1/ Thread: $TCEHY

I have rudimentary understanding on tech in China. @packyM wrote a fascinating piece on $TCEHY which I came across today and wanted to leave my notes here.

It is a riveting read. So feel free to read the actual piece. https://notboring.substack.com/p/tencent-the-ultimate-outsider">https://notboring.substack.com/p/tencent...

I have rudimentary understanding on tech in China. @packyM wrote a fascinating piece on $TCEHY which I came across today and wanted to leave my notes here.

It is a riveting read. So feel free to read the actual piece. https://notboring.substack.com/p/tencent-the-ultimate-outsider">https://notboring.substack.com/p/tencent...

2/ Born in 1971, Pony Ma, the founder of $TCEHY, built a stock market analysis tool while interning at a leading tech company in China.

He sold it for 50k CNY i.e. 3x his annual salary at that time.

He sold it for 50k CNY i.e. 3x his annual salary at that time.

3/ After college, he worked for 5 years at a pager company. In 1998, he finally left the company to start Tencent.

It was a bumpy start. During pre-AWS era, server cost was skyrocketing and it was also sued by AOL for copyright issues.

It was a bumpy start. During pre-AWS era, server cost was skyrocketing and it was also sued by AOL for copyright issues.

4/ Ma even wanted to sell $TCEHY for $431k, but the highest offer he received was ~$86k.

For context, it& #39;s current market cap is ~$630 Bn.

Ma finally sold 40% of Tencent to early US-based Chinese venture investor IDG Capital and Yingke for $2.2 million.

For context, it& #39;s current market cap is ~$630 Bn.

Ma finally sold 40% of Tencent to early US-based Chinese venture investor IDG Capital and Yingke for $2.2 million.

5/ But as users crossed 100 mn without any revenue model, costs continued to creep up. Pretty soon, Tencent was back in the fund raising game.

Ma approached Sohu (Chinese Search company) and Yahoo China. They weren& #39;t interested.

Then something remarkable happened.

Ma approached Sohu (Chinese Search company) and Yahoo China. They weren& #39;t interested.

Then something remarkable happened.

6/ "In 2001, the South African firm Naspers (literally) walked in the door and offered to invest at a $60 million valuation. So that Ma didn’t lose majority ownership, IDG sold 12.8% of its 20% and Yingke sold its entire stake for an 11x gain (not bad!), giving Naspers 32.8%...

7/ ...of the company for $19.68 million. Today, that investment is worth $205 billion, good for a 10,436x return!"

What!

$TCEHY finally IPO& #39;ed in 2004 at $790 Mn valuation.

They Ma hired Martin Lau and Allen Zhang, two of the most instrumental figures behind Tencent& #39;s success.

What!

$TCEHY finally IPO& #39;ed in 2004 at $790 Mn valuation.

They Ma hired Martin Lau and Allen Zhang, two of the most instrumental figures behind Tencent& #39;s success.

8/ $TCEHY revenue

2005: $200 Mn

2010: $2.9 Bn

2005 to 2010: topline 15x

Then in 2011, WeChat happened in which Zhang was the mastermind.

2005: $200 Mn

2010: $2.9 Bn

2005 to 2010: topline 15x

Then in 2011, WeChat happened in which Zhang was the mastermind.

9/ Time it took to hit 100 Mn users

$FB 5.5 years

$TWTR 4 years

WeChat 433 days

WeChat has 1.2 Bn users today.

$FB 5.5 years

$TWTR 4 years

WeChat 433 days

WeChat has 1.2 Bn users today.

10/ Lau, on the other hand, was busy acquiring games.

In 2011, he acquired 92.8% of Riot Games, creators of League of Legends for $400 mn.

In 2012, he bought 40% of Epic Games for $330 Mn.

In 2011, he acquired 92.8% of Riot Games, creators of League of Legends for $400 mn.

In 2012, he bought 40% of Epic Games for $330 Mn.

11/ In the last decade, Lau and his team invested in more than 700 companies (no typo here), of which 160 of them are unicorns (as per a recent speech by Lau)

This includes familiar names such as

~5% of $TSLA

~35% of $SE

~18% of $JD

~17% of $PDD

~12% of $SNAP

This includes familiar names such as

~5% of $TSLA

~35% of $SE

~18% of $JD

~17% of $PDD

~12% of $SNAP

12/ Of course, nobody knows all the companies $TCEHY owns. @packyM counted 103 companies.

Go to this link to see the portfolio: #gid=1756026598">https://docs.google.com/spreadsheets/d/1owpL6WmMK30X19Kw3BziAw39rGJbsfIMOOexdtvAkxU/edit #gid=1756026598">https://docs.google.com/spreadshe...

Go to this link to see the portfolio: #gid=1756026598">https://docs.google.com/spreadsheets/d/1owpL6WmMK30X19Kw3BziAw39rGJbsfIMOOexdtvAkxU/edit #gid=1756026598">https://docs.google.com/spreadshe...

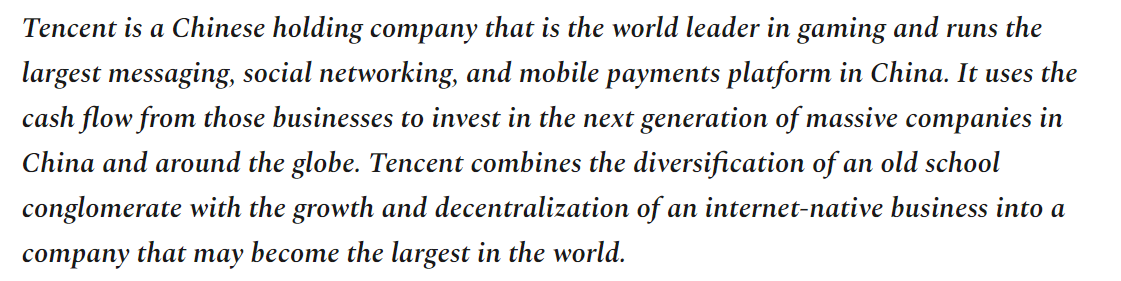

13/ So what exactly is $TCEHY?

Difficult to answer this within a tweet, so I& #39;ll let you read @packyM& #39;s eloquent response to that "simple" question:

Difficult to answer this within a tweet, so I& #39;ll let you read @packyM& #39;s eloquent response to that "simple" question:

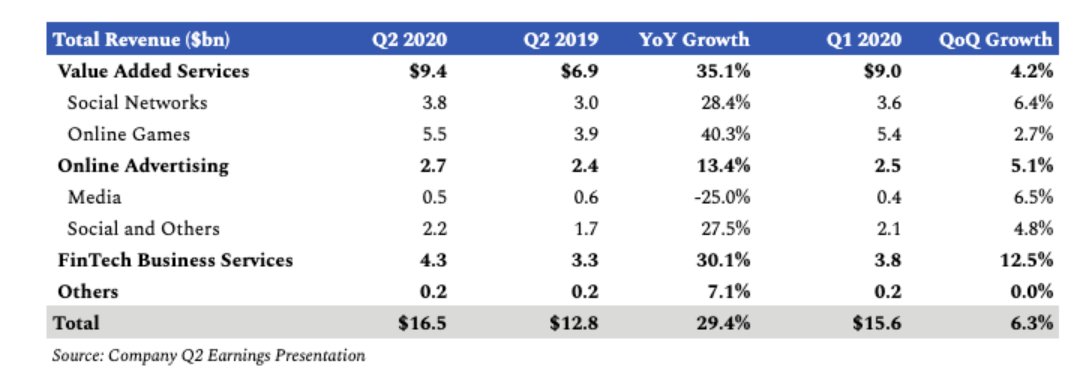

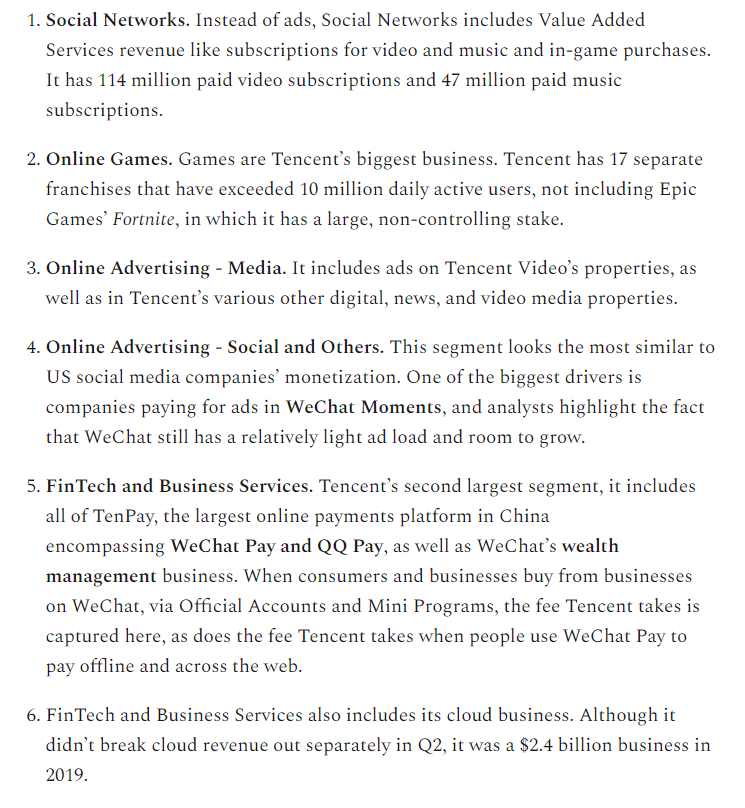

14/ How does $TCEHY make money?

Ignoring the investments, core business makes money in six ways

I. Payments

II. Subscriptions (video/music)

III. Social ads

IV. Media ads

V. Games

VI. Cloud

Ignoring the investments, core business makes money in six ways

I. Payments

II. Subscriptions (video/music)

III. Social ads

IV. Media ads

V. Games

VI. Cloud

15/ Of the companies @packyM could find that $TCEHY invested in, 54 are based in China and 49 are international.

Here& #39;s how the geographical mix looks like

Here& #39;s how the geographical mix looks like

End/ @packyM wrote a part II of his $TCEHY deep dive. This one is more on what lies ahead (I& #39;m yet to read it, but this goes to tomorrow& #39;s to-do list)

All my twitter threads: https://mbi-deepdives.com/twitter-threads/">https://mbi-deepdives.com/twitter-t... https://notboring.substack.com/p/tencents-dreams">https://notboring.substack.com/p/tencent...

All my twitter threads: https://mbi-deepdives.com/twitter-threads/">https://mbi-deepdives.com/twitter-t... https://notboring.substack.com/p/tencents-dreams">https://notboring.substack.com/p/tencent...

Read on Twitter

Read on Twitter