1/ Dear @TransferWise customers!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨👩👧👦" title="Normale Familie (Mann, Frau, Mädchen, Junge)" aria-label="Emoji: Normale Familie (Mann, Frau, Mädchen, Junge)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨👩👧👦" title="Normale Familie (Mann, Frau, Mädchen, Junge)" aria-label="Emoji: Normale Familie (Mann, Frau, Mädchen, Junge)">

Today we submitted our PwC audited annual financial report for April & #39;19 - March & #39;20.

What is in there?

Today we submitted our PwC audited annual financial report for April & #39;19 - March & #39;20.

What is in there?

2/ We raised £302.6 million from you, our customers, in transparent fees for your international banking.

Thank you for your support! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙇♂️" title="Mann verbeugt sich tief" aria-label="Emoji: Mann verbeugt sich tief">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙇♂️" title="Mann verbeugt sich tief" aria-label="Emoji: Mann verbeugt sich tief">

We put £20.4 million into our rainy day fund. They call it profit.

How did we use the remaining £282.2 million?

Thank you for your support!

We put £20.4 million into our rainy day fund. They call it profit.

How did we use the remaining £282.2 million?

3/ We spent £117.6m in direct costs related to offering the service, e.g. bank and network fees in the 52 currency zones where we serve you.

The remaining £165m splits in half. Half to provide the service, maintain servers, support calls, operations. The other half to improve.

The remaining £165m splits in half. Half to provide the service, maintain servers, support calls, operations. The other half to improve.

4/ You kept us busy this year. We& #39;re not complaining though.

Hope the savings were worthwhile. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

Hope the savings were worthwhile.

5/ Did we make TransferWise better?

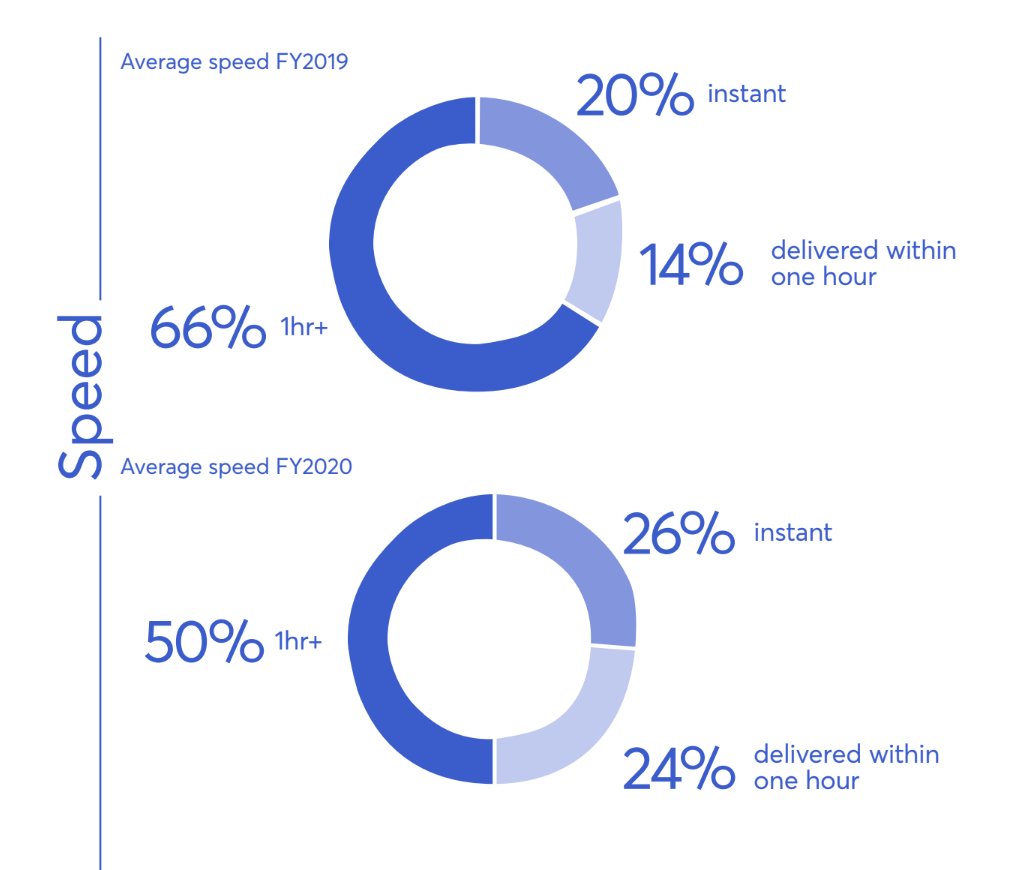

Proud for progress on speed. This year 26% of transfers on our platform reached the recipient bank account in a foreign country in less than 20 seconds.

Proud for progress on speed. This year 26% of transfers on our platform reached the recipient bank account in a foreign country in less than 20 seconds.

6/ The story on price went in the wrong direction this year. We& #39;re working on getting these fees closer and closer to 0.

7/ The borderless account launched with the debit card in the US, Australia, New Zealand, Singapore.

We& #39;re built in directly into 8 banks for you, counting @monzo @n26 @EQBank @bunq @up_banking etc

We launched for businesses accounting in @Xero and getting paid with @GoCardless

We& #39;re built in directly into 8 banks for you, counting @monzo @n26 @EQBank @bunq @up_banking etc

We launched for businesses accounting in @Xero and getting paid with @GoCardless

8/ The story on transparency is mixed.

On one hand EU law banning hidden markups came to force.

On the other hand, some banks like NatWest seem to ignore that and go further - hiking the hidden fees during covid. https://transferwise.com/gb/blog/cbpr2-natwest">https://transferwise.com/gb/blog/c...

On one hand EU law banning hidden markups came to force.

On the other hand, some banks like NatWest seem to ignore that and go further - hiking the hidden fees during covid. https://transferwise.com/gb/blog/cbpr2-natwest">https://transferwise.com/gb/blog/c...

9/ We& #39;re now in 14 cities around the world. But we need help - we& #39;re early in our mission.

55 open roles!

https://www.transferwise.jobs/search/?t=&o= ">https://www.transferwise.jobs/search/...

55 open roles!

https://www.transferwise.jobs/search/?t=&o= ">https://www.transferwise.jobs/search/...

The revolution in banking is irreversible.

We build products that are multiple times cheaper, experiences that are infinitely more pleasant. While being transparent with you, our customers ...

... and financially solid, here for the next decades.

Thank you. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

We build products that are multiple times cheaper, experiences that are infinitely more pleasant. While being transparent with you, our customers ...

... and financially solid, here for the next decades.

Thank you.

Full report: https://transferwise.com/gb/blog/2020-report">https://transferwise.com/gb/blog/2...

Read on Twitter

Read on Twitter Today we submitted our PwC audited annual financial report for April & #39;19 - March & #39;20.What is in there?" title="1/ Dear @TransferWise customers! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨👩👧👦" title="Normale Familie (Mann, Frau, Mädchen, Junge)" aria-label="Emoji: Normale Familie (Mann, Frau, Mädchen, Junge)">Today we submitted our PwC audited annual financial report for April & #39;19 - March & #39;20.What is in there?" class="img-responsive" style="max-width:100%;"/>

Today we submitted our PwC audited annual financial report for April & #39;19 - March & #39;20.What is in there?" title="1/ Dear @TransferWise customers! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨👩👧👦" title="Normale Familie (Mann, Frau, Mädchen, Junge)" aria-label="Emoji: Normale Familie (Mann, Frau, Mädchen, Junge)">Today we submitted our PwC audited annual financial report for April & #39;19 - March & #39;20.What is in there?" class="img-responsive" style="max-width:100%;"/>

We put £20.4 million into our rainy day fund. They call it profit.How did we use the remaining £282.2 million?" title="2/ We raised £302.6 million from you, our customers, in transparent fees for your international banking.Thank you for your support! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙇♂️" title="Mann verbeugt sich tief" aria-label="Emoji: Mann verbeugt sich tief">We put £20.4 million into our rainy day fund. They call it profit.How did we use the remaining £282.2 million?" class="img-responsive" style="max-width:100%;"/>

We put £20.4 million into our rainy day fund. They call it profit.How did we use the remaining £282.2 million?" title="2/ We raised £302.6 million from you, our customers, in transparent fees for your international banking.Thank you for your support! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙇♂️" title="Mann verbeugt sich tief" aria-label="Emoji: Mann verbeugt sich tief">We put £20.4 million into our rainy day fund. They call it profit.How did we use the remaining £282.2 million?" class="img-responsive" style="max-width:100%;"/>

" title="4/ You kept us busy this year. We& #39;re not complaining though.Hope the savings were worthwhile. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">">

" title="4/ You kept us busy this year. We& #39;re not complaining though.Hope the savings were worthwhile. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">">

" title="4/ You kept us busy this year. We& #39;re not complaining though.Hope the savings were worthwhile. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">">

" title="4/ You kept us busy this year. We& #39;re not complaining though.Hope the savings were worthwhile. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">">