Anyone running a rewards program needs to study Starbucks.

No one else& #39;s program so tightly integrates with the broader business strategy.

Here’s one example of this that I noticed this week https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

No one else& #39;s program so tightly integrates with the broader business strategy.

Here’s one example of this that I noticed this week

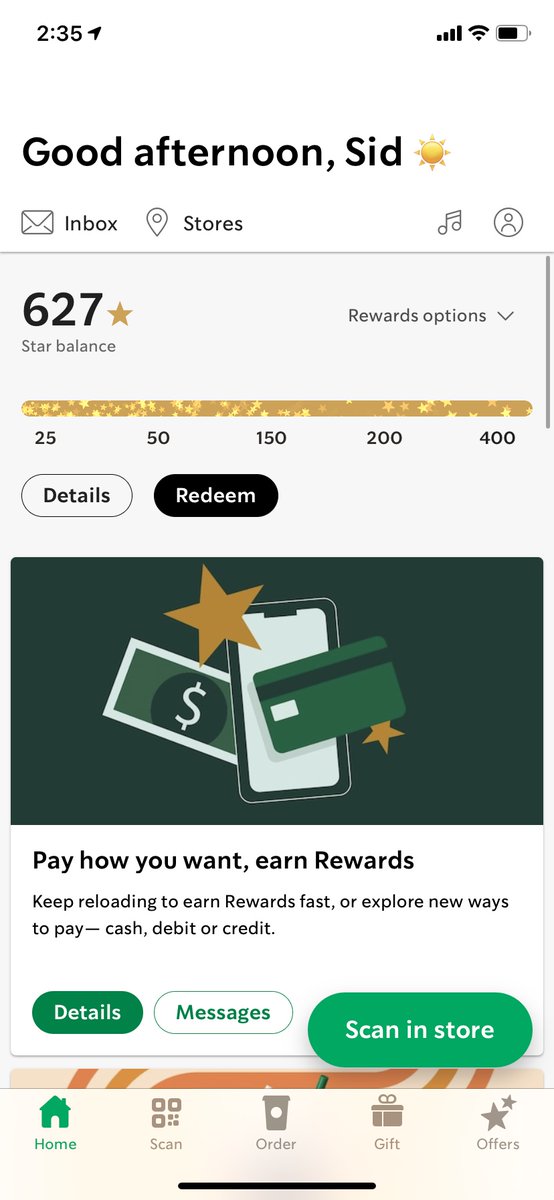

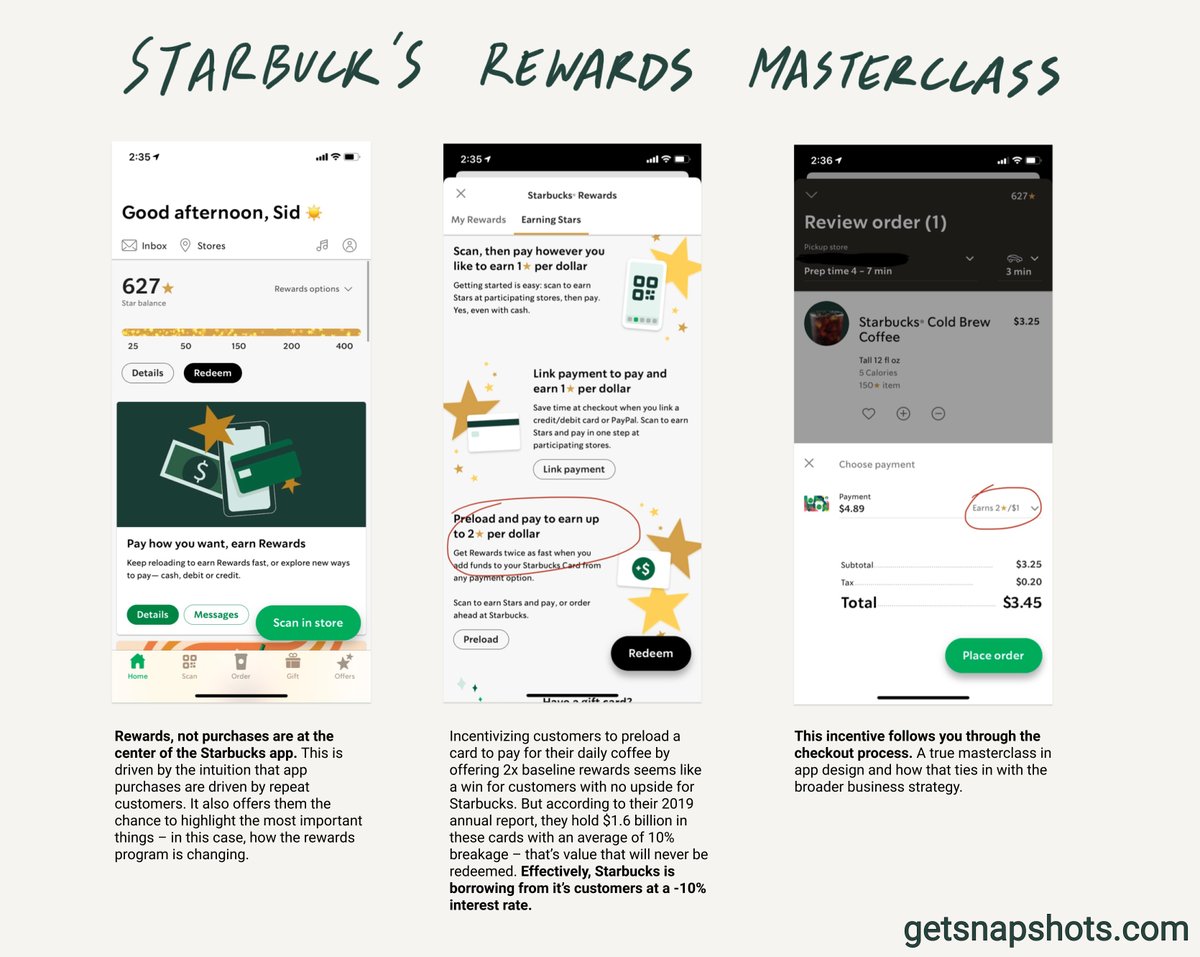

When you log into the Starbucks app, you see that rewards, not purchases are at the center of the Starbucks app. This is driven by the intuition that app purchases are driven by repeat customers who are willingly to go through a couple of taps to make a purchase.

It also offers them the chance to highlight the most important things – this week, this was how the rewards program is changing.

The change?

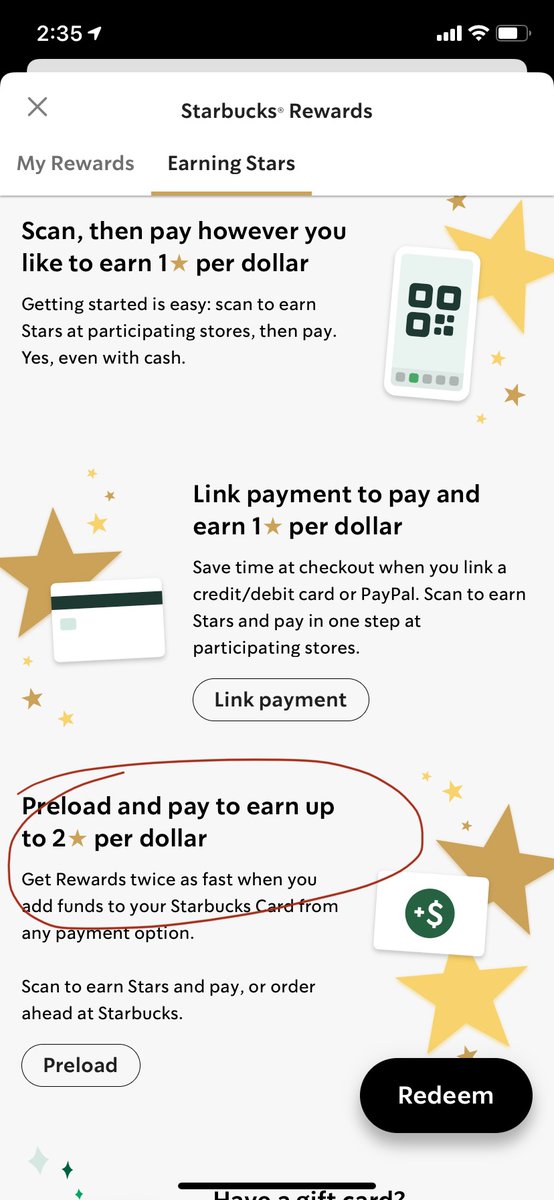

Pre-loading a card gives you 2x the reward points for purchases compared to 1x for all other payment methods.

The change?

Pre-loading a card gives you 2x the reward points for purchases compared to 1x for all other payment methods.

Incentivizing customers to preload a card to pay for their daily coffee by offering 2x baseline rewards seems like a win for customers with no upside for Starbucks.

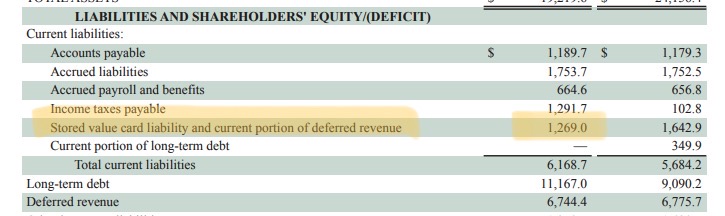

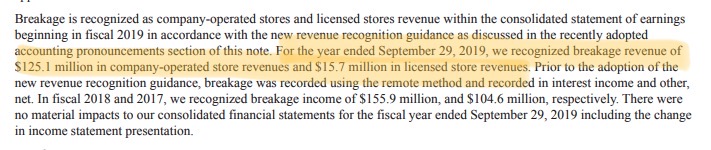

But according to their 2019 annual report, they hold $1.27 B in these cards with $140.8M of breakage – that’s value that will never be redeemed. So effectively, Starbucks is borrowing from its customers at a ~ -10% interest rate!

2019 10-K: https://s22.q4cdn.com/869488222/files/doc_financials/2019/2019-Annual-Report.pdf">https://s22.q4cdn.com/869488222...

2019 10-K: https://s22.q4cdn.com/869488222/files/doc_financials/2019/2019-Annual-Report.pdf">https://s22.q4cdn.com/869488222...

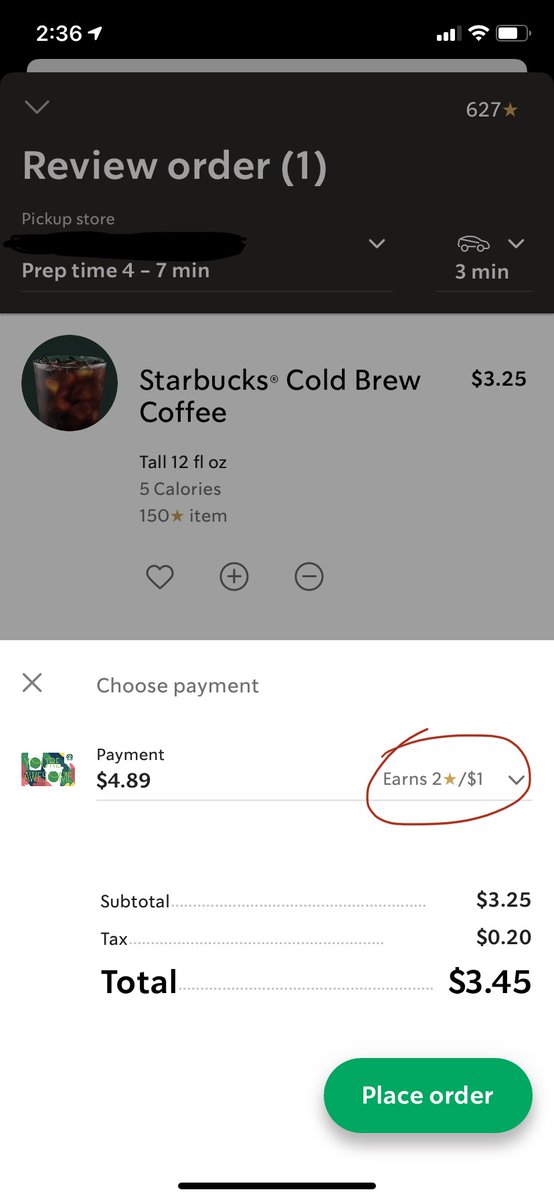

This incentive follows you through the checkout process. A true masterclass in app/rewards program design and how that ties in with the broader business strategy.

If you liked that thread, you& #39;ll like my weekly newsletter, Sunday Snapshots where I write about the most important business topics that everyone is ignoring and my takeaways from under-rated books. http://getsnapshots.com"> http://getsnapshots.com

Read on Twitter

Read on Twitter " title="Anyone running a rewards program needs to study Starbucks.No one else& #39;s program so tightly integrates with the broader business strategy.Here’s one example of this that I noticed this week https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Anyone running a rewards program needs to study Starbucks.No one else& #39;s program so tightly integrates with the broader business strategy.Here’s one example of this that I noticed this week https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>