While the neoliberal economist Raghuram Rajan continues to be a darling of the liberals, let us remember that the Indian banking sector escaped from catastrophe during the global financial crisis which began in 2007-08, because India DID NOT follow his advice to privatise banks.

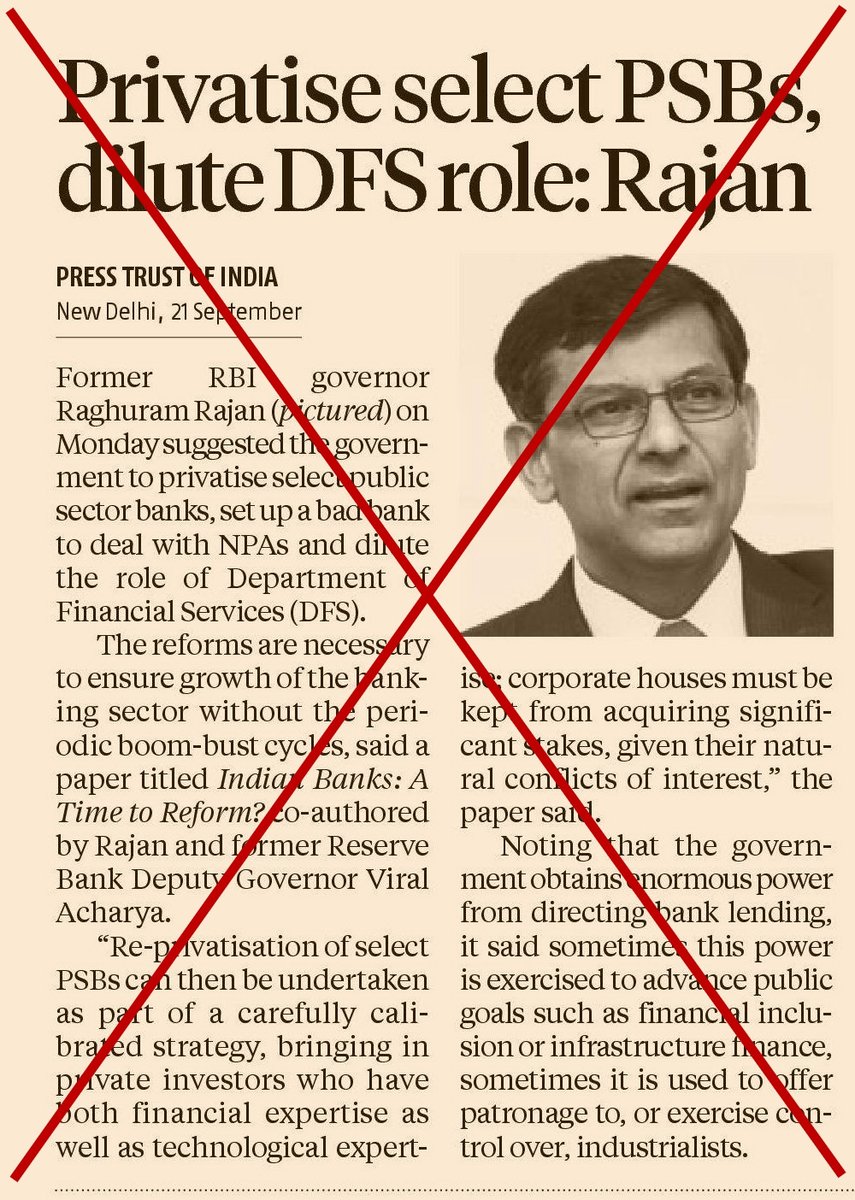

A committee headed by him had proposed that small "underperforming" public sector banks be sold, that government ownership in larger public sector banks be brought down to below 50 percent,...

... that more power be given to outside shareholders including private strategic investors in the boards of public sector banks, that government oversight on such banks be reduced, and that fewer constraints should be imposed on banks.

The committee submitted its report in 2008, when the sub-prime crisis was snowballing into a wider financial crisis. Since it was obvious that private sector-dominated banking systems were far more prone to crises, India did not follow through on the committee& #39;s recommendations.

But Raghuram Rajan keeps pushing the privatisation agenda, even though we know from experience that private banks are more prone to failure. And the "liberals" keep applauding. https://www.newsclick.in/banks-must-be-publicly-owned-heres-why">https://www.newsclick.in/banks-mus...

Read on Twitter

Read on Twitter