1- Been studying insurance claim rejections for people with COVID.

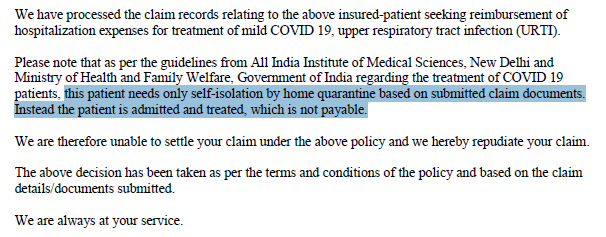

Here, someone being rejected by Star because its "mild COVID."

Here, someone being rejected by Star because its "mild COVID."

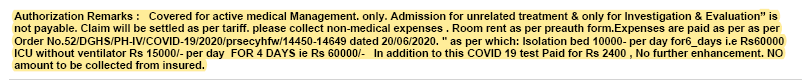

Here, someone& #39;s claim being rejected by HDFC ERGO because the private hospital in Delhi refused to charge the gov capped rates and insurance company wants to pay only the capped rates.

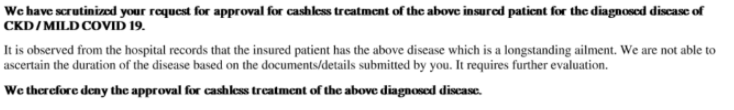

Here, claim rejected by Star, says patient shouldnt& #39;ve been admitted for "mild COVID," had pre existing kidney disease

But customer& #39;s med check while buying policy didnt show CKD, rejection says cant ascertain duration of CKD, & COVID hospitalisation was mandated by state gov.

But customer& #39;s med check while buying policy didnt show CKD, rejection says cant ascertain duration of CKD, & COVID hospitalisation was mandated by state gov.

If youre being denied your insurance claim for COVID/ during this pandemic, pls refer to: https://twitter.com/AnooBhu/status/1309054535260868608">https://twitter.com/AnooBhu/s...

https://twitter.com/AnooBhu/status/1310790730772697089">https://twitter.com/AnooBhu/s...

India is largely un-insured:

~ Only 19.1% urban India, 14.1% rural India has some sort of health expenditure coverage (NSS 2018).

Of this, most are covered by government insurance schemes, not private insurance.

~ Only 19.1% urban India, 14.1% rural India has some sort of health expenditure coverage (NSS 2018).

Of this, most are covered by government insurance schemes, not private insurance.

Getting cashless claims processed by insurance companies can be challenging:

Rs 2,927.88 crore ($399 mil) worth of cashless insurance claims were outstanding for 1.12 million claims

(by end of 2018-2019, acc to IRDA data) (in the health and accident insurance category).

Rs 2,927.88 crore ($399 mil) worth of cashless insurance claims were outstanding for 1.12 million claims

(by end of 2018-2019, acc to IRDA data) (in the health and accident insurance category).

Healthcare insurance (27.3%) is the second largest non-life insurance sector in India, after motor insurance (36.6%), in 2019-20.

The total value of health insurance premiums paid by Indian consumers in 2019-20 was Rs 51,637 crore ($7.03 billion), up 17% over 2018-19.

The total value of health insurance premiums paid by Indian consumers in 2019-20 was Rs 51,637 crore ($7.03 billion), up 17% over 2018-19.

https://twitter.com/AnooBhu/status/1303196685858824192">https://twitter.com/AnooBhu/s...

https://twitter.com/AnooBhu/status/1310800150558732288">https://twitter.com/AnooBhu/s...

https://twitter.com/wiredmau5/status/1313718353370857477?s=19">https://twitter.com/wiredmau5...

Read on Twitter

Read on Twitter