*Half-baked idea*

Investing in public tech companies during a bubble isn& #39;t a bad thing, it just looks a lot more like VC than public market investing.

Explanation and back of the envelope math:

Investing in public tech companies during a bubble isn& #39;t a bad thing, it just looks a lot more like VC than public market investing.

Explanation and back of the envelope math:

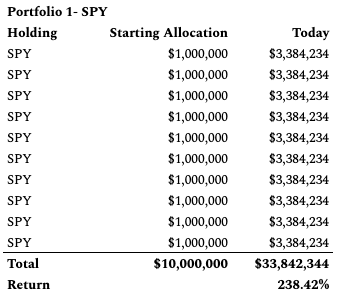

The goal is to beat the market over a long period of time. SPY started 1998 (pre-bubble) at $97.31. Today, it& #39;s at 329.33. It& #39;s up 3.38x over that period.

That& #39;s the bar. Portfolio 1 - all SPY - is what we have to beat.

That& #39;s the bar. Portfolio 1 - all SPY - is what we have to beat.

What& #39;s a fair way to do this? Idea in venture (conservatively) is that you& #39;ll lose on 80-90% of your investments, and 10-20% will return the fund.

So let& #39;s say we& #39;re building a $10mm portfolio of ten public tech stocks at the peak of the bubble in 99-00. Equal allocation, $1mm

So let& #39;s say we& #39;re building a $10mm portfolio of ten public tech stocks at the peak of the bubble in 99-00. Equal allocation, $1mm

Portfolio 2: You buy 9 stocks that go to 0, and $AMZN at its peak.

It hit $113 on 12/5/99, up 23x from the start of 1998.

You& #39;re up 2.7x for a return of 172%, worse than just buying SPY by 28%.

Not great, but you& #39;re up, and you bought at the absolute worst time!

It hit $113 on 12/5/99, up 23x from the start of 1998.

You& #39;re up 2.7x for a return of 172%, worse than just buying SPY by 28%.

Not great, but you& #39;re up, and you bought at the absolute worst time!

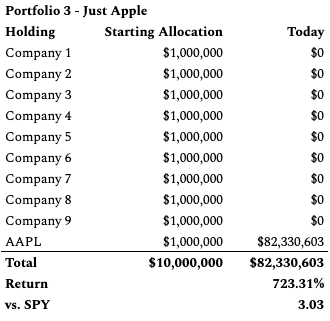

Portfolio 3: Same thing, but with $AAPL.

It hit $1.34 (split adjusted) on 3/19/00, up 9x from the start of 1998.

Today, you& #39;re up 8.2x for a return of 723%, 3x better than just buying SPY.

You tripled market performance even though you bought at AAPL& #39;s peak!

It hit $1.34 (split adjusted) on 3/19/00, up 9x from the start of 1998.

Today, you& #39;re up 8.2x for a return of 723%, 3x better than just buying SPY.

You tripled market performance even though you bought at AAPL& #39;s peak!

Read on Twitter

Read on Twitter