[thread] Court packing may be the best thing for the judicial branch but would be an abject social disaster in 2021.

There’s another way. Think like a trader: assume it goes FUBAR & manage the 3 most toxic risks:

1. Duration risk

2. Vega

2. Kurtosis

This translates to politics.

There’s another way. Think like a trader: assume it goes FUBAR & manage the 3 most toxic risks:

1. Duration risk

2. Vega

2. Kurtosis

This translates to politics.

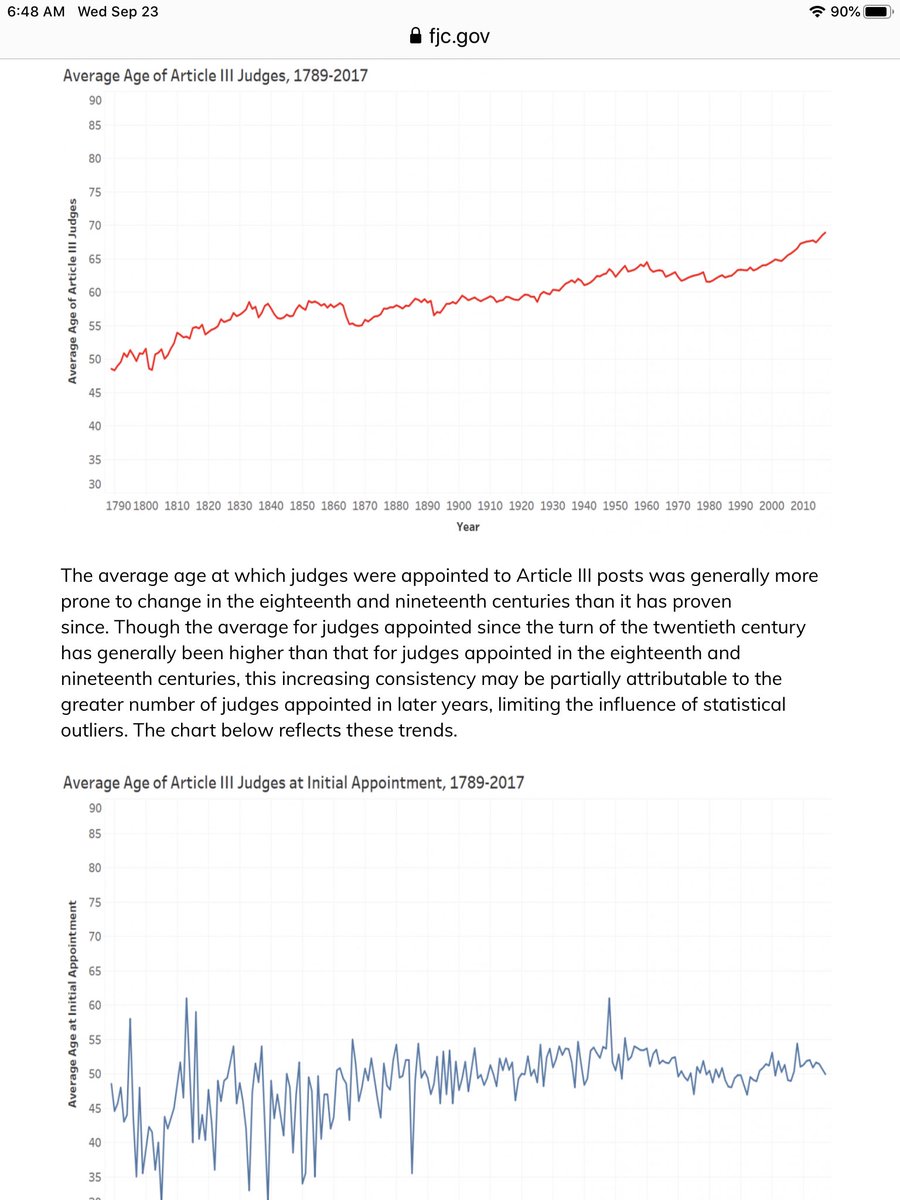

The judicial branch has gone FUBAR. Federal judges are being appointed younger, they’re on average older & sticking around longer. That locks in generational dogma & political toxicity when *the trend isn’t your friend* via partisan war games.

#_ftn12">https://www.fjc.gov/history/exhibits/graphs-and-maps/age-and-experience-judges #_ftn12">https://www.fjc.gov/history/e...

#_ftn12">https://www.fjc.gov/history/exhibits/graphs-and-maps/age-and-experience-judges #_ftn12">https://www.fjc.gov/history/e...

We can fix it. Growing the number of district, circuit & SCOTUS judges (court packing) may be a good solution, but it is also the most toxic one as a hedge/cure for partisan bad actors.

There’s a less expensive (less socially & politically toxic) hedge: mandatory retirement age.

There’s a less expensive (less socially & politically toxic) hedge: mandatory retirement age.

1. Duration risk

Federal judges are being appointed younger, are staying on the job longer & the average age is rising. We have *too much duration extension risk on the pad*

Ask any bond trader what that means & he will turn green telling you it means you’re fucked soon enough.

Federal judges are being appointed younger, are staying on the job longer & the average age is rising. We have *too much duration extension risk on the pad*

Ask any bond trader what that means & he will turn green telling you it means you’re fucked soon enough.

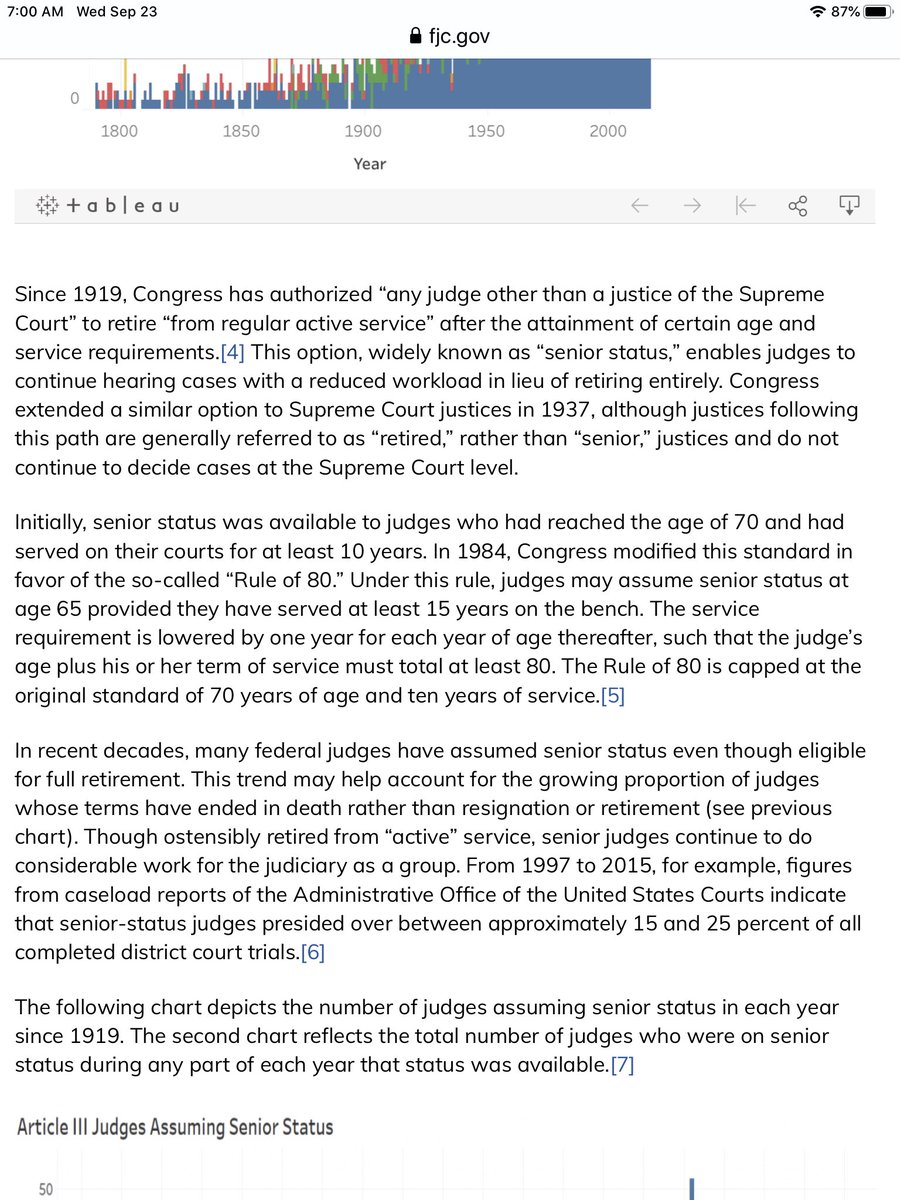

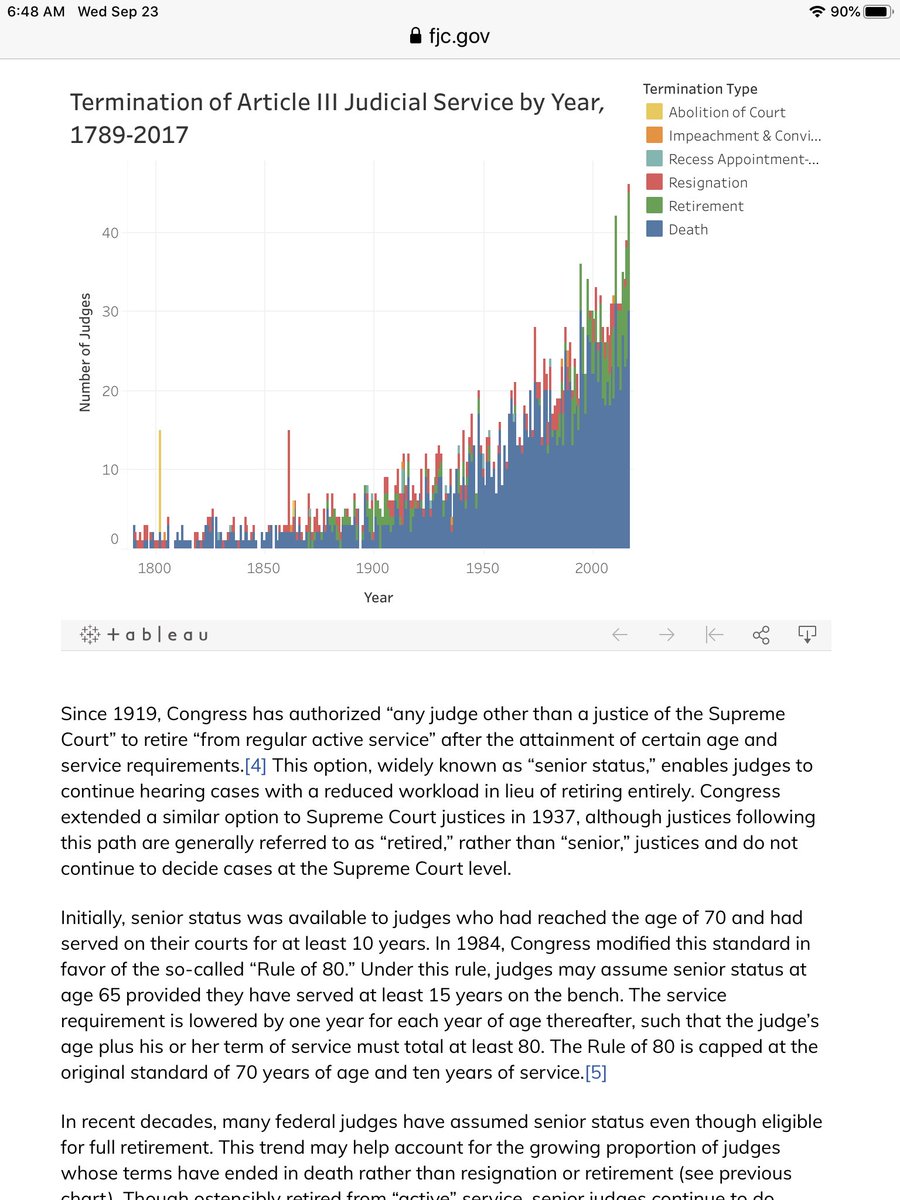

To wit, in 1984 Congress passed the *Rule of 80* into law which, ostensibly, encourages federal judges to hang on at full salary + benefits until death. We’ve encouraged the institutionalization of elders on the bench.

In 1984 Congress invited uncurbed latent duration risks.

In 1984 Congress invited uncurbed latent duration risks.

That’s exactly what happened. Not only are judges aging on the bench, they are also a critical cog in the district & appellate courts system. Rule of 80 judges on senior status were the bench judges in about 1/5th of ALL federal cases litigated. https://www.uscourts.gov/statistics-reports/judicial-business-2019">https://www.uscourts.gov/statistic...

Rule of 80 judges, a.k.a. judges on senior status, are showing less of a proclivity to retire. The trend has moved demonstrably toward remaining on the bench until death. Makes sense. There aren’t a lot of part time jobs w/ full highest salary & bens in any profession.

2. Vega

Vega is a Greek word used in financial calculus. It close to literally means this: when things go bad, bad things tends to both correlate & compound on themselves. When it rains it pours.

Vega is a Greek word used in financial calculus. It close to literally means this: when things go bad, bad things tends to both correlate & compound on themselves. When it rains it pours.

Young traders always learn this the hard way. There is plainly no way to plan for a hurricane when it is a moment away & it is impossible to move fast enough so as not to get wet.

Congress never learned this lesson. Since 1984 we have been steamrolling to this disaster today.

Congress never learned this lesson. Since 1984 we have been steamrolling to this disaster today.

One latent social, political risk is federal judges correlate to each other over time. They become, with rare exception, more institutionalized. The outliers are an easy Mark. There will always be firebrand liberals or conservs who won’t/can’t mellow with age, but most do.

Said another way, as judges age up they calcify toward regular order w/ fewer innovators (thoughtful naysayers like RBG, lions of the majority like Scalia).

Most trades are perishable. People pickle out. I’m 59, young for a federal judge but too ancient to be a trader. I’m out.

Most trades are perishable. People pickle out. I’m 59, young for a federal judge but too ancient to be a trader. I’m out.

When all you own are correlated assets, like say a shit ton of loan structured product in 2007 or mortgage backed securities in 1994, and it starts to go wrong IT REALLY GOES WRONG.

Correlations rise & you can’t hedge it. It’s too late. Look at this https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://public.tableau.com/vizql/w/LongevityRevised/v/Sheet1/tempfile/sessions/D338423CDDEB423BBFF9DB04AC1AF14F-0:0/?key=1249092727&keepfile=yes&attachment=yes&download=true">https://public.tableau.com/vizql/w/L...

Correlations rise & you can’t hedge it. It’s too late. Look at this

https://public.tableau.com/vizql/w/LongevityRevised/v/Sheet1/tempfile/sessions/D338423CDDEB423BBFF9DB04AC1AF14F-0:0/?key=1249092727&keepfile=yes&attachment=yes&download=true">https://public.tableau.com/vizql/w/L...

Pick the nit in this table & you will find lots & lots of GH Bush appointees, many more Reagan & still some Carter, Ford & Nixon. If you are turning 18 this year & voting for the first time, all of these judges have served longer than you have been alive. Many twice as long.

3. Kurtosis

Kurtosis is a fancy word in finance for *tail risk*, fat tails are extraordinary event markets. The thousand year storms; you know, the shit that happens & leads to financial markets crashing every 7 years or so.

Tail risks are a casualty of dogma. This’ relatable.

Kurtosis is a fancy word in finance for *tail risk*, fat tails are extraordinary event markets. The thousand year storms; you know, the shit that happens & leads to financial markets crashing every 7 years or so.

Tail risks are a casualty of dogma. This’ relatable.

Kurtosis in the courts happened when politicians in the Senate decided to package concentrated risk & sell it. Was it a good idea when Louie Ranieri pioneered mortgage backed securities at Solly in the 1980s?

No. That shit blew up the financial system THREE TIMES in 4 decades.

No. That shit blew up the financial system THREE TIMES in 4 decades.

But...MBS product packeting, pooling, rebalancing & syndicating was something that earned tens of billions of $ for Wall Streeters. All that was needed was people stupid/ignorant to risks to keep buying it (insurance cos, pension funds). It worked.

It’s still working. There’s more toxic debt polled product in the market today than in 2007. It’ll happen again.

Think this time Wall Street guys will love you in the morning? Right.

Dogma. It sets in over time.

Think this time Wall Street guys will love you in the morning? Right.

Dogma. It sets in over time.

Mitch McConnell did what Louie Ranieri did. By force he bullied market share to his desk, held a captive market for a long time & eventually made it such that he alone is the market. He places, controls & brokers again all of the assets. He is the market.

Until it blows up.

Until it blows up.

It just did. Wake up.

Manage your duration, vega & kurtosis risks. Fucking vote Democrat this time. Not for partisan reasons, but rather for diversification needs. Otherwise the next storm carries you out when correlations go to one. It’s just that simple.

Manage your duration, vega & kurtosis risks. Fucking vote Democrat this time. Not for partisan reasons, but rather for diversification needs. Otherwise the next storm carries you out when correlations go to one. It’s just that simple.

Also, BEG your new electeds to reverse the Rule of 80 code & replace it with a mandatory retirement age of 75 for all federal judges.

Tourists > age 75 Europe can’t rent a car. Too old. Enough dogma. Have a logical mandatory retirement age for federal judges. Do it right away.

Tourists > age 75 Europe can’t rent a car. Too old. Enough dogma. Have a logical mandatory retirement age for federal judges. Do it right away.

Read on Twitter

Read on Twitter