Interestingly, both Turkey and Hungary attributed the increase in rates to an effort to prevent a rise in inflation risks or inflation expectations, and thereby maintaining price stability.

Turkey statement on the left, Hungary on the right:

Turkey statement on the left, Hungary on the right:

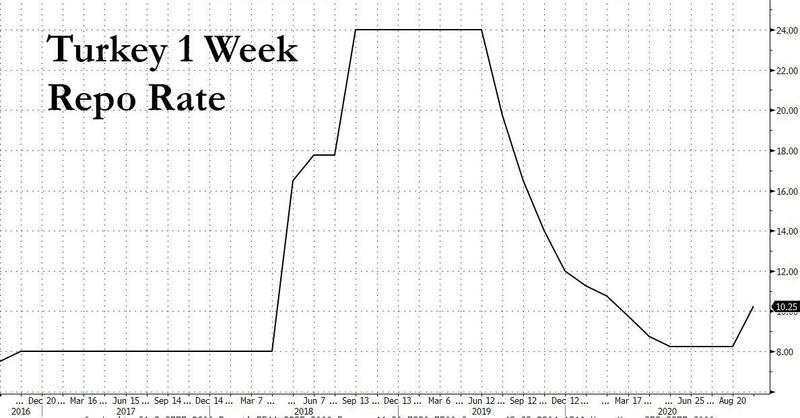

The lira has been steadily depriciating the last couple of years against most major currencies. Today& #39;s decision knocked it down about 1%, but at the moment, $USDTRY is trading at 7.6 compared to 7.7 before the decision.

The Hungarian Forint has also weakened over the last couple of years, but nowhere near to the extent the lira has. Today& #39;s decision also lead to a small strengthening, as shown on the $USDHUF chart.

It& #39;ll be interesting to know why the Hungarian felt such a strong need to hike seeing as the Forint hasn& #39;t weakened spectacularly in any way, especially compared to other EM currencies.

Additionaly, several analysts pointed out that these moves may only be a hint of more...

Additionaly, several analysts pointed out that these moves may only be a hint of more...

If a weakening currency is making CBs uneasy due to inflation risks, then seeing as the global picture isn& #39;t looking that healthy, and EM currencies are coming under constant and increasing pressure, then this may lead to CBs hiking rates higher in response. It& #39;s a slippery slope

Seeing as both CBs blamed the hike on rising inflation risks and expectations, lets have a quick look at inflation in both countries.

In Turkey, inflation is high, but has been relatively stable over the last few months, not like late 2018 and 2019.

In Turkey, inflation is high, but has been relatively stable over the last few months, not like late 2018 and 2019.

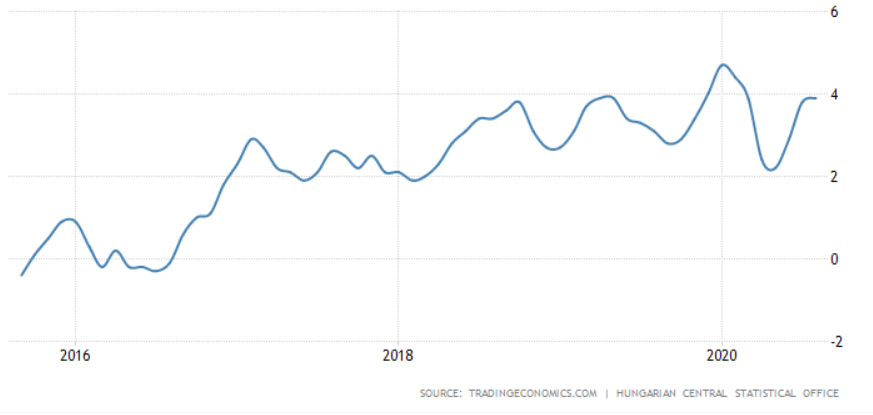

In Hungary, headline inflation is lower compared to Turkey but it has been steadily rising, reaching 3.8% (YoY) in July. May& #39;s inflation rate was 2.2% so this is a a substantial increase, more than what was expected.

However, according to @ING_Economics, inflation should drop in the coming months, and could ease to 2.8% in 2021.

Seeing this, it doesn& #39;t exactly warrant a surprise rate hike, but perhaps the CB is seeing data that we aren& #39;t...

Seeing this, it doesn& #39;t exactly warrant a surprise rate hike, but perhaps the CB is seeing data that we aren& #39;t...

With regards to the CBRT hike, it perhaps not surprising to see $BBVA rising around 5% on the day, considering it& #39;s close correlation with the strenth of the lira.

In conclusion, I& #39;m trying to see how these moves fit in to the larger macroeconomic picture. In a world where monetary policy is super-easy and loose, and NIRP have already been implemented in several countries, it& #39;s interesting to see CBs going the opposite direction.

Will EM currencies continue to struggle, rendering their hikes futile? Will they prove to be right? Will inflation make a surprise comeback in other EMs and DMs?

Is this a warning sign that hikes around the world may be closer than we think they are??

Only time will tell...

Is this a warning sign that hikes around the world may be closer than we think they are??

Only time will tell...

Read on Twitter

Read on Twitter