Negativity re gold on twitter is getting more common as the price has been going sideways for a while. So here is a thread on the bull market in gold from 1968-80–with some detail on its forgotten ups & downs and factors relative to the market since 2000 #gold 1/n

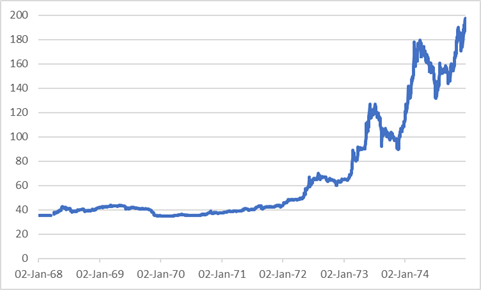

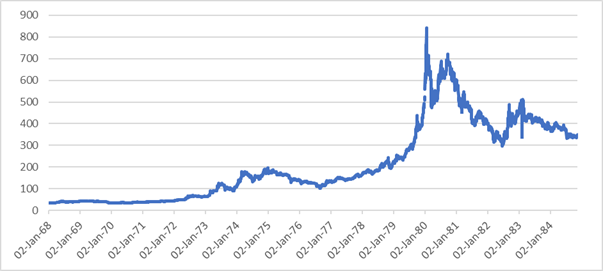

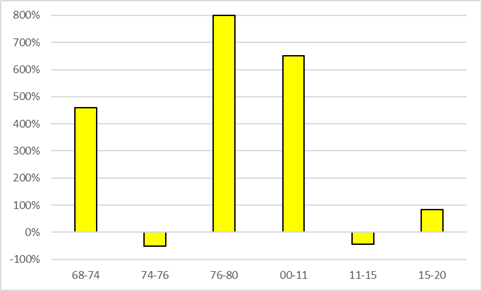

We remember gold hit $850 in Jan 80. But we forget this was 2nd bull run gold went on post the Dollar tie to gold severed. Between 68 and the second last day of 74 gold rose over 460% to $197. It doesn’t look impressive on the long run chart but in context was a huge bull run

Many said gold was dead–Central banks were selling&who would buy? But new demand was coming. Weaker USD led speculators to buy&liberalisation of the Japanese market in 73 resulted in large flows. Jan 74 saw US investors allowed to own gold coins for the first time since the 30’s

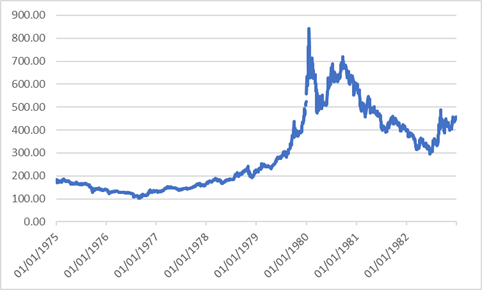

From 74 Inflation concerns abated and gold bottomed at $103 in August 76 before the bull run to $850 in Jan 80 began, up 800% and reaching its Real all-time high. This began with again a weakening dollar and reduced IMF gold auctions. South African supply started to fall.

76 Saw record demand from Middle eastern jewellery markets, with 30% of all gold supplies going to that region and India. This trend continued as middle eastern tensions increased up to the Irian crisis in 1979-with countries distrusting dollar assets and diversifying into gold.

Unlike today there was significant growth in demand for Industrial&commercial applications. Like modern markets new ways of owning gold were popping up, with paper holding of gold through the US futures market(founded in 74)and unallocated accounts allowing more ways to own gold

Gold peaked at $850 on the 21st of Jan 80 at the PM fixing. Silver was also on a massive bull run due to the actions of the Hunt brothers and both went down together after that

But it wasn’t all one way. Prices fell below $500 in 80 before rising again to 720 before year-end. But the bull market had ended. So what were the common and not common factors with the bull market from 2000? Where does history say prices might go from here?

Common Factors:

1)New Markets–70’s US, Japanese&Middle Eastern–00& #39;s India&China.

2)News means of ownership–70& #39;s US futures and unallocated accounts–00 ETF’s and Internet

3)Reduced CB selling–70& #39;s falls in CB sales over time–99 Central Bank Gold Agreement and CB buying recently

1)New Markets–70’s US, Japanese&Middle Eastern–00& #39;s India&China.

2)News means of ownership–70& #39;s US futures and unallocated accounts–00 ETF’s and Internet

3)Reduced CB selling–70& #39;s falls in CB sales over time–99 Central Bank Gold Agreement and CB buying recently

4) Diversification out of dollar assets - 70& #39;s Middle East after Iran - Now Central Banks buying gold to diversify holdings

The bear markets between the 70s bulsl & the 00’s have similar falls circa 50%. Based on the past the second bull run we are in now has a long way to go–up only 80% to date from the lows of ‘15. If gold prices doubled from here this would be a small rise compared to the past.

Forgive my typos!

Read on Twitter

Read on Twitter