It& #39;s accepted fact in the exchange space that taking market share from competitors is nearly impossible.

Yet one exchange is doing just that, defying incredible odds since launching in 2009.

This is the story of how Nodal took over the power futures market:

Yet one exchange is doing just that, defying incredible odds since launching in 2009.

This is the story of how Nodal took over the power futures market:

On April 8, 2009, Nodal entered the power market, launching a contract in partnership with LSE& #39;s clearinghouse.

The contract separated itself as a more granular, precise way to hedge local power price risk.

The contract separated itself as a more granular, precise way to hedge local power price risk.

Nodal& #39;s launch saw promising initial demand, and as new products were added and platform improvements were made, liquidity started to build.

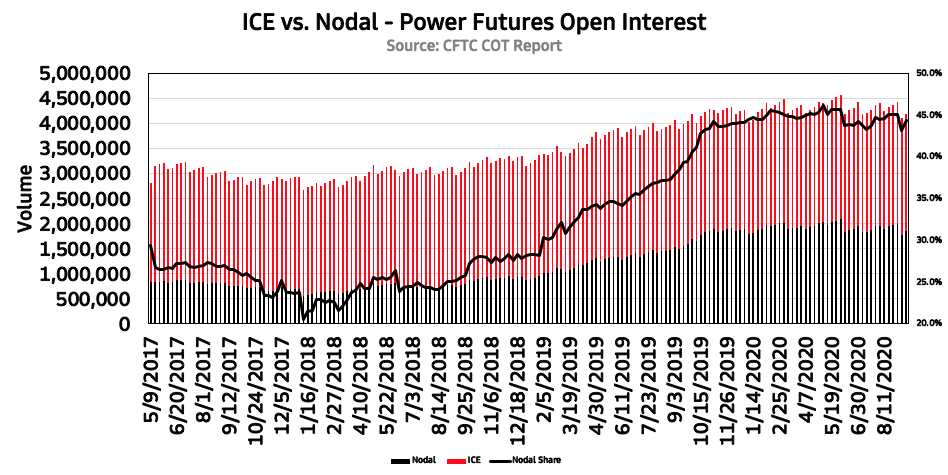

By 2013, Nodal had captured 20% of the power market.

By 2013, Nodal had captured 20% of the power market.

At the time, the power market was complex, fragmented and illiquid. ICE had a majority of the market, with CME and Nasdaq battling for 2nd place. Nodal& #39;s success took share from CME and Nasdaq, but also brought new volume to the market.

Below comments from Nodal& #39;s CEO in 2013:

Below comments from Nodal& #39;s CEO in 2013:

In 2019, Nodal bought Nasdaq& #39;s commodities business and added more power positions to its market. Its network effects had reached critical mass and customer demand kept growing.

By the end of 2019, Nodal& #39;s power market share reached 45%, a truly impressive feat after 10 years of growth and with exchange behemoths as main competitors:

To summarize, here& #39;s how Nodal was able to take over the power futures market:

- Laser-like focus on power futures

- Organic growth mixed with strategic M&A

- A differentiated product with client demand

- Powerful backers (Nodal is owned by Deutsche Boerse)

- Laser-like focus on power futures

- Organic growth mixed with strategic M&A

- A differentiated product with client demand

- Powerful backers (Nodal is owned by Deutsche Boerse)

Sources:

https://www.nodalexchange.com/nodal-exchange-acquires-u-s-commodities-business-of-nasdaq-futures-inc-nfx/#:~:text=Washington%2C%20DC%20%2C%20November%2012%2C,the%20portfolio%20of%20NFX%20contracts

https://www.nodalexchange.com/nodal-exc... href=" https://www.cftc.gov/MarketReports/CommitmentsofTraders/HistoricalCompressed/index.htm

https://www.cftc.gov/MarketRep... href=" https://www.nodalexchange.com/wp-content/uploads/2015/01/Nodal-Exchange-sees-trading-growth-270613.pdf

https://www.nodalexchange.com/wp-conten... href=" https://www.nodalexchange.com/wp-content/uploads/Nodal-Exchange-Named-2013-Exchange-of-the-Year-Final.pdf">https://www.nodalexchange.com/wp-conten...

https://www.nodalexchange.com/nodal-exchange-acquires-u-s-commodities-business-of-nasdaq-futures-inc-nfx/#:~:text=Washington%2C%20DC%20%2C%20November%2012%2C,the%20portfolio%20of%20NFX%20contracts

Read on Twitter

Read on Twitter