@quantsapp Fasttrack advisory review with today’s trade. Jublfood 2400 CE asked to buy at 94 at 10:07am.

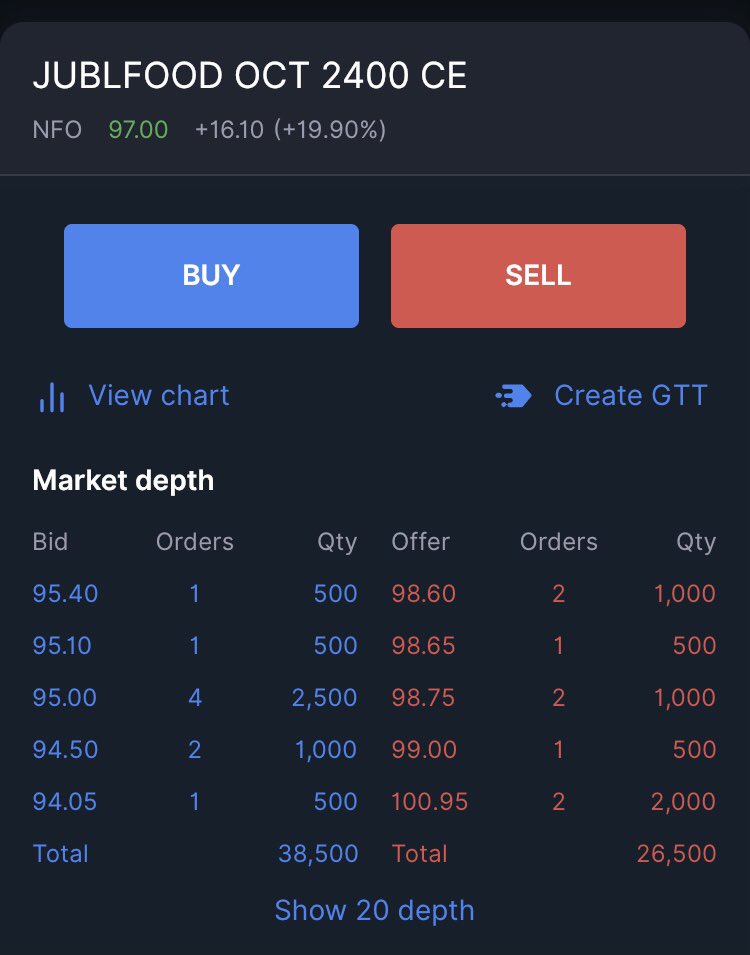

At that time Call has already much higher than buying price suggested. Also see the liquidity of this call. 40% of Target price gets lost in bid ask diff only. Call has hardly traded in earlier minutes. @quantsapp consider it as liquid option.

It’s impossible to enter at 94. If you put limit order at 94, no trades are possible & advisory fee is donation. Let’s say one enter at 96~97 with limit order with huge bid ask diff. If one put market order, one get it at 98~99.

@quantsapp Fasttrak advisory as usual provides exit just after call makes top. Exit is provided at highest tick of 104 after it reverses to 96. It’s impossible to exit at this price & with very low liquidity, one can not exit with profit.

@quantsapp Fasttrack advisory provides final exit at 94 when call goes to 93. With the liquidity present in market, one can exit at 93 only. If one puts limit order, huge loss will be on the way.

Finally Great @quantsapp Fasttrack advisory posts 5000 Rs profit in their imaginary book with lowest entry & highest tick of entry. User makes Loss of 3000~5000. That also if traded with limit orders.

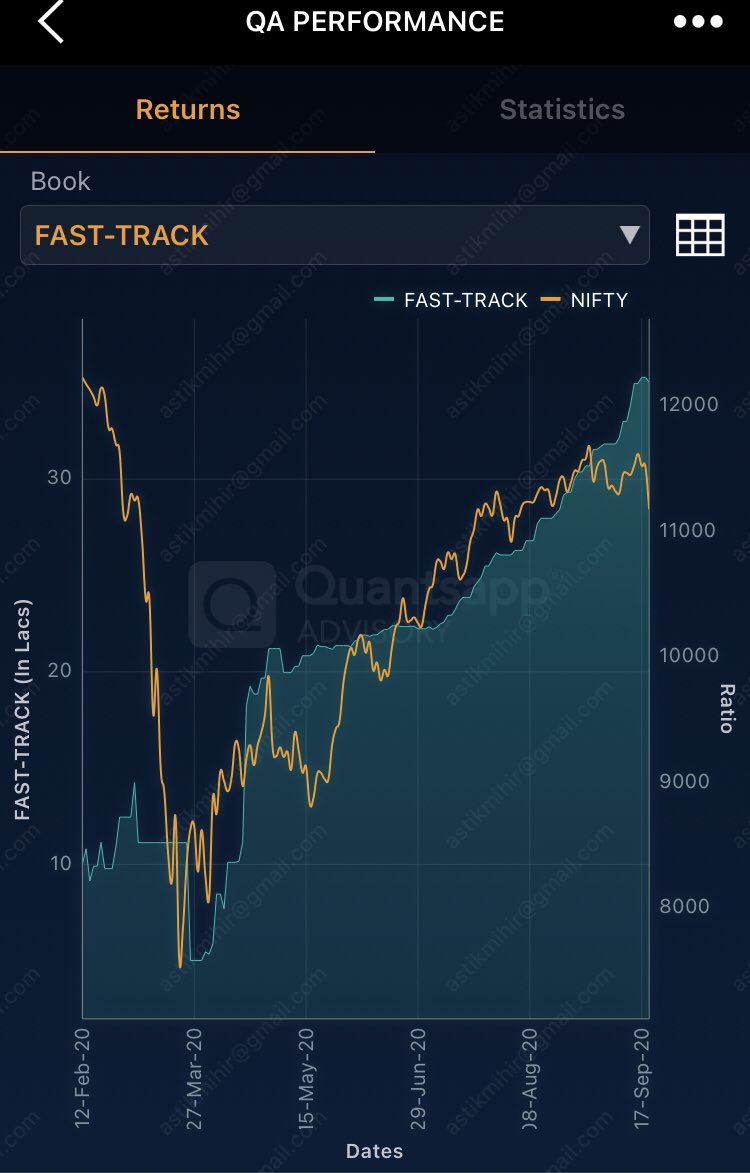

That is the way @quantsapp advisory shows equity graph going to roof and shows to future subscribers. Isn’t it a cheating?

@quantsapp team @shubham_quant

@quantsapp @bhavin_option @Tinagadodia blocked me for writing honest & real thing. Is being #ethical so difficult for them? #OptionsTrading #Advisory

@quantsapp @bhavin_option @Tinagadodia blocked me for writing honest & real thing. Is being #ethical so difficult for them? #OptionsTrading #Advisory

Read on Twitter

Read on Twitter