Where are we in the DeFi market?

We& #39;re definitely not at the 2018 stage of the market where we see a long bear market

Probably somewhere between First Sell Off and Bear Trap

Some analysis below. https://twitter.com/Rewkang/status/1278434524934930435">https://twitter.com/Rewkang/s...

We& #39;re definitely not at the 2018 stage of the market where we see a long bear market

Probably somewhere between First Sell Off and Bear Trap

Some analysis below. https://twitter.com/Rewkang/status/1278434524934930435">https://twitter.com/Rewkang/s...

1/ Technicals

On the drop, we retraced around a month& #39;s worth of price action. At the top, futures never were egregiously in contango, compared to being backwardated -50% APR as recently as early Jul

This indicates that market was only slightly overextended via derivs

On the drop, we retraced around a month& #39;s worth of price action. At the top, futures never were egregiously in contango, compared to being backwardated -50% APR as recently as early Jul

This indicates that market was only slightly overextended via derivs

2/ Short interest in DeFi coins continue to grow on the way down with LINK OI doubling on the drop in the last week.

But still ~30% off the OI highs in early Aug

H/T @CL207

But still ~30% off the OI highs in early Aug

H/T @CL207

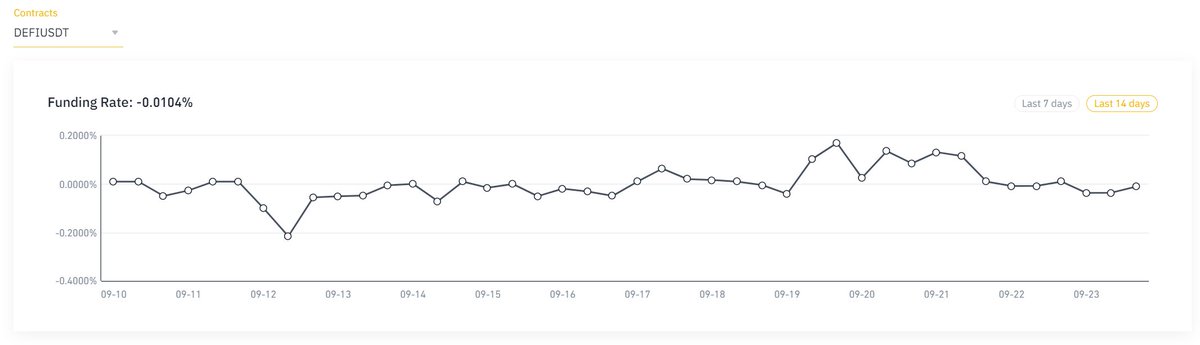

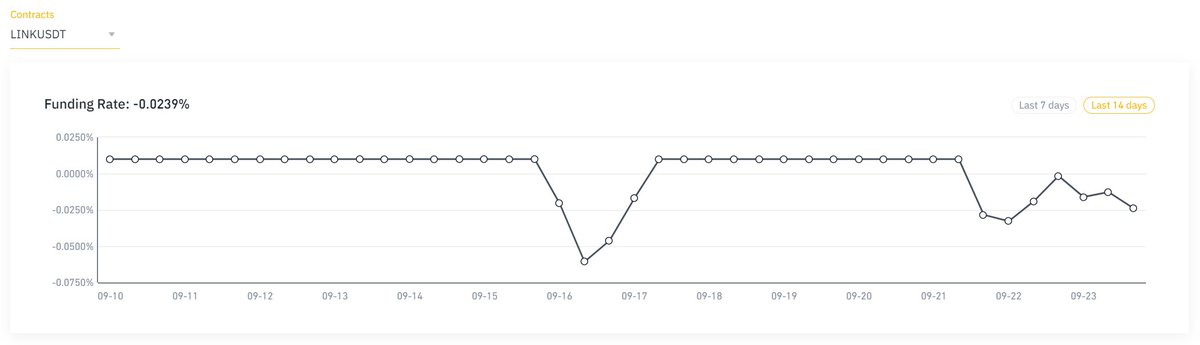

3/ The negative sentiment in perps is also reflected in the below normal funding on LINKUSDT & DEFIUSDT on Binance Futures

4/ Market Structure & Flows

Most large trading firms and "lone traders" have mostly taken off their DeFi exposure now with low to none in the actively traded portion of their book with it being shifted to cash or BTC

Most large trading firms and "lone traders" have mostly taken off their DeFi exposure now with low to none in the actively traded portion of their book with it being shifted to cash or BTC

5/ Qualitatively, price discovery is much less unhinged with traders being much more disciplined in profit-taking preventing prices running too far ahead of the range that the market could consider "fair value"

Less overextension = Less retrace

Less overextension = Less retrace

6/ Average CT seems to still have many degens fully deployed, although there are many with decent cash stacks as well

True retail doesn& #39;t seem to have entered much yet, and I& #39;m still debating whether/how that happens this cycle https://twitter.com/mrjasonchoi/status/1308394830016389128">https://twitter.com/mrjasonch...

True retail doesn& #39;t seem to have entered much yet, and I& #39;m still debating whether/how that happens this cycle https://twitter.com/mrjasonchoi/status/1308394830016389128">https://twitter.com/mrjasonch...

7/ In terms of new funds entering, I& #39;m aware of at least a dozen that have recently raised or just finished raising. Many of these intend to play in the public secondary markets.

Unclear how much gets deployed over what timeline

Unclear how much gets deployed over what timeline

8/ Fundamentals

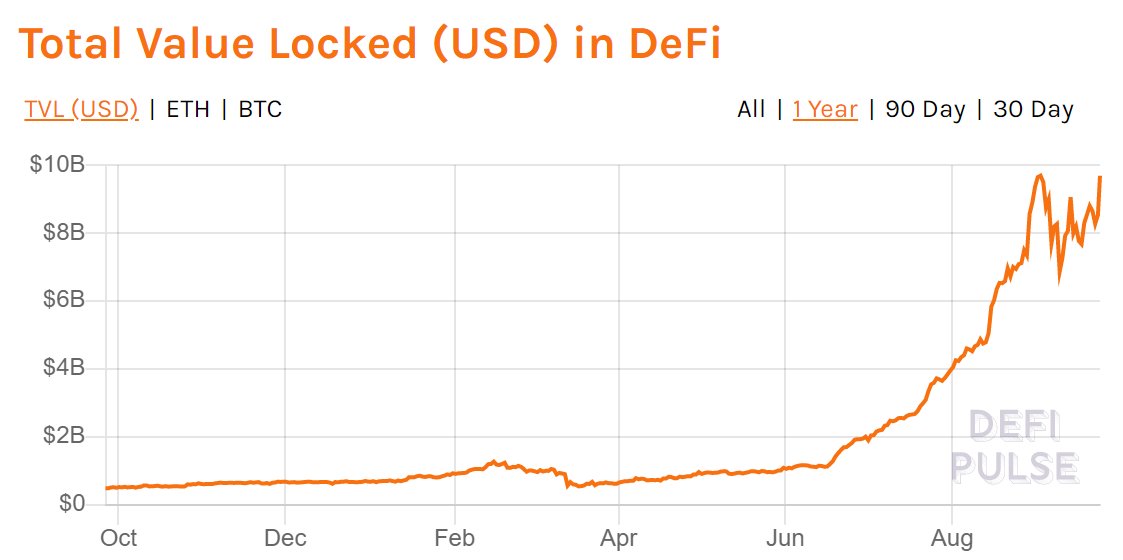

In terms of DeFi activity growth, TVL continues to advance parabolically after a small dip even in the face of price stagnation indicating more assets moving in

TVL is at 3x the level as the last time @FTX_Official DeFi index was last at this level in late July

In terms of DeFi activity growth, TVL continues to advance parabolically after a small dip even in the face of price stagnation indicating more assets moving in

TVL is at 3x the level as the last time @FTX_Official DeFi index was last at this level in late July

9/ For both public and private DeFi projects, the innovation and pace of development continues forward at a blistering pace - even faster than it was two months ago.

Early players created the building blocks for new developers to build off of or take inspiration from

Early players created the building blocks for new developers to build off of or take inspiration from

10/ So what happens over this next period?

Probably some consolidation and range trading (Index +/- 30%) for a few weeks as overexposed players continue to rebalance and some new funds flow in buying these re-rated assets

All the while, development & innovation will continue

Probably some consolidation and range trading (Index +/- 30%) for a few weeks as overexposed players continue to rebalance and some new funds flow in buying these re-rated assets

All the while, development & innovation will continue

11/ But with BTC, and thus all crypto markets now tied to global macro, where DeFi prices go depend heavily on stonks and gold. If global markets rally, then probably all of crypto does as well. If they go the other way, then crypto probably will as well

Read on Twitter

Read on Twitter