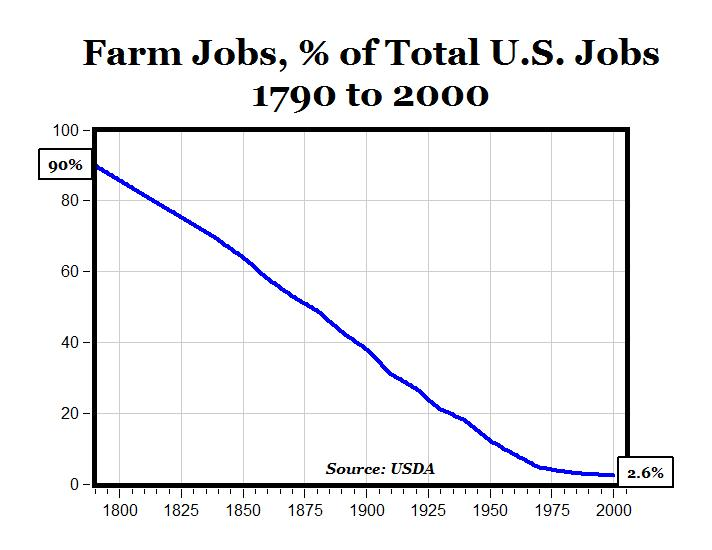

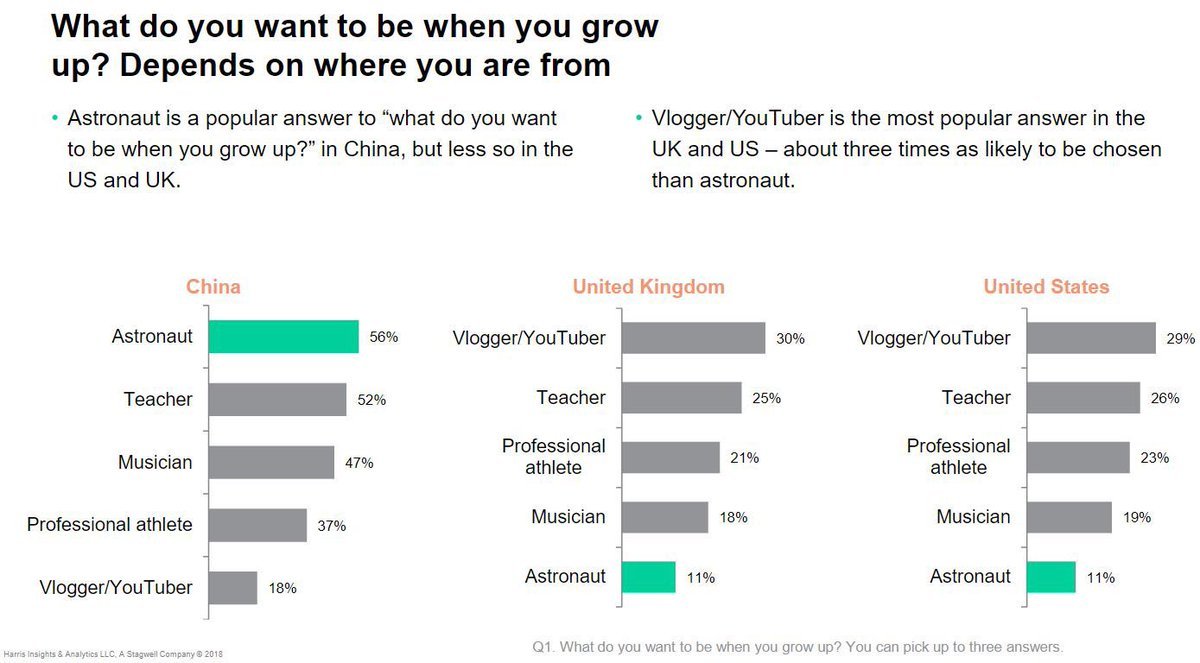

Farming was the 1800s. Manufacturing was the 1900s. Counterintuitively, could investing become the most common "job" of the 2000s?

Reason: crypto and fintech are turning everyone into an investor, just like the internet turned everyone into publishers. How far does that go?

Reason: crypto and fintech are turning everyone into an investor, just like the internet turned everyone into publishers. How far does that go?

One way of measuring this: what percentage of income do people derive from investments vs wage labor?

We think of wage labor for a salary as the default today, but the transition from farming to manufacturing was a big change. An improvement in some respects, and not in others.

We think of wage labor for a salary as the default today, but the transition from farming to manufacturing was a big change. An improvement in some respects, and not in others.

Many bemoan the financialization of the economy. But perhaps we lean into that. Perhaps investing is what people do in a robotic economy if they don& #39;t want to be founders.

Investing is similar to consumption. Just click to buy. Picking is hard. But you can join a rolling fund...

Investing is similar to consumption. Just click to buy. Picking is hard. But you can join a rolling fund...

In this hypothetical world:

- everyone is micro-investing, every day

- the $10000 micro-exit is kind of like the viral tweet

- what would have been "college money" seeds your fund

- picking a fund manager is like picking an employer

- robotics gives a low-scarcity basic lifestyle

- everyone is micro-investing, every day

- the $10000 micro-exit is kind of like the viral tweet

- what would have been "college money" seeds your fund

- picking a fund manager is like picking an employer

- robotics gives a low-scarcity basic lifestyle

One response is "someone still has to do the jobs."

But the share of farming jobs crashed even as the population rose, because we got really efficient.

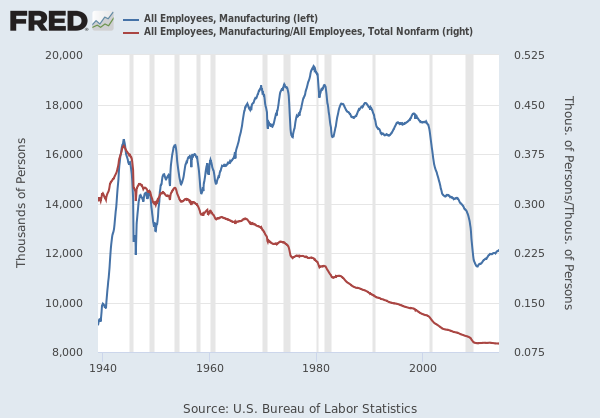

Perhaps robotics similarly reduces manufacturing share.

And then perhaps investing becomes the main post-manufacturing thing.

But the share of farming jobs crashed even as the population rose, because we got really efficient.

Perhaps robotics similarly reduces manufacturing share.

And then perhaps investing becomes the main post-manufacturing thing.

Read on Twitter

Read on Twitter