There is a big difference between a small business & a start-up. Over the years building @MyGrowthFund I cant tell you how many entrepreneurs I have come across that don& #39;t understand this.

... and you have to understand if you to growth & funding.

... and you have to understand if you to growth & funding.

South Africa& #39;s obsession with small business as a solution to chronic levels of unemployment has created this mindset of "starting a business". The mindset itself is good.

But the question is this, "start a business for what reason"?

But the question is this, "start a business for what reason"?

Most people that start a business actually just want to survive & put food on the table. So their businesses are built to provide an income to the founder & their families.

This is not bad. But this is not a start-up. Its a small business.

This is not bad. But this is not a start-up. Its a small business.

The idea that the business must provide a source of income for the founder & create jobs as a primary reason for existing by definition means that the business must be profitable.

This is the 1st major difference between start-ups & SMEs. SMEs must be profitable.

This is the 1st major difference between start-ups & SMEs. SMEs must be profitable.

So the founder of the SME usually uses personal savings (savings, 2nd mortgage, pension etc) to fund their business. But because they have to payback that debt, the business must generate sufficient cash flows meet the interest charge of the debt.

So the founder must make a profit. How else can they sustainably meet the debt obligations.

This is a trap. But to understand why, I have to illustrate:

This is a trap. But to understand why, I have to illustrate:

A small business will never outprice a large business. Its Economics 101. Remember those lectures at uni or college? Yeah? You shouldn& #39;t have bunked them.

Speaking of Economics 101, I was a student of Prof. Karungu at Wits University for first year. Is Prof still teaching at Wits? Who can forget the tag-line, "Wits gives to the edge".

Who can forget the fast talking, joke spitting, shade throwing Prof.

Who can forget the fast talking, joke spitting, shade throwing Prof.

Back to the thread:

The basic reason big businesses become big is bargaining power. They get better prices at better terms from their suppliers.

The bigger they get, the better their free cash flow (if they manage the working capital cycles efficiently).

The basic reason big businesses become big is bargaining power. They get better prices at better terms from their suppliers.

The bigger they get, the better their free cash flow (if they manage the working capital cycles efficiently).

Remember @Clicks_SA

I have seen hundreds of tweets asking the question of why doesn& #39;t Clicks diversify their supplier base & create more shelf space for small black businesses.

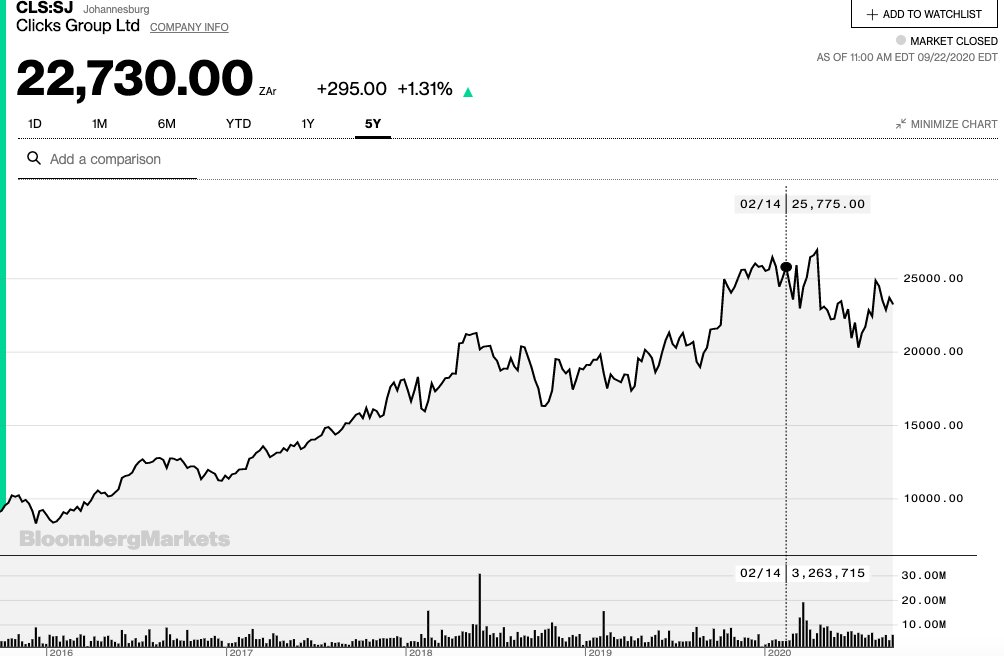

This is the Clicks share price movement over the past 5years. Impressive Yes?!

I have seen hundreds of tweets asking the question of why doesn& #39;t Clicks diversify their supplier base & create more shelf space for small black businesses.

This is the Clicks share price movement over the past 5years. Impressive Yes?!

A big part of the gain in the share price for Clicks has been how efficiently they have managed their working capital.

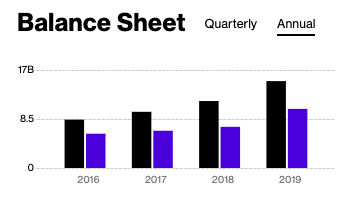

Without going through the details of the Clicks Balance Sheet, here is the high-level picture:

The black is the Total Assets.

Without going through the details of the Clicks Balance Sheet, here is the high-level picture:

The black is the Total Assets.

Part of the growth in their Total Assets is growth in inventory (which is financed by their suppliers because of their trade terms) & cash (the holy grail).

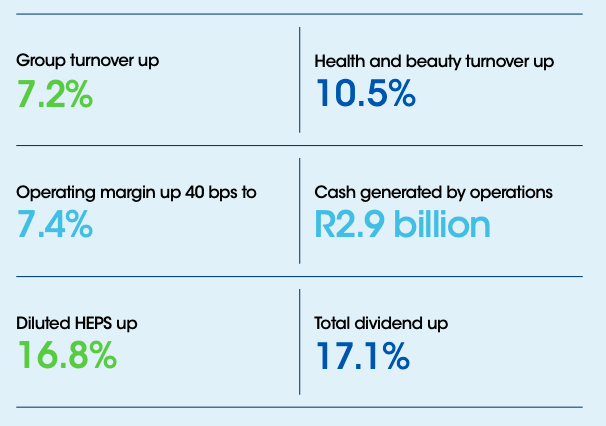

Here is a summary of their financial performance over the past year. Source: Analysts Report, Clicks Group.

Here is a summary of their financial performance over the past year. Source: Analysts Report, Clicks Group.

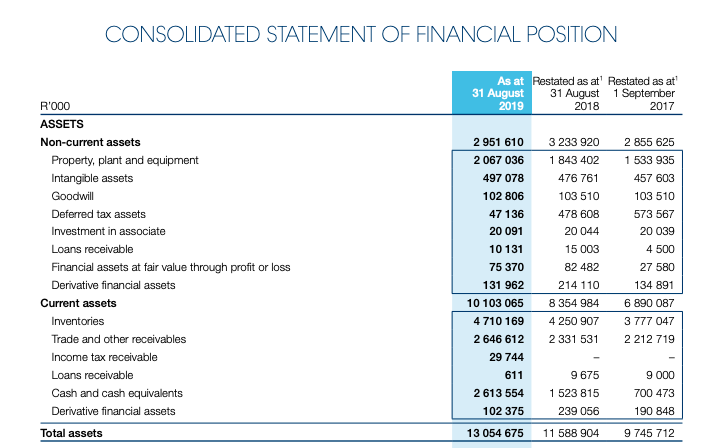

Now have a look at the Balance Sheet. If you& #39;re a non-financial person, don& #39;t panic.

Cast your eye on the line-items "inventory" as well as "cash & cash equivalents". Big jump in cash right?

Cast your eye on the line-items "inventory" as well as "cash & cash equivalents". Big jump in cash right?

Why?

Simple. Clicks has large companies as its suppliers that can carry the load of supplying them on credit (what retailers call "terms") for an extended period of time.

So when Joe Soap with a small business wants shelf-space at Clicks, you simply cant meet the terms.

Simple. Clicks has large companies as its suppliers that can carry the load of supplying them on credit (what retailers call "terms") for an extended period of time.

So when Joe Soap with a small business wants shelf-space at Clicks, you simply cant meet the terms.

Remember, yours is a small business. it must generate a positive cash flows to pay for your operating costs & a profit to keep you a going concern.

So the small business owner cant play financiers to a retailer for the sake of revenue growth.

So the small business owner cant play financiers to a retailer for the sake of revenue growth.

I have perhaps over-simplified what is a very complex issue. But this is a thread not a academic thesis.

You get the point.

The small business needs profits to stay a going concern & positive cash flows to meet its current liabilities.

You get the point.

The small business needs profits to stay a going concern & positive cash flows to meet its current liabilities.

The start-up is VEEEEEEEEEEEERY different.

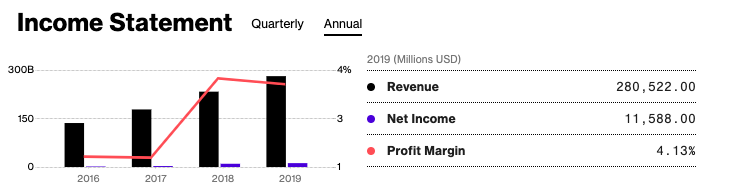

Lets take the now overused example of @amazon . Classic start-up tail. Look at their Revenue to Profit Margins ratio. Spike over the past few years. Why?

Lets take the now overused example of @amazon . Classic start-up tail. Look at their Revenue to Profit Margins ratio. Spike over the past few years. Why?

Amazon is built to accumulate market-share (even if you make losses). This is what we in venture investing call "Scale". They will enter a new market (new product, new customer or new geography) & run losses, as long they gain more customers.

Once they have sufficient scale (and they have forced out their competitors) they will then normalize prices and reap the profits from the position of a market-leading incumbent.

In this classic start-up tale: profits are bad! (at least while you scale)

In this classic start-up tale: profits are bad! (at least while you scale)

So to summarise:

Small businesses require profits. Start-up wants market share.

Start-ups see loss-making a strategy for scale. So they raise funding to finance their losses & accelerate growth.

Follow @zach_cpt for more tips on this way of thinking. Solid lad.

Small businesses require profits. Start-up wants market share.

Start-ups see loss-making a strategy for scale. So they raise funding to finance their losses & accelerate growth.

Follow @zach_cpt for more tips on this way of thinking. Solid lad.

Why is this important?

Simple.

South Africa is obsessed with small & medium sized businesses. The research actually show different.

If you want mass scale in job opportunities, build more start-ups not SMEs.

Simple.

South Africa is obsessed with small & medium sized businesses. The research actually show different.

If you want mass scale in job opportunities, build more start-ups not SMEs.

Whose got this right?

Isreal.

Morocco.

Rwanda.

... and did I mention Isreal? They have nailed this formula over the past couple of years. If the start-up fails, no lengthy liquidation process. Close it. Tie it up legally. Quickly. And start another.

Isreal.

Morocco.

Rwanda.

... and did I mention Isreal? They have nailed this formula over the past couple of years. If the start-up fails, no lengthy liquidation process. Close it. Tie it up legally. Quickly. And start another.

@EmilyKatePope wrote a great article on this a few weeks ago. Check it out here: https://www.fundera.com/blog/startup-vs-small-business#:~:text=Small%20Business%3A%20The%20Main%20Difference,growth%20goals%20and%20revenue%20forecast.&text=Small%20businesses%2C%20on%20the%20other,growth%20in%20an%20existing%20market.">https://www.fundera.com/blog/star...

We @MyGrowthFund have just announced our partnership with @VenturesSahara to build their next generation of pan-African start-ups.

I cant get into the details yet. But check out @Afruturist . He shares great articles & resources in this area for entrepreneurs.

I cant get into the details yet. But check out @Afruturist . He shares great articles & resources in this area for entrepreneurs.

So don& #39;t forget: an SME is not necessarily a start-up.

If you want to scale FAST, have mass impact, & exponential growth, choose the start-up model.

Back to your regular scheduled program.

Asante sana.

VT

If you want to scale FAST, have mass impact, & exponential growth, choose the start-up model.

Back to your regular scheduled program.

Asante sana.

VT

Read on Twitter

Read on Twitter