#Ecommerce  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> penetration reached 27%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> penetration reached 27%  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> in Q2 & #39;20

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> in Q2 & #39;20

This BOOSTED $SHOP https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> $AMZN

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> $AMZN  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📦" title="Paket" aria-label="Emoji: Paket"> $SE

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📦" title="Paket" aria-label="Emoji: Paket"> $SE  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus">

But who has ALSO benefited from the shift to this VIRTUAL WORLD https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte"> Payment & Financial Solutions

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte"> Payment & Financial Solutions  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

Let’s talk about $ADYEY https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

This BOOSTED $SHOP

But who has ALSO benefited from the shift to this VIRTUAL WORLD

Let’s talk about $ADYEY

$ADYEY was founded in 2006 by Arnout Schuijff and Pieter van der Does  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten">

Before starting Adyen, Pieter was the Chief Commerce Officer https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨💼" title="Man office worker" aria-label="Emoji: Man office worker"> at Bibit and Arnout was a Systems Architect

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨💼" title="Man office worker" aria-label="Emoji: Man office worker"> at Bibit and Arnout was a Systems Architect  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨💻" title="Man technologist" aria-label="Emoji: Man technologist">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨💻" title="Man technologist" aria-label="Emoji: Man technologist">

Fair to say, $ADYEY was founded by industry veterans https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">

Before starting Adyen, Pieter was the Chief Commerce Officer

Fair to say, $ADYEY was founded by industry veterans

But what does $ADYEY do? Let’s dive into payment solutions  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">

Let’s say you want to start selling the beautiful clothes https://abs.twimg.com/emoji/v2/... draggable="false" alt="👚" title="Damenbekleidung" aria-label="Emoji: Damenbekleidung">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👚" title="Damenbekleidung" aria-label="Emoji: Damenbekleidung"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👕" title="T-Shirt" aria-label="Emoji: T-Shirt"> you design as a side project

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👕" title="T-Shirt" aria-label="Emoji: T-Shirt"> you design as a side project

First things first, you set up a $SHOP website https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> and start accepting payments with Shopify Payments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> and start accepting payments with Shopify Payments  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">

Let’s say you want to start selling the beautiful clothes

First things first, you set up a $SHOP website

Things are going well and you decide to open a retail location  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏬" title="Kaufhaus" aria-label="Emoji: Kaufhaus"> and start selling abroad

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏬" title="Kaufhaus" aria-label="Emoji: Kaufhaus"> and start selling abroad  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">

Now, you need to accept in-person payments https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten"> and foreign cards

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten"> and foreign cards  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

This is still possible with $SHOP point-of-sale https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> and Shopify Payments which is available in 16 countries

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> and Shopify Payments which is available in 16 countries  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏳️" title="Wehende weiße Flagge" aria-label="Emoji: Wehende weiße Flagge">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏳️" title="Wehende weiße Flagge" aria-label="Emoji: Wehende weiße Flagge">

Now, you need to accept in-person payments

This is still possible with $SHOP point-of-sale

For now, everything is running just fine but you don’t want to be limited by $SHOP reach of 16 countries

You have an IDEA https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne"> Now that your sales are good

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne"> Now that your sales are good  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> You decide to build your own website

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> You decide to build your own website

This way, you can customise https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖌" title="Farbpinsel unten links" aria-label="Emoji: Farbpinsel unten links"> it as you want and add all the features you want

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖌" title="Farbpinsel unten links" aria-label="Emoji: Farbpinsel unten links"> it as you want and add all the features you want  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">

You have an IDEA

This way, you can customise

But wait  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen"> Who is going to take care of the collecting payments now?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen"> Who is going to take care of the collecting payments now?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">

Since you are not a *World Class Business* yet https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> you want a simple payment solution you can install overnight

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> you want a simple payment solution you can install overnight  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

Since you are not a *World Class Business* yet

Here is a small note

Ok, let’s say that the small clothing brand you started grew to become Nike  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃" title="Person running" aria-label="Emoji: Person running">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏃" title="Person running" aria-label="Emoji: Person running">

You now have thousands of shops https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏬" title="Kaufhaus" aria-label="Emoji: Kaufhaus"> and accept payments in lots of countries

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏬" title="Kaufhaus" aria-label="Emoji: Kaufhaus"> and accept payments in lots of countries  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

Your POS system is fragmented, you rely on different payment gateways, service providers, acquirers and processors https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

You now have thousands of shops

Your POS system is fragmented, you rely on different payment gateways, service providers, acquirers and processors

To keep it short, since you now run *OMNI-CHANNEL* operations (online, physical stores) on a *GLOBAL* scale  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> You have 3 problems

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> You have 3 problems  https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Your global POS system is fragmented among lots of intermediaries

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Your global POS system is fragmented among lots of intermediaries  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔀" title="Verbogene nach rechts zeigende Pfeile" aria-label="Emoji: Verbogene nach rechts zeigende Pfeile"> (payment gateways, service providers, acquirers, processors)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔀" title="Verbogene nach rechts zeigende Pfeile" aria-label="Emoji: Verbogene nach rechts zeigende Pfeile"> (payment gateways, service providers, acquirers, processors)

What did Nike do? They worked with $ADYEY  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Adyen is a payment gateway, service provider, acquirer and processor for online

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Adyen is a payment gateway, service provider, acquirer and processor for online  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> and physical shops

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden"> and physical shops  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏬" title="Kaufhaus" aria-label="Emoji: Kaufhaus">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏬" title="Kaufhaus" aria-label="Emoji: Kaufhaus">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> It just requires 1 system, 1 process integration and 1 contract for ANY company

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> It just requires 1 system, 1 process integration and 1 contract for ANY company

Of course, every single startup would sign up with $ADYEY if it was that simple  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne">

Here’s why Stripe is more popular with SMB and Adyen caters to med and large business https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Here’s why Stripe is more popular with SMB and Adyen caters to med and large business

When using Stripe, your business’ funds are deposited into a single merchant account, along with the funds of other business  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobiltelefon mit nach rechts zeigendem Pfeil auf der linken Seite" aria-label="Emoji: Mobiltelefon mit nach rechts zeigendem Pfeil auf der linken Seite"> Stripe then transfers these funds minus their fees to your business bank account

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobiltelefon mit nach rechts zeigendem Pfeil auf der linken Seite" aria-label="Emoji: Mobiltelefon mit nach rechts zeigendem Pfeil auf der linken Seite"> Stripe then transfers these funds minus their fees to your business bank account

When using Adyen, you need to set up a merchant account  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> Your funds are then deposited into your merchant account directly

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> Your funds are then deposited into your merchant account directly  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Adyen’s fees are often limited to the Interchange++ fees (and $ADYEY own fees)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Adyen’s fees are often limited to the Interchange++ fees (and $ADYEY own fees)

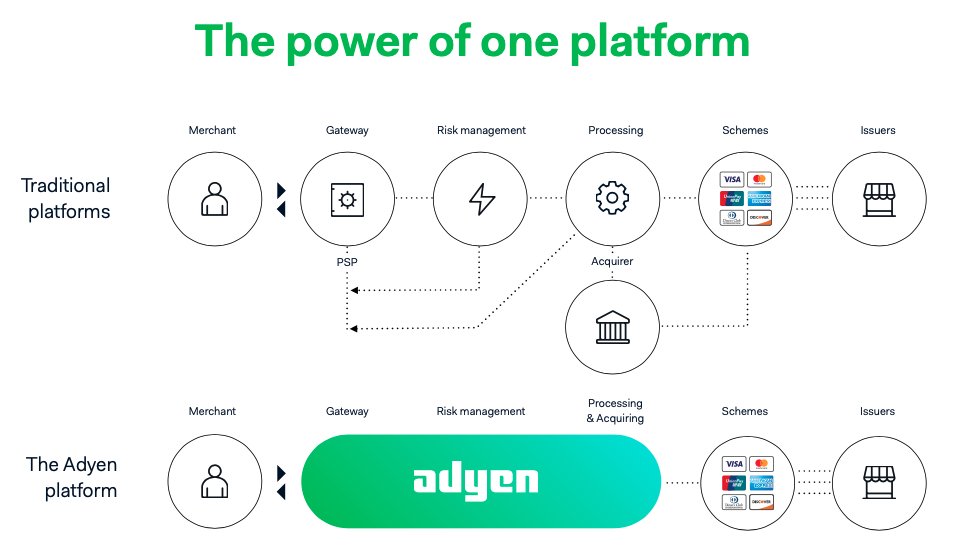

Here is a more schematic explanation

If you just discovered a passion for Merchant Accounts, here is all you have to know  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.fundera.com/blog/merchant-account">https://www.fundera.com/blog/merc...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.fundera.com/blog/merchant-account">https://www.fundera.com/blog/merc...

So by now this whole payment solutions thing should be clarified and the “WHY” of Adyen should also be clear

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Adyen acts as a single solution for all payments (online and physical) on a global scale

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Adyen acts as a single solution for all payments (online and physical) on a global scale

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> It is more complex but cheaper, more robust and more focussed on payments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> It is more complex but cheaper, more robust and more focussed on payments

This strategy pays off and translates into the following numbers for the first half of 2020 (H1 ’20)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Processed volume at € 129B - a 23% YoY increase

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Processed volume at € 129B - a 23% YoY increase

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> Net revenue at € 280m - a 27% YoY increase

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> Net revenue at € 280m - a 27% YoY increase

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">EBITDA at € 141m - a 12% YoY increase

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">EBITDA at € 141m - a 12% YoY increase

On these numbers  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> $ADYEY was affected by #COVID more than $SHOP $AMZN as they also provide payment solutions to physical shops and travel, hospitality industry

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> $ADYEY was affected by #COVID more than $SHOP $AMZN as they also provide payment solutions to physical shops and travel, hospitality industry

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> $ADYEY is by no means cheap, trading at a PE of 227 but delivers a Return on Equity (average 5Y) of 26%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> $ADYEY is by no means cheap, trading at a PE of 227 but delivers a Return on Equity (average 5Y) of 26%

In order to justify its valuation $ADYEY needs to deliver  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen"> What’s in the box?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen"> What’s in the box?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Winning key customers $MSFT $SPOT $ETSY $UBER $BKNG $FVRR $FTCH $EBAY

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Winning key customers $MSFT $SPOT $ETSY $UBER $BKNG $FVRR $FTCH $EBAY

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Focussing on creating the best platform, here is a testimony from Spreedly

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Focussing on creating the best platform, here is a testimony from Spreedly  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

"Adyen is laser focused on payment processing and doing everything they can to improve payment processing. They discuss success and decline rates and what they can do to improve them for you today and over time, higher cart conversion [...] and so on."

Hope you liked this thread!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> For more content, follow us on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> For more content, follow us on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Want to get UNDER HYPED companies delivered straight to your inbox? Subscribe now! https://getbenchmark.substack.com"> https://getbenchmark.substack.com

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Want to get UNDER HYPED companies delivered straight to your inbox? Subscribe now! https://getbenchmark.substack.com"> https://getbenchmark.substack.com

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Fundera

Sources

✑ Investor presentation

✑ Company website

✑ Fundera

Read on Twitter

Read on Twitter penetration reached 27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> in Q2 & #39;20This BOOSTED $SHOP https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> $AMZN https://abs.twimg.com/emoji/v2/... draggable="false" alt="📦" title="Paket" aria-label="Emoji: Paket"> $SE https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus">But who has ALSO benefited from the shift to this VIRTUAL WORLD https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte"> Payment & Financial Solutions https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Let’s talk about $ADYEY https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" title=" #Ecommerce https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> penetration reached 27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> in Q2 & #39;20This BOOSTED $SHOP https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> $AMZN https://abs.twimg.com/emoji/v2/... draggable="false" alt="📦" title="Paket" aria-label="Emoji: Paket"> $SE https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus">But who has ALSO benefited from the shift to this VIRTUAL WORLD https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte"> Payment & Financial Solutions https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Let’s talk about $ADYEY https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>

penetration reached 27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> in Q2 & #39;20This BOOSTED $SHOP https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> $AMZN https://abs.twimg.com/emoji/v2/... draggable="false" alt="📦" title="Paket" aria-label="Emoji: Paket"> $SE https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus">But who has ALSO benefited from the shift to this VIRTUAL WORLD https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte"> Payment & Financial Solutions https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Let’s talk about $ADYEY https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" title=" #Ecommerce https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> penetration reached 27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> in Q2 & #39;20This BOOSTED $SHOP https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer"> $AMZN https://abs.twimg.com/emoji/v2/... draggable="false" alt="📦" title="Paket" aria-label="Emoji: Paket"> $SE https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus">But who has ALSO benefited from the shift to this VIRTUAL WORLD https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte"> Payment & Financial Solutions https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Let’s talk about $ADYEY https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>

Adyen is more complex to set up but offers a more robust and more complete solution than StripeHere is a more schematic explanation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm"> (taken from Capital Market Day, April 12 2019)" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad"> Adyen is more complex to set up but offers a more robust and more complete solution than StripeHere is a more schematic explanation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm"> (taken from Capital Market Day, April 12 2019)" class="img-responsive" style="max-width:100%;"/>

Adyen is more complex to set up but offers a more robust and more complete solution than StripeHere is a more schematic explanation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm"> (taken from Capital Market Day, April 12 2019)" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad"> Adyen is more complex to set up but offers a more robust and more complete solution than StripeHere is a more schematic explanation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm"> (taken from Capital Market Day, April 12 2019)" class="img-responsive" style="max-width:100%;"/>