1/ The rise of #DeFi Tokens and new criminal masterminds.

Today I am going to explain why the value proposition of #DeFi tokens is so sweet, but there are 50 shades of black as the Finnish tar at the same time.

Enter the thread

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Today I am going to explain why the value proposition of #DeFi tokens is so sweet, but there are 50 shades of black as the Finnish tar at the same time.

Enter the thread

2/ What is the major difference from the 2017-2018 ICO boom and today& #39;s #DeFi boom?

The tokens today have working products, trading volume and revenue.

My favourite dog walking ICO 2017 neither had revenue nor dogs.

The tokens today have working products, trading volume and revenue.

My favourite dog walking ICO 2017 neither had revenue nor dogs.

3/ You can do discounted cash flow and P/E analysis for #defi tokens, like you would do for publicly traded stock.

Note that even if some tokens are not paying dividends today, as a governance vote token holders can choose a dividend.

Note that even if some tokens are not paying dividends today, as a governance vote token holders can choose a dividend.

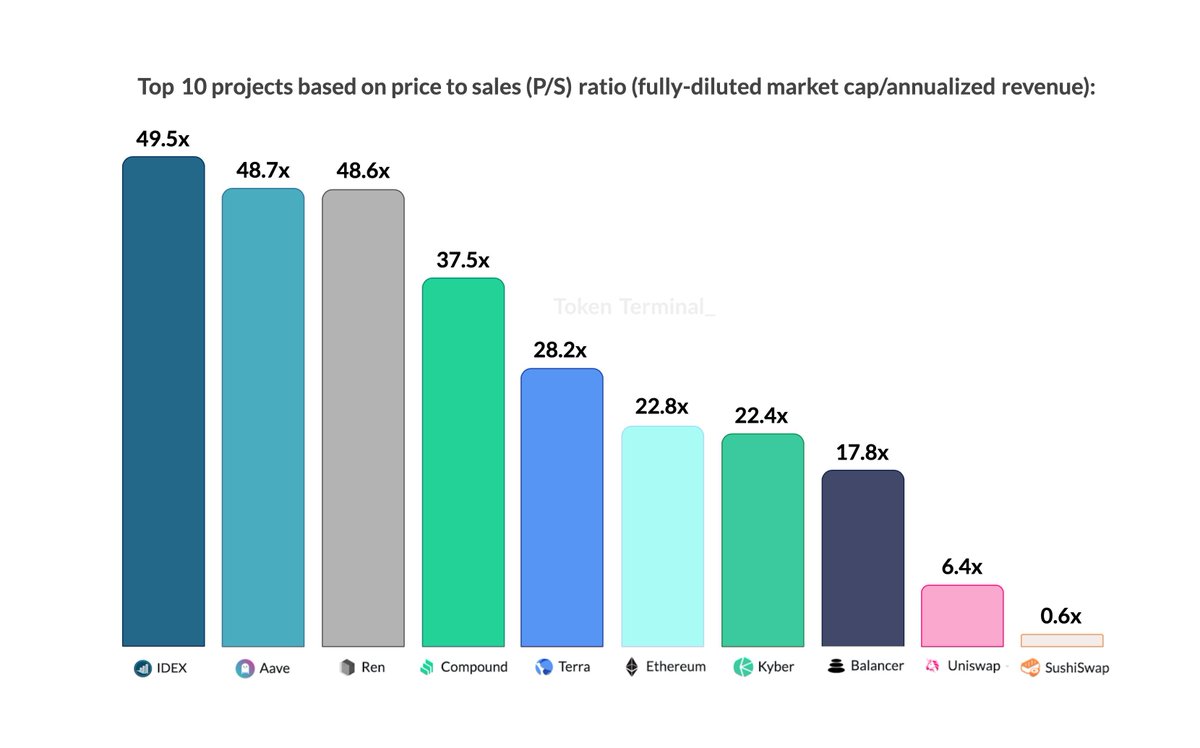

4/ Find #Defi token price and profit estimations analysis below:

Includes metrics like price/equity, price/revenue.

Tokens have a fair price and are not only hot air.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Includes metrics like price/equity, price/revenue.

Tokens have a fair price and are not only hot air.

5/ @iearnfinance $YFI by @Rewkang https://twitter.com/Rewkang/status/1307124886633091075">https://twitter.com/Rewkang/s...

6/ @CurveFinance $CRV report by @TokenTermimal https://twitter.com/tokenterminal/status/1297550797291622400">https://twitter.com/tokenterm...

7/ @UniswapProtocol $UNI by @idiom_bytes https://twitter.com/idiom_bytes/status/1307118327295283201">https://twitter.com/idiom_byt...

8/ @SushiSwap $SUSHI by @liesleichholz https://insights.glassnode.com/sushi-token-economics-impact-of-inflation/">https://insights.glassnode.com/sushi-tok...

9/ $CRV governance actually passed their dividends proposal recently here: https://gov.curve.fi/t/cip-13-implement-an-admin-fee-of-50-0-02-across-all-pools-to-be-distributed-to-vecrv-holders/690">https://gov.curve.fi/t/cip-13-...

10/ Here more of the projects on price/revenue chart from @tokenterminal

* Not an investment advise, $UNI price has gone significantly up since then

* Not an investment advise, $UNI price has gone significantly up since then

11/ Everybody is making money!

This is your cyberpunk DAO governed future as we promised back in 2016!

All good?

NO!

This is your cyberpunk DAO governed future as we promised back in 2016!

All good?

NO!

12/ These governance tokens look much like shares, either as in equity or in lesser cases as in debt, bonds.

13/ As pointed out some of the leading crypto lawyers in this space

If it quacks like a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦆" title="Ente" aria-label="Emoji: Ente">, it is not

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦆" title="Ente" aria-label="Emoji: Ente">, it is not  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦄" title="Einhorngesicht" aria-label="Emoji: Einhorngesicht"> having a

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦄" title="Einhorngesicht" aria-label="Emoji: Einhorngesicht"> having a  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📣" title="Anfeuerungsmegafon" aria-label="Emoji: Anfeuerungsmegafon"> attached to it.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📣" title="Anfeuerungsmegafon" aria-label="Emoji: Anfeuerungsmegafon"> attached to it.

If it quacks like a

14/ Trading financial instruments, like shares like, is regulated activity in most of the world.

You can only trade them on a trading venue that has received a license from the local regulators.

You can only trade them on a trading venue that has received a license from the local regulators.

15/ Note that securities law concerns are independent of the anti-money laundering concerns, as securities and AML are often governed by different laws and different organisations.

@kuskowskipawel can fill details on AML if needed.

@kuskowskipawel can fill details on AML if needed.

16/ However we can skip "most of the world", as the only jurisdiction we really care is the USA.

This is because the SEC is the only regulator in the world that has teeth, money and staff, to come after these projects.

This is because the SEC is the only regulator in the world that has teeth, money and staff, to come after these projects.

17/ The problem is that if the project is truly decentralised we cannot block out jurisdictions.

The citizens of the capitalistic US of A are going to come and put their money in if there is profit to be made.

The citizens of the capitalistic US of A are going to come and put their money in if there is profit to be made.

18/ And the SEC has shown they go even after non-fraud projects lately.

https://www.sec.gov/news/press-release/2020-211">https://www.sec.gov/news/pres...

https://www.sec.gov/news/press-release/2020-211">https://www.sec.gov/news/pres...

19/ Unlike in the ICO boom 2017-2018, in this point it is fairly established that these projects do not care about violating these securities laws.

They do not even pretend.

Here is my #defi song: https://www.youtube.com/watch?v=L397TWLwrUU">https://www.youtube.com/watch...

They do not even pretend.

Here is my #defi song: https://www.youtube.com/watch?v=L397TWLwrUU">https://www.youtube.com/watch...

20/ The o;d ICOs tried to tiptoe around the law to make sure that there is only "utility" and tokens fall under commodities trading.

"Not securities! Not investment! Do not talk about trading!" was the mantra.

"Not securities! Not investment! Do not talk about trading!" was the mantra.

21/ Well... today the popular tokens are equity and securities all but in the name.

22/ Breaking the law makes you a criminal.

And this is what the leadeing crypto lawyers, pardon me giving them this title myselefleading, are saying:

And this is what the leadeing crypto lawyers, pardon me giving them this title myselefleading, are saying:

23/ @palley says: https://twitter.com/stephendpalley/status/1306568391617130496">https://twitter.com/stephendp...

24/ @prestonjbyrne says: https://www.coindesk.com/token-airdrops-icos-defi">https://www.coindesk.com/token-air...

25/ @_gabrielShapir0 says: https://twitter.com/lex_node/status/1307001837397008385">https://twitter.com/lex_node/...

26/ The consensus is that #DeFi rev share and governance tokens are illegal.

IANAL but I believe it is illegal for a lawyer to give advice that would result in their client to do a crime.

IANAL but I believe it is illegal for a lawyer to give advice that would result in their client to do a crime.

27/ The SEC has not been helpful by not clarifying or not stopping the boom.

Instead,a it even looks like that if you have sufficiently good network of friends from prestigious universities, you can fall within the cracks.

Instead,a it even looks like that if you have sufficiently good network of friends from prestigious universities, you can fall within the cracks.

27/ After all, people on both side of the table, the lawyers presenting the DeFi project (and their VCs) and the lawyers presenting the SEC went to the same classes in the uni.

30/ The SEC is unlikely to come if you buy a token from the secondary market.

It is either

- Founding teams violating securities registration requirements

- Exchanges violating the Exchange Act of 1934

It is either

- Founding teams violating securities registration requirements

- Exchanges violating the Exchange Act of 1934

31/ It also means that an honest person cannot participate in the industry.

To stay competitive, you basically need to become a criminal by taking a risk that you are not either pursued or you can settle the lawsuit.

To stay competitive, you basically need to become a criminal by taking a risk that you are not either pursued or you can settle the lawsuit.

32/ This is very bad for the founding teams, as in the case of a sufficiently decentralised project, the SEC can take down individuals even if they would not be able to stop the project itself.

The project lives, but the founder dies.

The project lives, but the founder dies.

33/ A perverse universe we are living in, eh?

Being a good #defi project and making your investors happy is a being criminal.

Being a good #defi project and making your investors happy is a being criminal.

34/ That& #39;s all folks.

Maybe next week we discuss HOW we solve this mess of clearly illegal securities that no one can shut down in a coherent manner.

We also need to understand that those securities laws are in a place for a reason.

FIN

Ps. Encore https://www.youtube.com/watch?v=L397TWLwrUU">https://www.youtube.com/watch...

Maybe next week we discuss HOW we solve this mess of clearly illegal securities that no one can shut down in a coherent manner.

We also need to understand that those securities laws are in a place for a reason.

FIN

Ps. Encore https://www.youtube.com/watch?v=L397TWLwrUU">https://www.youtube.com/watch...

Read on Twitter

Read on Twitter