Thread.

@RideoutTim #ScottishCurrencyGroup I listened to this podcast. It contained multiple fallacies about Scotland creating its own currency. I& #39;m going to walk through 5 of them. https://www.barrheadboy.com/scottish-prism-18th-sept-2020-dr-tim-rideout/">https://www.barrheadboy.com/scottish-...

@RideoutTim #ScottishCurrencyGroup I listened to this podcast. It contained multiple fallacies about Scotland creating its own currency. I& #39;m going to walk through 5 of them. https://www.barrheadboy.com/scottish-prism-18th-sept-2020-dr-tim-rideout/">https://www.barrheadboy.com/scottish-...

#1: Strength of the S£.

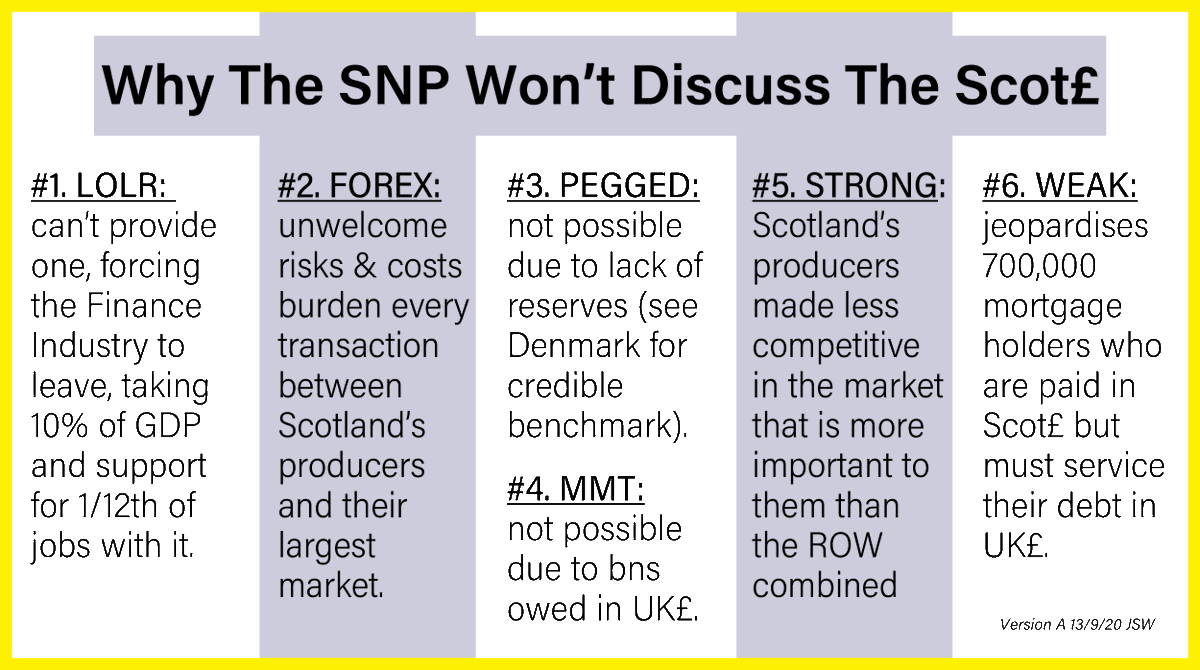

At ~4& #39; you say "the Scottish pound will probably be relatively strong". Why would this be? All you say is "Brexit". But that is not an answer. What would the fundamentals of the Scottish economy be that would cause the S£ to appreciate? Furthermore: why

At ~4& #39; you say "the Scottish pound will probably be relatively strong". Why would this be? All you say is "Brexit". But that is not an answer. What would the fundamentals of the Scottish economy be that would cause the S£ to appreciate? Furthermore: why

would we want that? Scotland& #39;s private sector producers do more trade with the rUK than they do with the ROW combined. Why do we want to make them all less competitive in their most important market?

#2: Pegging to the UK£.

At ~8& #39; you say "for the first 5 or 6 weeks, the £ sterling & the Scottish £ would be interchangeable. The Scottish £ would be pegged at 1 to 1 to Sterling."

This is absurd. Pegs can& #39;t be set by fiat. You can& #39;t dictate to the market what the value of a

At ~8& #39; you say "for the first 5 or 6 weeks, the £ sterling & the Scottish £ would be interchangeable. The Scottish £ would be pegged at 1 to 1 to Sterling."

This is absurd. Pegs can& #39;t be set by fiat. You can& #39;t dictate to the market what the value of a

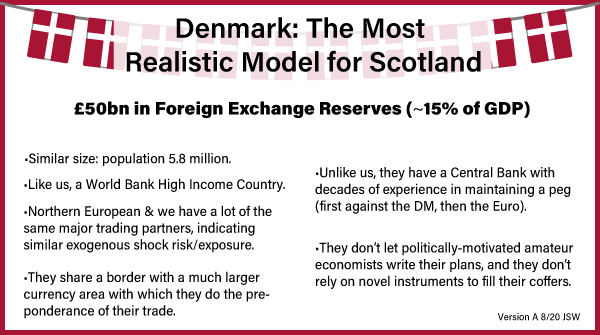

currency is. You can only establish a peg if you have sufficient reserves available to defend it. And the example of Denmark demonstrates that Scotland would need to TRIPLE the sum it leaves the UK with in order to have a market-credible level of reserves.

#3. It is all going to be easy.

At around 10& #39; you say: "It is very straightforward. There& #39;s a ready-made example because when the Soviet Union collapsed all the republics that were part of it introduced their own currency."

Which of those countries shared Scotland& #39;s particulars,

At around 10& #39; you say: "It is very straightforward. There& #39;s a ready-made example because when the Soviet Union collapsed all the republics that were part of it introduced their own currency."

Which of those countries shared Scotland& #39;s particulars,

such as a first-world, service-based economy with Finance generating 10% of GDP and supporting 1/12th of jobs?

Scotland is not a backward economy. It is a place where virtually all of the available capital could flee almost overnight.

Scotland is not a backward economy. It is a place where virtually all of the available capital could flee almost overnight.

#4. The speed of transition.

At around 11& #39; you say "if we have a 2-year transition, while independence arrangements are negotiated, that& #39;s when we get ready. And we then introduce the currency maybe two months after independence day."

In the real world, between a Scexit vote &

At around 11& #39; you say "if we have a 2-year transition, while independence arrangements are negotiated, that& #39;s when we get ready. And we then introduce the currency maybe two months after independence day."

In the real world, between a Scexit vote &

Independence Day, the current constitutional arrangements stay in place. So what are we going to do: have trainee accountant Kate Forbes rob the education, health & transport budgets? Also, let& #39;s recall that the people currently in charge at Holyrood needed 3 years & £178mn to

set up a system for sending subsidy cheques to farmers - & somebody else was paying the subsidies!

#5 The Seigniorage Myth.

At around 13:30 you start peddling the Seigniorage Myth: that people will have to buy the S£ from the SCB, and therefore the SCB will be amassing foreign currency reserves.

In reality, the iSG will print & inject >S£1bn into the economy every single week

At around 13:30 you start peddling the Seigniorage Myth: that people will have to buy the S£ from the SCB, and therefore the SCB will be amassing foreign currency reserves.

In reality, the iSG will print & inject >S£1bn into the economy every single week

via its spending: paying wages, buying goods & services.

Every single week.

There will be so much S£ floating around that no one will ever need to transact directly with the SCB.

Imagine that the NHS needs to buy £50mn in drugs from a Swiss company. They insist the deal be

Every single week.

There will be so much S£ floating around that no one will ever need to transact directly with the SCB.

Imagine that the NHS needs to buy £50mn in drugs from a Swiss company. They insist the deal be

done in the new currency. The Swiss company marks up the price by 33% to compensate for the risk, and completes the transaction. They now have S£66mn that they don& #39;t need and don& #39;t want to hold. So they exchange it at a commercial bank for a different currency. That bank now has

S£66mn it can sell to a Scot who has to trade in UK£ for S£s in order to pay his taxes to the iSG. All of this is done without a single UK£, €, or CHF accruing to the coffers of the SCB.

Read on Twitter

Read on Twitter