Providing just a single least-cost solution underplays an immense degree of freedom when planning future energy systems.

There are many near-optimal alternatives with attractive properties like social acceptance due to less onshore wind capacity or limited grid reinforcement.

There are many near-optimal alternatives with attractive properties like social acceptance due to less onshore wind capacity or limited grid reinforcement.

Highlights below, or read full paper at https://doi.org/10.1016/j.epsr.2020.106690">https://doi.org/10.1016/j... or last year& #39;s preprint https://arxiv.org/abs/1910.01891 .

With">https://arxiv.org/abs/1910.... @nworbmot @KITKarlsruhe @Helmholtz

Kudos to the pioneers @jfdecarolis and @etrutnevyte!

With">https://arxiv.org/abs/1910.... @nworbmot @KITKarlsruhe @Helmholtz

Kudos to the pioneers @jfdecarolis and @etrutnevyte!

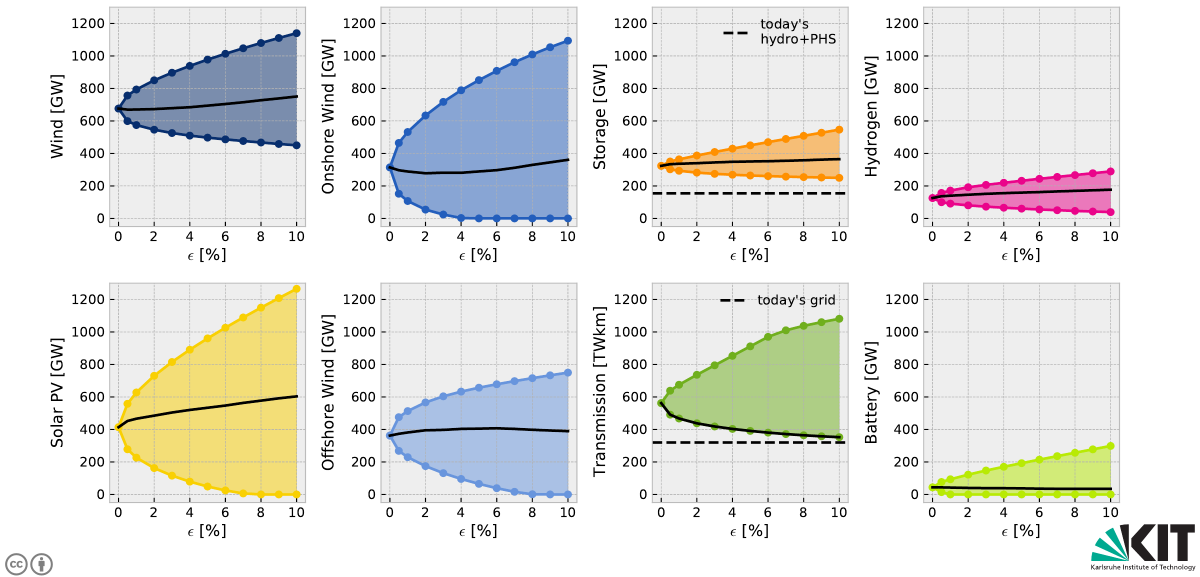

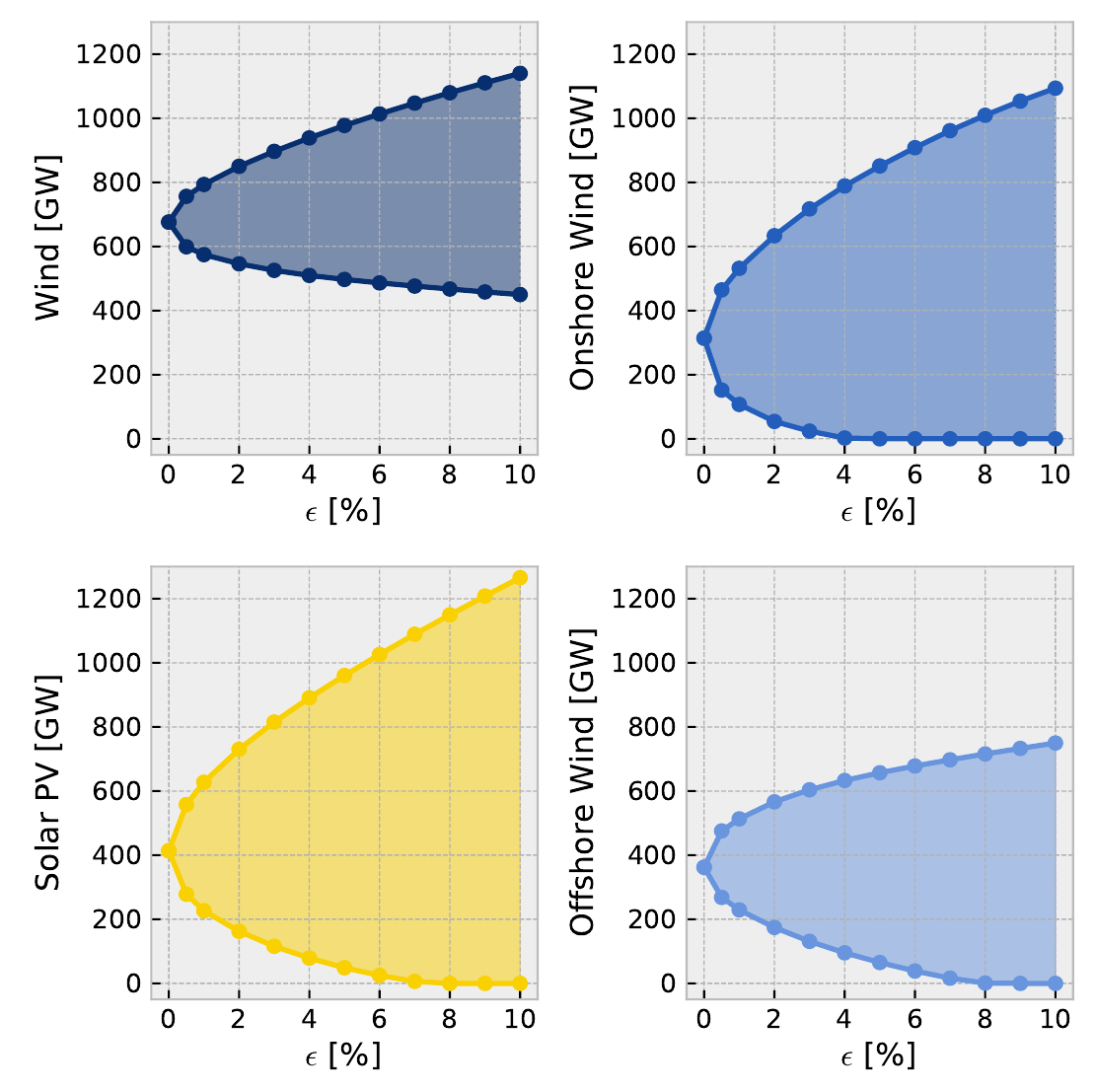

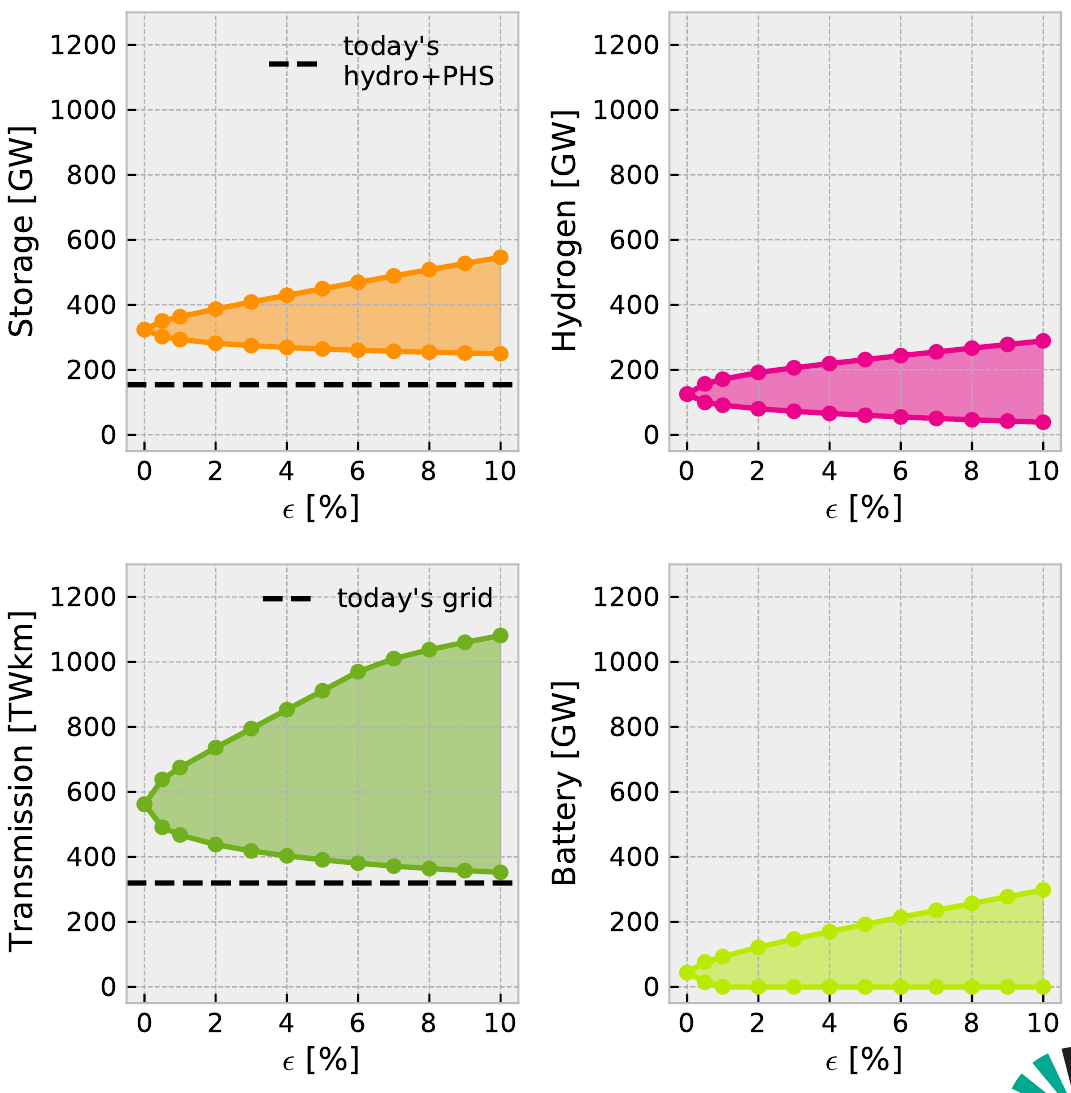

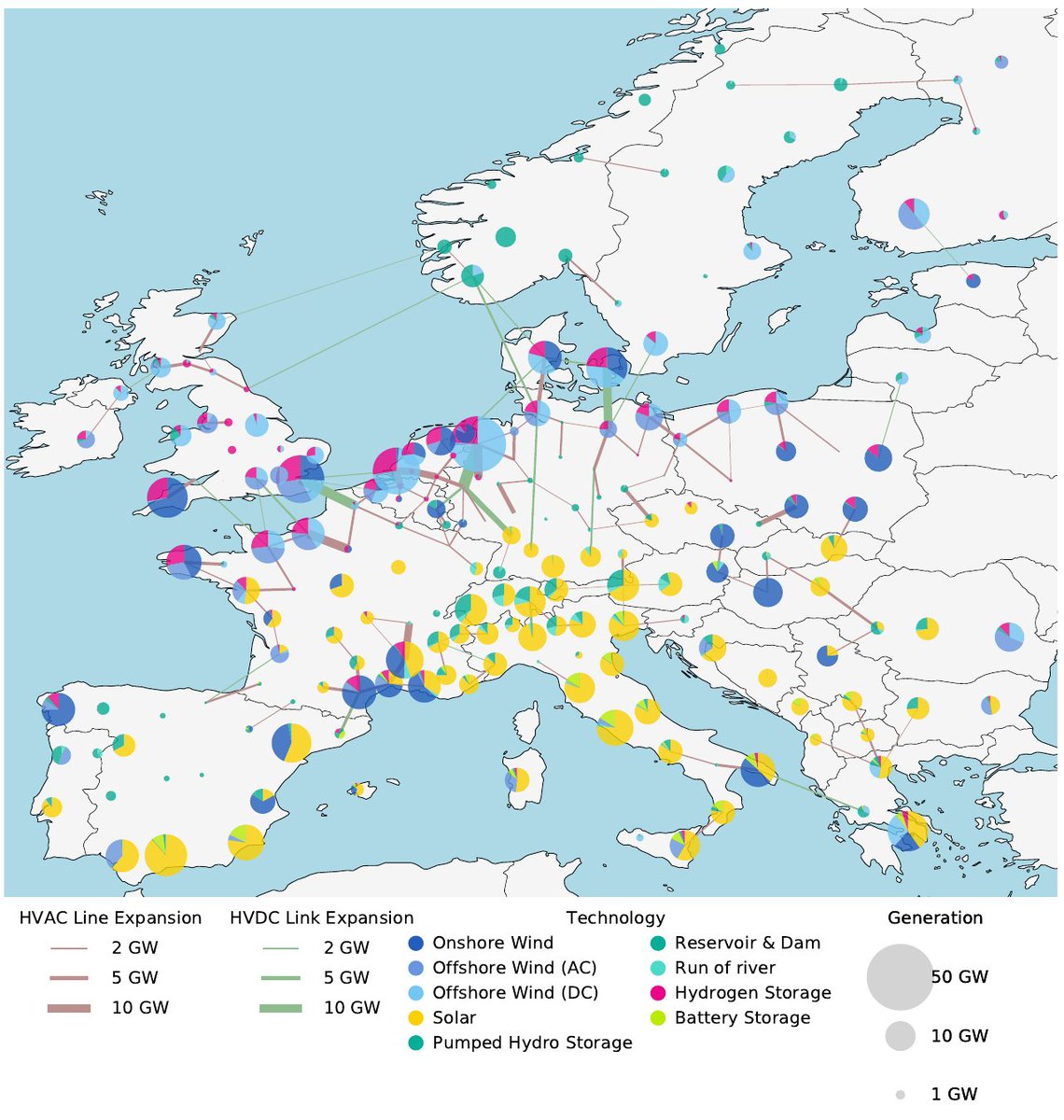

We systematically explored the decision space of a European power system model based on wind and solar that co-optimises generation, storage and grid infrastructure.

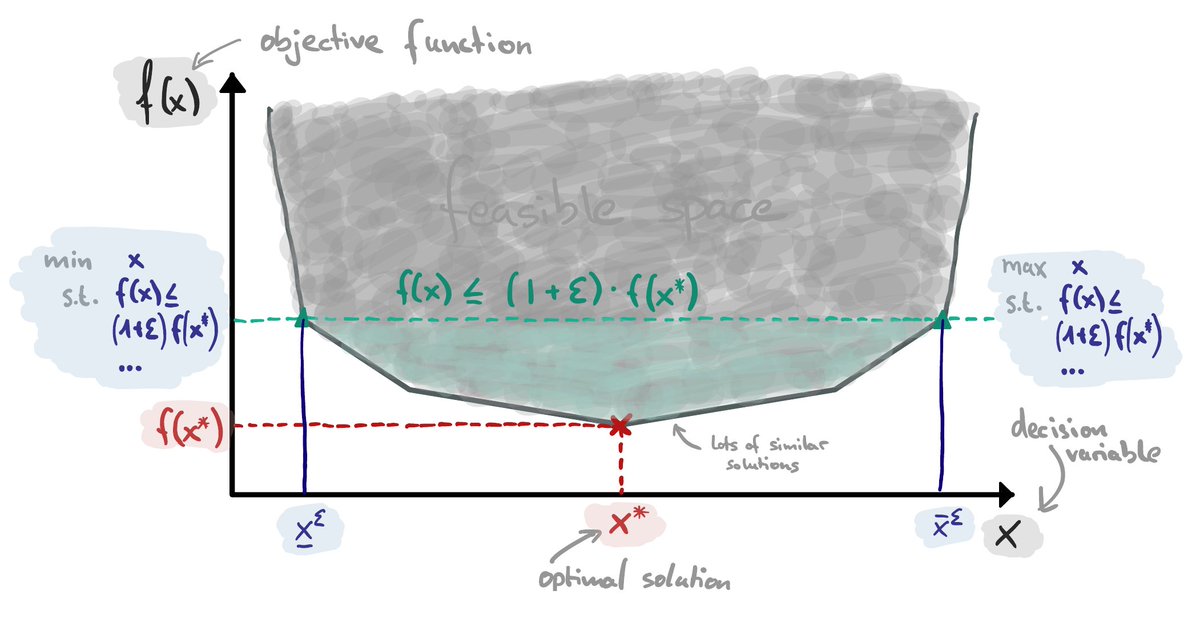

We look at how the capacities of each technology can deviate if the costs are epsilon % away from the optimum.

We look at how the capacities of each technology can deviate if the costs are epsilon % away from the optimum.

We find that we can go without onshore wind for a cost increase of 4% and forego solar or offshore wind for 8%.

Already a minor cost deviation of merely 0.5% offers much flexibility -> nonlinear!

However, at least one of offshore and onshore wind must be built in large measure.

Already a minor cost deviation of merely 0.5% offers much flexibility -> nonlinear!

However, at least one of offshore and onshore wind must be built in large measure.

Also some hydrogen storage and grid reinforcement appear to be essential to keep costs within 10% of the

optimum.

Nonetheless, it is possible to significantly reduce the amount of transmission expansion whithout skyrocketing system costs.

optimum.

Nonetheless, it is possible to significantly reduce the amount of transmission expansion whithout skyrocketing system costs.

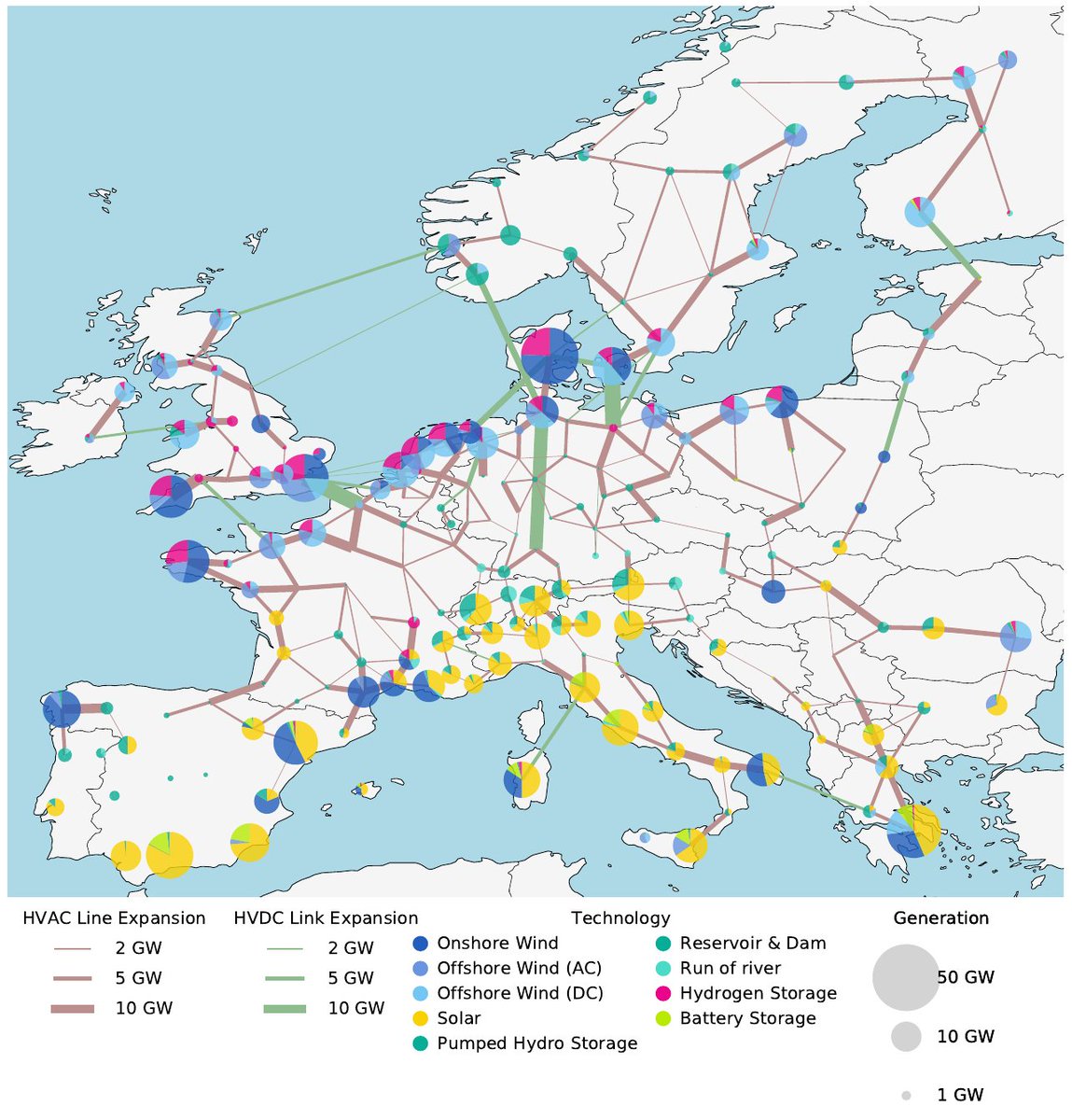

Expansion plans between

the cost-optimum (left) and a 5% more costly solution with minimal transmission expansion (right)

can already be vastly different.

The remaining grid expansion is used to strengthen the connection between offshore wind production sites.

the cost-optimum (left) and a 5% more costly solution with minimal transmission expansion (right)

can already be vastly different.

The remaining grid expansion is used to strengthen the connection between offshore wind production sites.

The main reason why I think these results are interesting and important is, because they help to accommodate political and social dimensions that are otherwise hard to quantify.

Knowing that near the optimum many similarly costly but technologically diverse solutions exist, leaves room for political discussion and compromises.

Rather than giving in to the illusion of the single one go-to solution, we can work with a set of more vague but also more robust boundary conditions that must be met to keep costs within pre-defined ranges.

Sidenote on methods: It& #39;s rather simple.

First, we find the least-cost solution for a set of cost assumptions.

Then, for many epsilons we min/max investment in technology X (new objective) such that the annual system costs increase by less than $\epsilon$ (new constraint).

First, we find the least-cost solution for a set of cost assumptions.

Then, for many epsilons we min/max investment in technology X (new objective) such that the annual system costs increase by less than $\epsilon$ (new constraint).

The #opensource code is available at http://github.com/pypsa/pypsa-eur-mga">https://github.com/pypsa/pyp... and depends on PyPSA-Eur ( http://pypsa-eur.readthedocs.io"> http://pypsa-eur.readthedocs.io ) and uses #snakemake for efficient workflow management.

Results are for a single set of cost assumptions. But are conclusions robust wrt cost uncertainty?

Yet to be shown, but probably yes. I& #39;m on it.

Recent work on uncertainty analysis by @timtroendle @JLilliestam @stemarelli @stefpf is a very fine read: https://twitter.com/timtroendle/status/1294320932509622273">https://twitter.com/timtroend...

Yet to be shown, but probably yes. I& #39;m on it.

Recent work on uncertainty analysis by @timtroendle @JLilliestam @stemarelli @stefpf is a very fine read: https://twitter.com/timtroendle/status/1294320932509622273">https://twitter.com/timtroend...

Also @FrLomb @bryn_pickering @EmyColomboPOLI @stefpf have recently looked at weak trade-offs / flat directions in the Italian power system: https://twitter.com/FrLomb/status/1297932071034327041">https://twitter.com/FrLomb/st...

Naturally, there& #39;s always more to do, like including parametric uncertainty and cross-sectoral integration. Keep tuned.

Cheers for staying on until the end of the thread!

Any questions and comments welcome!

All graphics in this thread are CC-BY-4.0 Fabian Neumann (KIT).

Cheers for staying on until the end of the thread!

Any questions and comments welcome!

All graphics in this thread are CC-BY-4.0 Fabian Neumann (KIT).

Read on Twitter

Read on Twitter