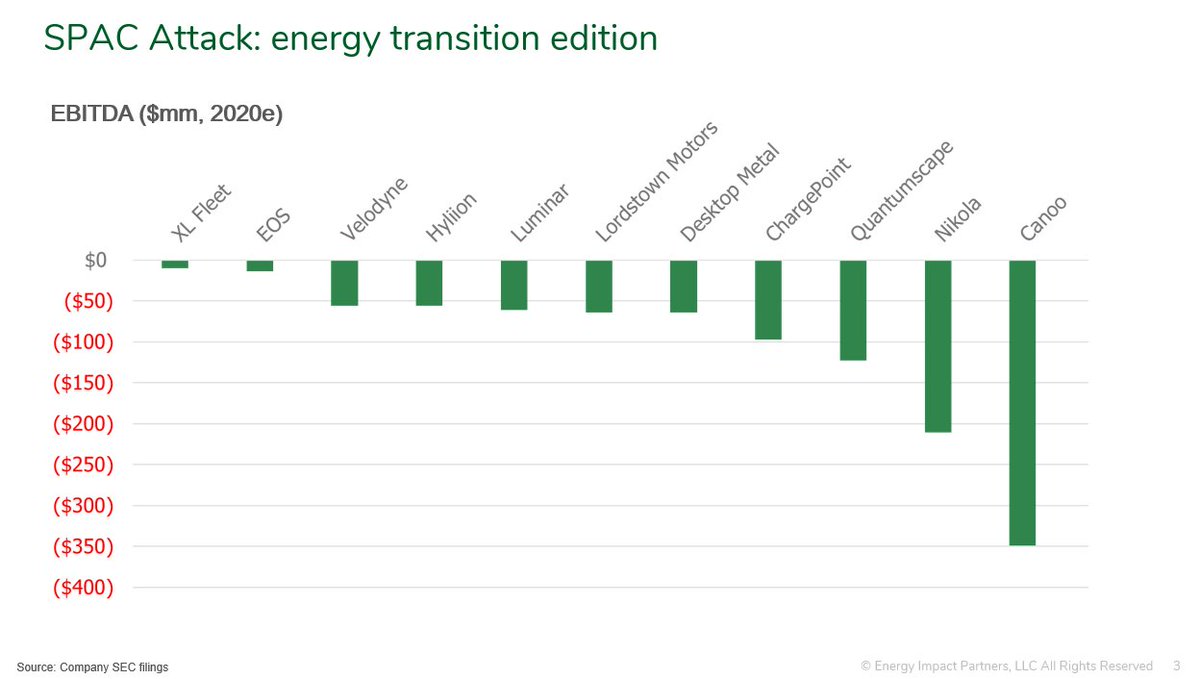

2024 forecasts should obviously be taken with a mountain of salt, but I find them informative anyway. Really, Fisker/Lordstown?

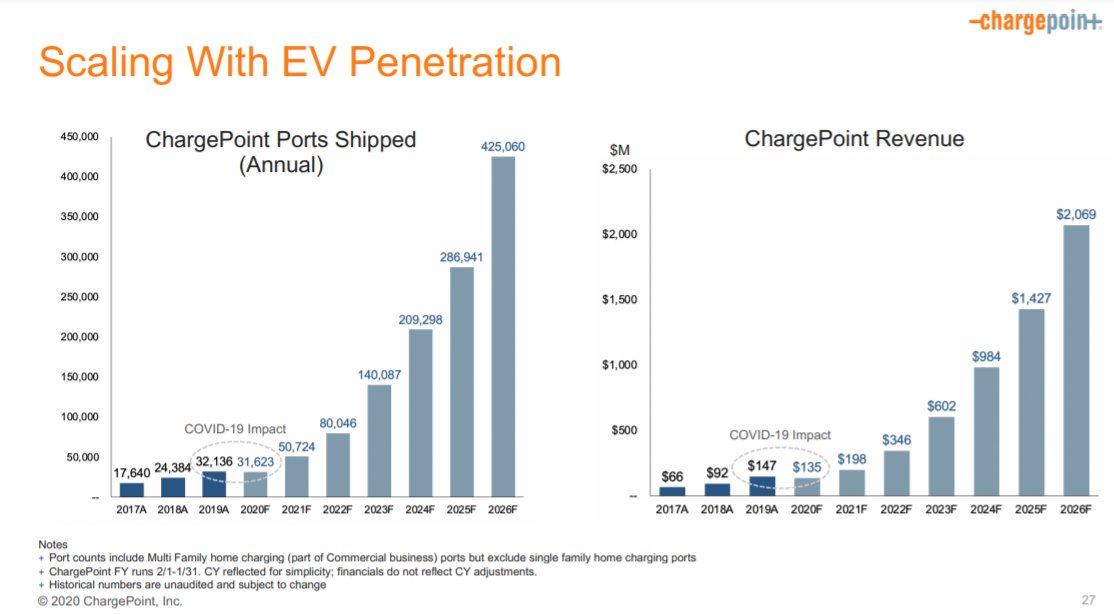

Just a brief sojourn on ChargePoint specifically, since they might be the most interesting SPAC yet. Rare to see a company go public in a down year:

Still, on a comparative basis, ChargePoint looks much closer to a traditional IPO candidate than the rest, with real customers and real revenue

There are so. many. more. SPACs hunting for energy/mobility/climate/ESG targets. Expect this list to grow. /fin

Read on Twitter

Read on Twitter