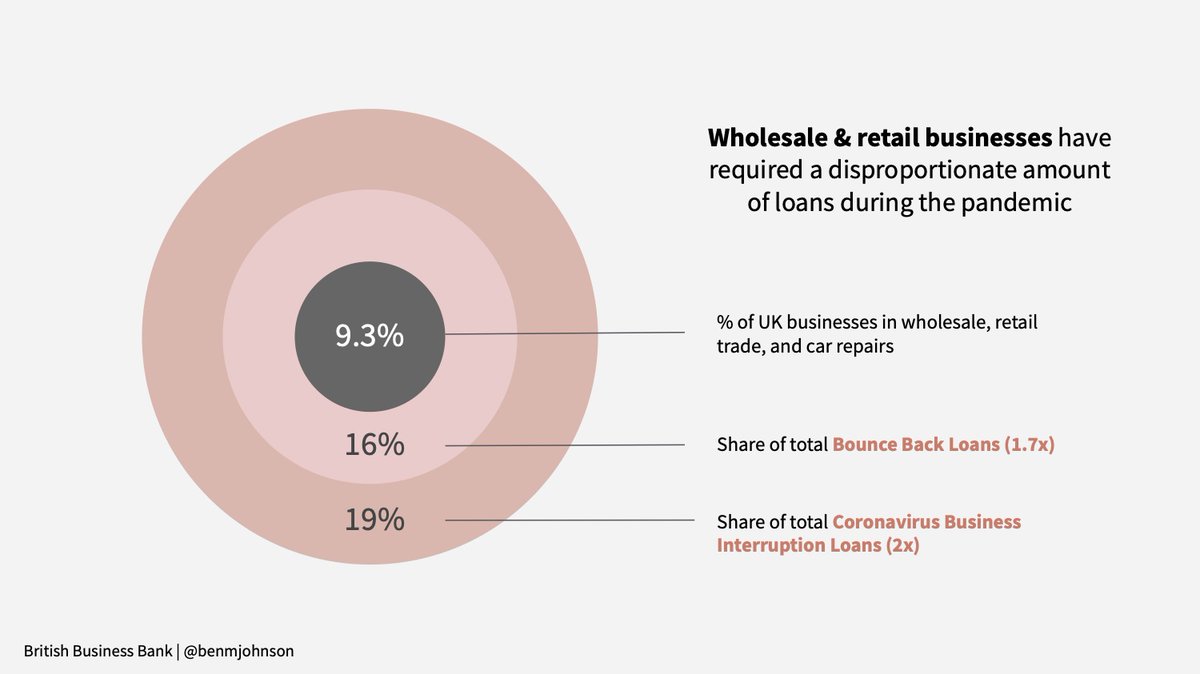

As the UK government looks to extend the government backed coronavirus loan schemes, I looked into the data to see which industries are at most need of these loans. Unsurprisingly wholesale & retail have relied heavily on both CBILS and BBLS (/a short thread)

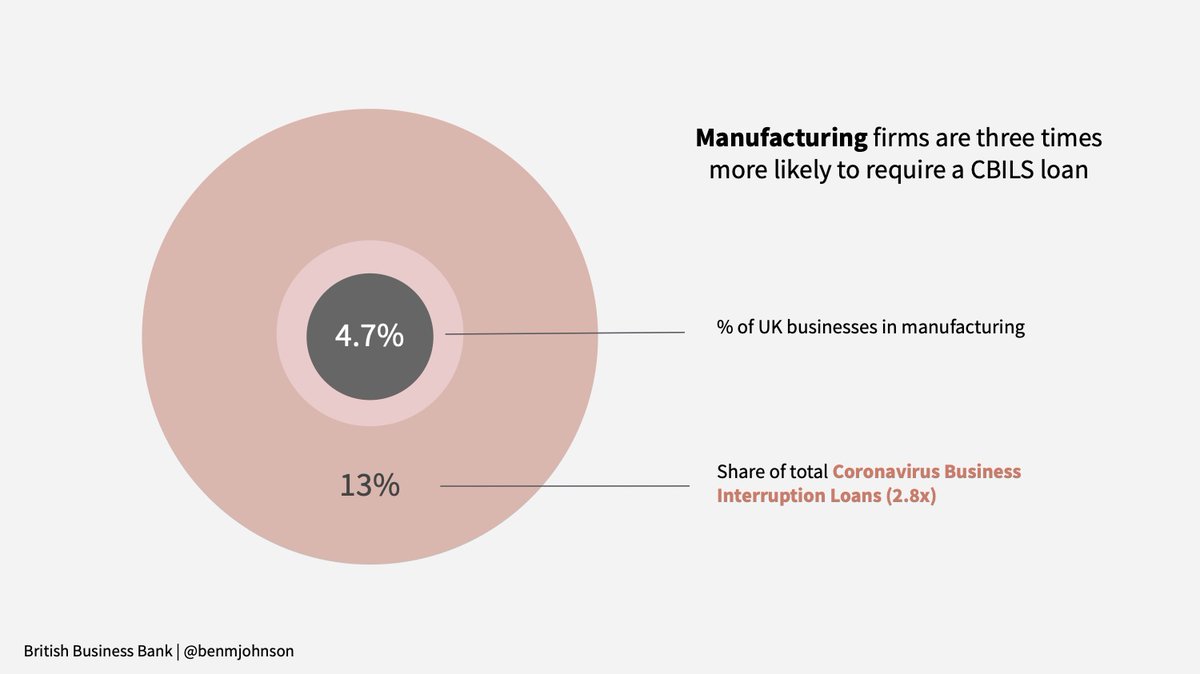

Manufacturing firms are three times more likely to use a CBILS loan, but far less have taken advantage of the 2.5% APR Bounce Back Loans. Assuming the £50k maximum is too small for this sector.

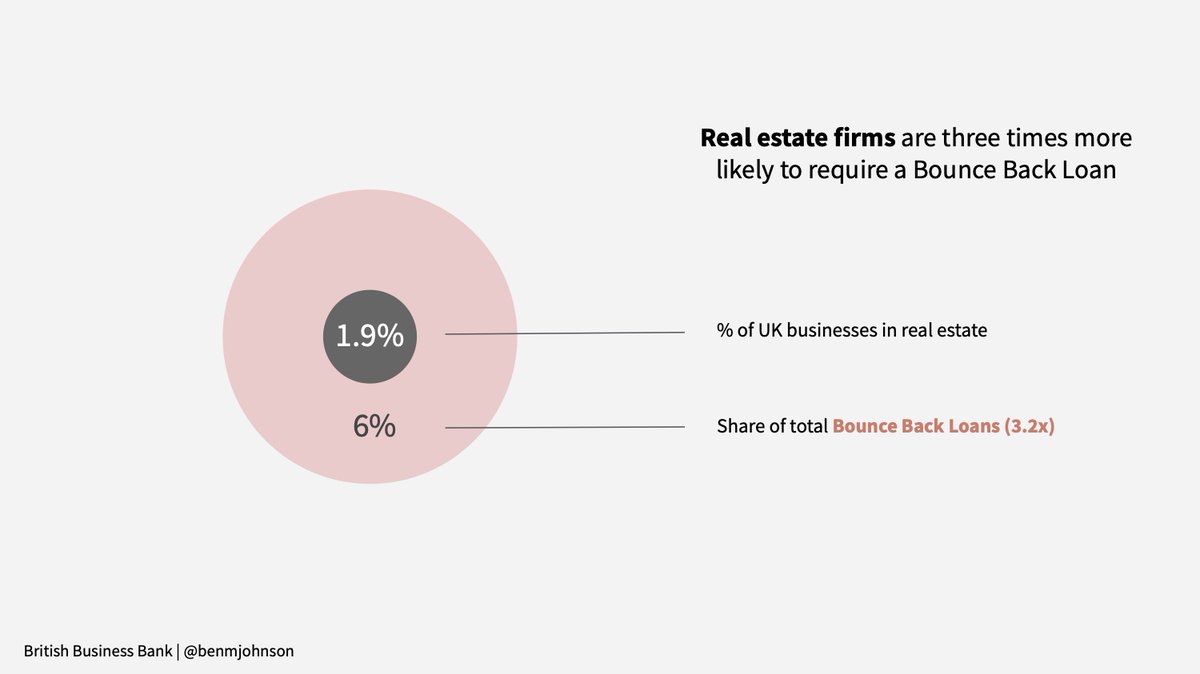

Whereas real estate, which makes up 2% of UK businesses, have accessed 6% of the Bounce Back Loans offered to date. As the furlough scheme supported salaries, other operating costs are relatively low in comparison to other sectors.

Are bigger loans the answer for these firms if we return to restricted trading? At some point that becomes unsustainable, and the government needs to intervene with sector specific support - like the "Eat Out to Help Out" scheme, which was weird, but effective. (/end thread)

Read on Twitter

Read on Twitter