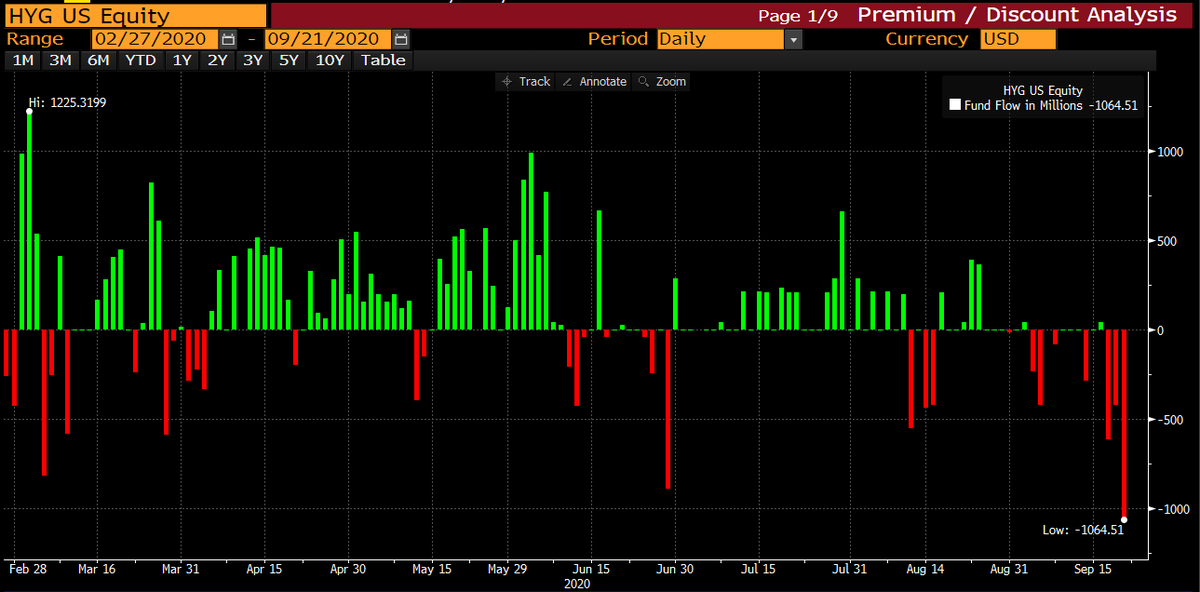

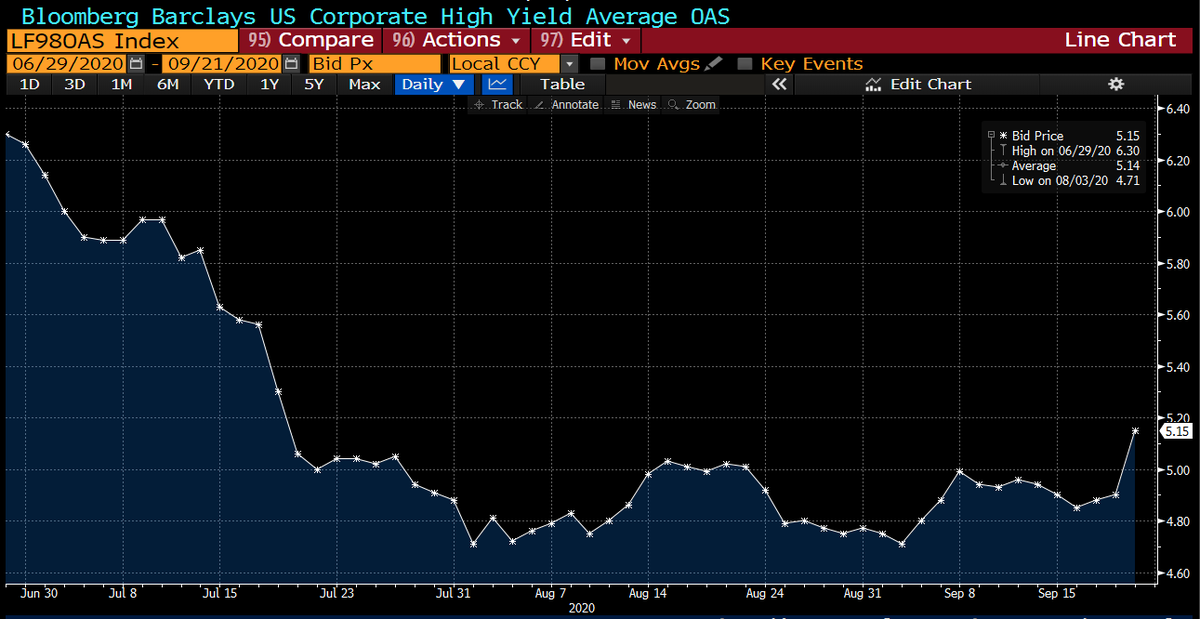

Investors pulled more than $1 billion yesterday from the biggest junk-bond ETF, BlackRock& #39;s $27.8 billion fund that trades as $HYG. It& #39;s the biggest daily withdrawal since February, and one of the bigger ones in the fund& #39;s history.

Interestingly, traders also pulled $744 million from $LQD, the popular U.S. investment-grade bond ETF, even though some traders had been treating top-rated credit almost as nearly interchangeable with U.S. Treasuries for much of the year.

Read on Twitter

Read on Twitter